Advanced Micro Devices Inc. (AMD) Stock Comprehensive Review as of August 2024 🟢

Current Price: $138.56

Industry: Semiconductors

Stock Type: Growth

Rating: A

Key Financial Metrics (Latest Earnings)

- Revenue Growth: AMD has rebounded strongly in 2024, with revenues projected to reach $25.87 billion, a 14% year-over-year increase. This growth is driven by its expanding portfolio of processors and graphics products, as well as gains in its data center and AI-related sectors. For 2025, revenue is forecasted to grow by 28.5%, potentially reaching $33.24 billion, bolstered by increased demand for AI-driven technologies and EPYC server processors.

- Net Income: AMD is highly profitable, with EPS for 2024 expected at $3.44, marking a remarkable 550.37% increase from 2023’s EPS of $0.53. EPS is expected to climb to $5.49 in 2025, a 59.45% increase as AMD capitalizes on cost efficiencies and higher-margin product segments.

- Free Cash Flow: AMD’s cash flow is solid, supported by its strategic focus on high-growth areas, though ongoing competition in the semiconductor space could pressure margins.

💰 Valuation Analysis

- P/E Ratio: With a forward P/E ratio of 43.18x, AMD trades at a premium, reflecting the market’s confidence in its growth potential within AI and data centers. This valuation positions AMD as a growth stock, but at a risk of volatility due to high competition.

- Price Target: Analysts have set an average price target of $195.77, indicating a 31.74% upside. The highest price target is $250, suggesting optimism around AMD’s AI and data center expansion efforts, while the low target of $145 reflects caution due to competitive pressures from peers like Nvidia.

- Market Cap: AMD’s market capitalization of approximately $148 billion underscores its strong position in the tech sector, with a focus on innovative products to support long-term growth.

📈 Growth Metrics

- 2025 Growth Forecast: AMD is expected to sustain strong growth, especially in its AI and data center products, potentially boosting its revenue to over $33 billion. Its ongoing product development in GPUs, CPUs, and AI processors positions the company to capture market share in a competitive landscape.

- Price Target: Analysts remain optimistic, given AMD’s innovation pipeline and expansion in high-demand areas. The forecast for strong EPS and revenue growth supports positive long-term potential.

🔮 Forecast

AMD's strong product portfolio in AI, data center, and consumer processors positions it well for continued growth. Although the semiconductor industry is cyclical and highly competitive, AMD’s strategic focus on cutting-edge products and efficiency improvements bolsters its long-term outlook. The company is expected to remain a high-growth player, though investors should consider potential market volatility and competition.

Final Summary

- 🚀 High Growth Potential: AMD’s leadership in semiconductor innovation and its strategic expansion into AI and data centers make it a compelling growth investment.

- 📈 Attractive Long-Term Upside: The stock's valuation is high, but its growth trajectory and product pipeline justify a A rating.

