Dell Technologies Inc. (DELL) Stock Comprehensive Review as of November 29, 2024 🟢

Current Price: $127.59

Industry: Technology Hardware, IT Services

Stock Type: Mature

Rating: B

Key Financial Metrics (Q3 Fiscal 2025)

- Revenue: $24.4 billion, up 10% year-over-year.

- Net Income: $1.1 billion, increasing by 83% YoY.

- Gross Margin: 22.5%, indicating stable operational efficiency.

- EPS (Earnings Per Share): $2.15, surpassing analyst expectations of $2.06.

- Free Cash Flow: $1.5 billion, reflecting solid cash generation.

💰 Valuation Analysis

- P/E Ratio: 18.4x, aligning with industry averages.

- P/S Ratio: 0.8x, suggesting the market values its revenue modestly.

- Forward P/E: 15.2x, indicating a positive earnings outlook.

- PEG Ratio: 1.1, showing a balance between growth and valuation.

- Market Cap: $92.5 billion, classifying it as a large-cap stock.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Dell is projected to achieve a 15% EPS growth, driven by its AI server business and IT services.

- Price Target: Analysts have set a consensus price target of $148.18, indicating potential upside.

🔍 Revenue Breakdown

- Client Solutions Group (CSG) (50%): $12.2 billion (+1% YoY)

- Stable performance in PC and peripheral sales.

- Infrastructure Solutions Group (ISG) (47%): $11.4 billion (+34% YoY)

- Significant growth driven by AI server demand.

- VMware and Other (3%): $0.8 billion (+5% YoY)

- Steady contributions from software and services.

🔮 Forecast

Dell's strong performance in the AI server market, with $3.6 billion in orders and a 50% growth in its pipeline, positions it well for future growth. However, cautious spending in non-AI categories like PCs and storage may impact overall performance.

Final Summary

- 🚀 Buy: Dell's leadership in AI servers and solid financials make it a compelling investment.

- 📊 Stable Financials: Consistent revenue and net income growth highlight its financial health.

- 💡 Valuation Reasonable: Valuation metrics align with industry norms, supporting its current price.

- ⚠️ Risks: Potential challenges include competition in the PC market and economic uncertainties affecting IT spending.

Dell remains a solid investment with growth potential, maintaining a B rating due to its balanced performance and outlook.

