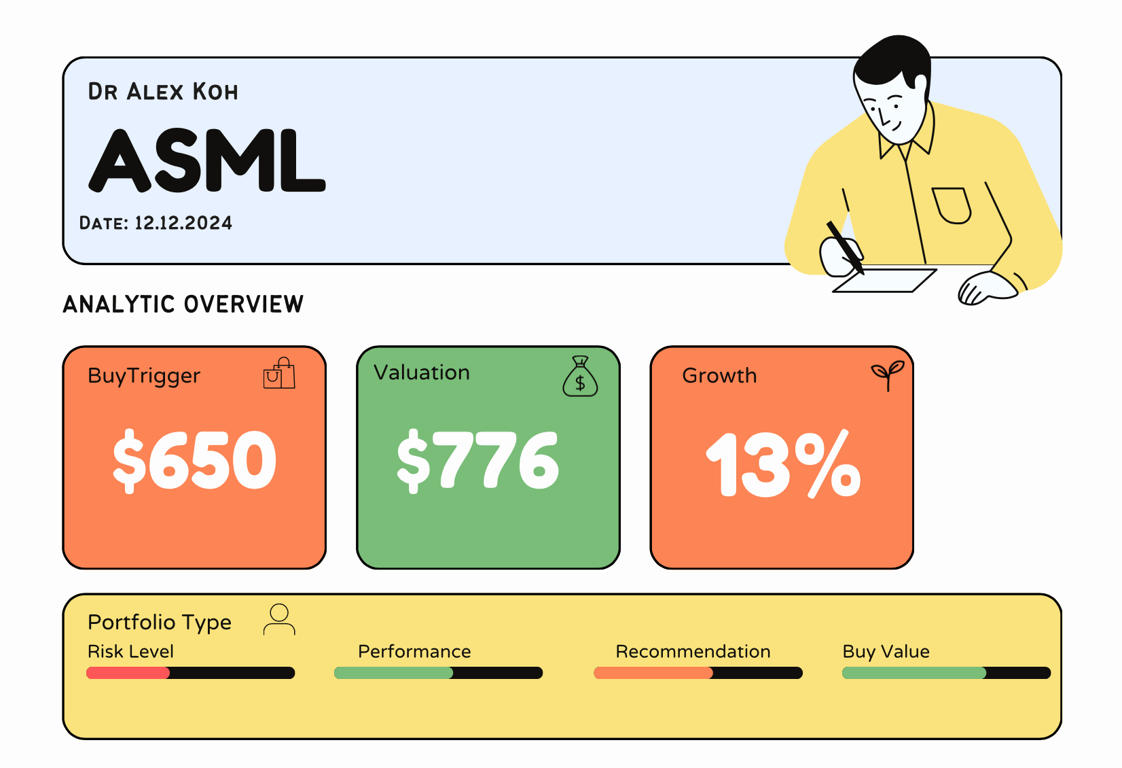

ASML Holding N.V. (ASML) Stock Comprehensive Review as of December 12, 2024 🟢Current Price: $714.43Industry: Semiconductor EquipmentStock Type: GrowthRating: B+

Key Financial Metrics (Q3 Fiscal 2024)

- Revenue: €7.5 billion, up 20% year-over-year, exceeding guidance.

- Net Income: €2.1 billion, reflecting strong profitability.

- Gross Margin: 50.8%, within the expected range.

- EPS (Earnings Per Share): €5.28 (basic), indicating robust earnings.

- Free Cash Flow: Not specified in the latest report.

💰 Valuation Analysis

- P/E Ratio: Approximately 36x, indicating a premium valuation.

- P/S Ratio: Approximately 9.6x, reflecting high market valuation relative to sales.

- Forward P/E: Approximately 29x, suggesting expectations of continued growth.

- PEG Ratio: Not specified, but growth prospects justify current multiples.

- Market Cap: $281.43 billion, classifying it as a mega-cap stock.

📈 Growth Metrics

- 2025 Revenue Growth Forecast: Projected between €30 billion and €35 billion, indicating significant growth potential.

- EPS Growth Forecast: Expected to align with revenue growth, supported by strong demand for advanced lithography systems.

- Bookings: Q3 net bookings of €2.6 billion, including €1.4 billion in EUV bookings, showcasing robust demand.

🔍 Revenue Breakdown

- New Lithography Systems (89 units sold): Major contributor to revenue growth, driven by advanced technology adoption.

- Installed Base Management Sales: €1.54 billion, reflecting ongoing service and upgrade revenue.

🔮 Forecast

ASML maintains a strong position in the semiconductor equipment industry, with a near-monopoly in EUV lithography technology. The company expects total net sales for 2024 to be around €28 billion, with a gross margin between 50% and 51%. Despite short-term challenges, including geopolitical tensions and potential export restrictions, ASML's long-term outlook remains positive, supported by its technological leadership and anticipated growth in the semiconductor market.

Final Summary

- 🚀 Strengths: Leading position in advanced lithography technology, strong financial performance, and robust demand for EUV systems.

- 📊 Concerns: Potential impact of geopolitical tensions and export restrictions on sales, particularly to China.

- 💡 Valuation: High valuation multiples reflect growth prospects but may pose short-term volatility.

- ⚠️ Risks: Geopolitical factors and competition could affect future performance.

ASML's technological leadership and strong financials position it well for long-term growth, making it a compelling investment opportunity despite near-term uncertainties.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [Dec 12, 2024 09:40 AMGMT+00:00]