History Charts

🕶️ Chronological Update below 👇🏻

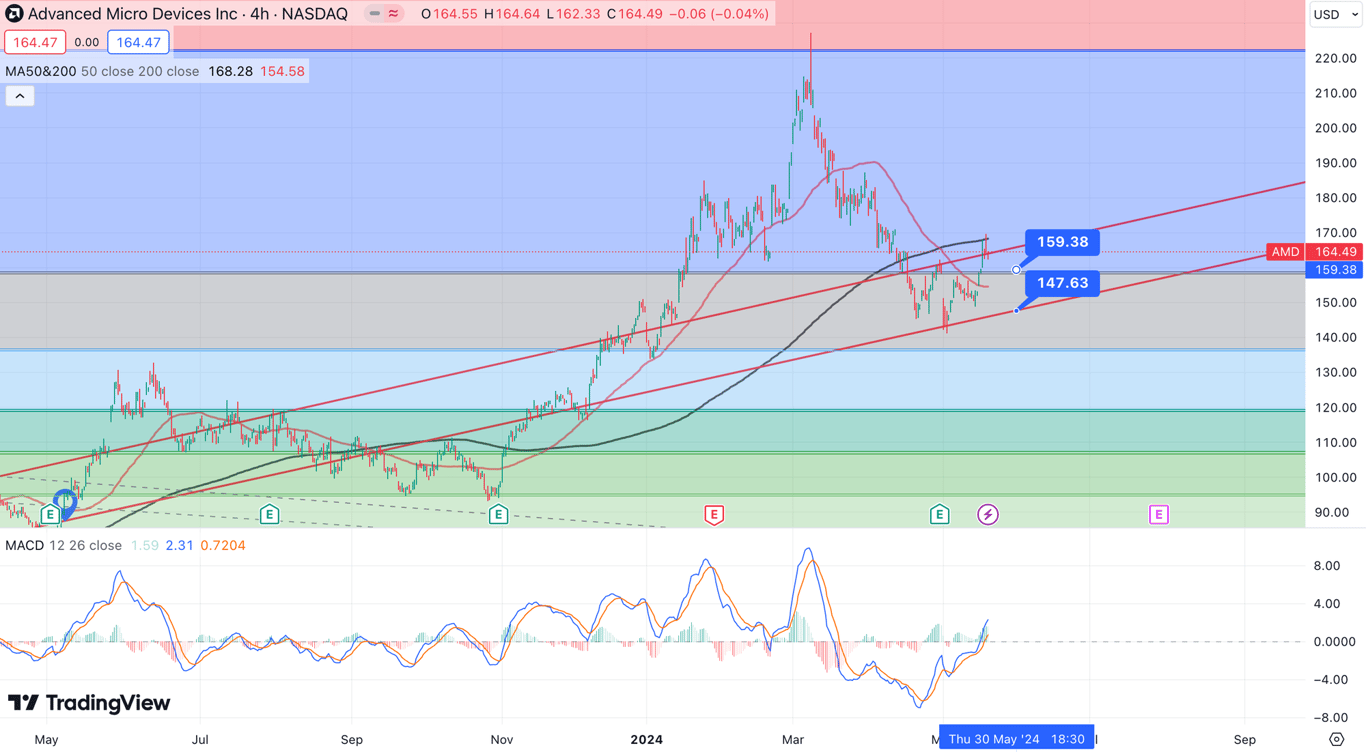

Technical Analysis Update [Aug 18, 2024 02:41 PMGMT+00:00]

- Buy $AMD

- Its cheap and TA looks super bullish!

Technical Analysis Update [May 18, 2024 10:45 PMGMT+00:00]