Interesting Facts

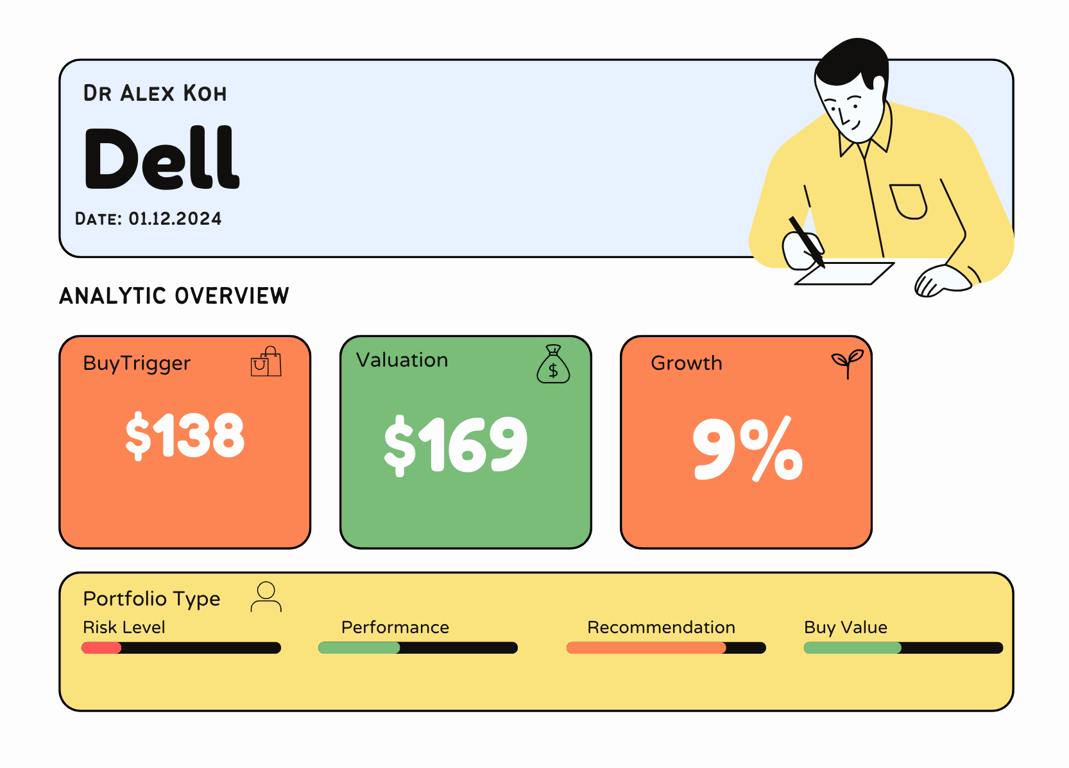

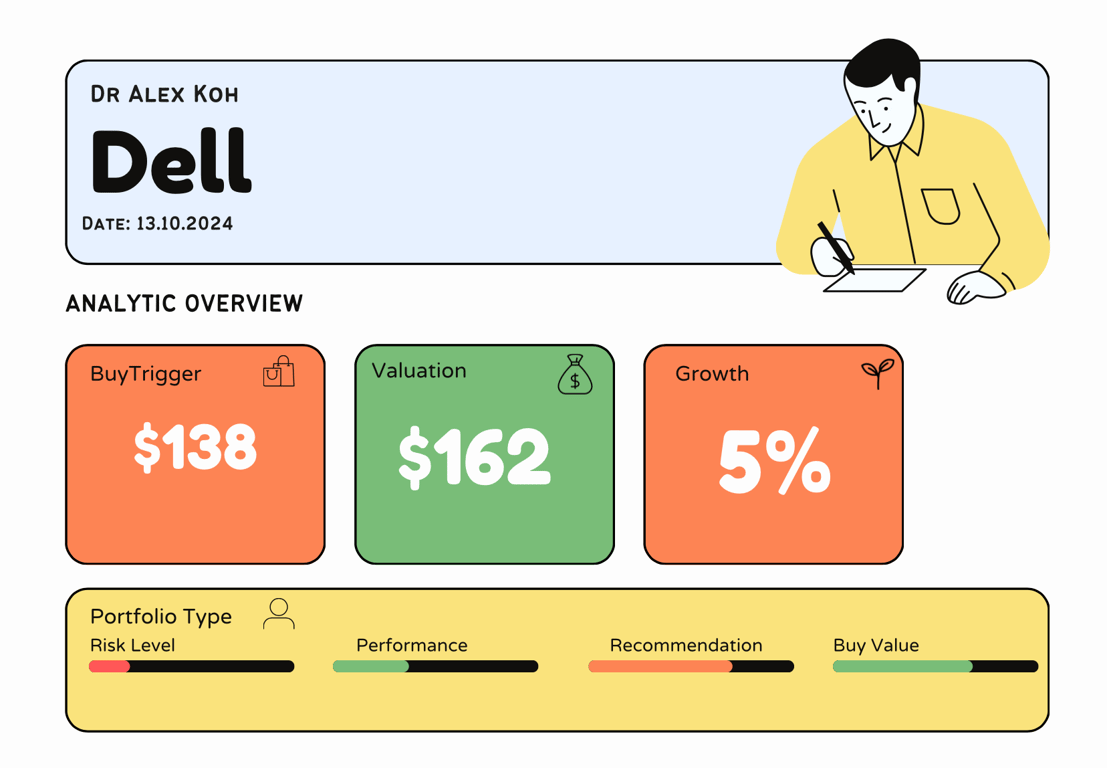

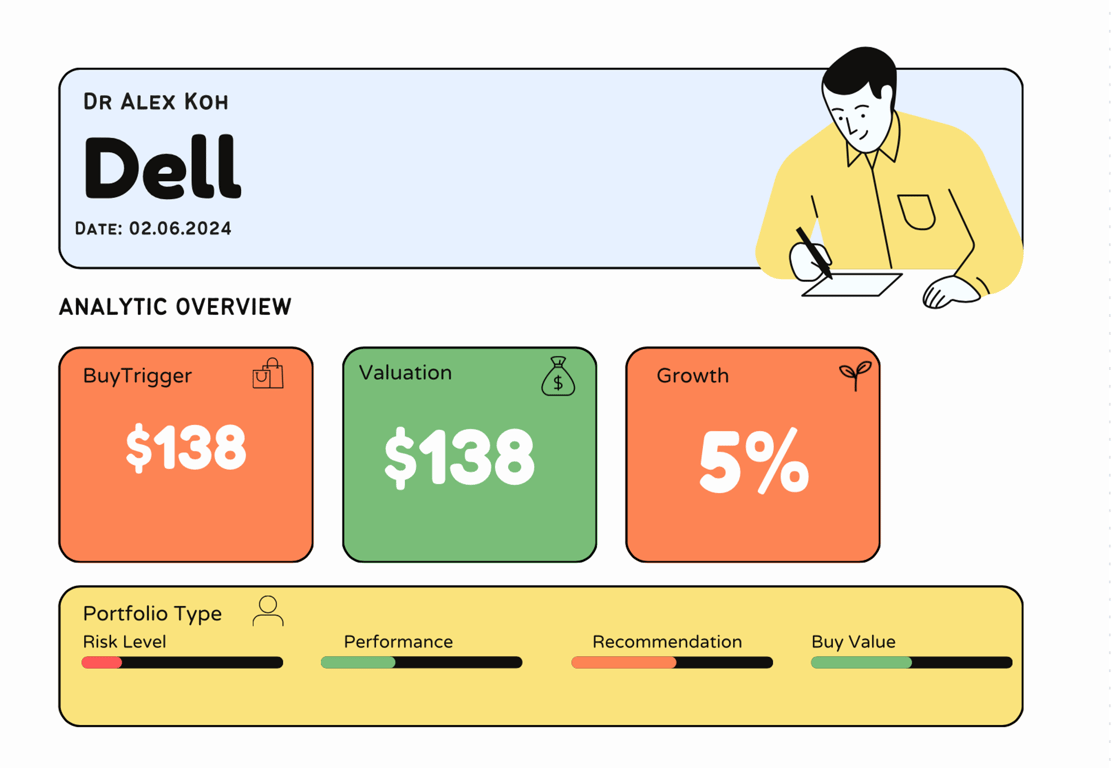

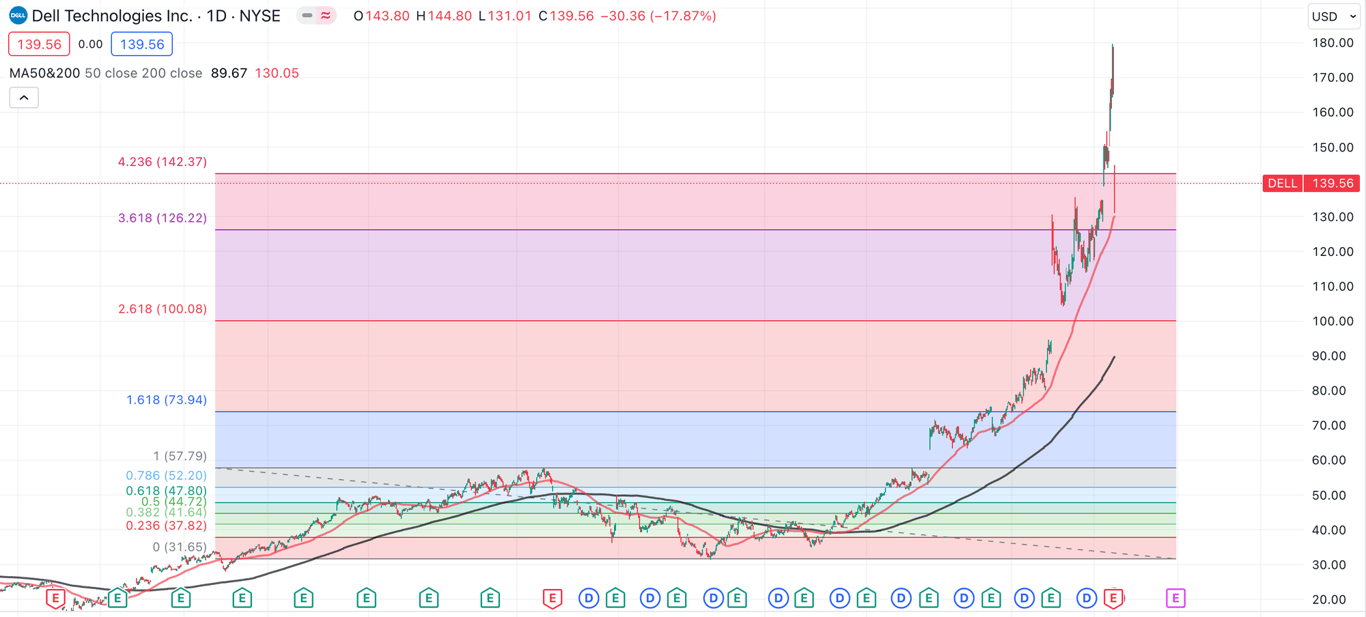

Technical Analysis Update [Jun 2, 2024 09:35 AMGMT+00:00]

- Denied Super breakout - too early - i am happy there is a huge pull back to deny a bubble machine