Interactive Brokers Group, Inc. (IBKR) Stock Comprehensive Review as of January 2025 🟢

Current Price: $218.99

Industry: Financial Services – Brokerage

Stock Type: Growth

Rating: A-

Key Financial Metrics (Q4 Fiscal 2024)

- Revenue: $1.387 billion, a 22% year-over-year increase, surpassing expectations.

- Net Income: $1.04 billion, reflecting strong profitability.

- Earnings Per Share (EPS): $1.99 GAAP; adjusted EPS of $2.03, exceeding estimates of $1.84.

- Commission Revenue: Increased 37% to $477 million, driven by higher customer trading volumes.

- Net Interest Income: Rose 11% to $807 million, attributed to higher average customer margin loans and credit balances.

💰 Valuation Analysis

- P/E Ratio: Approximately 27.5x, indicating a premium valuation.

- P/S Ratio: Approximately 15.8x, reflecting high market valuation relative to sales.

- Market Cap: Approximately $23.5 billion, classifying it as a large-cap stock.

📈 Growth Metrics

- Customer Accounts: Increased 30% to 3.34 million, showcasing robust growth.

- Daily Average Revenue Trades (DARTs): Rose 61% to 3.12 million, highlighting heightened trading activity.

- Customer Equity: Grew 33% to $568.2 billion, reflecting increased client assets.

🔍 Revenue Breakdown

- Commissions: $477 million, up 37% year-over-year, driven by higher trading volumes in options (+32%) and stocks (+65%).

- Net Interest Income: $807 million, a 11% increase due to higher customer margin loans and credit balances.

- Other Fees and Services: $81 million, up 47%, led by growth in risk exposure fees and payments for order flow.

🔮 Forecast

Interactive Brokers is well-positioned for sustained growth, supported by increased customer engagement, robust trading activity, and its competitive pricing model. The company’s focus on technological innovation and its leadership in electronic brokerage services provide a strong foundation for future performance.

Final Summary

- 🚀 Strengths: Robust revenue and earnings growth, significant increases in customer accounts and trading volumes, and strong positioning in electronic brokerage services.

- 📊 Concerns: High valuation multiples may lead to short-term volatility; regulatory changes could impact operations.

- 💡 Valuation: Premium valuation reflects strong growth prospects but requires cautious consideration.

- ⚠️ Risks: Market volatility and competition in the brokerage industry could challenge growth.

Interactive Brokers offers a strong investment case, driven by consistent growth and expanding customer activity, making it a compelling choice for exposure to the financial services sector.

Interesting Facts

🕶️ Chronological Update below 👇🏻

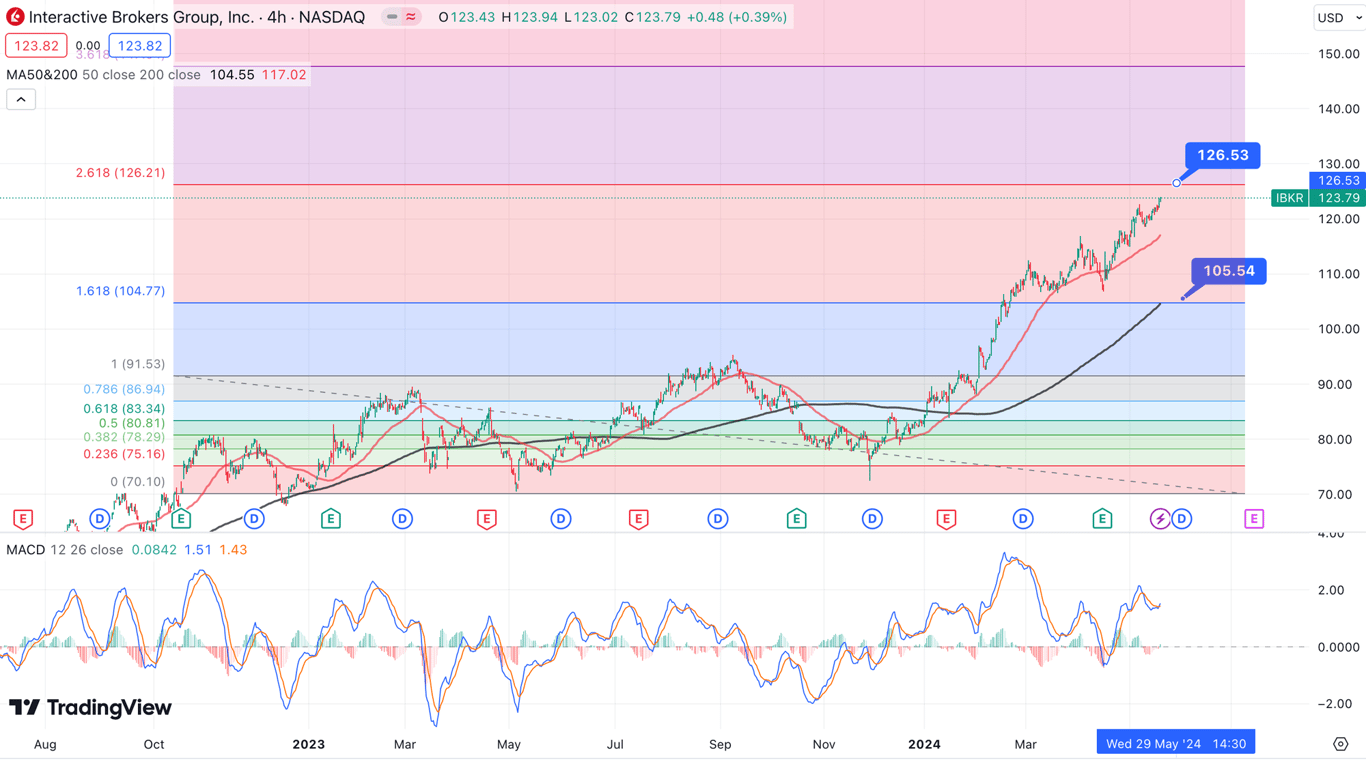

Technical Analysis Update [May 18, 2024 11:03 PMGMT+00:00]

- I am holding 105 for Buy Trigger. I expect a pull back before breaking $126