Duolingo, Inc. (DUOL) Stock Comprehensive Review as of October 2024 🟡Current Price: $283.49Industry: Educational Technology, Mobile LearningStock Type: High Growth, Innovation-DrivenRating: B

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Duolingo achieved 41% year-over-year revenue growth in Q2 2024, bolstered by new AI-driven features like Duolingo Max, which provides advanced learning tools such as interactive video calls.

- Net Income: Although the company is nearing profitability, Duolingo is still heavily investing in product development and global market expansion, expecting to break even by 2025.

- Free Cash Flow: Duolingo continues to generate healthy cash flow, supporting its product innovations and global expansion plans.

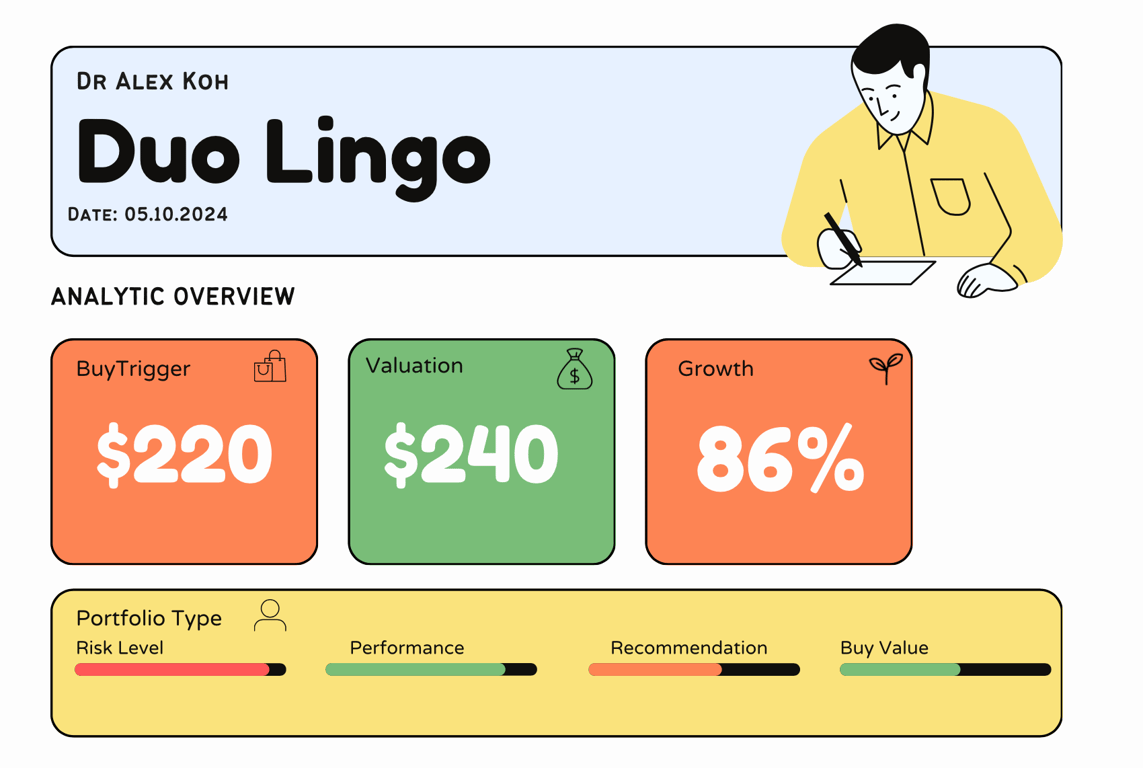

💰 Valuation Analysis

- P/E Ratio: Duolingo’s valuation remains focused on future earnings potential, as it is still in its growth phase. Analysts have set price targets between $254.30 and $310, indicating moderate upside from current levels.

- Price Target: Trading around $283.49, the stock offers growth potential, though recent increases in valuation suggest limited near-term upside.

- Market Cap: With a $12.34 billion market cap, Duolingo has solidified its place as a leader in mobile learning, but much of its value is tied to continued innovation and user growth.

📈 Growth Metrics

- 2025 Growth Forecast: Duolingo is expected to maintain growth, particularly through its expanding curriculum, which now includes subjects like music and math. Its focus on AI-driven educational experiences should support continued user acquisition and engagement.

- Price Target: Although there is long-term potential, the stock’s high valuation and competitive landscape may slow near-term stock appreciation.

🔮 Forecast

Duolingo’s innovative AI-driven tools and expanding content position it for future growth, but the competitive ed-tech market and its current high valuation could present challenges. The company’s trajectory remains positive, but investors should expect moderate risk in the near term.

Final Summary

- 🚀 Innovative, but Competitive: Duolingo continues to lead in mobile learning with its advanced features, but faces increased competition in the education sector.

- 📉 Moderate Upside: While long-term growth potential is strong, Duolingo's current valuation suggests limited short-term gains, justifying the B rating.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [Oct 6, 2024 06:39 PMGMT+00:00]