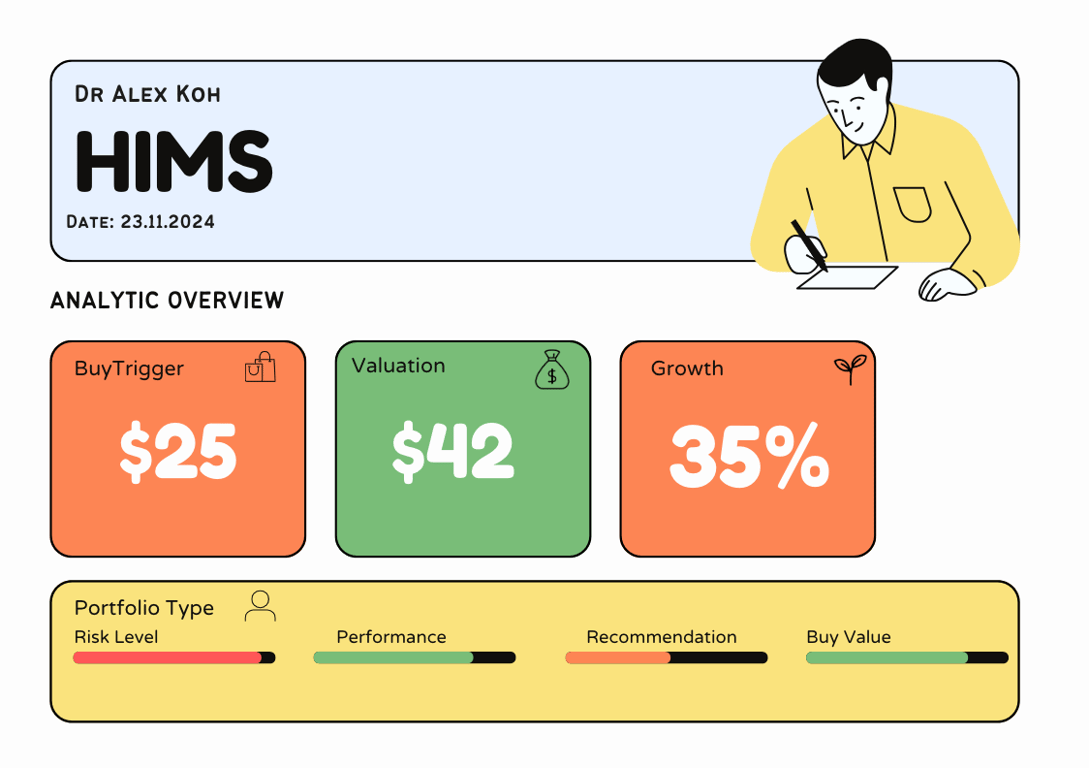

Hims & Hers Health, Inc. (HIMS) Stock Comprehensive Review as of November 23, 2024 🟢Current Price: $21.19Industry: Telehealth, Health & WellnessStock Type: GrowthRating: B+

💡 Key Financial Metrics (Q3 2024)

