Amazon.com Inc. (AMZN) Stock Comprehensive Review as of August 2024 🟢

Current Price: $197.93

Industry: E-commerce, Cloud Computing, Digital Services

Stock Type: Growth, Blue Chip

Rating: A

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Amazon reported a 12.7% year-over-year revenue increase, bringing 2024 revenue projections to $647.90 billion. Growth was driven by Amazon Web Services (AWS) and expanding advertising revenue, both essential pillars of Amazon’s profitability. Looking forward to 2025, revenue is expected to increase by an additional 10.7% to $717.44 billion, supported by continued growth in AWS and e-commerce innovations.

- Net Income: EPS for 2024 is forecasted at $4.83, a significant jump of 66.5% from last year, reflecting Amazon’s increased operating efficiency and profitability in AWS. EPS for 2025 is projected to rise further by 23.1% to $5.94, as Amazon continues to scale high-margin sectors.

- Free Cash Flow: Amazon’s cash flow remains robust, driven by its diversified business model and the high-margin AWS segment, which provides essential funding for ongoing investments in technology and logistics.

💰 Valuation Analysis

- P/E Ratio: With a forward P/E ratio of 41.0x, Amazon trades at a premium, reflective of its growth in high-margin sectors and continued expansion in cloud and advertising services.

- Price Target: Analysts have an average 12-month price target of $233.15, indicating a potential upside of 17.8% from the current price. The high-end target is $285, with confidence in AWS growth and expanded monetization of its ecosystem through advertising and Prime memberships.

- Market Cap: Amazon’s market cap is approximately $1.03 trillion, solidifying its position as one of the largest technology companies globally, with a leadership role in e-commerce, cloud computing, and digital services.

📈 Growth Metrics

- 2025 Growth Forecast: Amazon’s revenue is expected to reach $717.44 billion in 2025, with consistent growth in AWS and advertising services. AWS remains Amazon's most profitable segment, expected to drive significant earnings as cloud adoption accelerates.

- Price Target: Analysts remain bullish, with Amazon’s expansion in profitable sectors like cloud, advertising, and AI-supported services indicating strong upside potential.

🔮 Forecast

Amazon’s strategic focus on high-margin areas like AWS and digital advertising, along with continued innovation in e-commerce, positions it well for sustainable growth. Despite recent economic challenges, Amazon’s diversified business model and robust revenue streams make it an attractive long-term investment. With high growth in AWS and a steady increase in Prime membership, Amazon is set to continue its strong performance.

Final Summary

- 🚀 Strong Performer Across Multiple Sectors: Amazon’s solid financials and diversified revenue streams make it a compelling investment for growth-focused investors.

- 📈 Attractive Long-Term Upside: With promising growth in AWS and expanding digital services, Amazon’s A rating reflects its strong market positioning and growth potential.

Amazon remains a cornerstone investment in the tech sector, with strong growth prospects supported by its leadership in key industries.

