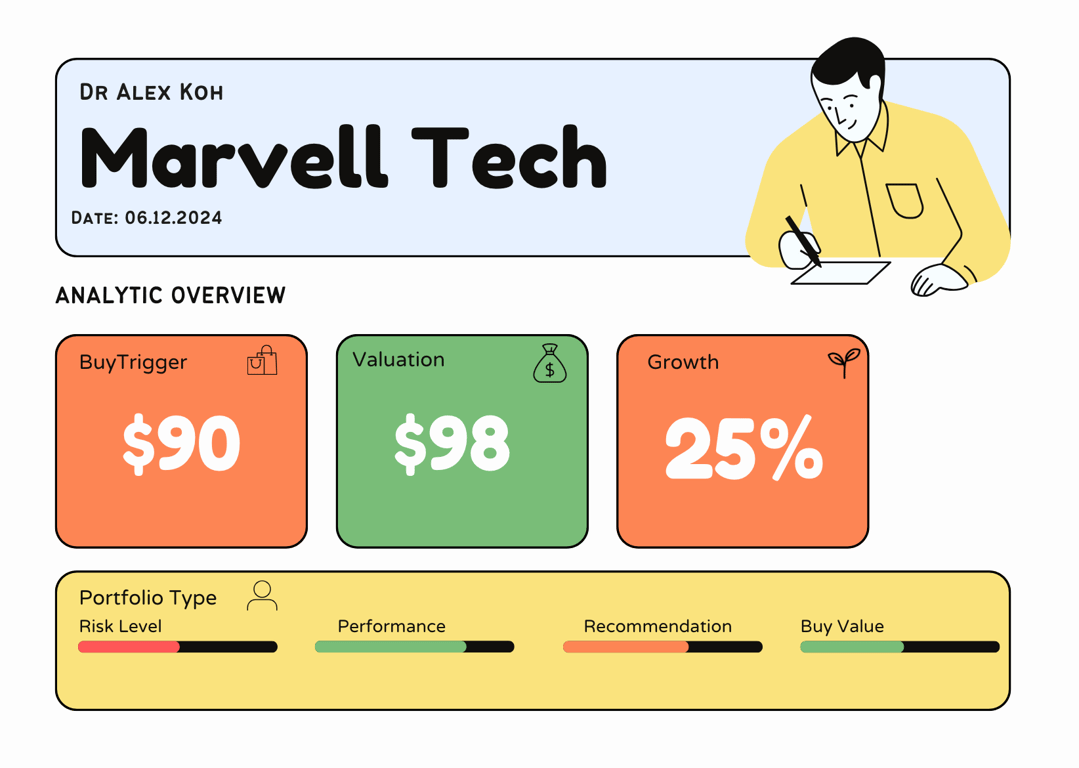

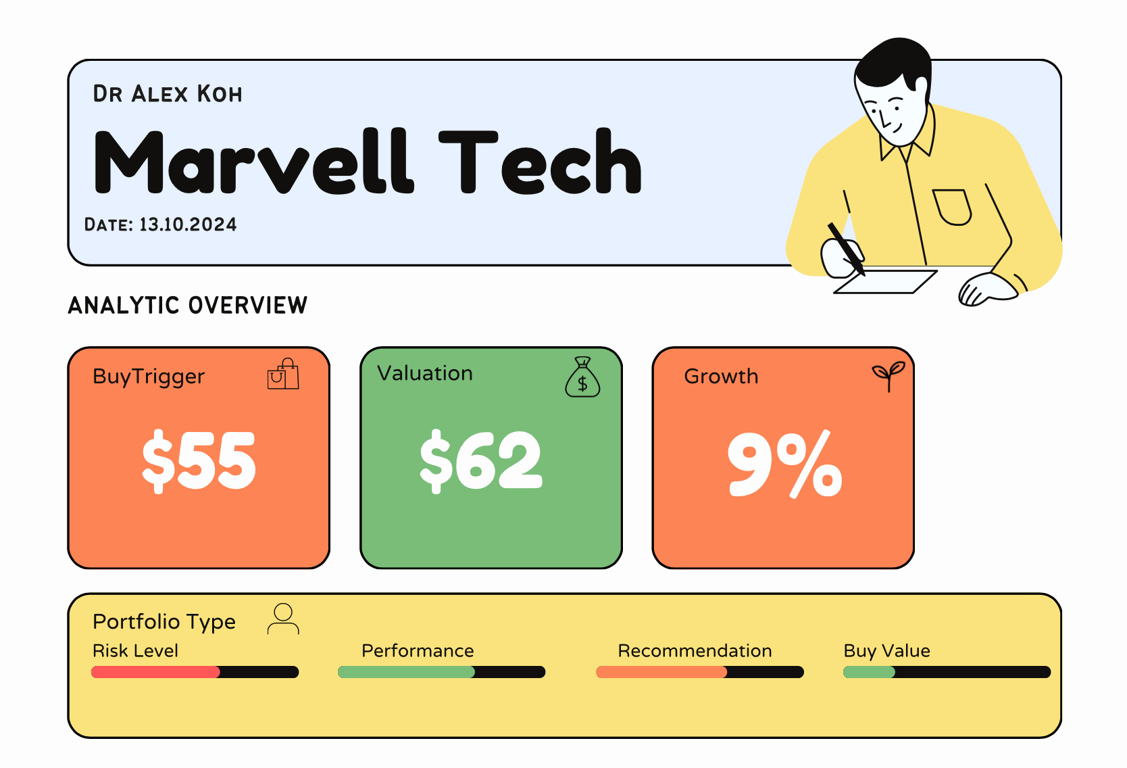

Marvell Technology, Inc. (MRVL) Stock Comprehensive Review as of December 6, 2024 🟠

Current Price: $114.00

Industry: Semiconductors

Stock Type: Growth

Rating: B

Key Financial Metrics (Q3 Fiscal 2024)

- Revenue: $1.63 billion, up 14% year-over-year.

- Net Income: $258 million, showing a return to profitability from a loss YoY.

- Gross Margin: 50.1%, reflecting typical semiconductor industry margins, far below those of software companies.

- EPS (Earnings Per Share): $0.42, surpassing analyst expectations of $0.39.

- Free Cash Flow: $280 million, demonstrating solid cash generation.

💰 Valuation Analysis

- P/E Ratio: 108x, significantly higher than the industry average, reflecting an ambitious growth premium.

- P/S Ratio: 18x, underscoring the high market valuation of its revenue.

- Forward P/E: 75x, suggesting valuation concerns despite future growth expectations.

- PEG Ratio: 2.9, indicating overvaluation relative to growth.

- Market Cap: Approximately $97 billion, classifying it as a large-cap stock.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Marvell is projected to grow EPS by 20-25%, driven by AI and data center demand.

- Price Target: Analysts have set a consensus price target of $120, reflecting limited upside potential.

🔍 Revenue Breakdown

- Data Center (43%): $700 million (+18% YoY)

- Growth driven by increasing adoption of AI chips and cloud demand.

