[MELI]

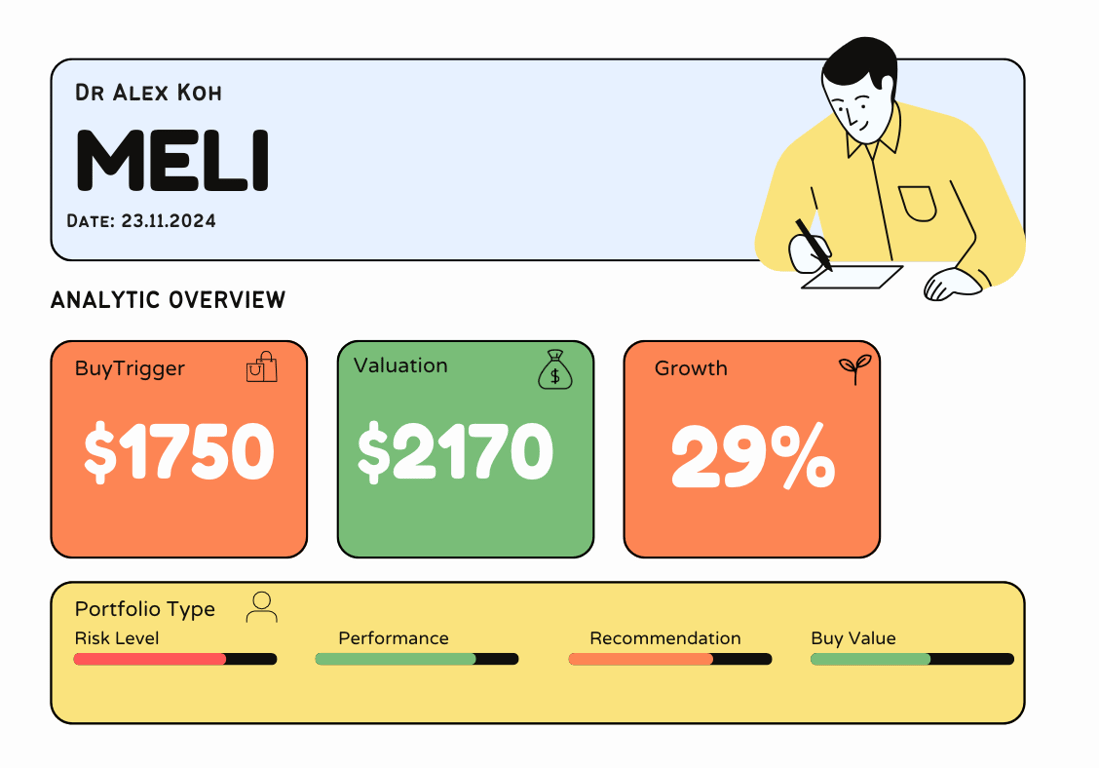

MercadoLibre, Inc. (MELI) Stock Comprehensive Review as of November 23, 2024 🟢Current Price: $2,005.00Industry: E-commerce, FintechStock Type: GrowthRating: B+

💡 Key Financial Metrics (Q3 2024)

- Revenue: $5.3 billion, up 35% year-over-year.

- Net Income: $397 million, increasing by 11% YoY.

- Gross Margin: 47%, indicating strong operational efficiency.

- EPS (Earnings Per Share): $7.83, slightly below analyst expectations of $10.00.

- Free Cash Flow: $1.2 billion, reflecting robust cash generation.

💰 Valuation Analysis

- P/E Ratio: 68.14x, higher than the industry average, reflecting a growth premium.

- P/S Ratio: 4.98x, indicating that the market values its revenue growth highly.

- Forward P/E: 59.41x, suggesting a continued growth trajectory.

- PEG Ratio: 1.2, highlighting a good balance between growth and valuation.

- Market Cap: $94.6 billion, solidifying its status as a large-cap stock.

📈 Growth Metrics

- 2025 EPS Growth Forecast: MercadoLibre is projected to see continued strong growth, driven by e-commerce expansion and fintech services.

- Price Target: Analysts have set a consensus price target of $2,200, reflecting confidence in MercadoLibre’s sustained performance.

