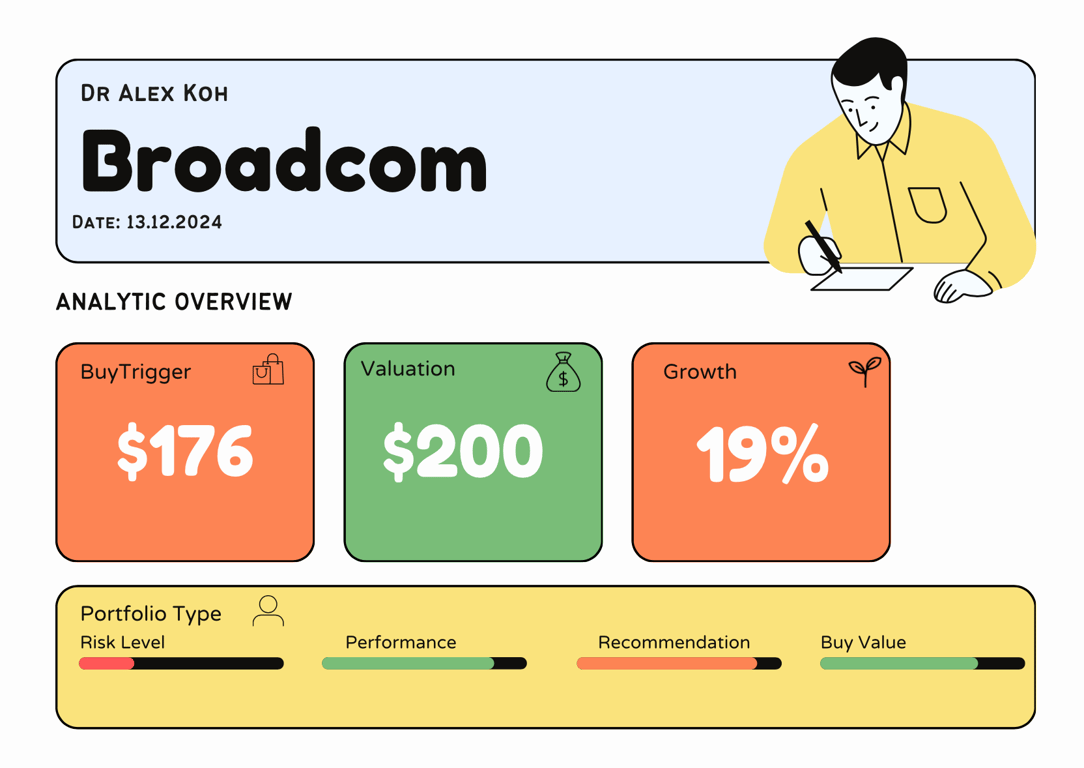

Broadcom Inc. (AVGO) Stock Comprehensive Review as of December 12, 2024 🟢

Current Price: $180.66

Industry: Semiconductor and Infrastructure Software

Stock Type: Growth

Rating: A

Key Financial Metrics (Q4 Fiscal 2024)

- Revenue: $14.05 billion, a 51% year-over-year increase, meeting expectations.

- Net Income: $4.32 billion, up from $3.52 billion in the same quarter last year.

- Gross Margin: Not specified but Broadcom typically maintains robust margins.

- EPS (Earnings Per Share): $0.90, reflecting an 8.4% year-over-year increase.

- Free Cash Flow: Not disclosed in this report.

💰 Valuation Analysis

- P/E Ratio: Approximately 157.47x, reflecting premium valuation.

- Forward P/E: Approximately 47.19x, supported by growth prospects.

- PEG Ratio: Approximately 2.11, highlighting a balance between growth and valuation.

- Market Cap: $300+ billion, classifying it as a mega-cap stock.

📈 Growth Metrics

- AI Revenue Growth: 220% year-over-year, driven by custom AI accelerators and Ethernet networking solutions.

- 2025 Revenue Growth Forecast: Projected at ~15%, driven by sustained demand for AI-related products.

- EPS Growth Forecast: Earnings expected to grow 35.88% next year, from $3.79 to $5.15 per share.

🔍 Revenue Breakdown

- Semiconductor Solutions: $8.2 billion, bolstered by AI-related sales.