- Enterprise Networking (28%): $456 million (+12% YoY)

- Steady growth in Ethernet and connectivity solutions.

- Automotive (18%): $294 million (+32% YoY)

- Rapid growth from advanced driver-assistance systems (ADAS) and EVs.

- Other (11%): $180 million (+8% YoY)

- Includes storage and legacy networking hardware.

🔮 Forecast

Marvell continues to benefit from growth in AI, cloud computing, and automotive markets. However, its hardware-centric model with lower gross margins and an aggressive valuation presents challenges for investors seeking value. The current price of $114 leaves limited room for upside relative to its growth forecasts and analyst price targets.

Final Summary

- 🚀 Buy with Caution: Marvell’s exposure to high-growth sectors like AI and automotive is compelling, but valuation concerns warrant a conservative approach.

- 📊 Solid Financials: Revenue growth and profitability are improving, but its margins remain constrained by its hardware model.

- 💡 Valuation Overhang: At $114, the stock trades at a high premium, limiting potential returns and exposing investors to valuation risks.

- ⚠️ Risks: High competition in semiconductors, reliance on hardware-driven revenue, and valuation pressures are key concerns.

Marvell earns a B rating, reflecting its strong growth potential offset by overvaluation and moderate hardware margins. It’s a worthwhile long-term growth stock, but current pricing makes it less attractive.

