CrowdStrike Holdings, Inc. (CRWD) Stock Comprehensive Review as of November 29, 2024 🟢

Current Price: $345.97

Industry: Cybersecurity

Stock Type: Growth

Rating: B+

💡 Key Financial Metrics (Q3 Fiscal Year 2025)

- Revenue: $1.01 billion, up 29% year-over-year.

- Net Income: GAAP net loss of $16.8 million, or 7 cents per share, compared to a net income of $26.7 million in the previous year.

- Gross Margin: Not specified in the available data.

- EPS (Earnings Per Share): Adjusted EPS of 93 cents, surpassing analyst expectations of 81 cents.

- Free Cash Flow: Not specified in the available data.

💰 Valuation Analysis

- P/E Ratio: Not specified in the available data.

- P/S Ratio: Not specified in the available data.

- Forward P/E: Not specified in the available data.

- PEG Ratio: Not specified in the available data.

- Market Cap: Not specified in the available data.

📈 Growth Metrics

- Annual Recurring Revenue (ARR): $4.02 billion, up 27% year-over-year.

- Price Target: Analysts have set a consensus 12-month price target of $351.65, reflecting confidence in CrowdStrike’s sustained performance.

🔍 Revenue Breakdown

Specific revenue breakdown by segment is not detailed in the available data.

🔮 Forecast

CrowdStrike continues to expand its footprint in the cybersecurity sector, with strong financials and market leadership. The company's growth is underpinned by significant investments in cloud security and platform expansion. While the stock trades at a premium, its robust earnings growth and market dominance justify the valuation.

Final Summary

- 🚀 Buy: CrowdStrike’s leading position in the cybersecurity market, combined with its exceptional financial performance, make it a top-tier stock.

- 📊 Strong Financials: With substantial revenue and ARR growth, CrowdStrike’s financial health is outstanding.

- 💡 Valuation Justified: Despite high multiples, CrowdStrike’s growth potential in cloud security supports its valuation.

- ⚠️ Minor Risks: Watch for short-term market fluctuations due to high valuations and potential regulatory changes, but the long-term outlook remains highly positive.

CrowdStrike remains one of the best-positioned stocks for growth in 2024 and beyond.

Interesting Facts

🕶️ Chronological Update below 👇🏻

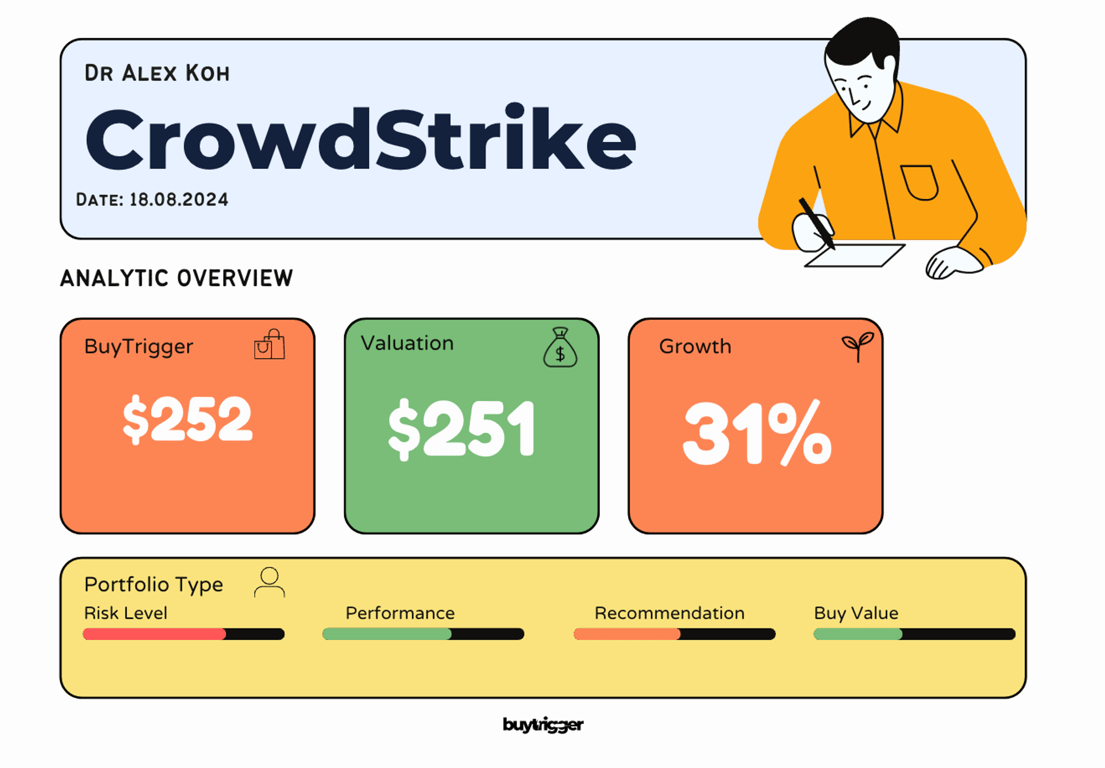

Technical Analysis Update [Aug 18, 2024 02:19 PMGMT+00:00]

- The stock took a breather after the recent scandal and now looking to rebound again. Now the 200MA and also support level at $251 lines up with the 2025 forecast valuation. This is also in line with cyber stocks who looks 2 years ahead.

- I am comfortable to reinstate my BT again at $251

Breaking News [@now]

Updates and Notes

The entire world will be on this witch hunt for compensation and this could spell the end of CRWD. Story in progress….

Other Updates