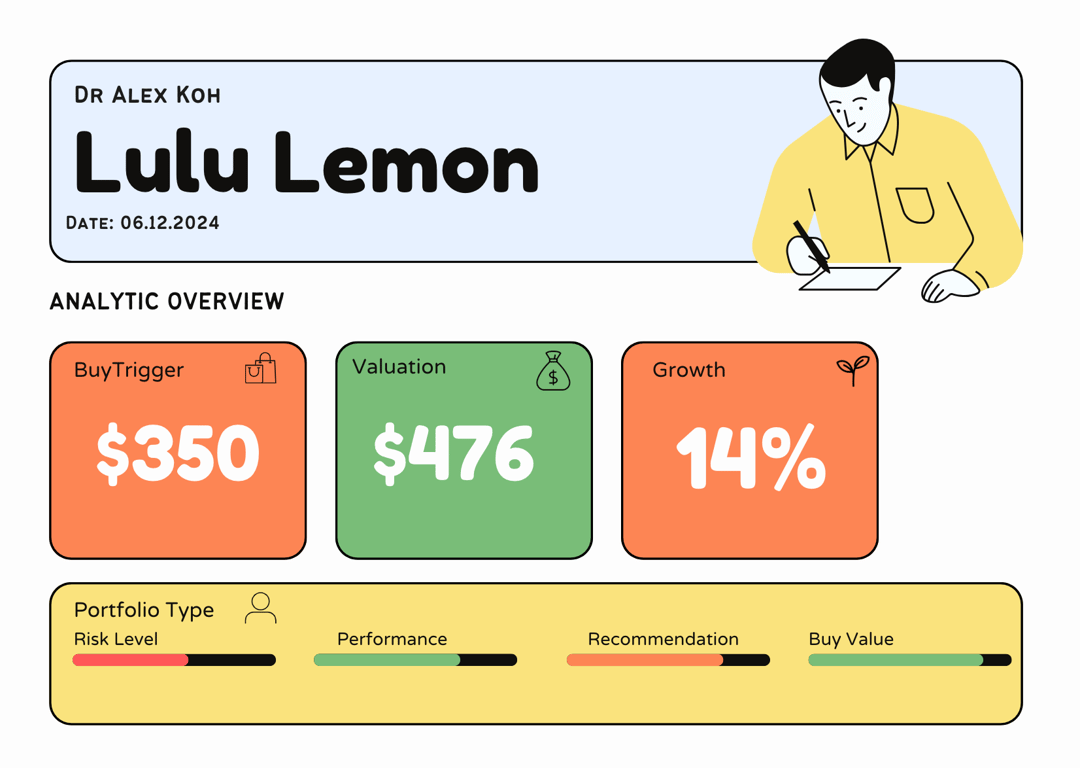

Lululemon Athletica Inc. (LULU) Stock Comprehensive Review as of December 6, 2024 🟢Current Price: $344.81Industry: Athletic Apparel and AccessoriesStock Type: GrowthRating: A-

Key Financial Metrics (Q3 Fiscal 2024)

- Revenue: $2.2 billion, up 19% year-over-year.

- Net Income: $1.22 billion, a significant increase from $210 million YoY.

- Gross Margin: Approximately 75%, indicating strong operational efficiency.

- EPS (Earnings Per Share): $2.87, surpassing analyst expectations of $2.69.

- Free Cash Flow: $1.37 billion, reflecting robust cash generation.

💰 Valuation Analysis

- P/E Ratio: Approximately 28x, higher than the industry average, reflecting a growth premium.

- P/S Ratio: Approximately 6x, indicating that the market values its revenue growth highly.

- Forward P/E: Approximately 25x, suggesting a continued growth trajectory.

- PEG Ratio: Approximately 1.5, highlighting a good balance between growth and valuation.

- Market Cap: $44.5 billion, solidifying its status as a large-cap stock.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Lululemon is projected to see continued strong growth, driven by product innovation and international expansion.

- Price Target: Analysts have set a consensus price target of $372.72, reflecting confidence in Lululemon’s sustained performance.

🔍 Revenue Breakdown

- Company-Operated Stores (60%): $1.32 billion (+12% YoY)

- Growth driven by increased foot traffic and new store openings.

