Berkshire Hathaway Inc. (BRK.B) Stock Comprehensive Review as of August 2024 🟢

Current Price: $472.33

Industry: Diversified Conglomerate

Stock Type: Blue Chip, Defensive

Rating: A

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Berkshire Hathaway reported $379.39 billion in revenue for the last 12 months, reflecting a 4.09% YoY increase. The company’s diverse portfolio, including insurance, railroads, and utilities, continues to generate strong, consistent revenue.

- Net Income: The company achieved a net income of $67.86 billion over the last year, with an EPS of $47,076 per share. This underscores Berkshire’s strong profitability across its various business units.

- Free Cash Flow: Berkshire generated $32.30 billion in free cash flow, demonstrating its robust ability to reinvest in businesses and potentially acquire new ones.

💰 Valuation Analysis

- P/E Ratio: Berkshire’s trailing P/E ratio is 8.06x, and its forward P/E is 22.26x. These ratios suggest that the stock is reasonably valued, with the lower P/E reflecting the company's large cash reserves and stable earnings.

- Price Target: Analysts have set a consensus price target of $471, indicating that the stock is currently trading near its estimated fair value. The highest target is $477, while the lowest is $465.

- Market Cap: Approximately $1 trillion, making Berkshire Hathaway the first non-tech U.S. company to reach this milestone.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Analysts expect a slight decrease in EPS in 2025 to $20.01 from $20.58 in 2024. This forecast reflects the stability of Berkshire’s earnings, though growth is expected to be modest.

- Price Target: The narrow range of price targets suggests that analysts view Berkshire Hathaway as a stable, low-volatility investment with limited near-term growth prospects.

🔮 Forecast

Berkshire Hathaway remains a cornerstone investment for many due to its diversified business model, strong cash flow, and low volatility. However, given its size and the mature nature of its businesses, future growth is expected to be steady rather than explosive. The company’s ability to deploy its massive cash reserves effectively will be key to maintaining its current valuation and potentially driving future growth.

Final Summary

- 🚀 Stable Investment: Berkshire Hathaway offers stability and consistent returns, making it a solid choice for conservative investors.

- 📉 Limited Growth Potential: While the company is financially robust, its size and diversified nature limit the potential for high growth.

- 🔎 Analyst Sentiment: Analysts generally recommend holding the stock, reflecting confidence in its stability but acknowledging limited upside potential.

Berkshire Hathaway remains a reliable, low-risk investment with a strong track record, particularly suited for those seeking long-term, steady returns in a diversified portfolio.

