Eli Lilly and Co. (LLY) Stock Comprehensive Review as of October 2024 🟢

Current Price: $846.83

Industry: Pharmaceuticals, Biotechnology

Stock Type: Growth, Innovation-Driven

Rating: A

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Eli Lilly has shown robust revenue growth, with projections for 2024 revenue reaching $46.74 billion, up by 36.96% year-over-year, primarily driven by strong demand for drugs like Mounjaro for diabetes and Zepbound for weight management. The company’s revenue growth is anticipated to remain solid, with analysts projecting 25.95% growth in 2025 as it continues to expand its drug portfolio.

- Net Income: EPS for 2024 is expected to be $16.58, representing a remarkable 185.82% increase from 2023. The company’s profitability continues to strengthen, and its EPS is projected to rise further by 40.25% to $23.25 in 2025, underscoring its expanding margins and robust demand across its therapeutic areas.

- Free Cash Flow: Eli Lilly maintains a strong cash flow, which supports substantial reinvestment in R&D and new product lines, especially within its growing focus on weight management and Alzheimer's therapies.

💰 Valuation Analysis

- P/E Ratio: With a forward P/E ratio of around 51.08x for 2024, Eli Lilly is trading at a premium, reflecting investor confidence in its growth trajectory and blockbuster drugs. This valuation highlights both its strong market position and its exposure to high-growth therapeutic areas.

- Price Target: Analysts have an average 12-month price target of $964.4, suggesting a 13.88% upside from the current price. Some forecasts are as high as $1,250, indicating optimism surrounding the company’s product pipeline and continued growth.

- Market Cap: Eli Lilly's market capitalization of over $860 billion solidifies its position as one of the most valuable companies in the pharmaceutical sector, buoyed by its innovative drug lineup and extensive market reach.

📈 Growth Metrics

- 2025 Growth Forecast: Eli Lilly’s revenue is projected to reach $58.86 billion by 2025, with sustained demand for its leading diabetes and obesity treatments. The company’s growth outlook remains strong, with potential upside from new approvals and market expansions in multiple regions.

- Price Target: The high-end price target reflects strong expected performance in key drug markets, supported by an expanding portfolio that includes treatments for Alzheimer's, cancer, and chronic conditions.

🔮 Forecast

Eli Lilly’s outlook remains highly favorable, with blockbuster drugs like Mounjaro and Zepbound continuing to drive revenue growth. Although it recently faced some quarterly setbacks due to inventory and supply chain challenges, its long-term growth prospects remain strong. Investors view the stock as a high-potential long-term investment due to its innovation-led strategy in critical therapeutic areas.

Final Summary

- 🚀 Growth Leader: Eli Lilly’s strong position in the pharmaceutical sector, backed by innovative drugs and strong financials, makes it a top choice for growth-oriented investors.

- 📈 Attractive Upside: The stock is expected to see continued gains driven by expanding product demand, justifying its A rating.