Interesting Facts

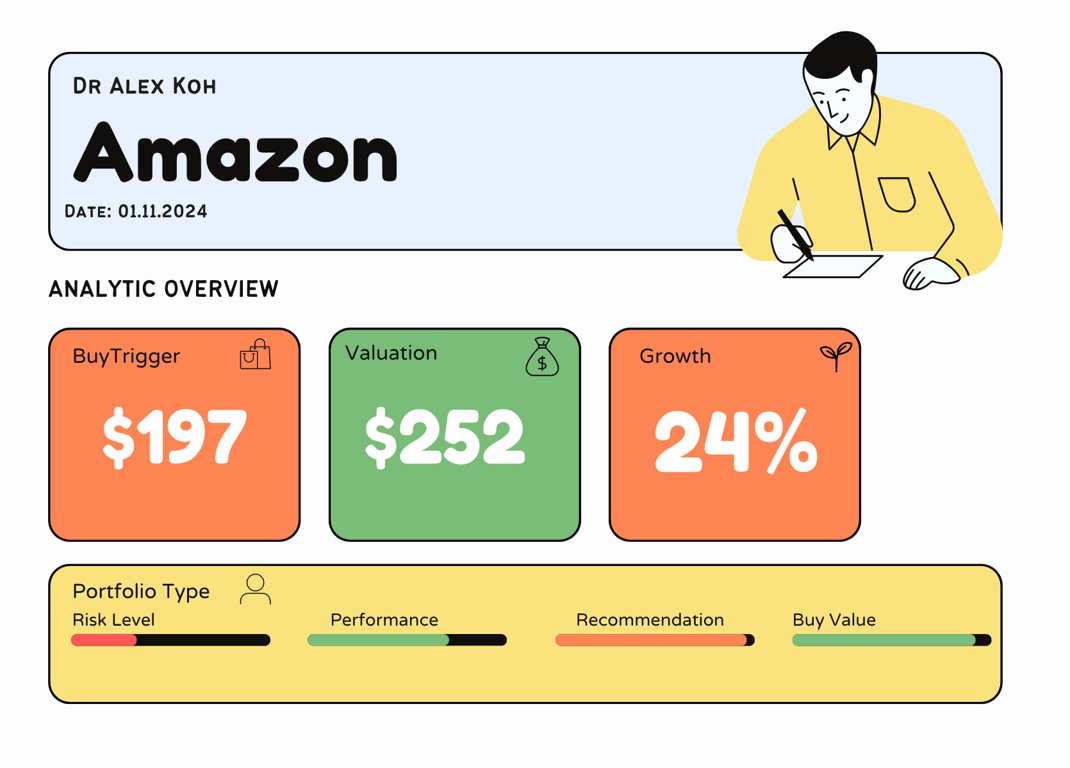

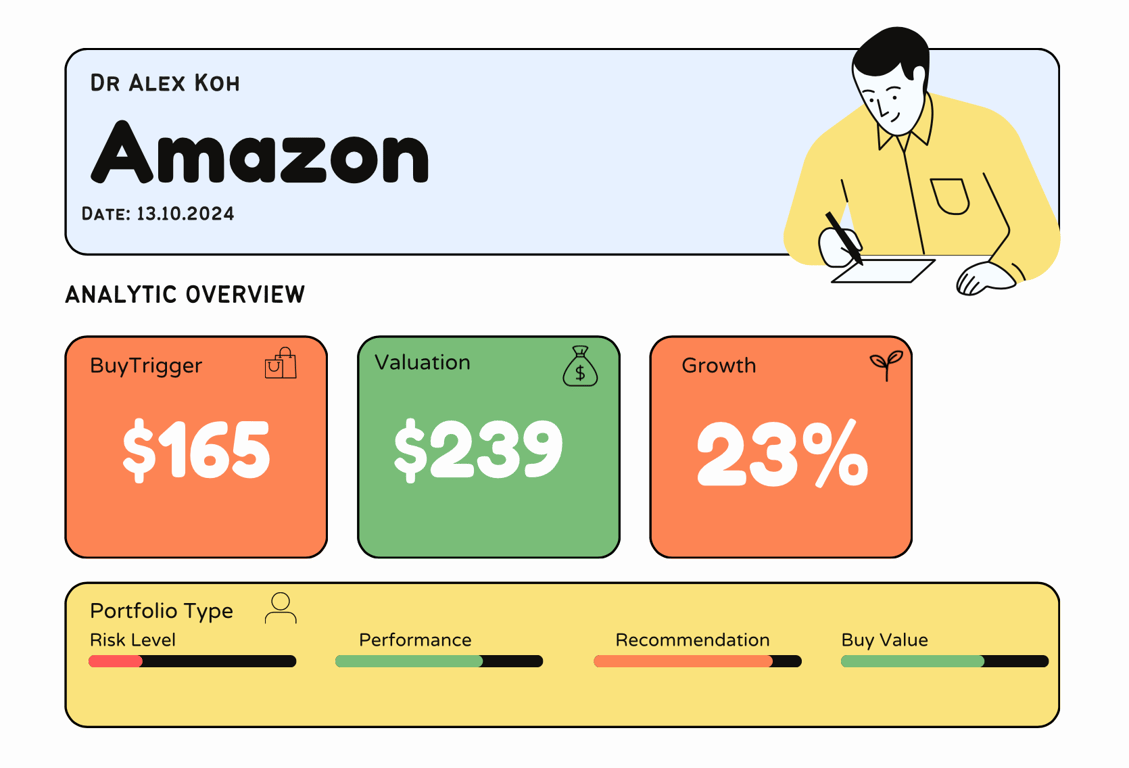

🕶️ Chronological Update below 👇🏻

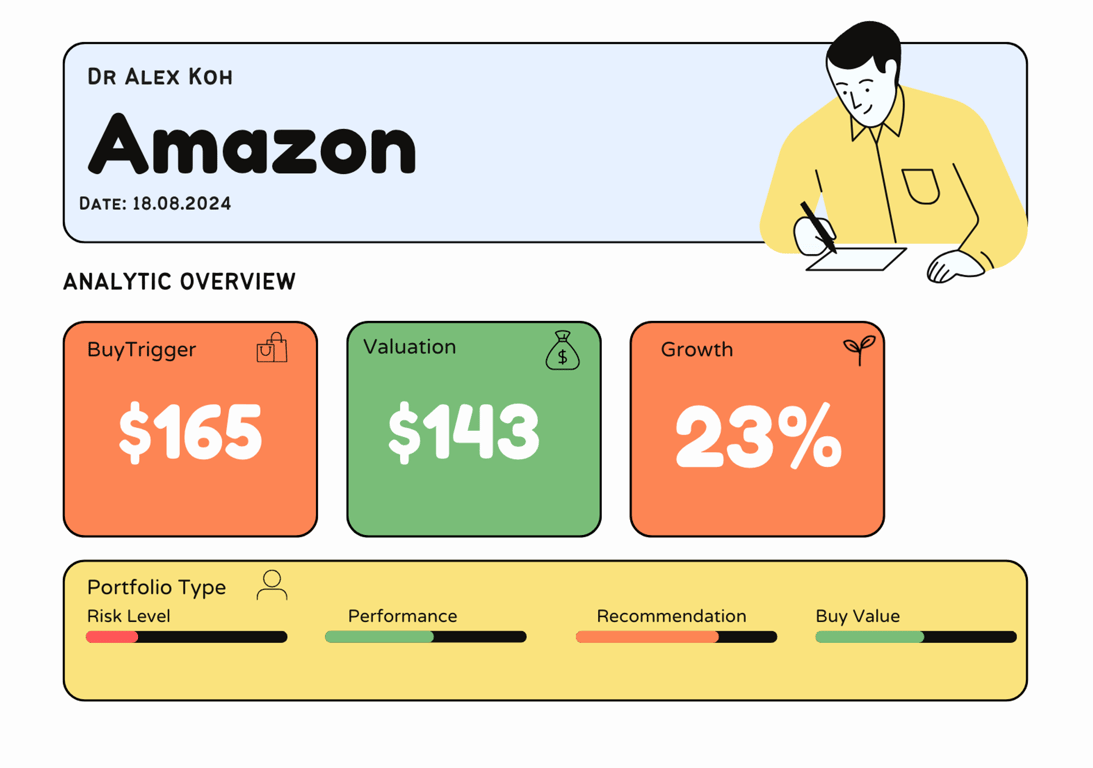

Technical Analysis Update [Aug 18, 2024 03:10 PMGMT+00:00]

- My Buytrigger is really strict here. $165 is a no brainer. Its below the trend line and if it goes back to the trend line then the growth is renewed.

- AMAZON fundamentally have to roll in their AI growth

