Apple Inc. (AAPL) Stock Comprehensive Review as of August 2024 🟢

Current Price: $229.79

Industry: Technology, Consumer Electronics

Stock Type: Growth, Blue Chip

Rating: A-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Apple reported $391.04 billion in revenue for 2024, a 2.02% YoY increase. Growth was driven by strong performance in Services and iPhone sales, with added support from new product categories. Revenue is projected to grow by 7.82% in 2025, reaching approximately $462.15 billion, fueled by product diversification and geographic expansion.

- Net Income: EPS for 2024 stands at $7.61, marking a 25.1% increase from the previous year. The EPS is expected to rise further in 2025 to $8.51, an 11.88% increase due to cost management and high-margin revenue growth from Services and wearables.

- Free Cash Flow: Apple maintains strong cash flow, which supports its large-scale share buyback program and continued R&D investments, especially in AI and new hardware.

💰 Valuation Analysis

- P/E Ratio: Apple’s forward P/E ratio of 31.1x is slightly above its five-year average, reflecting market confidence in its long-term growth, particularly within services and new product initiatives.

- Price Target: Analysts have set an average price target of $244.07, suggesting a 9.49% upside from the current price. The high-end target is $300, showing confidence in Apple's resilience and innovation-driven growth.

- Market Cap: Apple’s market cap of $3.37 trillion underscores its position as a dominant player in the tech sector and its role as a key component of the “Magnificent Seven” mega-cap stocks.

📈 Growth Metrics

- 2025 Growth Forecast: Apple’s revenue is expected to reach $462.15 billion in 2025, driven by continued growth in Services and potential new products in AR/VR. High customer loyalty and a diverse product ecosystem also support steady long-term growth.

- Price Target: With its core strengths in premium hardware and services, Apple remains a stable growth stock with positive outlook, and analysts remain bullish on its potential.

🔮 Forecast

Apple’s strong performance, driven by iPhone, Services, and new product lines, continues to solidify its position as a stable, high-growth investment. Despite challenges in international markets like China, Apple’s high customer retention and commitment to innovation make it an attractive option for long-term investors.

Final Summary

- 🚀 Consistent Performance and Innovation: Apple’s diversified business model, with high-margin services and strong hardware sales, makes it a robust investment for growth-focused portfolios.

- 📈 Moderate Upside Potential: Given its market position and steady growth trajectory, Apple merits an A- rating as it remains well-poised for further gains.

Apple continues to be a cornerstone investment, offering both stability and growth potential in a volatile market environment

