Caterpillar Inc. (CAT) Stock Comprehensive Review as of August 2024 🟠

Current Price: $352.91

Industry: Industrial Equipment, Heavy Machinery

Stock Type: Mature Growth

Rating: B

Key Financial Metrics (Latest Earnings)

- Revenue (Q2 2024): $16.69 billion, down 4% YoY.

- Net Income: $2.99 billion, reflecting a 15% YoY decrease.

- Gross Margin: 50.8%, maintaining solid operational efficiency despite revenue decline.

- EPS (Earnings Per Share): $5.99, surpassing analyst expectations by $0.46.

- Free Cash Flow: $3.0 billion, demonstrating strong cash generation and financial stability.

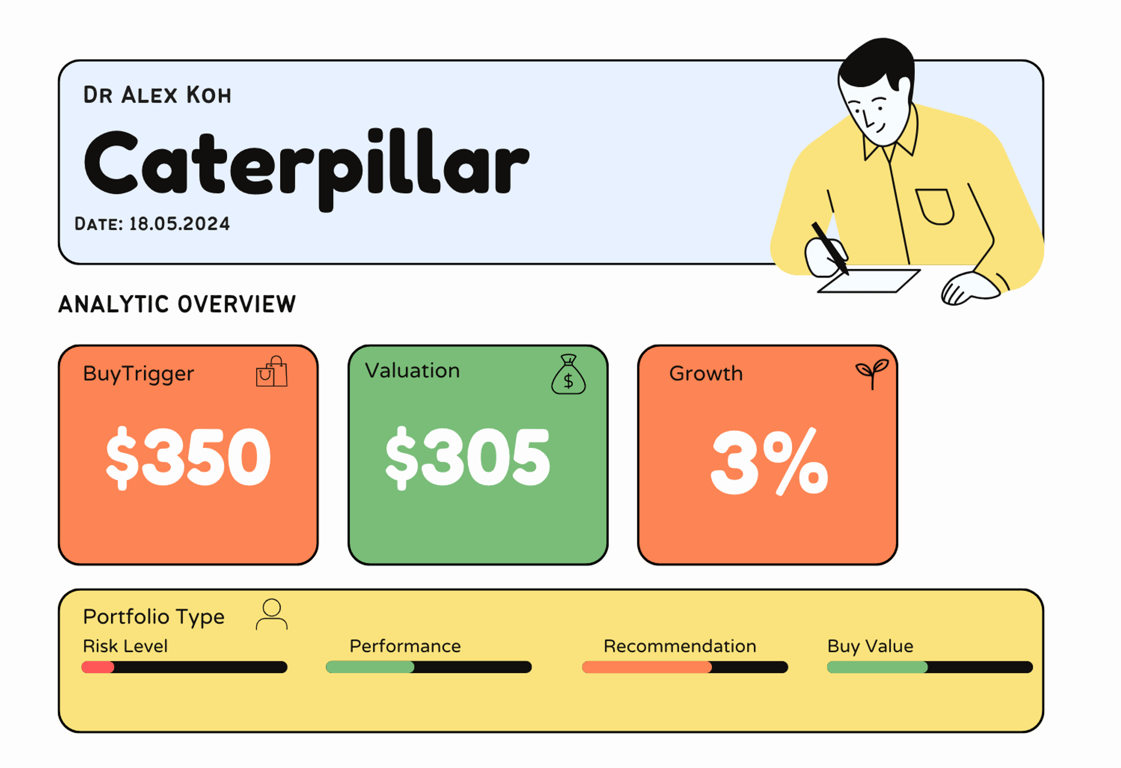

💰 Valuation Analysis

- P/E Ratio: 15.8x, indicating a fair valuation for a mature industrial stock.

- P/S Ratio: 2.2x, suggesting reasonable market expectations.

- Forward P/E: 14.5x, reflecting cautious optimism about future performance.

- PEG Ratio: 1.9, showing that future growth is moderately priced in.

- Market Cap: $184 billion, making CAT a significant player in the industrial sector.

📈 Growth Metrics

- 2024 EPS Growth Forecast: EPS growth is expected to be modest, given the recent slowdown in revenue.

- Price Target: Analysts have set a consensus price target of $336.53, with a range between $245 and $435.