Interesting Facts

🕶️ Chronological Update below 👇🏻

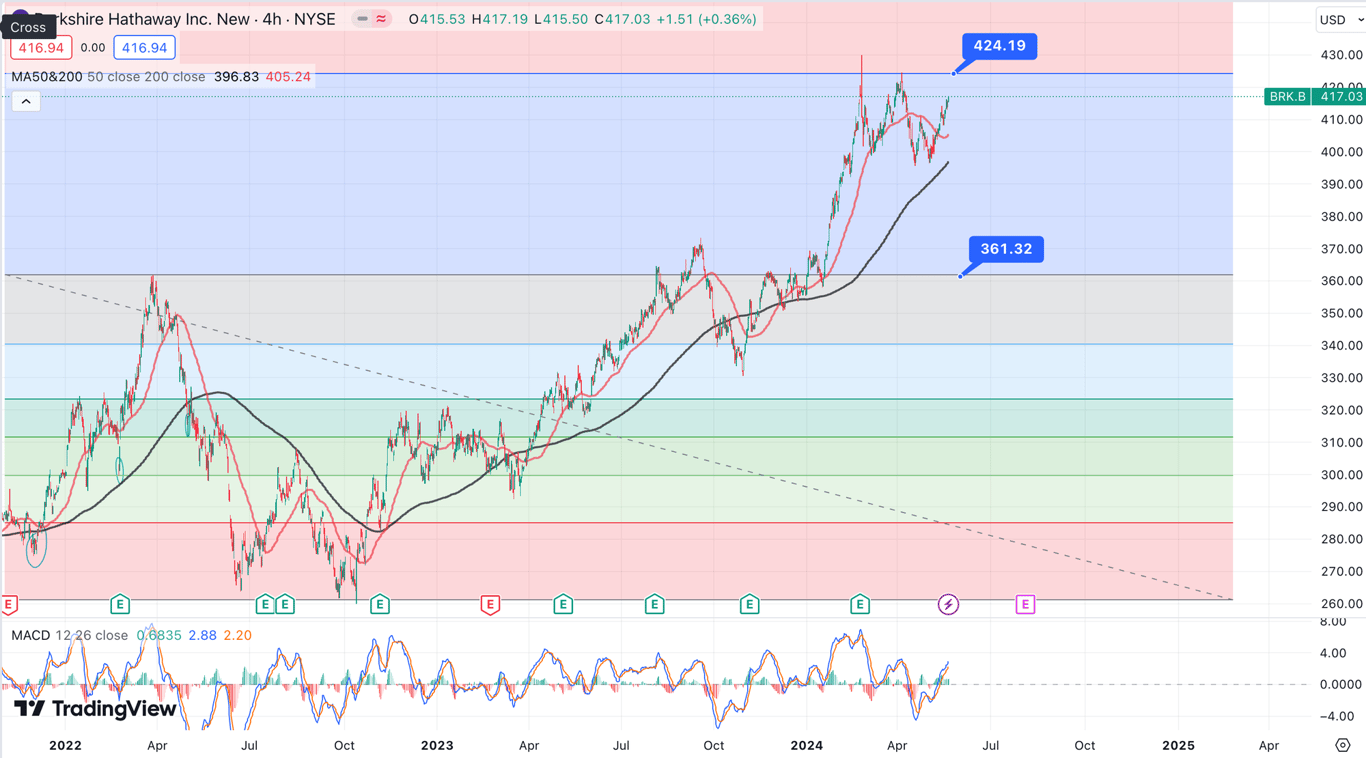

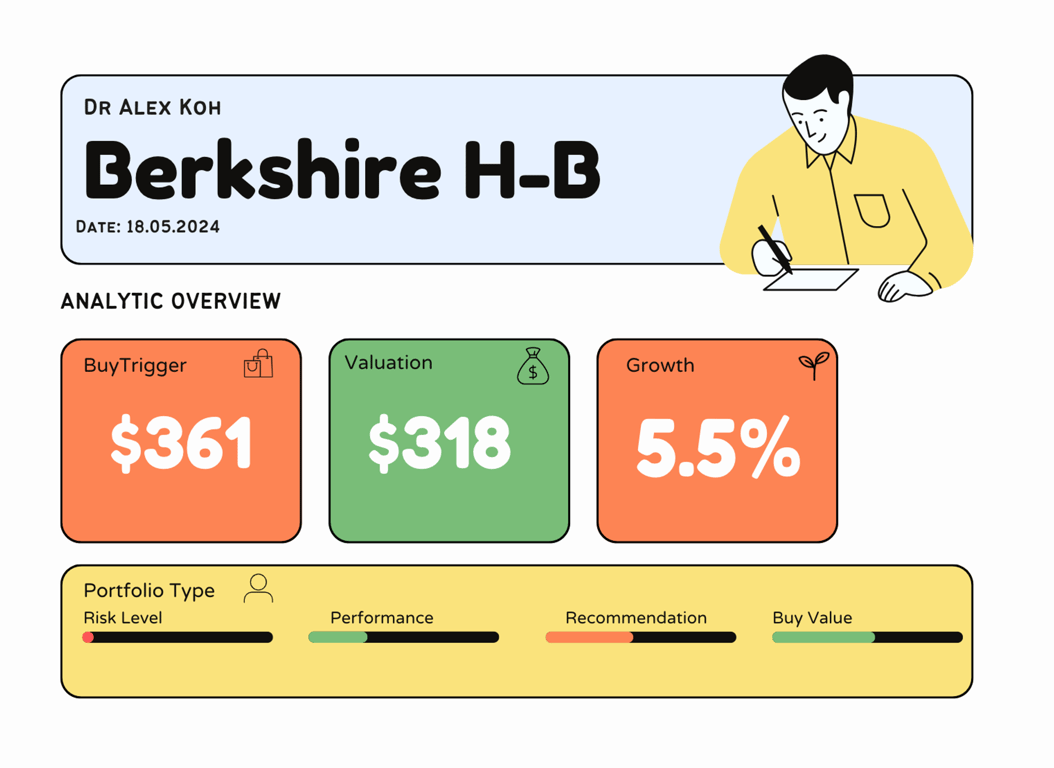

Technical Analysis Update [May 19, 2024 10:33 PMGMT+00:00]