Lockheed Martin (LMT) Stock Comprehensive Review as of August 2024 🟢

Current Price: $566.68

Industry: Aerospace & Defense

Stock Type: Mature Growth

Rating: A

💡 Key Financial Metrics (Latest Earnings)

- Revenue (Q2 2024): $17.03 billion, up 8.6% YoY.

- Net Income: $7.11 billion, reflecting strong performance with a 20% YoY growth.

- Gross Margin: 12.2%, indicating consistent profitability.

- EPS (Earnings Per Share): $7.11, beating analyst expectations by $0.66.

- Free Cash Flow: $6.95 billion, showing robust cash generation capabilities.

💰 Valuation Analysis

- P/E Ratio: 20.5x, suggesting that the stock is valued reasonably considering its growth and stability in the defense sector.

- P/S Ratio: 2.2x, reflecting market confidence in its revenue-generating capacity.

- Forward P/E: 19.4x, indicating slight optimism about future earnings.

- PEG Ratio: 1.6, showing a balanced relationship between valuation and growth potential.

- Market Cap: $135.97 billion, solidifying Lockheed Martin as a leading player in the aerospace and defense industry.

📈 Growth Metrics

- 2024 EPS Growth Forecast: Projected to continue steady growth driven by robust defense spending and new contracts.

- Price Target: Analysts have set a consensus price target of $600, with a range between $540 and $635.

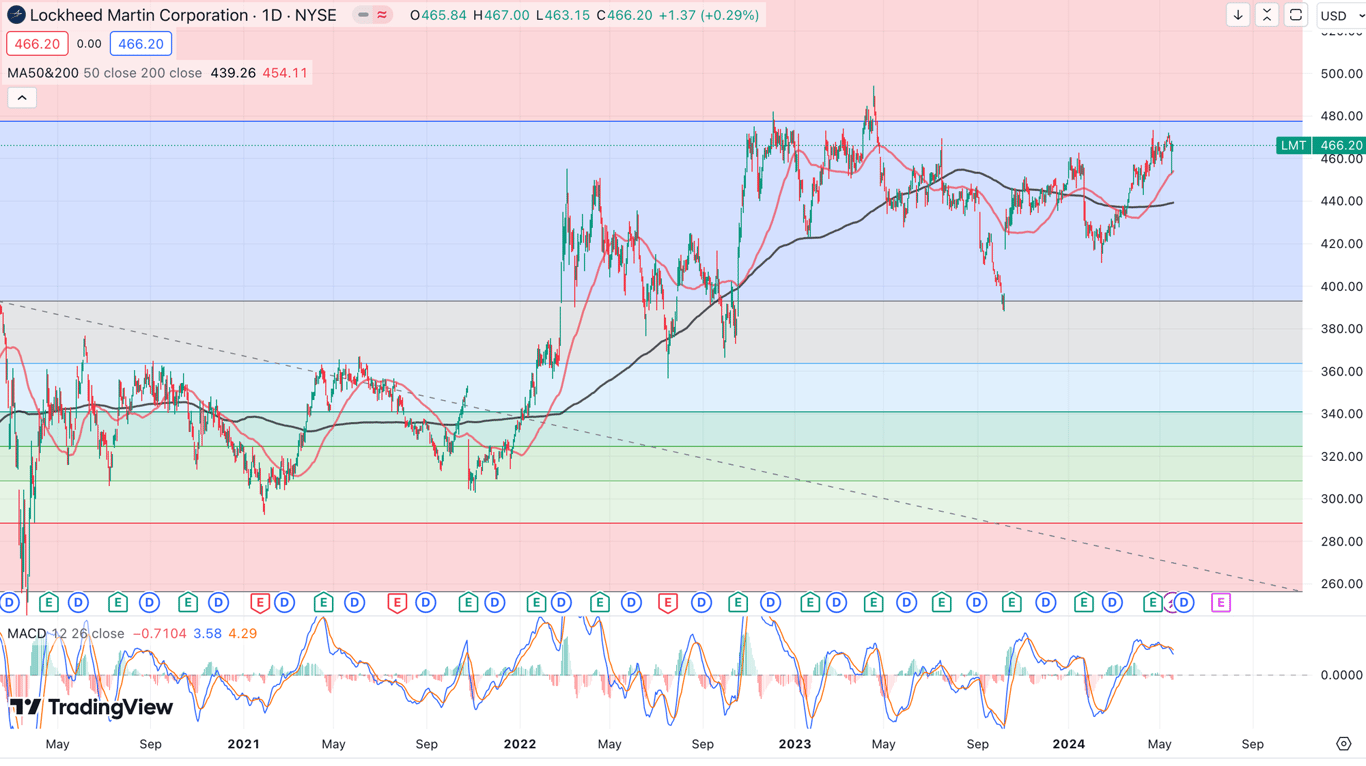

📊 Technical Indicators

- RSI (Relative Strength Index): Currently around 55, indicating the stock is neither overbought nor oversold.