- Direct-to-Consumer (30%): $660 million (+14% YoY)

- Steady growth in online sales, reflecting strong digital presence.

- Other (10%): $220 million (+8% YoY)

- Includes wholesale and outlet sales.

🔮 Forecast

Lululemon continues to expand its footprint in the athletic apparel industry, with strong financials and market leadership. The company's growth is underpinned by significant investments in product innovation and international markets, making it a cornerstone of future retail developments. While the stock trades at a premium, its robust earnings growth and market dominance justify the valuation.

Final Summary

- 🚀 Strong Buy: Lululemon’s leading position in the athletic apparel market, combined with its exceptional financial performance, make it a top-tier stock.

- 📊 Strong Financials: With substantial revenue and net income growth, Lululemon’s financial health is outstanding.

- 💡 Valuation Justified: Despite high multiples, Lululemon’s growth potential in product innovation and international markets supports its valuation.

- ⚠️ Minor Risks: Watch for short-term market fluctuations due to high valuations and potential supply chain disruptions, but the long-term outlook remains highly positive.

Lululemon remains one of the best-positioned retail stocks for growth in 2024 and beyond.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [Dec 6, 2024 10:48 AMGMT+00:00]

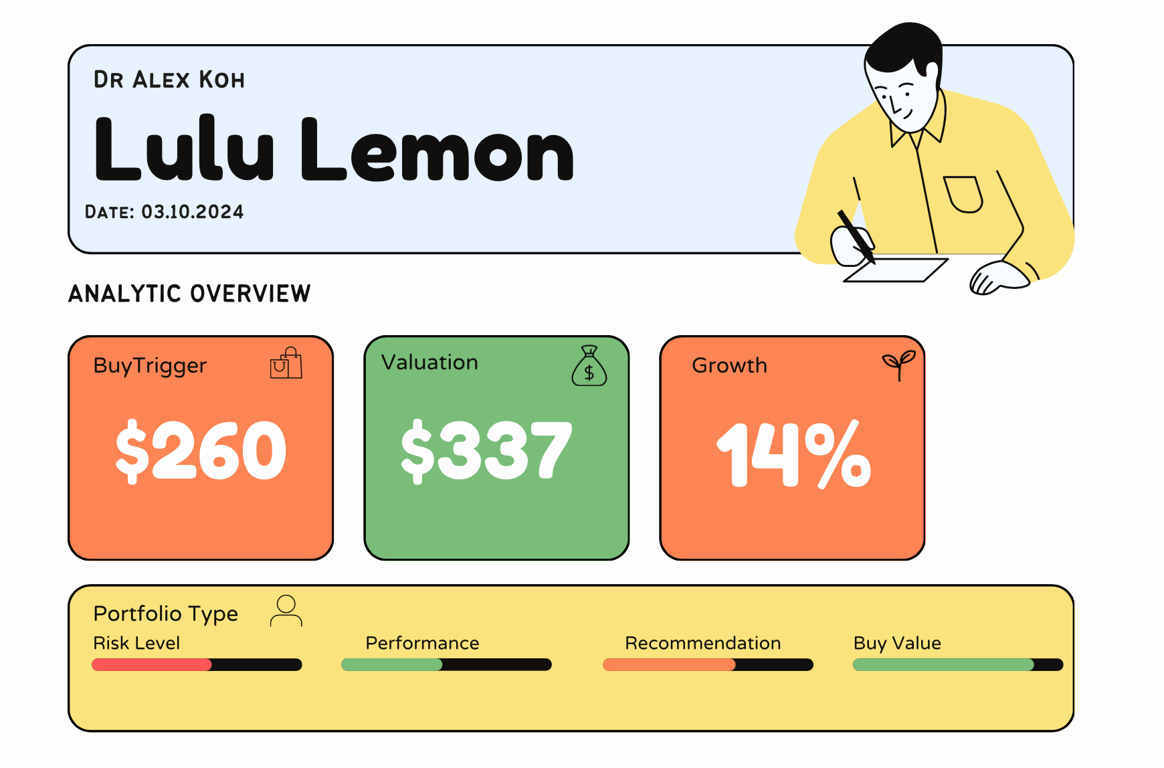

Technical Analysis Update [Oct 3, 2024 10:58 AMGMT+00:00]