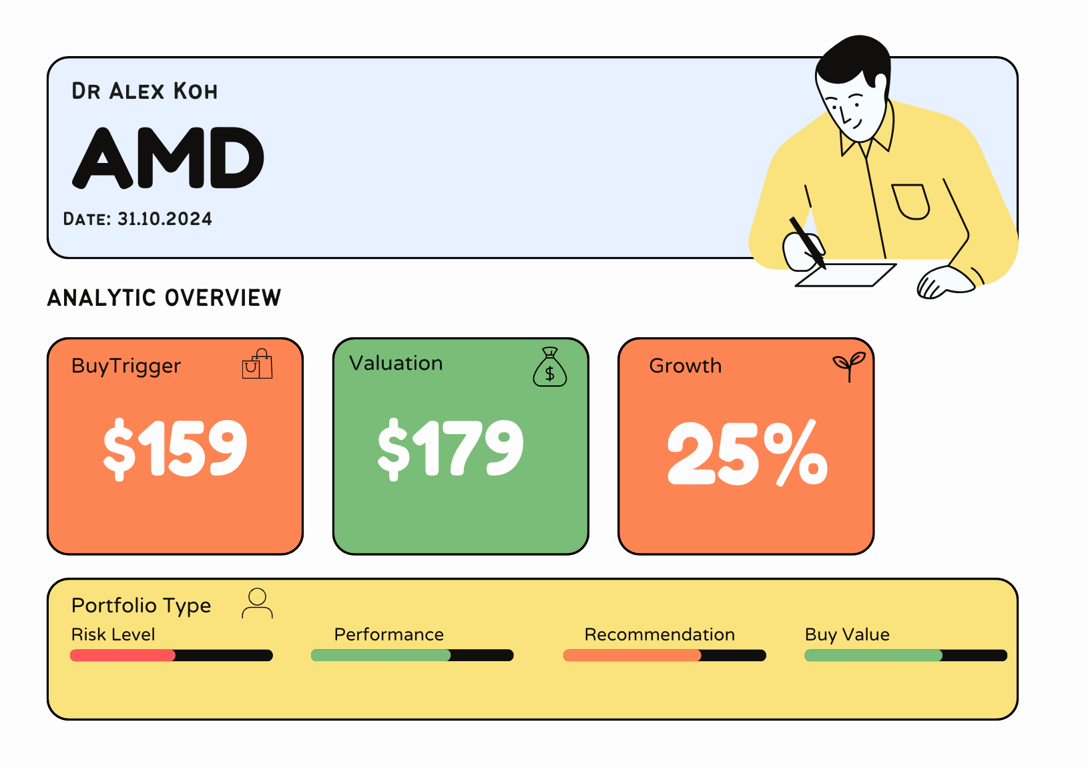

- i see death cross. Lowered my buy trigger as i am expecting for a short pull back.

Breaking News - My thought on the earnings

These are my key highlights from $AMD earnings live session.

- I fell asleep half way through because it was so boring (as expected).

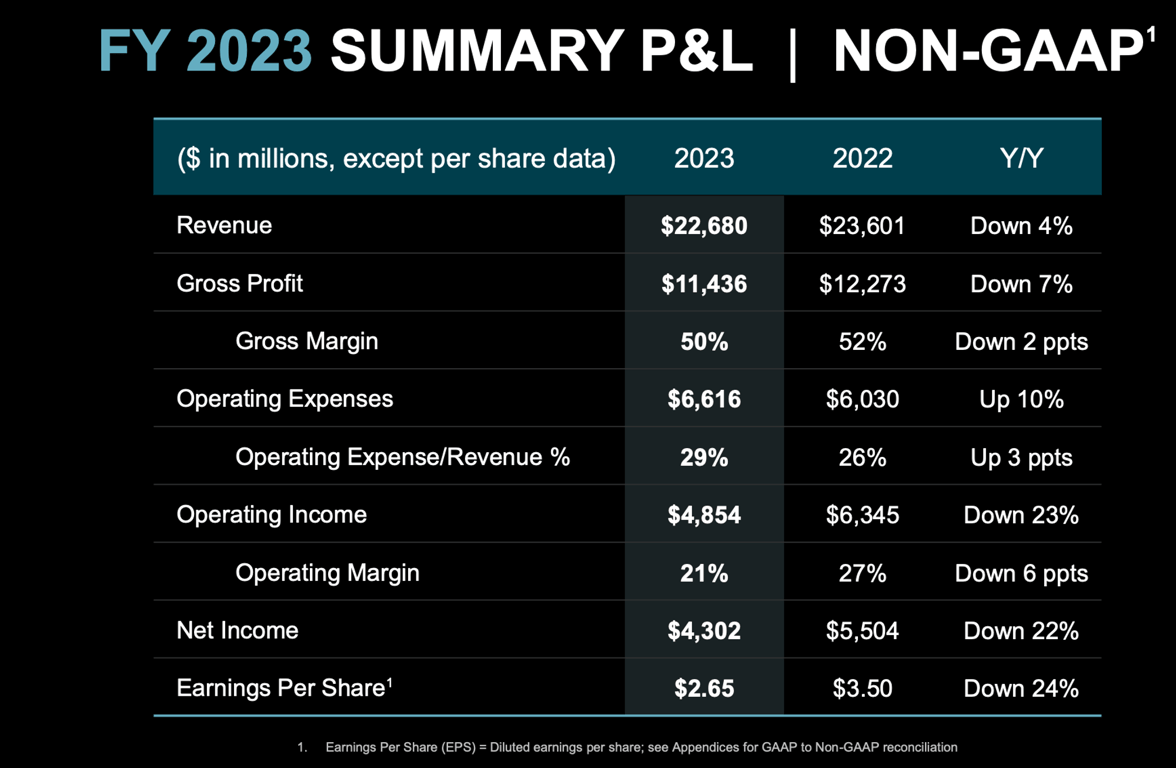

- Numbers was overall lower than 2022 and this gives a confirmed decline for EOY 2023. Any valuation from growth could be negate here.

- Huge decline in embeded and also gaming.

- Going forward embeded will still

Be in decline and gaming double digits decline (%). However data center will grow drastically. (No guidance)

- Instead of giving forecast the word provide some “colour” was used the whole 🕰️.

