Catalent, Inc. (CTLT) Stock Comprehensive Review as of October 2024 🟡Current Price: $60.59Industry: Biopharmaceuticals, Contract ManufacturingStock Type: Recovery, High RiskRating: B-

Key Financial Metrics (Latest Earnings)**

- Revenue Growth: Catalent posted $1.3 billion in revenue for Q4 2024, showing a 23% YoY increase. This growth is driven by a strong rebound in non-COVID-related product sales, especially in biologics and gene therapies, helping to stabilize the company’s performance.

- Net Income: Despite revenue growth, Catalent remains unprofitable, with a net loss driven by impairment charges and operational inefficiencies. The company’s current EPS is negative, but analysts expect earnings to recover, with projected EPS for 2025 around $1.44, up 69.41% from 2024.

- Free Cash Flow: Catalent continues to face challenges converting its growing revenues into positive cash flow due to high operational expenses and restructuring costs.

💰 Valuation Analysis

- P/E Ratio: Catalent’s P/E ratio is negative due to its losses, but its Price-to-Sales ratio of 2.49x suggests a relatively modest valuation in comparison to its peers.

- Price Target: Analysts have set an average price target of $59.83, indicating a slight downside risk from its current price, although some forecasts see an upside to $63.50.

- Market Cap: With a $10.97 billion market cap, Catalent holds a solid position in the biopharmaceutical manufacturing sector, though it needs to improve profitability to sustain investor confidence.

📈 Growth Metrics

- 2025 Growth Forecast: Catalent's revenue is expected to grow steadily as demand for biologics and gene therapies increases. Analysts project further revenue expansion, but the company's ability to control costs will be critical to achieving profitability.

- Price Target: The potential for long-term growth in high-demand areas like biologics makes Catalent a recovery play, but current risks temper enthusiasm.

🔮 Forecast

Catalent is in the midst of a recovery, bolstered by its expertise in biologics and gene therapies. However, ongoing restructuring efforts and operational challenges continue to impact profitability. If the company can streamline operations and capitalize on strong demand, it could return to growth.

Final Summary

- 🚀 Growth Opportunities with Operational Challenges: Catalent’s focus on high-demand biopharmaceutical products positions it well for the future, but inefficiencies and ongoing losses pose near-term risks.

- 📉 Recovery with Uncertainty: While the company has strong potential, Catalent’s negative earnings and ongoing restructuring justify a B- rating as it works to stabilize its financials.

Interesting Facts

🕶️ Chronological Update below 👇🏻

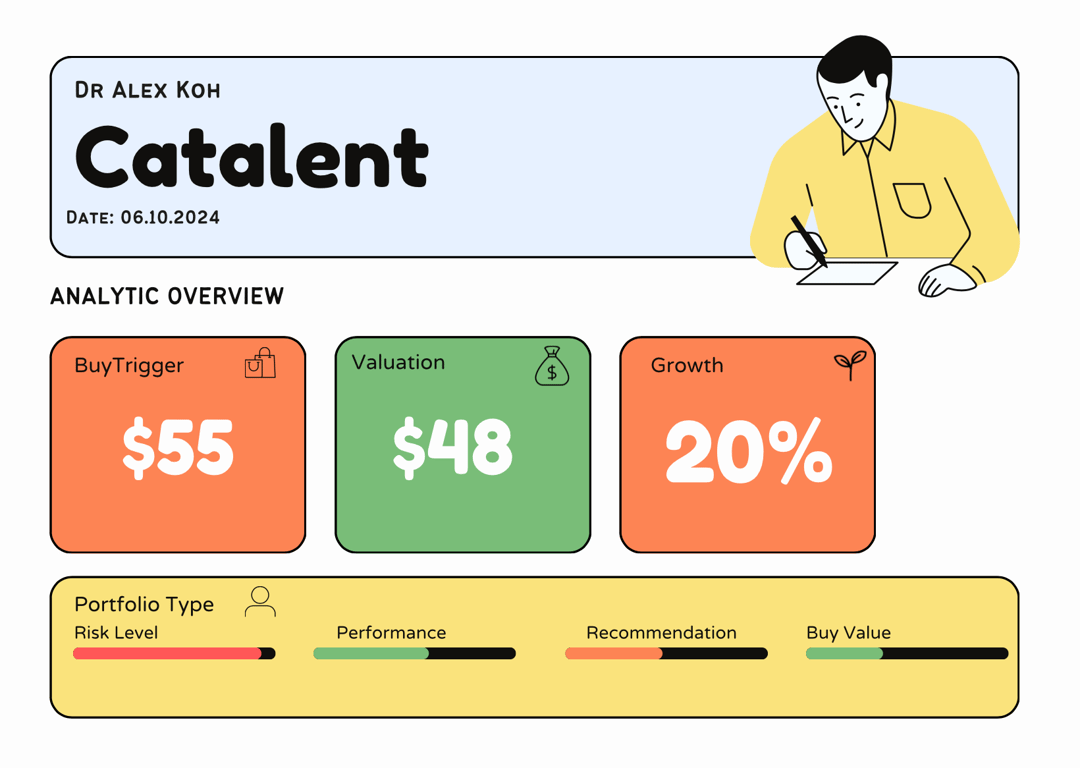

Technical Analysis Update [Oct 6, 2024 07:22 PMGMT+00:00]