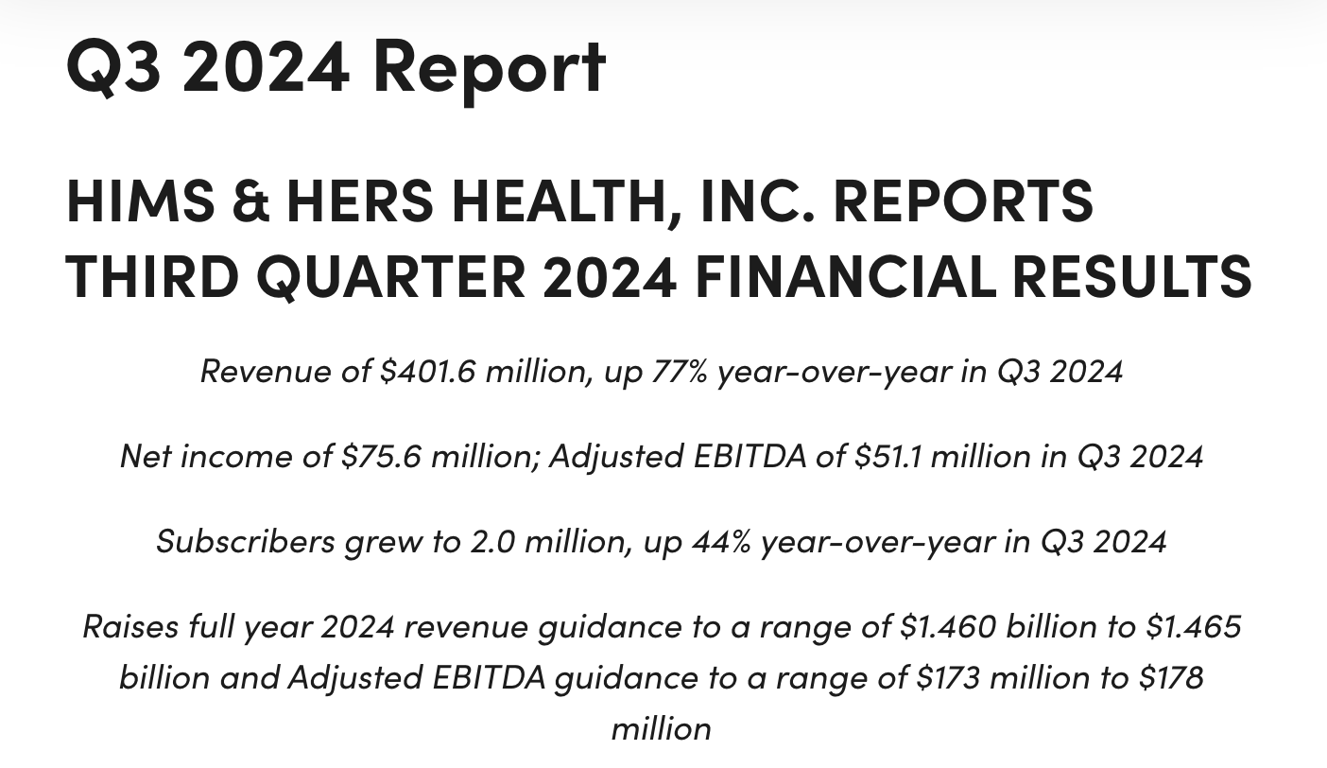

- Revenue: $401.6 million, up 77% year-over-year.

- Net Income: $75.6 million, achieving profitability compared to a net loss of $7.6 million in Q3 2023.

- Gross Margin: 79%, indicating strong operational efficiency.

- EPS (Earnings Per Share): $0.32, significantly surpassing analyst expectations of $0.06.

- Free Cash Flow: $79.4 million, reflecting robust cash generation.

💰 Valuation Analysis

- P/E Ratio: 47.98x, higher than the industry average, reflecting a growth premium.

- P/S Ratio: 5.3x, indicating that the market values its revenue growth highly.

- Forward P/E: 74.41x, suggesting a continued growth trajectory.

- PEG Ratio: 1.1, highlighting a good balance between growth and valuation.

- Market Cap: $4.5 billion, solidifying its status as a mid-cap stock.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Hims & Hers is projected to see continued strong growth, driven by personalized healthcare solutions and expansion into new therapeutic areas.

- Price Target: Analysts have set a consensus price target of $27.5, reflecting confidence in Hims & Hers’ sustained performance.

🔍 Revenue Breakdown

- Online Revenue (98%): $392.6 million (+79% YoY)

- Growth driven by increased subscriber base and higher average revenue per user.

- Wholesale Revenue (2%): $9 million (+20% YoY)

- Steady growth in retail partnerships and product distribution.