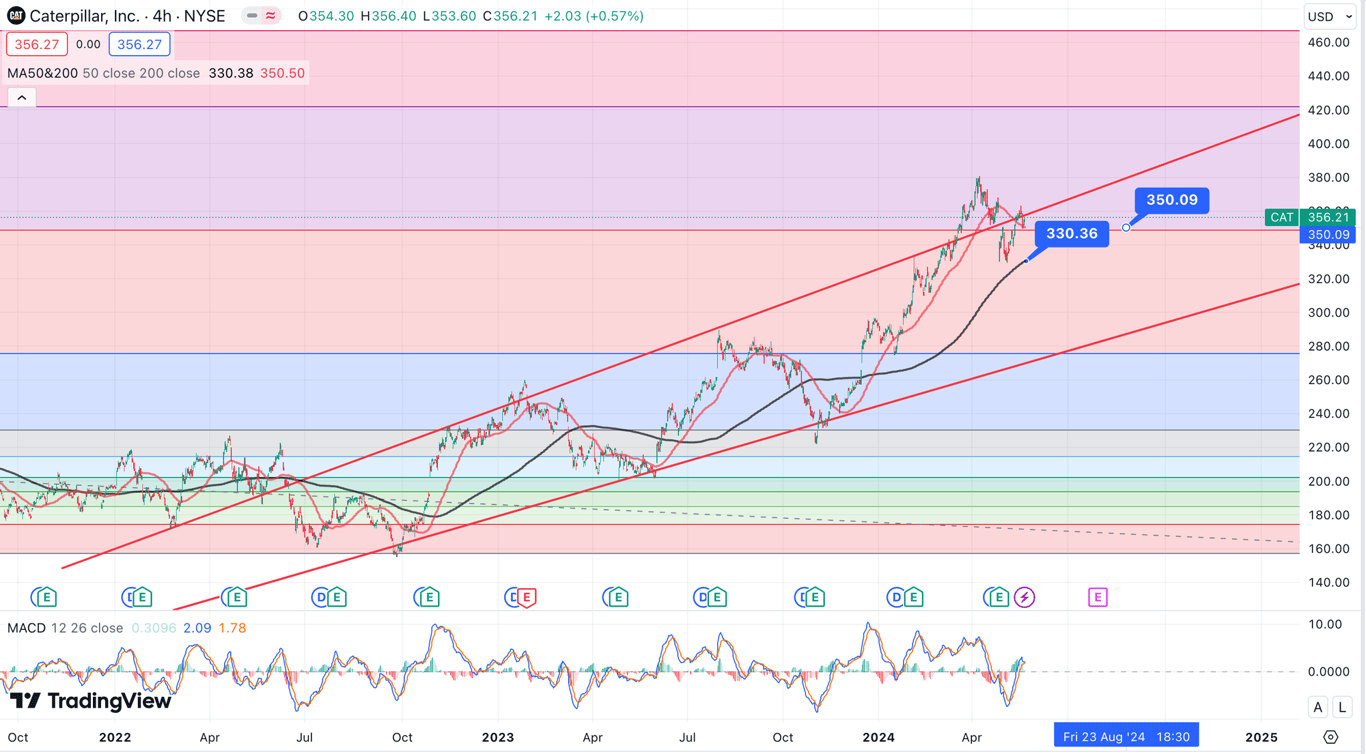

📊 Technical Indicators

- RSI (Relative Strength Index): Currently around 55, suggesting the stock is in neutral territory.

- MACD (Moving Average Convergence Divergence): Recently showed a bearish crossover, indicating potential short-term weakness.

- Moving Averages: The 50-day moving average is converging towards the 200-day moving average, signaling potential volatility.

- Support/Resistance Levels: Strong support around $340, with resistance near $365.

🔮 Forecast

Caterpillar continues to perform well operationally, but the decline in revenue and net income in Q2 2024 signals potential challenges ahead. While the company remains a dominant force in the industrial sector, its growth may be constrained by broader economic factors and sector-specific pressures.

Final Summary

- 🚀 Hold with Caution: While CAT remains a stable investment, recent financial performance suggests a cautious approach, especially given economic uncertainties.

- 📊 Stable Financials: Strong cash flow and profitability, though recent revenue declines could be concerning.

- 💡 Fair Valuation: Current valuation reflects the mature nature of the business, with limited upside potential.

- ⚠️ Risks: Economic downturns and industrial sector slowdowns could further impact growth.

Caterpillar is a solid investment for those seeking stability in the industrial sector, though recent performance suggests the need for cautious optimism.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [May 19, 2024 08:11 PMGMT+00:00]