- Q1 will be flat due to “seasonal” spending expectations. I guess company capex and budgeting. Q2 will show some tailwind. Q3 and Q4 expected to rise (better “colour”).

- Lisa is very proud of the optimisation of her hardware and confident going forward against competition.

My take -

It was expected. Lisa do not bullshit by giving 🌈 promises. She works on data and she does not use forecast as data unless they are secured.

It was expected. Lisa do not bullshit by giving 🌈 promises. She works on data and she does not use forecast as data unless they are secured.

Gaming and embeded decline are a revenue killer. They should have turned around in Q4 2022 but only pivot Q2 2023 earnings. She is concerned about her gaming and

Embeded decline but confident the data center will compensate.

Embeded decline but confident the data center will compensate.

This is a risk for investors. Also a risk for anyone projecting growth. 2024 growth is not guaranteed. Meaning 2024 > 2022. Something to ponder over next few days!

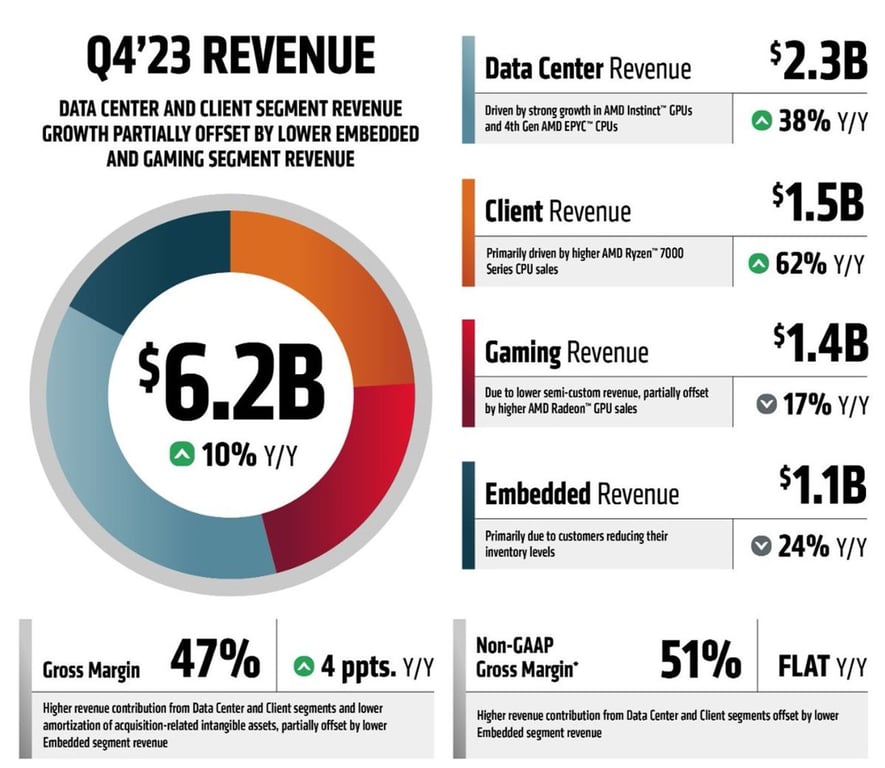

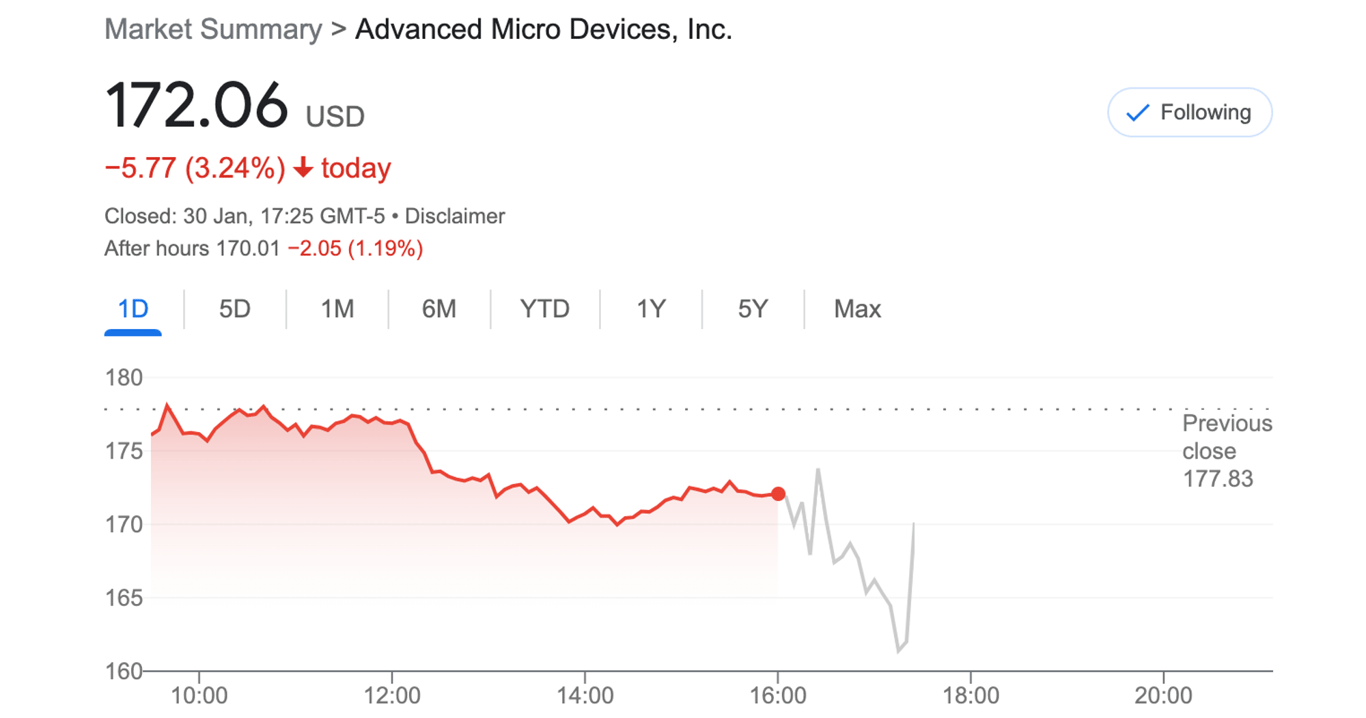

Earnings Update Q4 2024 - 30th Jan 2024 with TA update

- EPS Expected Vs EPS Recveived

- Revenue Exp vs Revenue Received

- decline in embeded

- decline in gaming double digit

- significant increase in data center

- MI300X will grow but they have no include their forecast

Updates and Notes

News Sentiment

Other Updates

Update

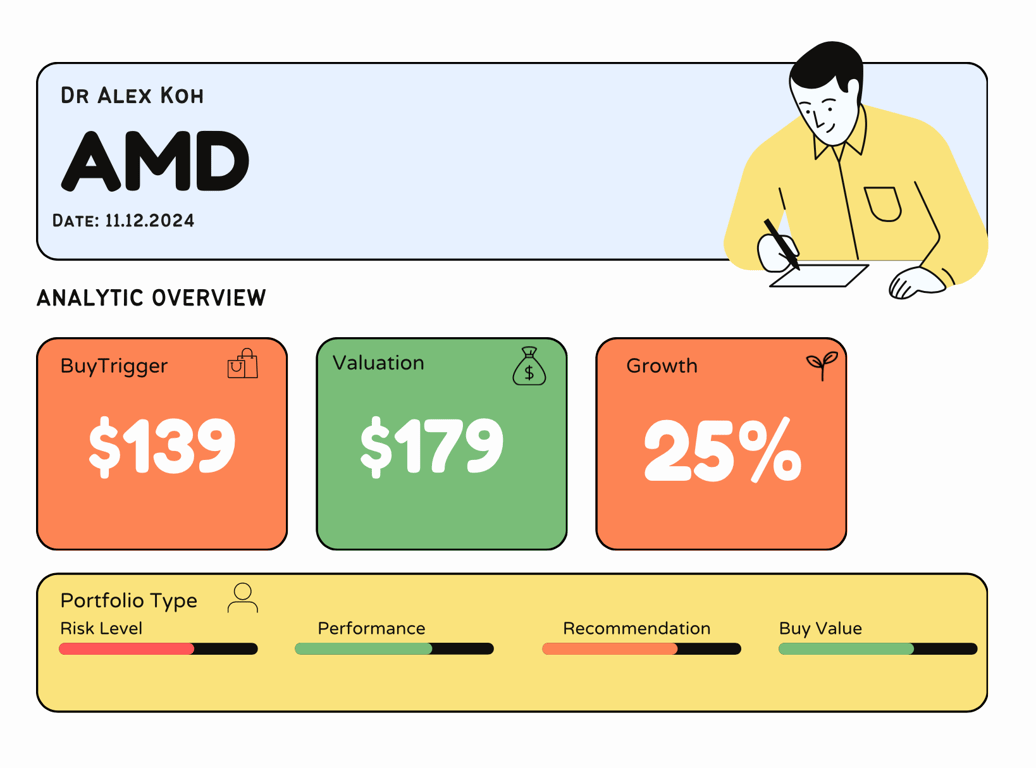

I change and updated the forecast long term. The valuation have been updated as it looks like a slow momentum to a rolling momentum and $175-176 will be my optimistic valuations zone. This will happen as we go along and BT is 150 and 132 which may happen this year with the cycles.

Research Update (26th December 0015hrs)

