Airbnb Inc. (ABNB) Stock Comprehensive Review as of August 2024 🟠

Current Price: $117.13

Industry: Online Marketplace, Travel

Stock Type: Mature Growth

Rating: B-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Airbnb reported $11.24 billion in revenue for 2024, a 13.36% YoY increase. The company continues to see growth, although at a slower pace compared to its rapid expansion in earlier years.

- Net Income: The company expects an EPS of $4.21 for 2024, which reflects a significant 41.84% decline YoY, largely due to macroeconomic challenges and rising costs.

- Free Cash Flow: Airbnb maintains solid free cash flow, supported by its asset-light business model, though concerns over profitability have emerged.

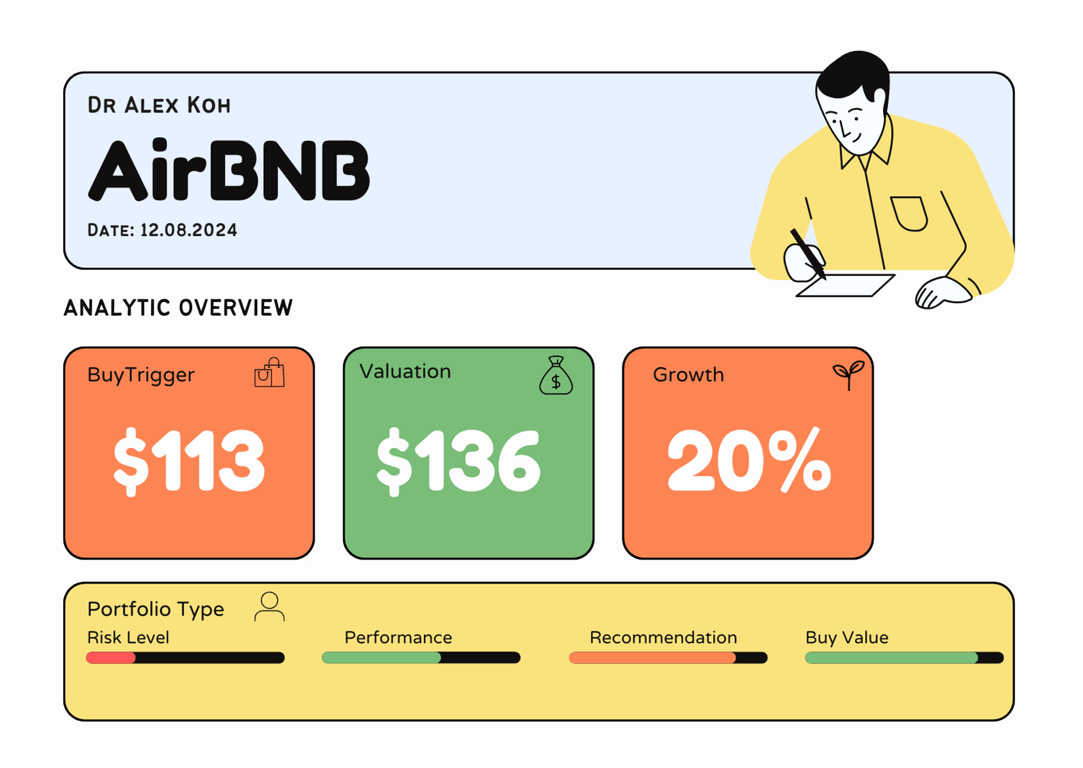

💰 Valuation Analysis

- P/E Ratio: Airbnb trades at a forward P/E ratio of 27.69x, which is lower than the broader tech sector but reflects a company that is still priced for growth.

- Price Target: Analysts have set a consensus price target of $133.16, representing a potential 14.20% upside from current levels. The high target is $195, while the low is $90, highlighting mixed sentiment.

- Market Cap: Approximately $73 billion, making Airbnb a significant player in the travel and hospitality industry but facing increasing competition and economic headwinds.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Analysts expect Airbnb's EPS to grow by 10.98% in 2025, driven by continued global travel demand and efforts to expand its service offerings.

- Price Target: The price target reflects cautious optimism, with a broad range indicating uncertainty about the company’s ability to maintain its growth trajectory amid potential economic slowdowns.

🔮 Forecast

Airbnb remains a key player in the travel and hospitality industry, leveraging its strong brand and global reach. However, the company faces challenges, including economic pressures affecting consumer spending and competition from traditional hospitality providers. While there is potential for upside, the stock's recent performance and mixed analyst sentiment suggest a cautious approach.

