Alphabet Inc. (GOOGL) Stock Comprehensive Review as of August 2024 🟢

Current Price: $162.93

Industry: Technology, Internet Services

Stock Type: Growth

Rating: A-

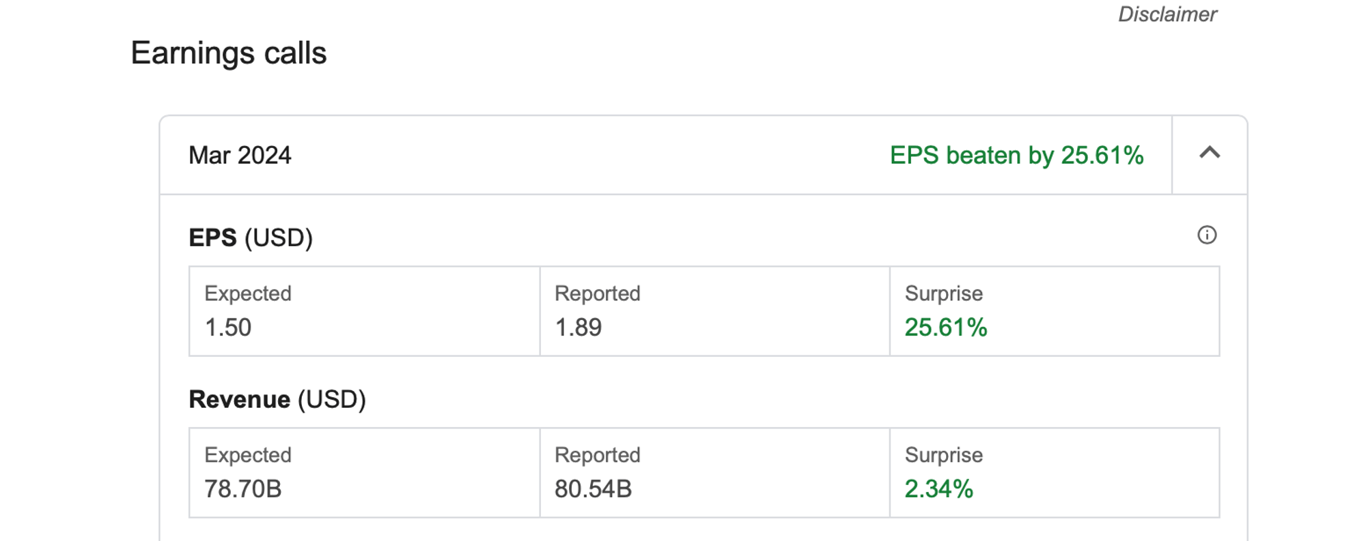

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Alphabet reported $357.79 billion in revenue for 2024, representing a 16.39% YoY increase. This growth was primarily driven by continued strength in digital advertising and expanding contributions from Google Cloud.

- Net Income: The company achieved an EPS of $7.89, up by 35.95% YoY, highlighting Alphabet's improved profitability and operational efficiency.

- Free Cash Flow: Alphabet continues to generate robust free cash flow, supporting its significant investments in AI and other innovative technologies.