Interesting Facts

🕶️ Chronological Update below 👇🏻

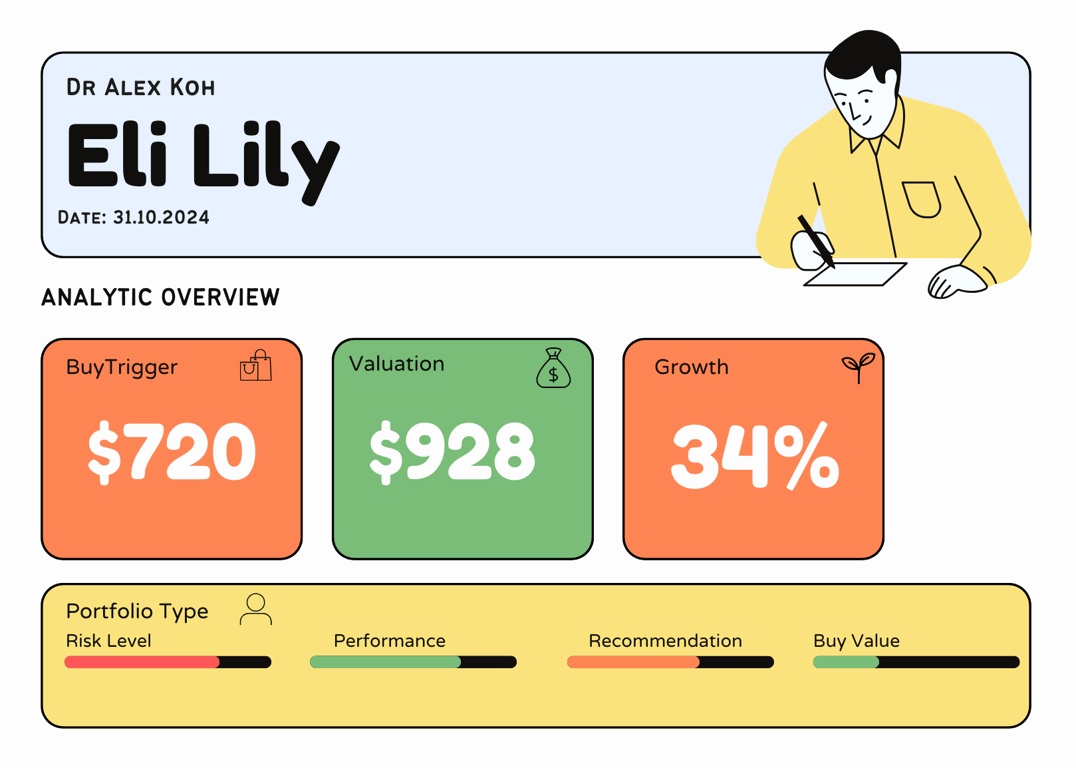

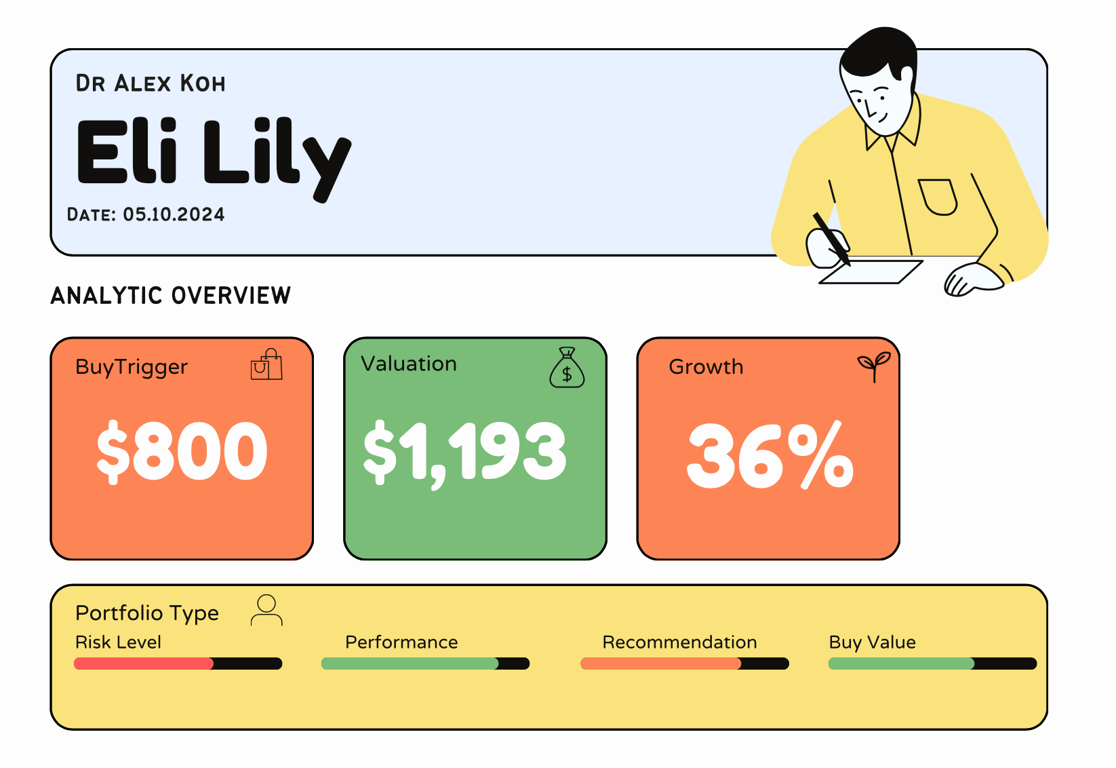

Price Valuation Update[Oct 31, 2024 08:40 AMGMT+00:00]

Reason for Update - They double miss on earnings - Forecast EPS 2024 dropped 16 to 13.5 which is massive.

