Adobe Inc. (ADBE) Stock Comprehensive Review as of December 12, 2024 🟡

Current Price: $549.93

Industry: Technology – Software

Stock Type: Growth

Rating: B+

Key Financial Metrics (Q4 Fiscal 2024)

- Revenue: $5.61 billion, up 11% year-over-year, exceeding estimates of $5.54 billion.

- Net Income: Not disclosed in detail.

- Gross Margin: Not disclosed, but Adobe typically maintains margins around 85%.

- EPS (Earnings Per Share): $4.81 (adjusted), beating analyst expectations of $4.67.

- Free Cash Flow: Not specified in this report.

💰 Valuation Analysis

- P/E Ratio: Approximately 33x, reflecting a premium for growth.

- P/S Ratio: ~15x, indicating high market valuation relative to sales.

- Forward P/E: ~27x, implying expectations of steady earnings growth.

- PEG Ratio: Not disclosed but likely >2, given competitive pressure and moderate growth.

- Market Cap: $248.8 billion, classifying it as a large-cap stock.

📈 Growth Metrics

- 2025 Revenue Growth Forecast: 9-11%, with projected revenue between $23.3 billion and $23.6 billion.

- EPS Growth Forecast: Expected in the range of $20.20 to $20.50, slightly below consensus estimates of $20.52.

- Digital Media Growth: Up 12% YoY to $4.2 billion in Q4, driven by Creative Cloud and Document Cloud subscriptions.

🔍 Revenue Breakdown

- Digital Media (75%): $4.2 billion (+12% YoY)

- Strength in Creative Cloud and Document Cloud drove growth.

- Digital Experience (25%): $1.2 billion (+10% YoY)

- Solid demand for customer analytics and marketing solutions.

🔮 Forecast

Adobe has shown strong financial results in its core businesses, but its 2025 outlook has tempered investor enthusiasm. The company's investments in AI are yet to translate into substantial monetization, and competitive pressures in the creative software and analytics markets could weigh on growth. Despite short-term headwinds, Adobe's robust ecosystem and consistent revenue streams position it for moderate long-term success.

Final Summary

- 🚀 Strengths: Solid financial performance with strong subscription revenue growth and robust EPS.

- 📊 Concerns: Below-expectation revenue and EPS forecasts for fiscal 2025, coupled with slow AI monetization.

- 💡 Valuation Caution: While Adobe remains a high-quality stock, its premium valuation may limit upside in the short term.

- ⚠️ Risks: Competition in AI and cloud-based creative tools could challenge growth momentum.

Adobe remains a strong long-term investment, and its solid Q4 performance justifies a B+ rating, despite short-term challenges.

Interesting Facts

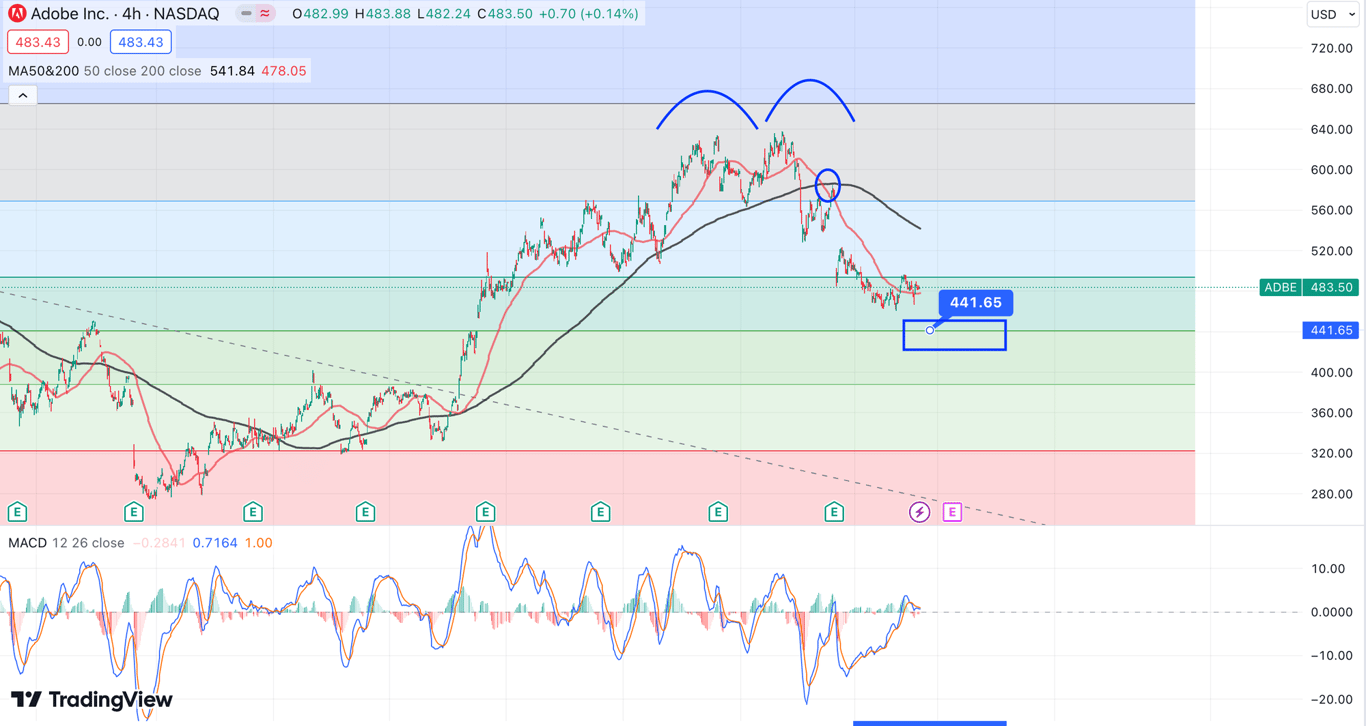

Technical Analysis Update [May 19, 2024 03:54 PMGMT+00:00]

- Double Top plus Death Cross Decline. The earnings 12th June 2024. will make or break the stock. Now the BuyTrigger is 441 but I am super cautious. If the earnings is poop then $320 could happen.