Interesting Facts

🕶️ Chronological Update below 👇🏻

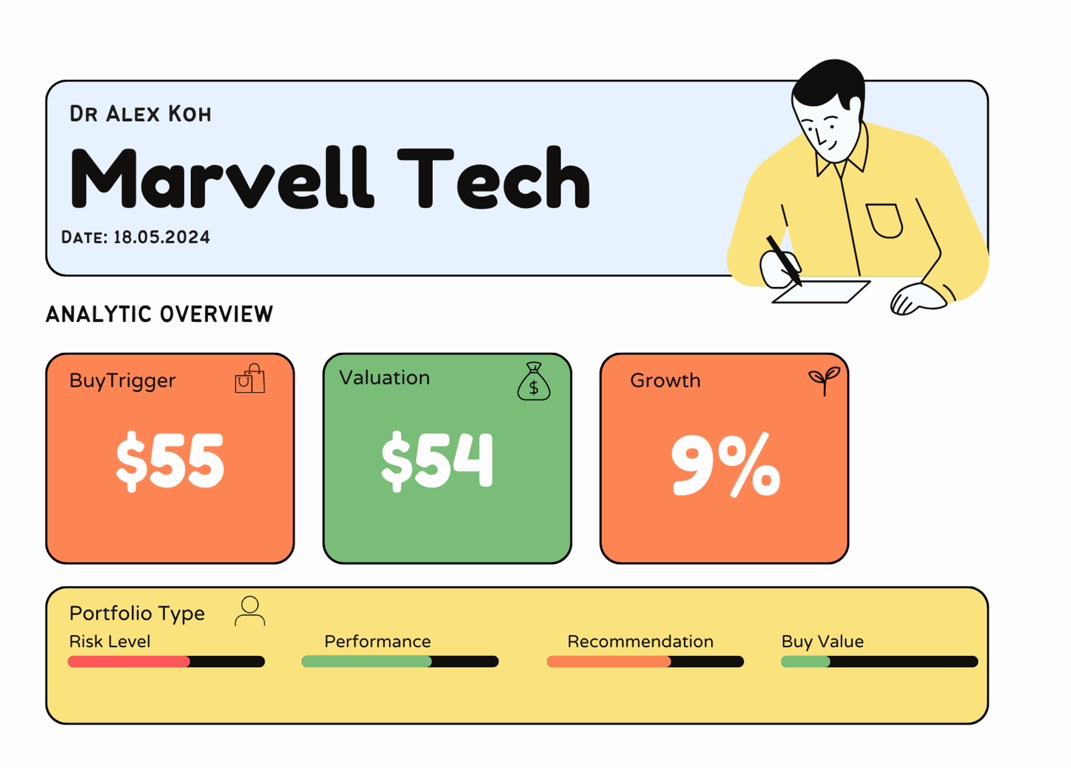

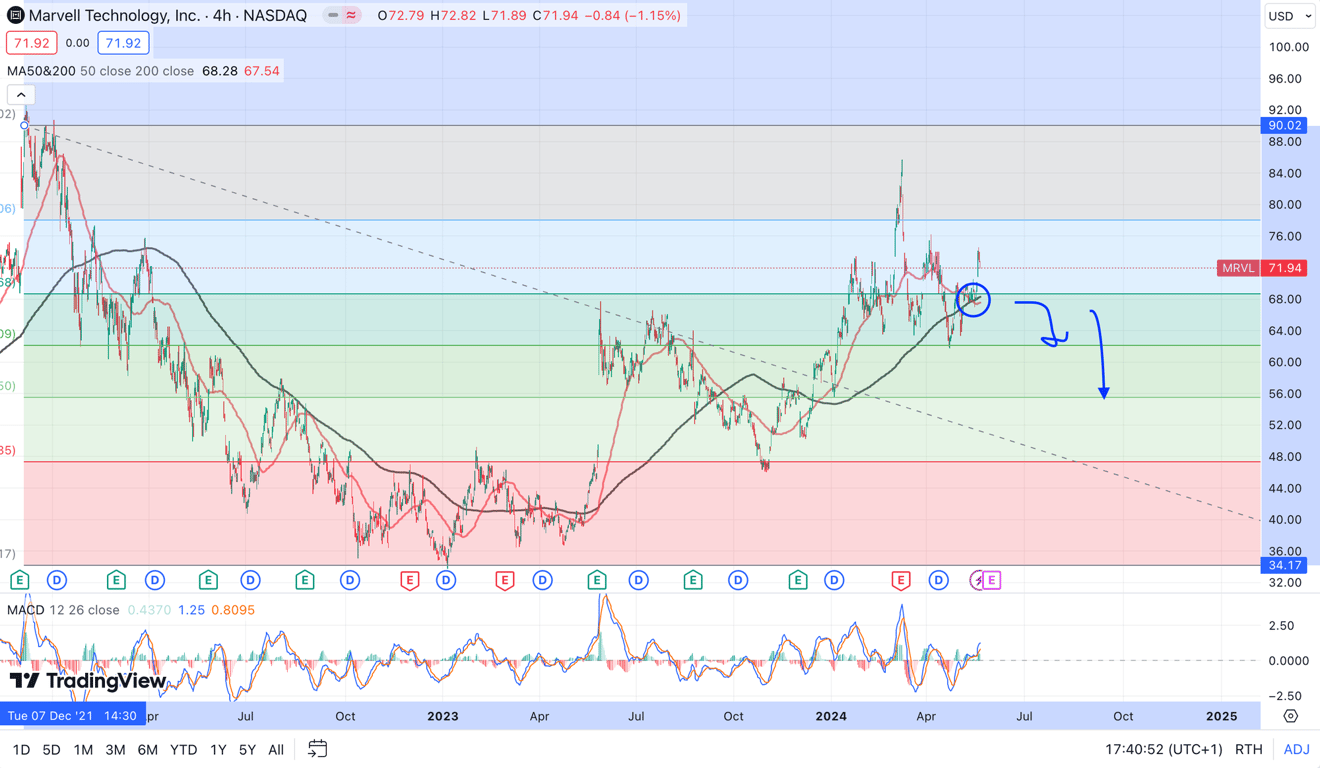

Technical Analysis Update [May 19, 2024 05:45 PMGMT+00:00]

- deathcross - momentum is finished. time to wait for few more quarters. Pull back is happening.