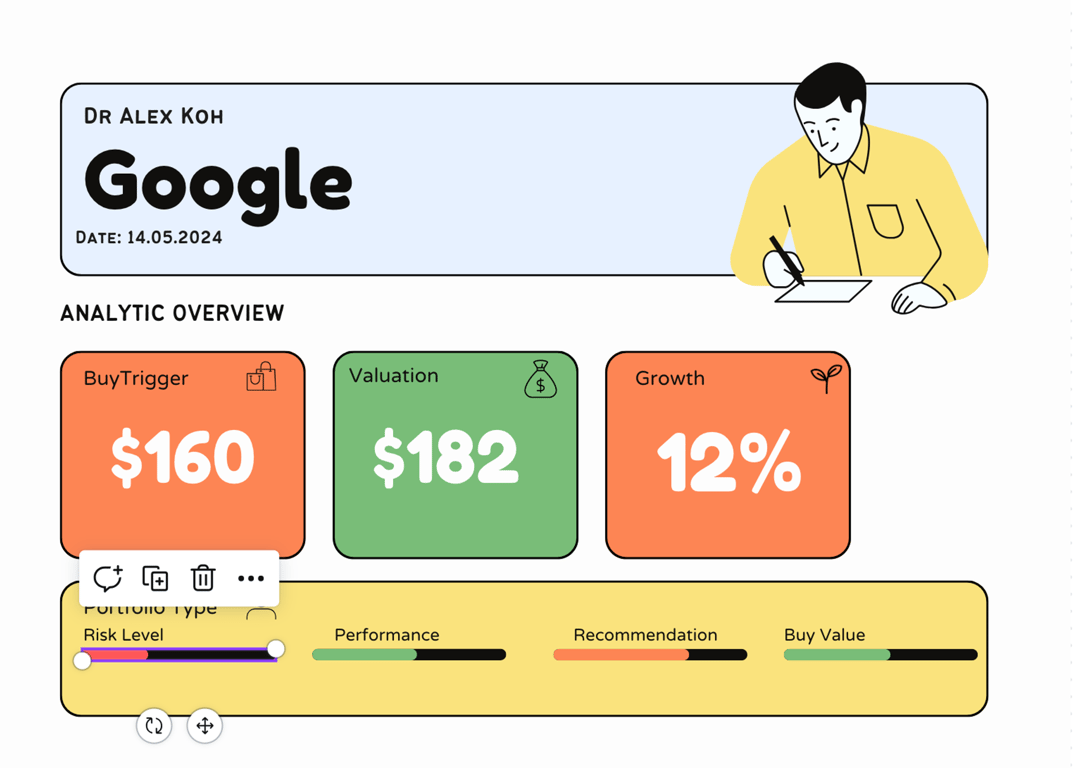

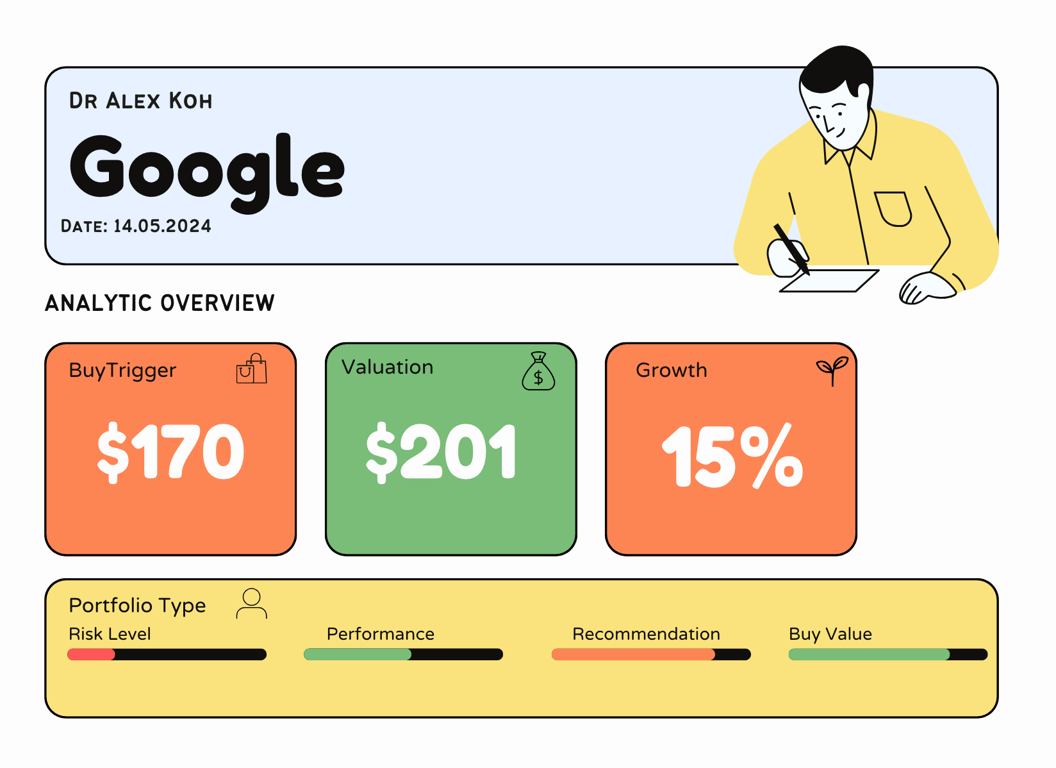

💰 Valuation Analysis

- P/E Ratio: Alphabet’s forward P/E ratio is 20.52x, reflecting a solid valuation relative to its growth prospects, especially in AI and cloud computing.

- Price Target: Analysts have set a consensus price target of $200.36, indicating a potential 23.85% upside. The highest target is $240, showing strong bullish sentiment.

- Market Cap: Approximately $2.06 trillion, making Alphabet one of the largest companies globally, with significant influence across various technology sectors.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Analysts expect continued growth, with EPS projected to reach $8.98 in 2025, driven by ongoing advancements in AI and increased cloud adoption.

- Price Target: The price target reflects strong confidence in Alphabet’s ability to maintain its leadership in key markets, particularly as AI continues to reshape the tech landscape.

🔮 Forecast

Alphabet is well-positioned to benefit from the rapid evolution of AI and cloud services. The company's continued investments in AI and data infrastructure, coupled with its dominant position in digital advertising, provide a solid foundation for future growth. However, ongoing regulatory challenges and market competition are potential risks that could impact performance.

Final Summary

- 🚀 Strong Buy: Alphabet's robust growth, strong cash flow, and strategic investments in AI and cloud services make it a top choice for growth investors.

- 📉 Regulatory and Competitive Risks: While Alphabet has strong growth prospects, ongoing regulatory scrutiny and competition could present challenges.

- 🔎 Positive Analyst Sentiment: Analysts are overwhelmingly bullish, with most recommending a "Buy," reflecting confidence in Alphabet’s long-term potential.

Alphabet remains a cornerstone investment in the technology sector, with significant upside potential driven by its leadership in AI and cloud computing.

Interesting Facts