- This is why i am reluctant to raise their BuyTrigger and forward forecast.

- I adjusted the FCF and valuation to a higher bond yield which pulled the growth down slighlty too.

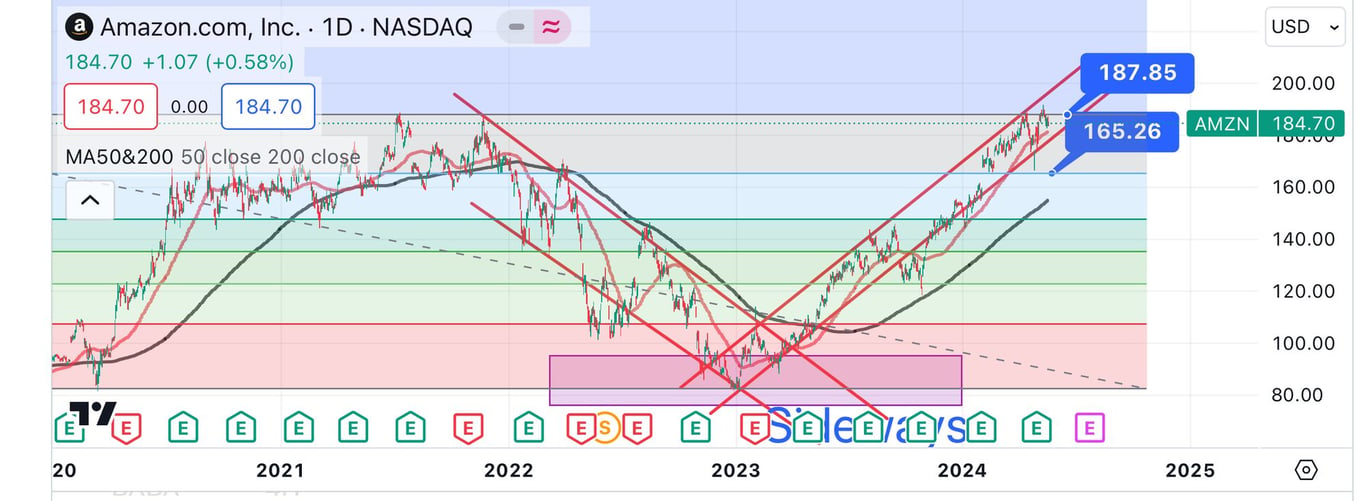

Technical Analysis Update [May 19, 2024 11:31 AMGMT+00:00]

- Can you see the double top then Cup and Handle?

- BT places at 165 because at this point I am hoping for a cup and handle. Handle formation expected before the real breakout