🔍 Revenue Breakdown

- E-commerce (60%): $3.18 billion (+30% YoY)

- Growth driven by increased online shopping and market expansion.

- Fintech (40%): $2.12 billion (+45% YoY)

- Boosted by higher adoption of Mercado Pago and credit services.

🔮 Forecast

MercadoLibre continues to expand its footprint in the Latin American e-commerce and fintech sectors, with strong financials and market leadership. The company's growth is underpinned by significant investments in logistics, technology, and financial services. While the stock trades at a premium, its robust earnings growth and market dominance justify the valuation.

Final Summary

- 🚀 Strong Buy: MercadoLibre’s leading position in the Latin American market, combined with its exceptional financial performance, make it a top-tier stock.

- 📊 Strong Financials: With substantial revenue and net income growth, MercadoLibre’s financial health is outstanding.

- 💡 Valuation Justified: Despite high multiples, MercadoLibre’s growth potential in e-commerce and fintech supports its valuation.

- ⚠️ Minor Risks: Watch for short-term market fluctuations due to high valuations and potential regulatory changes, but the long-term outlook remains highly positive.

MercadoLibre remains one of the best-positioned stocks for growth in 2024 and beyond.

Interesting Facts

🕶️ Chronological Update below 👇🏻

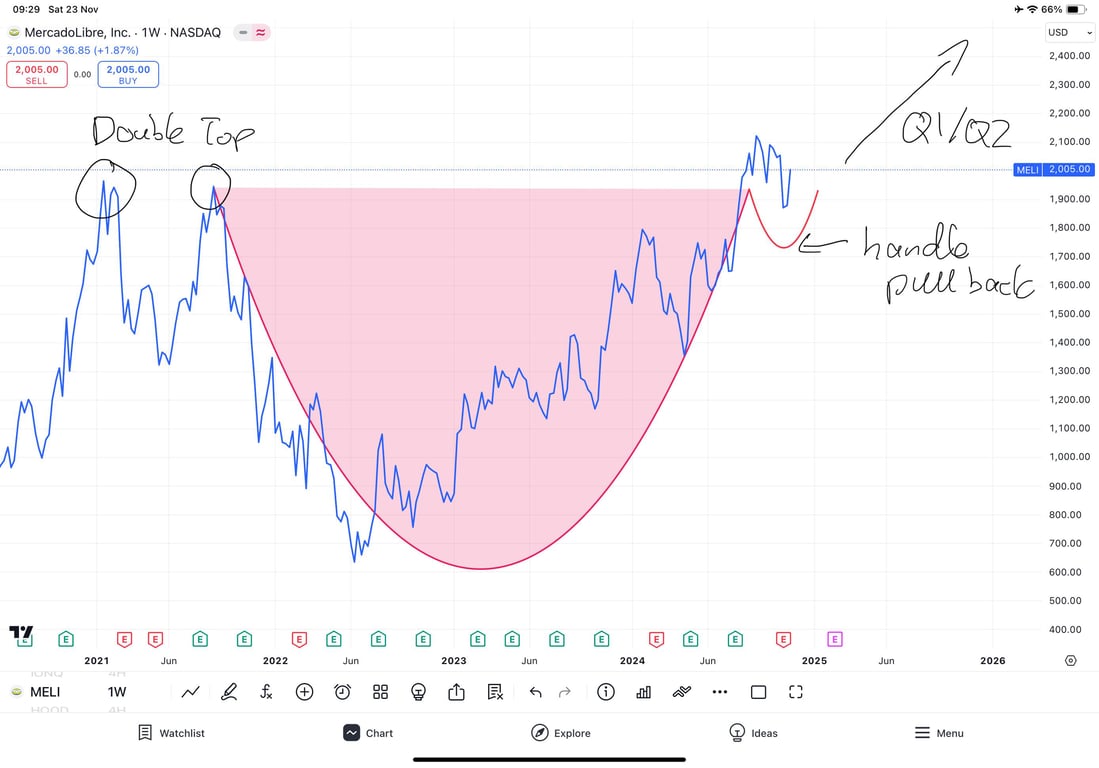

Technical Analysis Update [Nov 23, 2024 09:26 AMGMT+00:00]