Updates and Notes

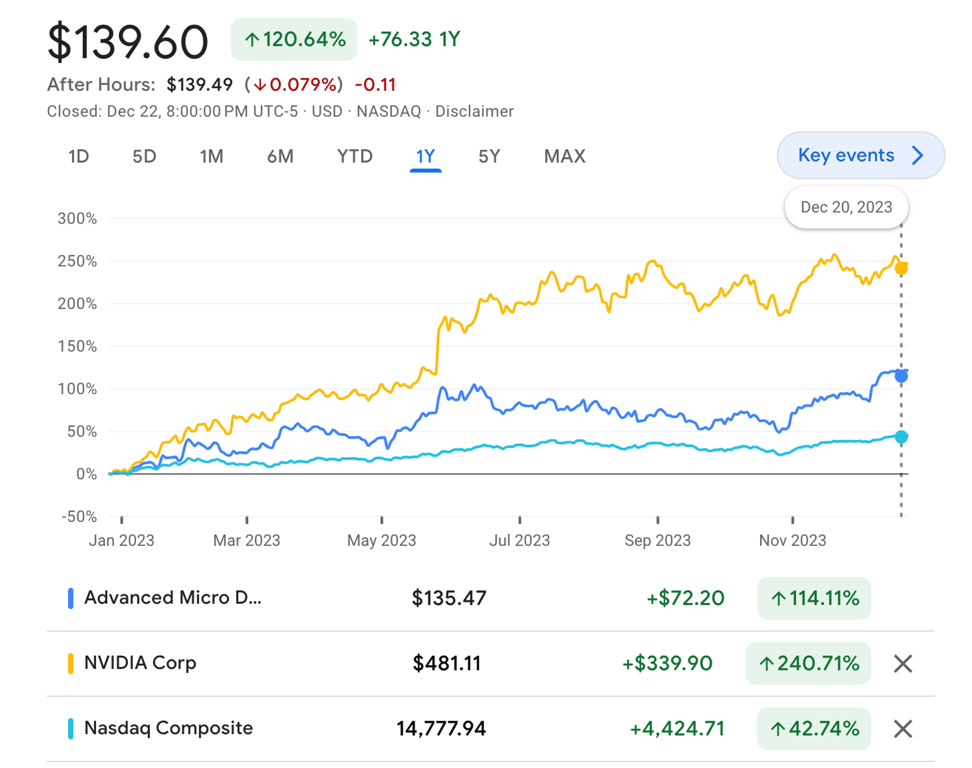

Better than the index but far from Nvidia. Well the two companies are different. To closely compare them to Ford and Toyota is simply wrong. These two comapnies are filling up gaps for next generation automation and AI and this will start to diverge to different applications and concepts.

Nvidia may be poised as a higher risk play as it feels plataeu. AMD may seem to be a safer play due to its down to earth and still realistic valuation.

Remember AMD 2024 forward PE is actually 40, which makes it appetising to hold on to.

warning

AMD will never leap frog over Nvidia. End of the day these both are chasing the same tech. The only way AMD will 10X over Nvidia is when they are taking a different technology move to edge everyone else. Its not Netflix vs Blockbuster moment. Its more Pepsi versus coke moment. Down to who markets better.

