Lam Research Corp. (LRCX) Stock Comprehensive Review as of August 2024 🟠

Current Price: $797.32

Industry: Semiconductors, Wafer-Fabrication Equipment

Stock Type: Growth, High Volatility

Rating: B+

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Lam Research reported $3.87 billion in revenue for Q4 FY2024, up 20.7% YoY, driven by strong performance in its Customer Support Business Group and a rebound in System revenues.

- Net Income: The company posted non-GAAP earnings of $8.14 per share, surpassing expectations by 8.2%. This represents a significant 36.1% YoY increase in earnings, underscoring the company’s operational efficiency despite industry challenges.

- Free Cash Flow: Lam Research continues to generate substantial free cash flow, which supports its capital investments and shareholder returns, including a 15% increase in its quarterly dividend to $2.30 per share(,).

💰 Valuation Analysis

- P/E Ratio: Lam Research’s forward P/E ratio stands at 26.1x, reflecting the company’s strong earnings growth potential but also indicating a premium valuation.

- Price Target: Analysts have set a consensus price target of $1,006.10, suggesting a potential upside of approximately 24.96%. The highest target is $1,325, which reflects strong optimism about the company’s future performance in AI and memory chip manufacturing().

- Market Cap: Approximately $105.26 billion, positioning Lam Research as a key player in the semiconductor manufacturing equipment sector.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Analysts expect continued growth in earnings driven by Lam’s strategic investments in advanced technologies such as 3D NAND and AI-related semiconductor equipment.

- Price Target: The range of price targets reflects a strong belief in Lam Research’s ability to capitalize on the expected recovery in wafer fabrication equipment (WFE) spending and memory chip demand().

🔮 Forecast

Lam Research is strategically positioned to benefit from the anticipated upturn in the semiconductor cycle, particularly in AI and memory technologies. The company's solid earnings growth, increasing dividends, and strong market position support its long-term growth potential. However, the stock’s high valuation and the cyclical nature of the semiconductor industry present risks that investors should consider

Final Summary

- 🚀 Growth Potential: Lam Research’s leadership in semiconductor equipment, particularly in etching and deposition technologies, positions it for strong future growth.

- 📉 Cyclical Risks: The semiconductor industry is cyclical, and while Lam is currently performing well, market downturns could affect profitability.

- 🔎 Positive Analyst Sentiment: Analysts generally recommend a "Buy," driven by confidence in Lam’s ability to sustain

Interesting Facts

🕶️ Chronological Update below 👇🏻

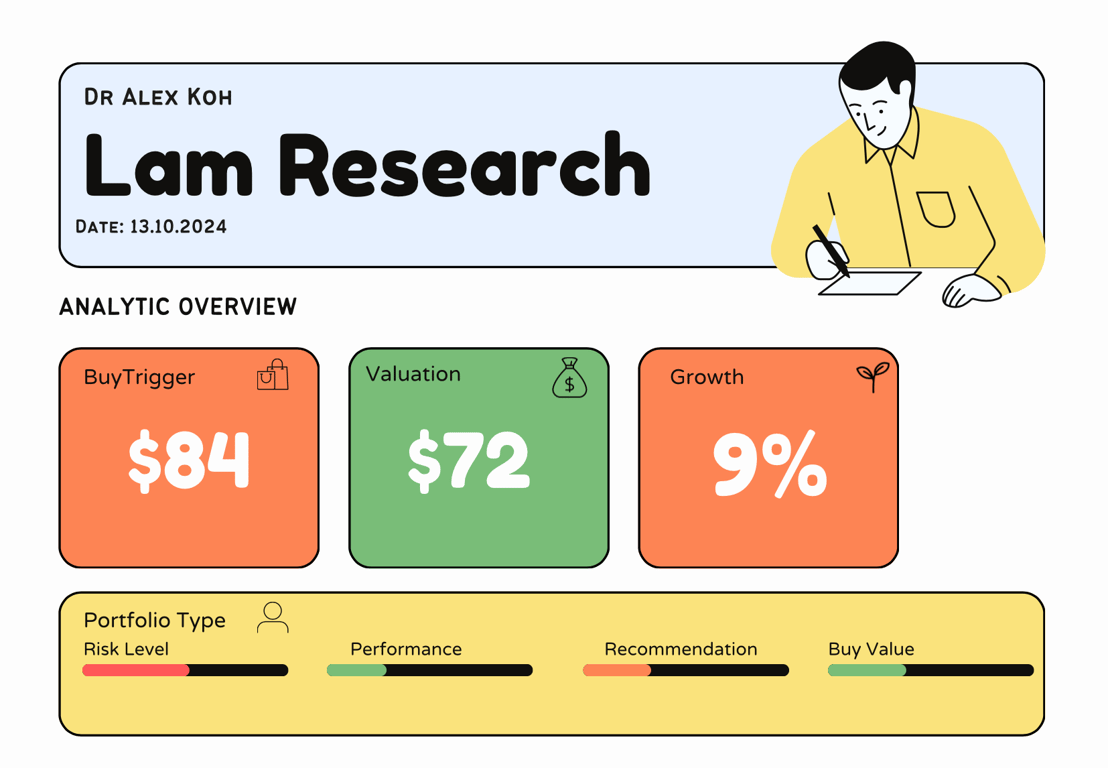

Technical Analysis Update [May 21, 2024 02:10 PMGMT+00:00]

- clear bullish trend on a breakout. Hard to be chasing this as late entry is too much risk for an industrial stock