Arm Holdings (ARM) Stock Comprehensive Review as of August 2024 🟠

Current Price: $134.44

Industry: Semiconductors (Chip Design)

Stock Type: Growth, High Valuation

Rating: B-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Arm Holdings reported strong revenue growth, primarily driven by its dominant position in the mobile CPU market. However, recent growth has slowed, reflecting broader market challenges.

- Net Income: Arm has maintained high gross margins, similar to software companies, but its EPS has been pressured by high valuations and market volatility.

- Free Cash Flow: The company generated $709 million in free cash flow over the past 12 months, benefiting from its capital-light business model.

💰 Valuation Analysis

- P/E Ratio: Arm’s valuation remains high, with the stock trading at elevated multiples due to its dominant market position and future growth expectations in AI and mobile technology.

- Price Target: Analysts have set a consensus price target of $150, with a potential 11.5% upside. However, the stock is down nearly 40% from its highs, indicating market concerns over its valuation.

- Market Cap: Approximately $68.5 billion, reflecting its significance in the semiconductor industry but also its vulnerability to market corrections.

📈 Growth Metrics

- 2024 EPS Growth Forecast: While Arm is expected to continue growing, the rate may be slower than anticipated, with EPS growth potentially impacted by macroeconomic factors and competition in the AI space.

- Price Target: The consensus among analysts remains cautiously optimistic, but the wide range of price targets suggests uncertainty about Arm's ability to meet high market expectations.

🔮 Forecast

Arm is well-positioned in the semiconductor industry, especially in mobile and AI chip design. However, the stock’s high valuation and recent market corrections suggest that investors should approach with caution. The company’s future performance will depend on its ability to maintain leadership in a rapidly evolving market.

Final Summary

- ⚠️ Cautious Buy: While Arm’s market position is strong, its high valuation and recent price volatility make it a more speculative investment.

- 📉 Financial Challenges: Despite strong cash flow and high margins, the company’s ability to sustain its growth at current valuations is uncertain.

- 🔎 Mixed Analyst Sentiment: Analysts are divided, with some recommending a buy based on long-term prospects, while others advise caution due to the stock’s elevated risk.

Arm remains a crucial player in the semiconductor sector, but investors should be mindful of the risks associated with its current valuation and market dynamics.