BT#1 - 720

Valuation - 1193 - 928

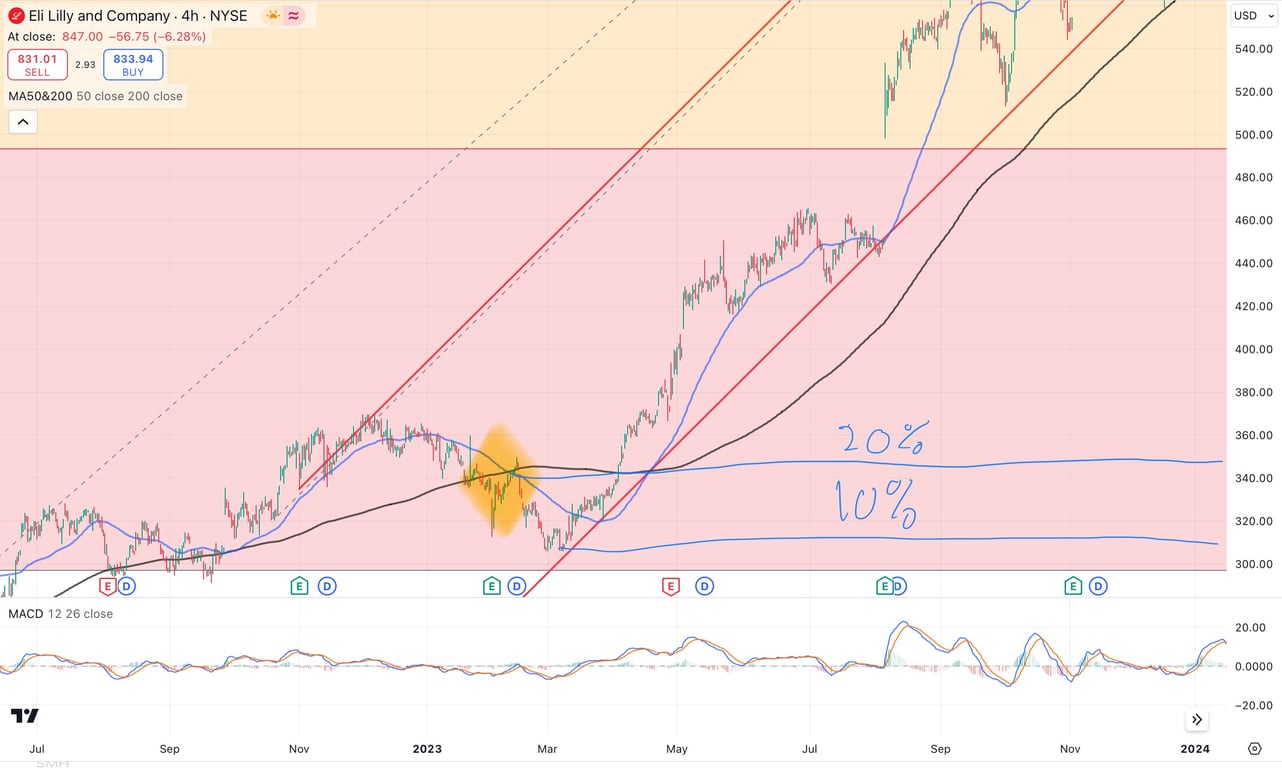

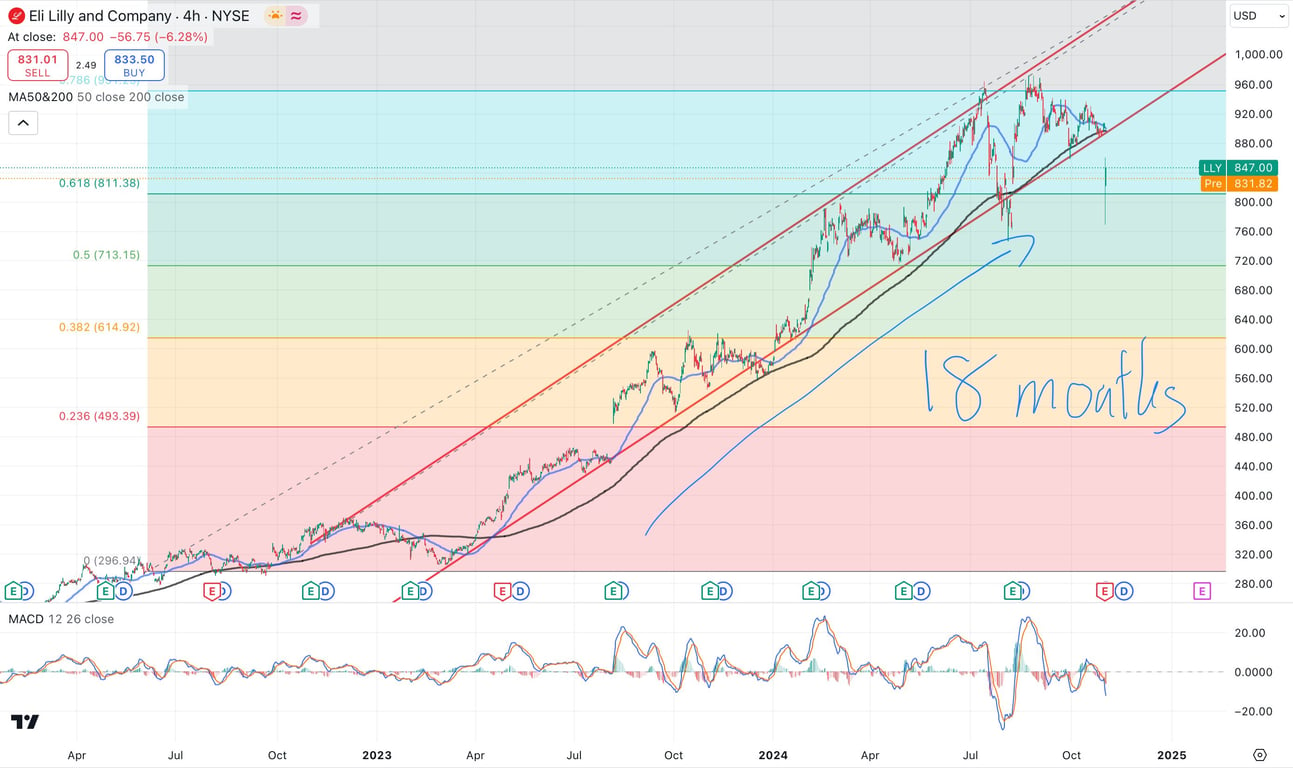

Technical Analysis Update [Oct 6, 2024 06:30 PMGMT+00:00]