Interesting Facts

🕶️ Chronological Update below 👇🏻

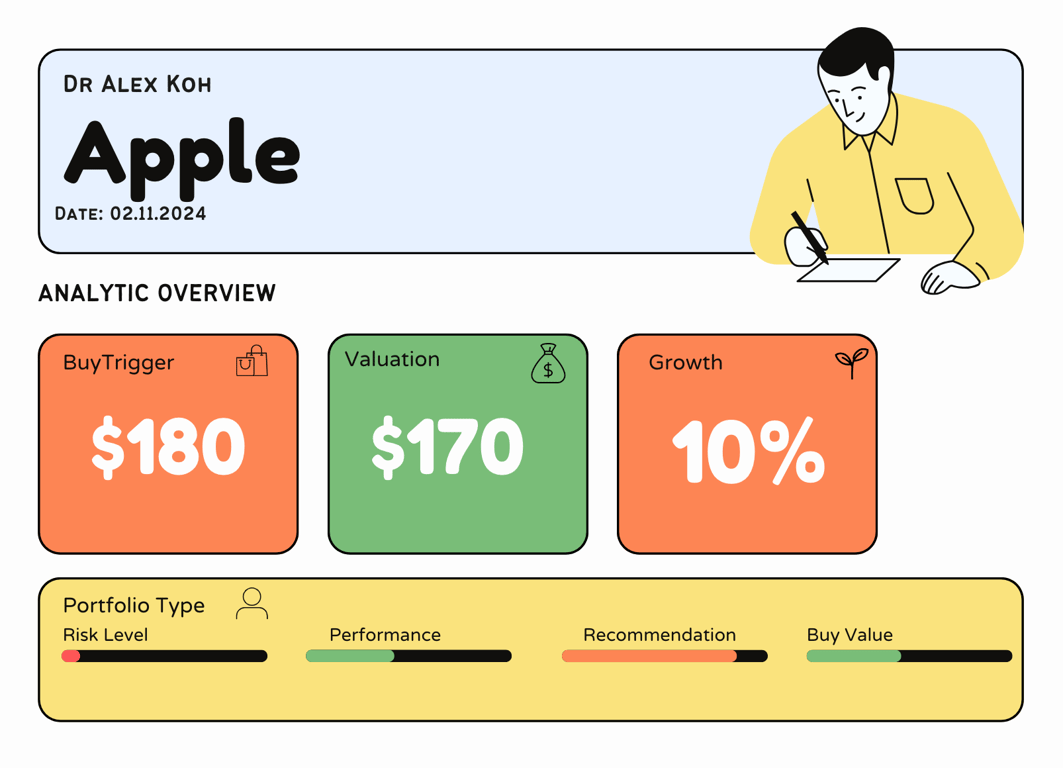

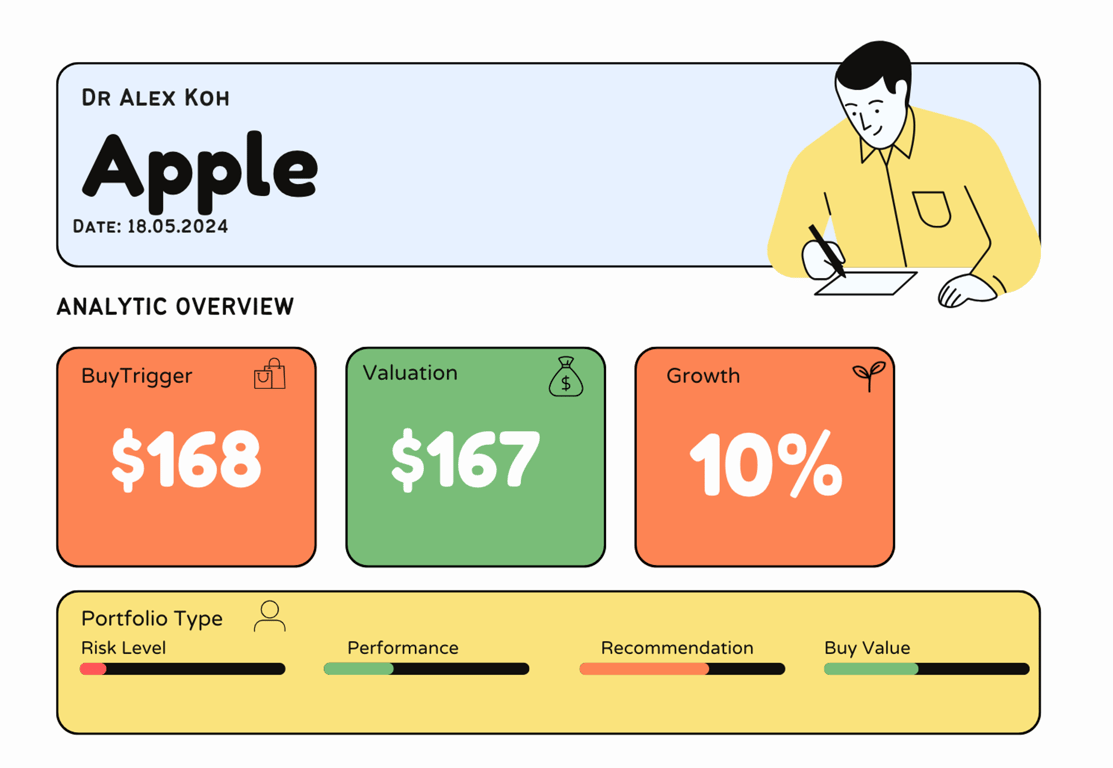

