[BABA]

Alibaba Group Holding Ltd. (BABA) Stock Comprehensive Review as of October 2024 🟢Current Price: $114.53Industry: E-commerce, TechnologyStock Type: Growth, RecoveryRating: B

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Alibaba is witnessing a strong rebound in 2024, driven by China’s economic stimulus policies. The company’s diversified business portfolio, including its e-commerce platforms (Taobao, Tmall), cloud computing, and logistics services, is expected to contribute to a 10% increase in revenue compared to 2023.

- Net Income: Alibaba is projected to post EPS of $8.63 for 2024, reflecting its recovery from regulatory setbacks and its ability to maintain profitability across key business units.

- Free Cash Flow: The company maintains a solid financial footing with a robust share buyback program worth $22 billion, signaling strong cash flow and a commitment to returning value to shareholders.

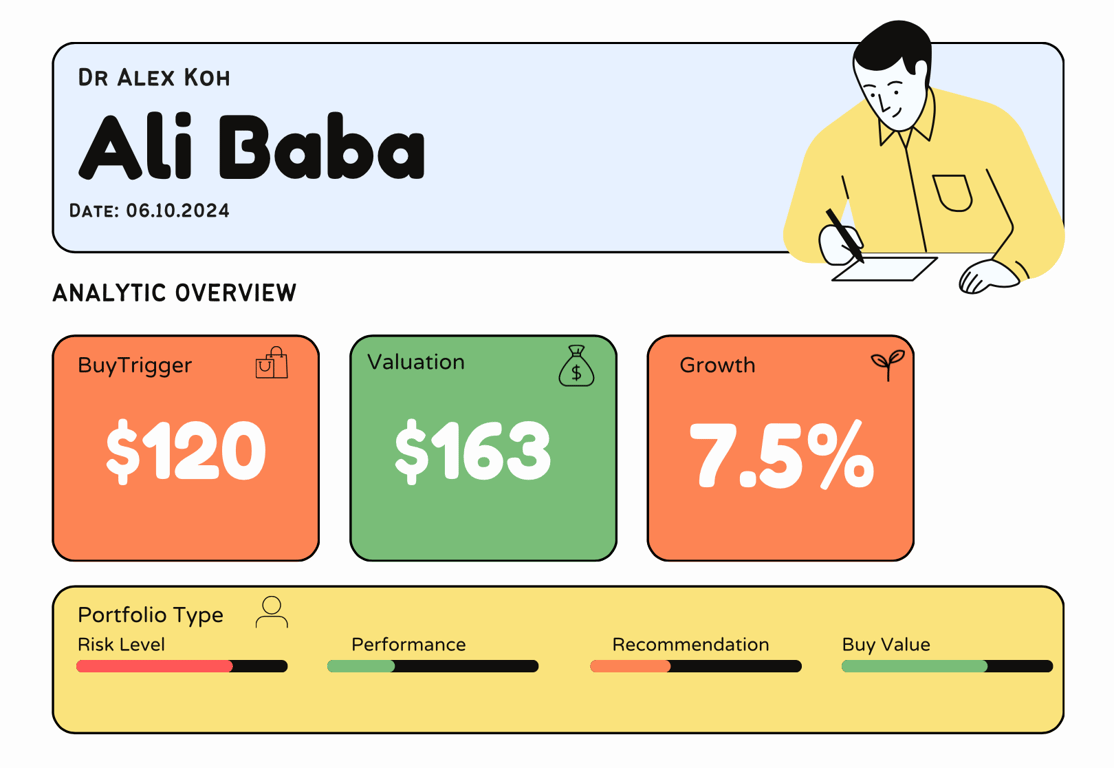

💰 Valuation Analysis

- P/E Ratio: Alibaba’s forward P/E ratio of 13.54x indicates that the stock is relatively undervalued compared to its global tech peers, making it an attractive investment, especially given its long-term growth prospects.

- Price Target: The average price target is $429.76, suggesting 12.56% upside from current levels, with some analysts forecasting even higher growth driven by AI and cloud investments.

- Market Cap: The company's market capitalization stands at $244 billion, positioning Alibaba as a dominant player in the global e-commerce and tech space.

📈 Growth Metrics

- 2025 Growth Forecast: Alibaba is expected to see substantial growth in its cloud computing division, driven by rising demand for AI infrastructure. With China’s government backing tech advancements, Alibaba’s diverse portfolio is poised for continued expansion into 2025 and beyond.

- Price Target: Long-term opportunities in e-commerce, cloud services, and AI present Alibaba as a potentially high-growth stock for investors focused on future tech trends.

🔮 Forecast

Alibaba is poised for further growth due to China’s stimulus efforts and its strategic investments in AI and cloud computing. Though regulatory challenges remain, the company’s diverse operations and financial strength support a strong recovery outlook for the coming years.

Final Summary

- 🚀 Recovery in Progress: Alibaba is capitalizing on government policies and tech investments, making it well-positioned for growth in its core sectors.

- 📈 Attractive Upside: The stock offers significant long-term growth potential, particularly for investors looking to capitalize on the future of cloud and AI technologies.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [Oct 6, 2024 06:27 PMGMT+00:00]