- MACD (Moving Average Convergence Divergence): Recently showed a bullish crossover, suggesting potential short-term strength.

- Moving Averages: The 50-day moving average is above the 200-day moving average, signaling a bullish trend.

- Support/Resistance Levels: Strong support around $550, with resistance near $580.

🔮 Forecast

Lockheed Martin is well-positioned to capitalize on continued defense spending, with strong financials and steady growth prospects. The company benefits from a solid backlog of contracts and a diversified portfolio in aerospace and defense, making it resilient to economic fluctuations.

Final Summary

- 🚀 Strong Buy: Lockheed Martin's robust earnings, strong cash flow, and leading position in the defense sector make it a solid investment.

- 📊 Financial Strength: Strong revenue and profitability growth with excellent cash flow generation.

- 💡 Reasonable Valuation: Despite a high P/E ratio, the stock’s growth potential and industry position justify its valuation.

- ⚠️ Risks: Global economic uncertainty and potential shifts in defense budgets could impact future growth.

Lockheed Martin remains a top pick in the aerospace and defense sector, with stable long-term growth potential.

Interesting Facts

🕶️ Chronological Update below 👇🏻

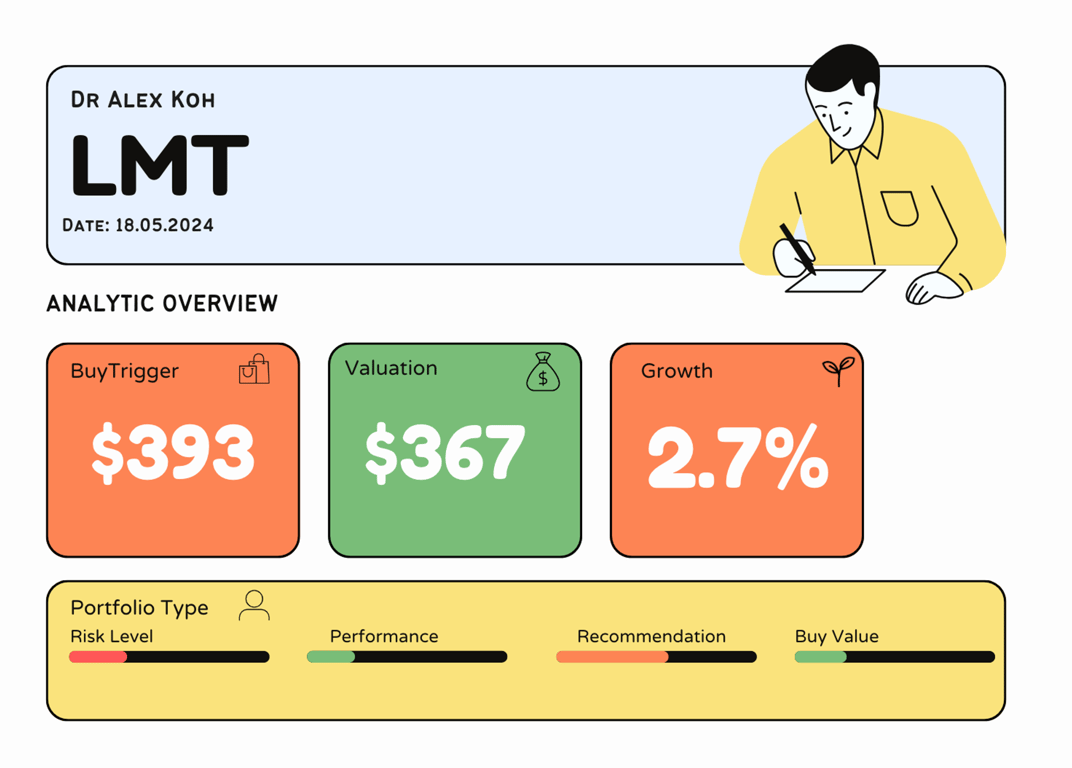

Technical Analysis Update [May 19, 2024 11:16 PMGMT+00:00]