🔮 Forecast

Hims & Hers continues to expand its footprint in the telehealth and personalized healthcare sectors, with strong financials and market leadership. The company's growth is underpinned by significant investments in technology, personalized care, and expansion into new therapeutic areas. While the stock trades at a premium, its robust earnings growth justifies the valuation.

Final Summary

- 🚀 Buy: Hims & Hers’ leading position in the telehealth market and solid growth make it an appealing stock.

- 📊 Risk Adjusted: While the company’s financials are strong, its high multiples and potential regulatory risks warrant a cautious approach.

- 💡 Valuation Moderation: Hims & Hers’ growth potential supports its valuation, but risks justify a slightly lower rating.

- ⚠️ Risks: Regulatory changes and competition could impact future growth, but the long-term outlook remains positive.

Hims & Hers is a solid choice for growth investors but sits at a B+ rating due to risk factors associated with its high valuation and competitive landscape.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Earnings Update [Q3/2024]

Updates and Notes

News Sentiment

Other Updates

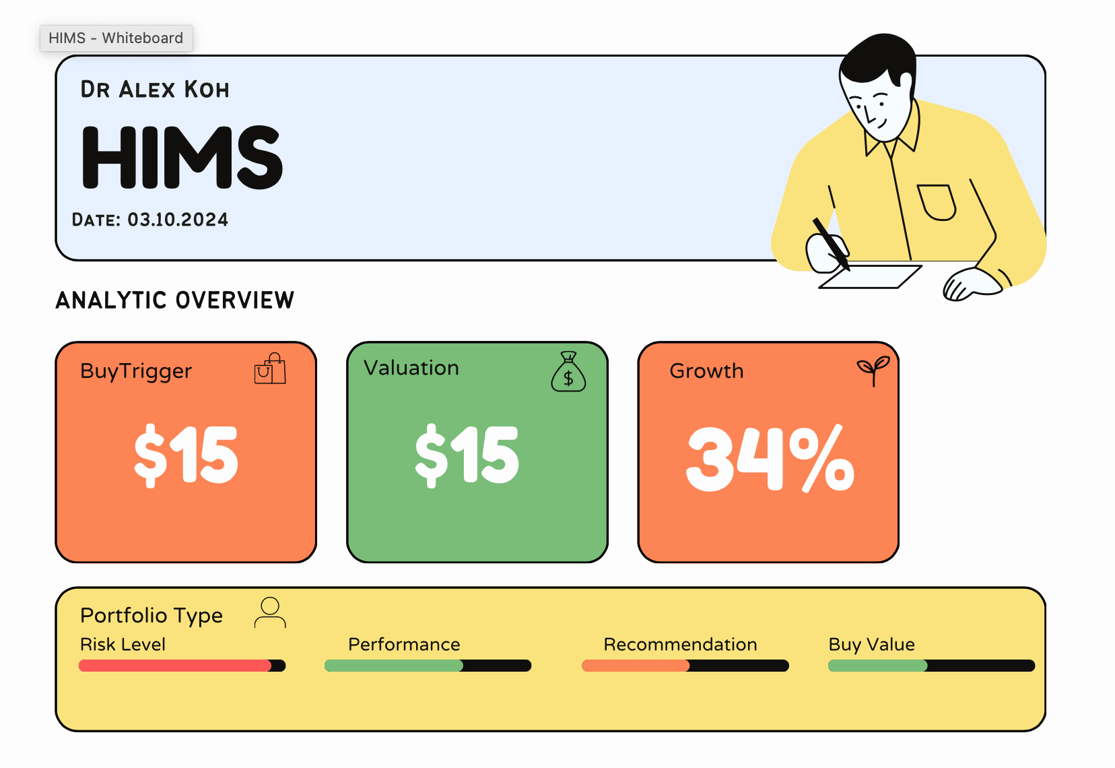

Technical Analysis Update [Oct 3, 2024 10:31 AMGMT+00:00]