Final Summary

- ⚠️ Moderate Buy: Airbnb offers growth potential, but its current valuation and mixed financial performance require careful consideration.

- 📉 Profitability Concerns: Despite solid revenue growth, the decline in EPS and potential economic headwinds raise concerns about the company’s profitability in the near term.

- 🔎 Mixed Analyst Sentiment: Analysts are divided, with some seeing significant upside while others are concerned about the challenges ahead.

Airbnb remains a significant player with growth opportunities, but the stock’s recent volatility and economic uncertainties suggest a more cautious investment approach

Interesting Facts

🕶️ Chronological Update below 👇🏻

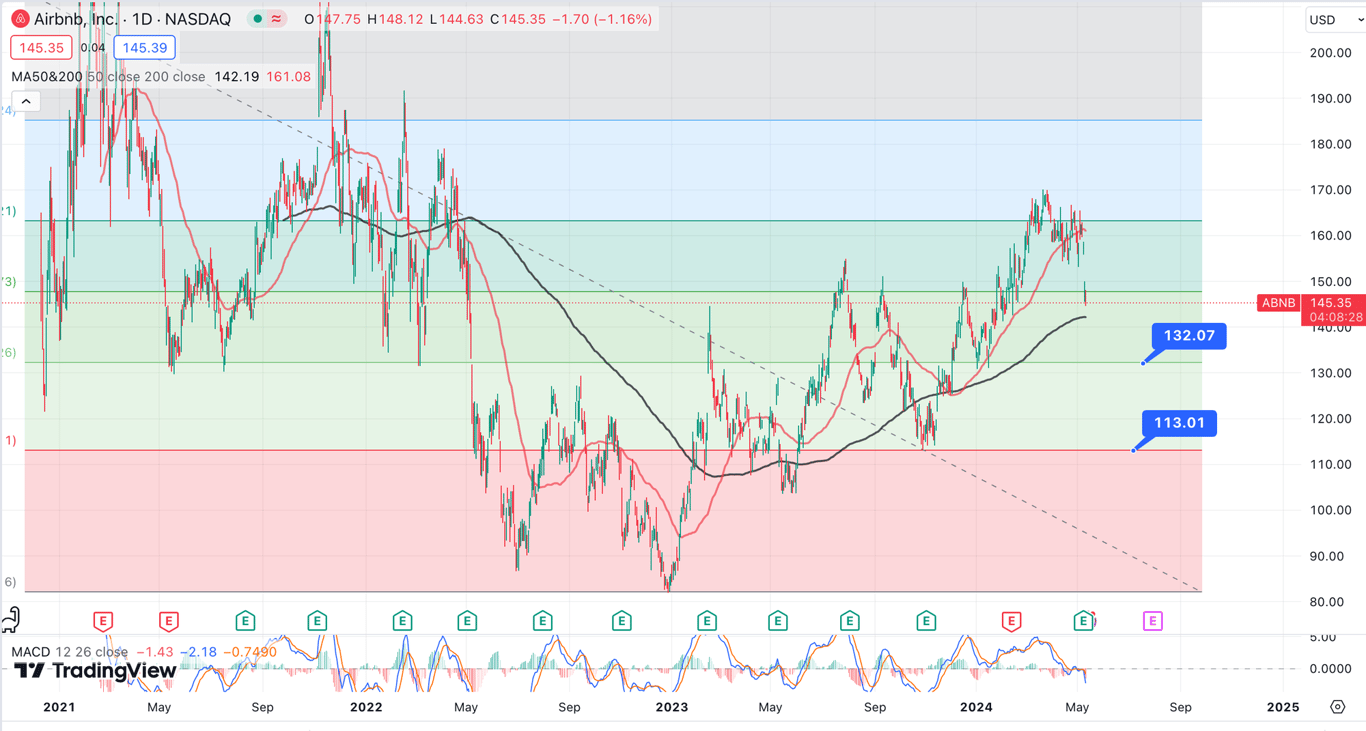

Technical Analysis Update [May 10, 2024 04:51 PMGMT+00:00]

- The $132 Fib Level coincides with the 2024 Forecast price

- The $113 Fib Level is close to the Intrinsic Valuation of AirBnB

- This is too coincidental and My set Target is $113