So if i was to pick one from the two, NVIDIA is a better team. For good value company, AMD is the place to be. However the company cashflow and business moat can be at risk if any further sign of decline kicks in.

Updates on Recommendations

- HOLD - too high and risky until we see results on new chip sales

- Wait for Entry - we need higher forecast valuation as currently over priced

- Media could attack and go lower if the promise dont hold.

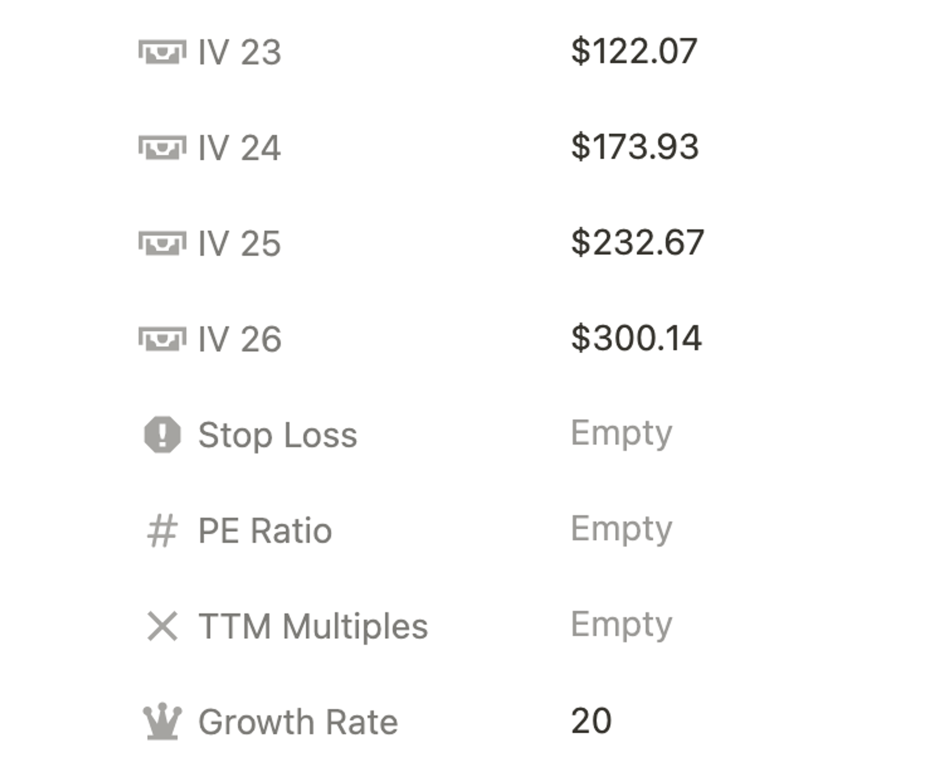

Price Valuation Update[Dec 25, 2023 10:25 PMGMT+00:00] (25th December 2225hrs)

with the current back to growth capacity at 20% after the decline dip, it looks like a potential to 2x from current pricing. The expenditure and cost increase for AMD to turn around to AI and chasing Nvidia seems slow.

Losing ground and playing the chasing game is preety tough for AMD. Back when capital was only 4 times behind NVIDIA to 10 times behind NVIDIA is dissappointing.

WIll AMD eventually catch up?