Interesting Facts

🕶️ Chronological Update below 👇🏻

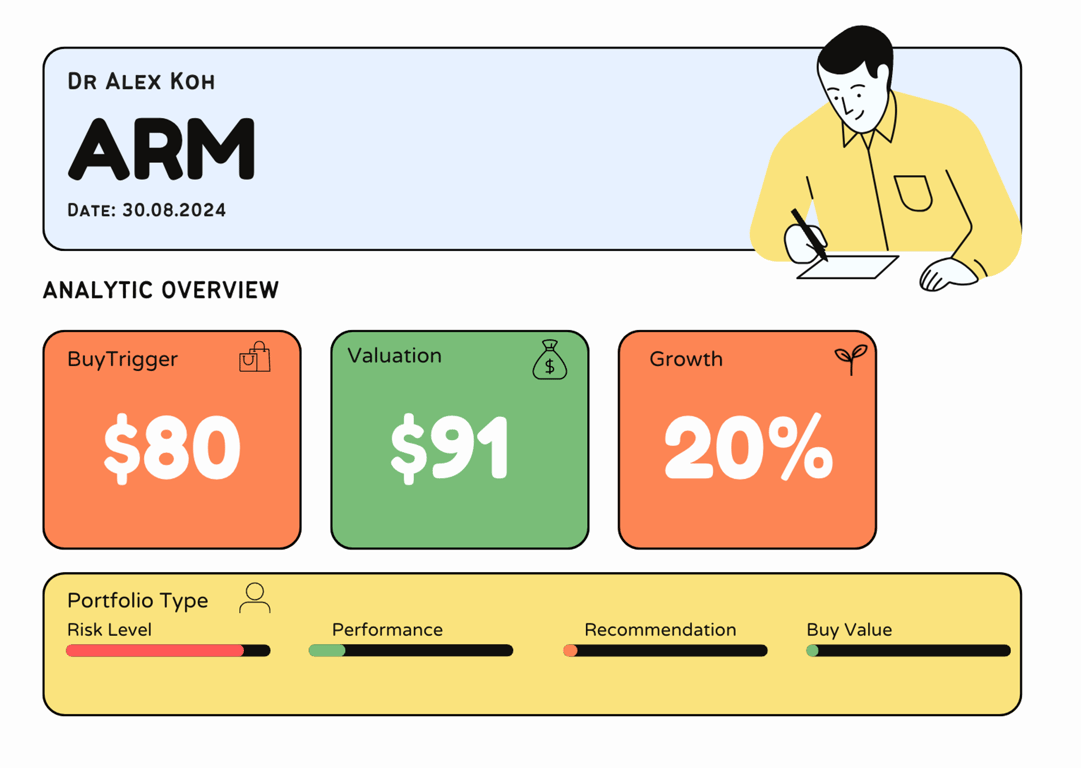

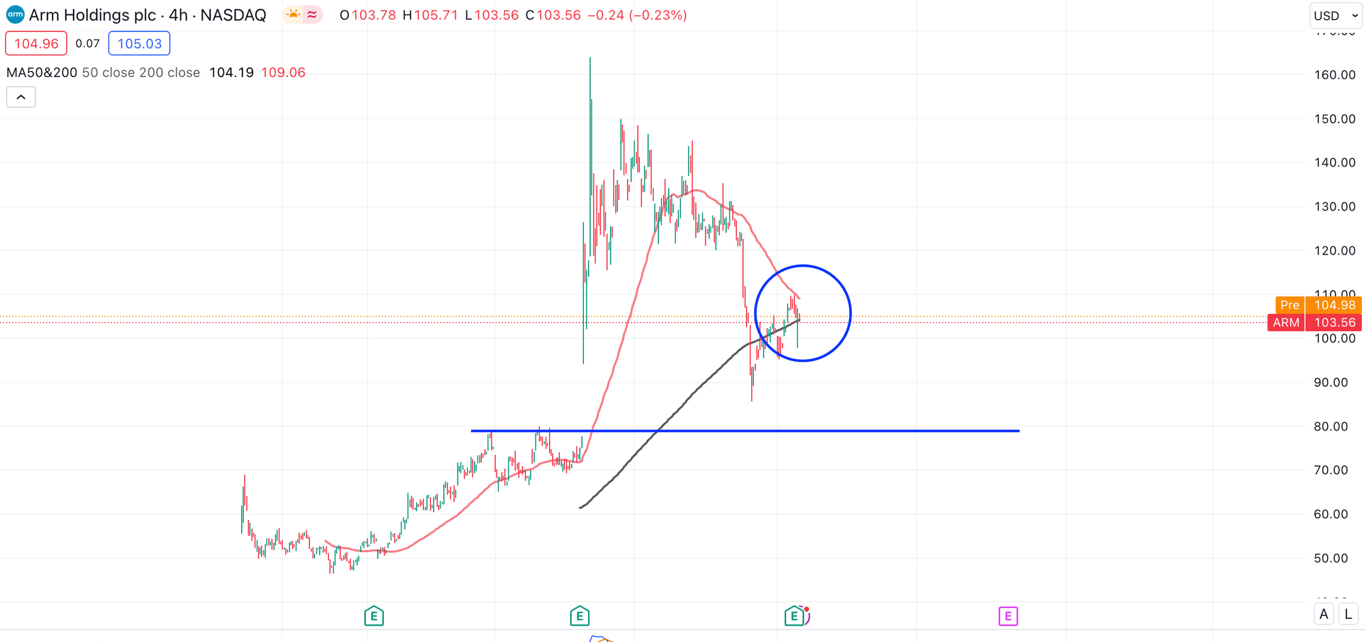

TA and BT Update [Q1/2024]

- Revenue Exp vs Revenue Received

Updates and Notes

Honestly I dont see why this stock is so expensive - $70-$80 is my closest generous buy. Even If i were to consider during the dip, i would watch out for other discounted Semi Stock before venturing to ARM.

Other Updates