Costco Wholesale Corporation (COST) Stock Comprehensive Review as of August 2024 🟢

Current Price: $887.00

Industry: Retail, Consumer Staples

Stock Type: Blue Chip, Defensive

Rating: A-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Costco reported $58.52 billion in revenue for Q3 2024, representing a 9.1% YoY increase. This growth reflects continued strong performance in its core retail operations and membership sales.

- Net Income: The company achieved an EPS of $3.78 for Q3 2024, surpassing analyst expectations of $3.70, underscoring its consistent profitability and effective cost management.

- Free Cash Flow: Costco continues to generate strong free cash flow, supporting its ability to pay dividends and invest in new store openings and expansions.

💰 Valuation Analysis

- P/E Ratio: Costco’s current P/E ratio is 54.9x, reflecting a premium valuation typical for a company with a strong brand, steady earnings growth, and a robust membership model.

- Price Target: Analysts have set a consensus price target of $819.89, indicating a potential downside of approximately 7.6% from the current price. However, some analysts have higher targets, reflecting optimism about Costco’s long-term growth prospects.

- Market Cap: Approximately $393 billion, positioning Costco as one of the largest and most stable retail companies globally.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Analysts expect EPS to grow by 10.26% in 2025, driven by continued expansion of Costco’s membership base and its strategic focus on efficiency and value for customers.

- Price Target: The wide range of price targets reflects differing views on Costco’s ability to maintain its current growth trajectory amidst economic uncertainties.

🔮 Forecast

Costco is well-positioned to continue its growth, benefiting from its strong brand loyalty, expanding membership base, and efficient operations. However, its high valuation suggests that the stock is priced for perfection, and any economic downturns or competitive pressures could introduce volatility.

Final Summary

- 🚀 Stable Growth: Costco’s reliable earnings, strong membership model, and strategic expansions make it a solid choice for defensive investors.

- 📉 Valuation Considerations: While Costco’s valuation is high, its consistent performance justifies the premium, though investors should be aware of potential risks.

- 🔎 Mixed Analyst Sentiment: While most analysts recommend a "Buy," the potential downside in the price target suggests caution, particularly given the stock's high valuation.

Costco remains a top defensive stock in the retail sector, offering stability and moderate growth potential, especially in uncertain economic times

Interesting Facts

🕶️ Chronological Update below 👇🏻

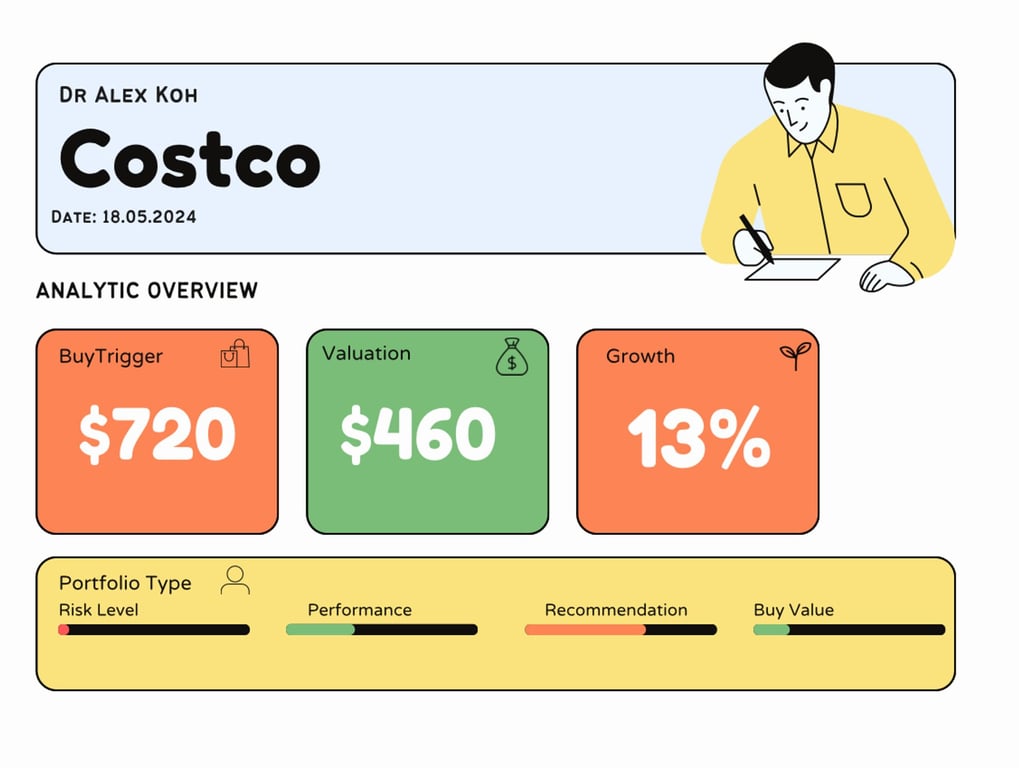

Technical Analysis Update [May 19, 2024 10:01 PMGMT+00:00]

- I cannot value and BT this stock! It’s purely support technicals only