- Infrastructure Software: $5.8 billion, reflecting strong contributions from VMware integration.

🔮 Forecast

Broadcom projects fiscal first-quarter revenue of approximately $14.6 billion, slightly above consensus estimates. CEO Hock Tan anticipates a massive opportunity in AI semiconductors, potentially creating a $60 billion to $90 billion market by 2027. Broadcom is strategically positioned to capitalize on this growth through its leadership in AI accelerators and networking.

Final Summary

- 🚀 Strengths: Exceptional growth in AI-related revenues, strong financial performance, and a diversified product portfolio.

- 📊 Concerns: Elevated valuation multiples may lead to short-term volatility.

- 💡 Valuation: High valuation is justified by Broadcom’s leadership and growth prospects.

- ⚠️ Risks: Potential competitive pressures in AI semiconductors and dependency on key customers like hyperscalers.

Broadcom's leadership in AI and robust growth trajectory make it a standout investment for 2024 and beyond, fully deserving an A rating.

Interesting Facts

🕶️ Chronological Update below 👇🏻

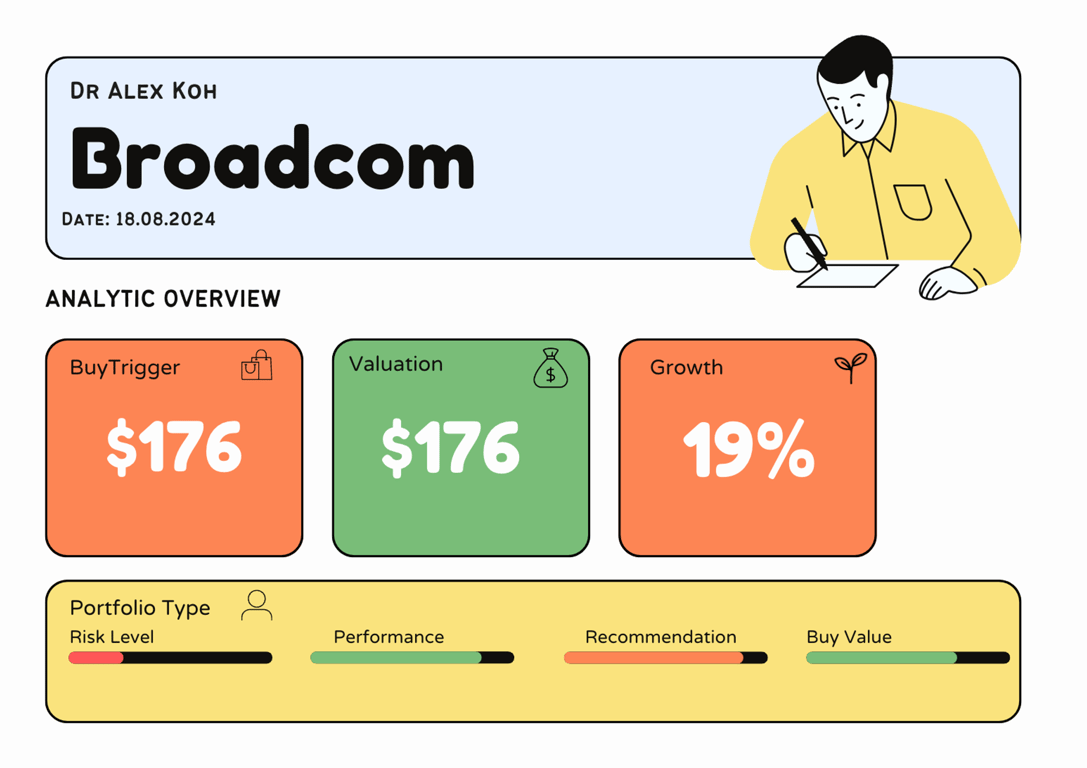

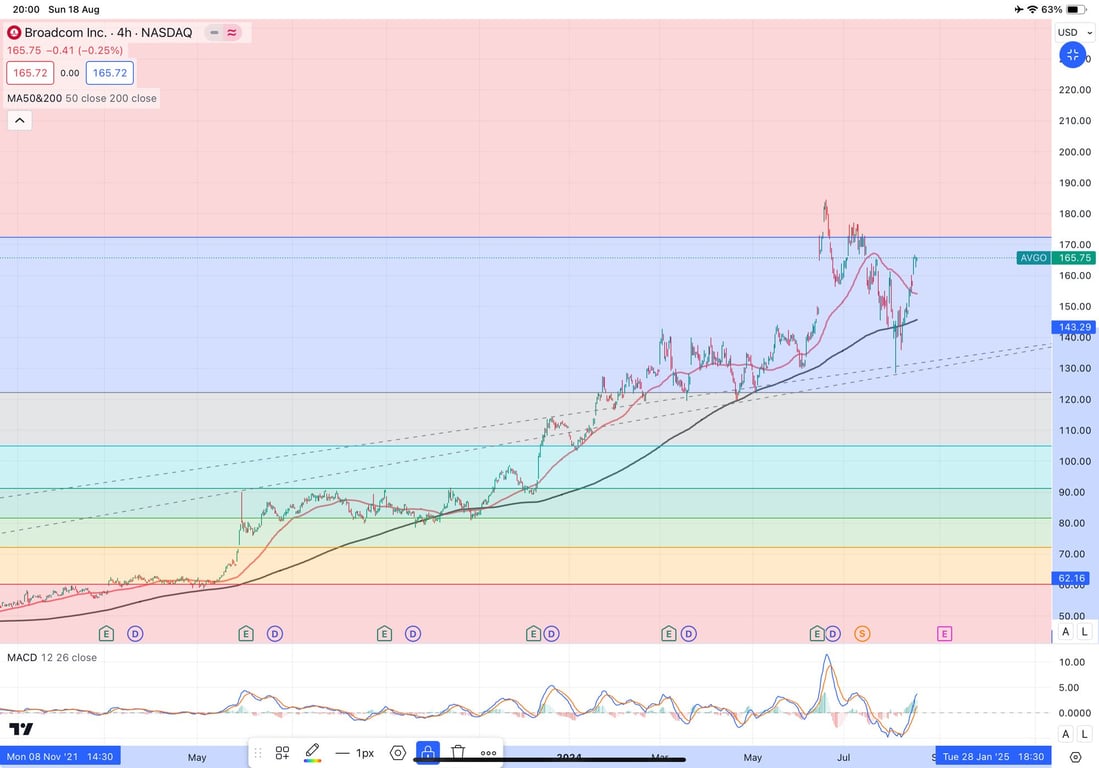

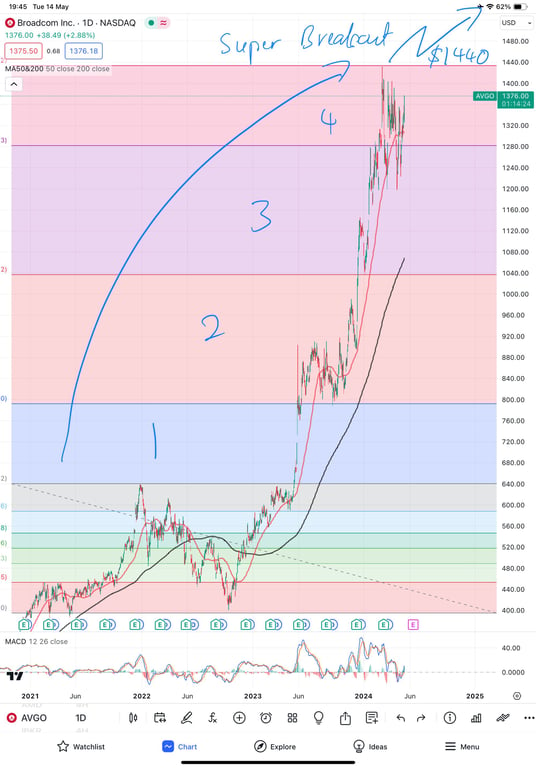

Technical Analysis Update [Aug 18, 2024 08:01 PMGMT+00:00]

- I am raising the Valuation and BT for AVGO to $176. The FIB and valuation are landing on the same price point.

Technical Analysis Update [Jun 18, 2024 12:13 PMGMT+00:00]

- BuyTrigger updated with new FIb level after super breakout completed!

Technical Analysis Update [May 14, 2024 07:42 PMGMT+00:00]

- Super breakout by next earnings