Reason for Update

- valuation excercise update pre Q4 2023 earnings

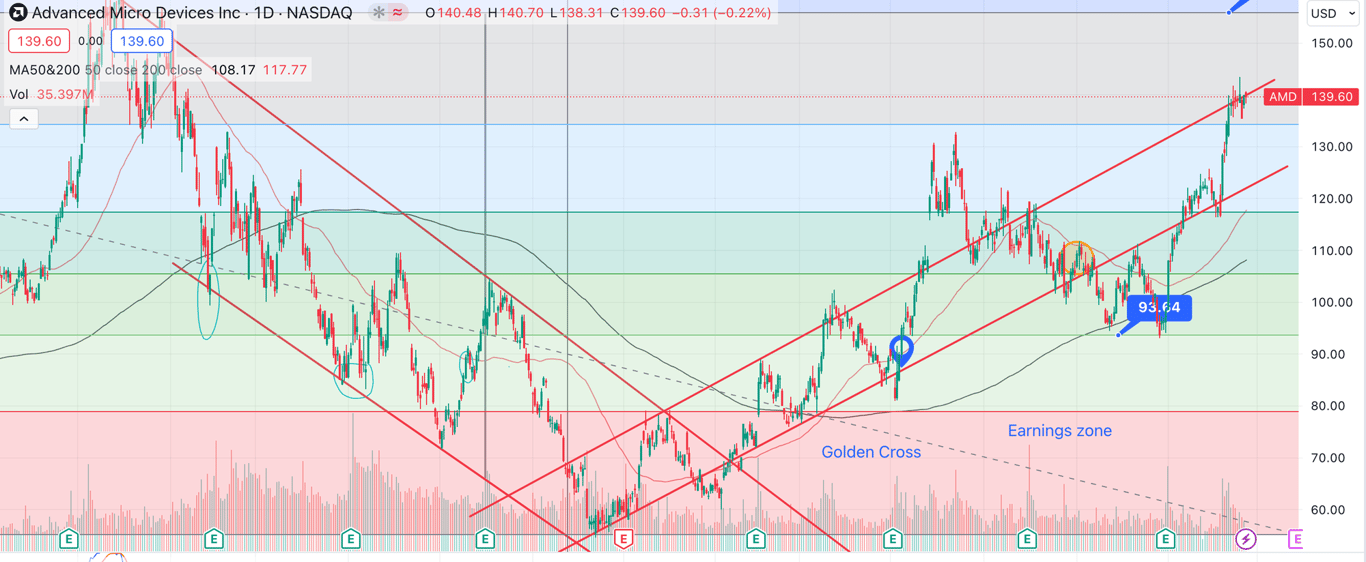

Technical Analysis Update [Dec 25, 2023 10:04 PMGMT+00:00] (25th December 2204hrs)

- Good old classic plot since Q4 2022 and still following the progressive swing. The stock still following the trend and there is no clarity if it will break the trend upwards or downwards.

- Breaking down if their competitiveness in their AI genchip fails

- Break upwards if their development and convincing investors their AI next gen chips will replace their main gaming and retail computing.

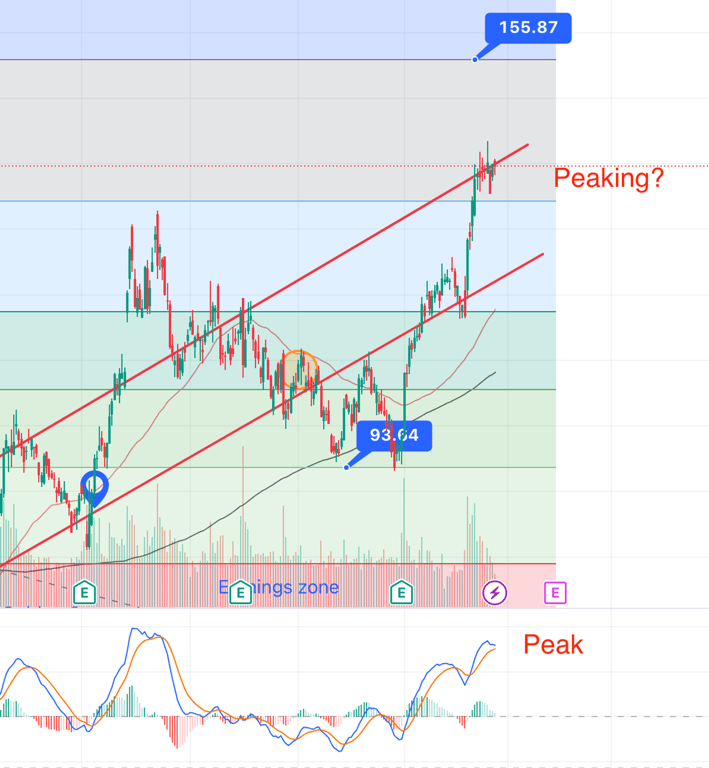

- Short term technical trend looks peaking on the trend and also MACD. It would require alot of breaking news to break above this level to $155.

- Buy Trigger 1 = $117.95 (could be last low level)

- Sell Trigger = $156.05