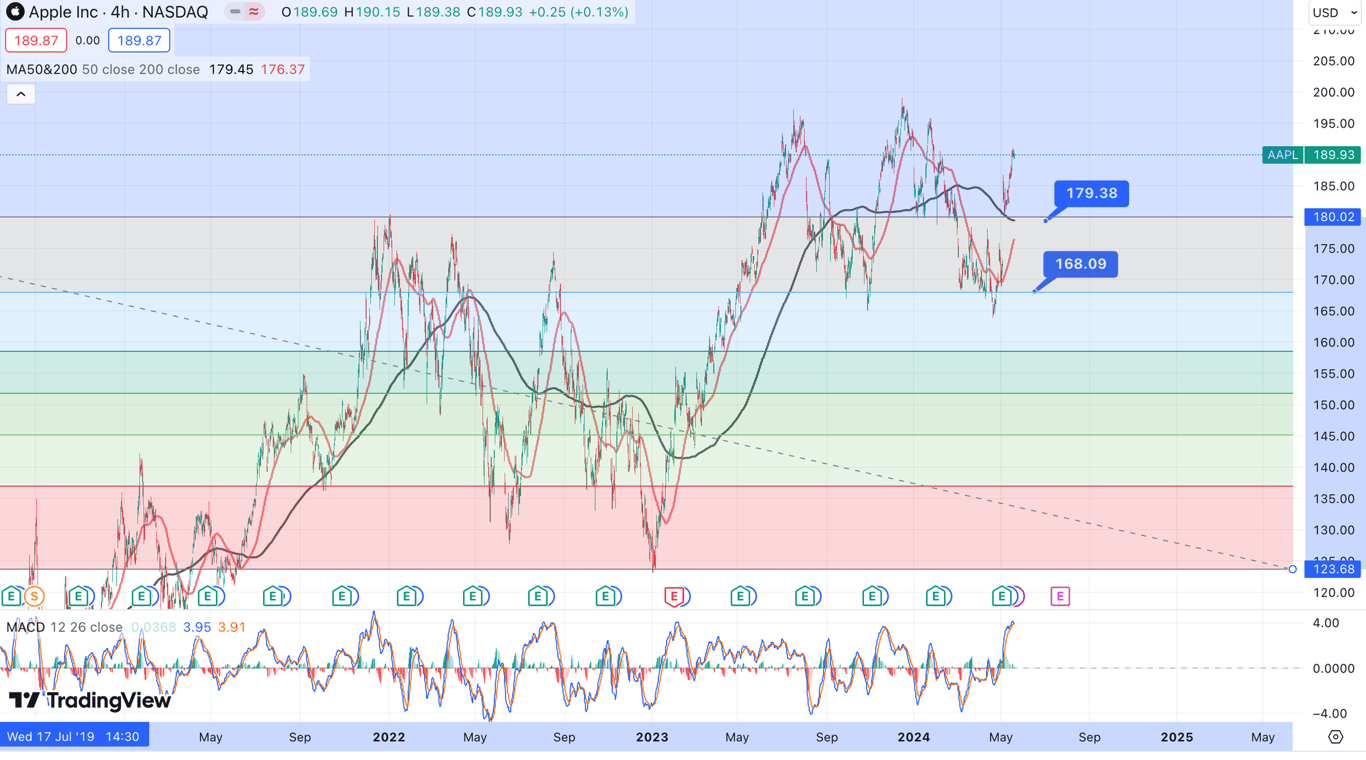

Technical Analysis Update [May 19, 2024 09:01 PMGMT+00:00]

- BT at 168 instead of 178. This is for risk reward entry.