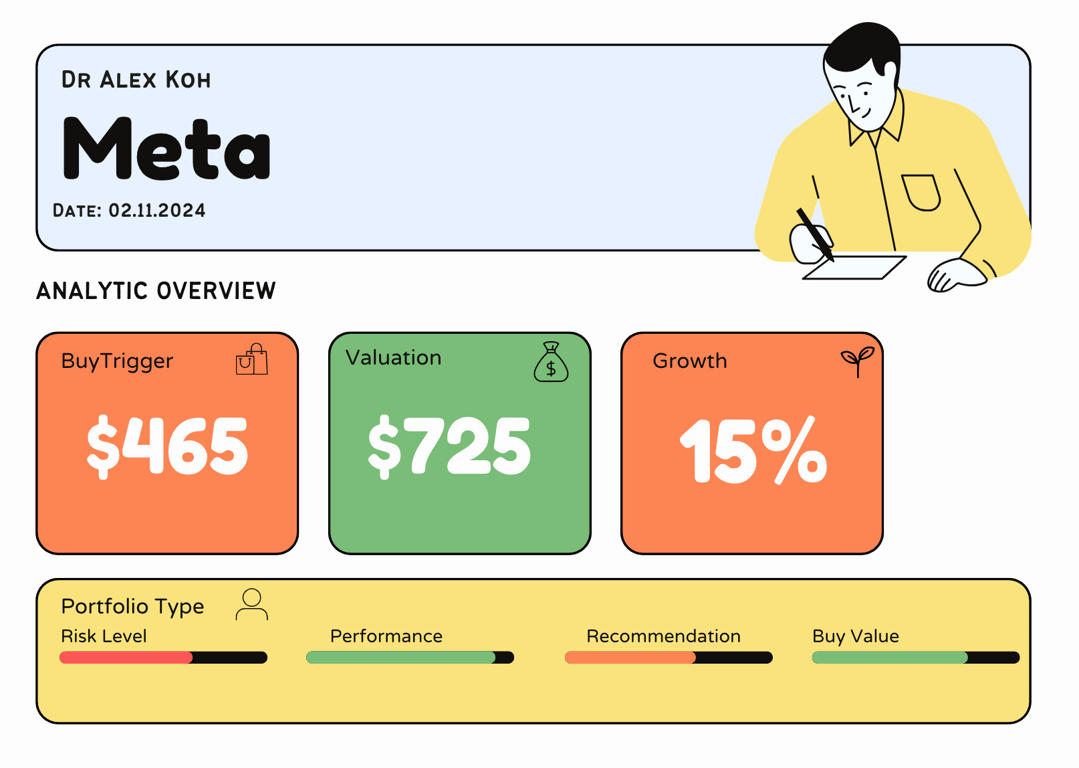

Meta Platforms Inc. (META) Stock Comprehensive Review as of August 2024 🟢

Current Price: $518.22

Industry: Social Media, Technology

Stock Type: Growth, Blue Chip

Rating: A-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Meta reported $156.23 billion in revenue for the last twelve months, marking a 23.06% YoY increase. This growth is largely driven by a surge in digital advertising and improved ad-targeting technologies. Revenue is projected to grow by another 13.86% in 2025, reaching $187.80 billion as Meta capitalizes on new features like Threads and enhanced monetization of Reels and Stories.

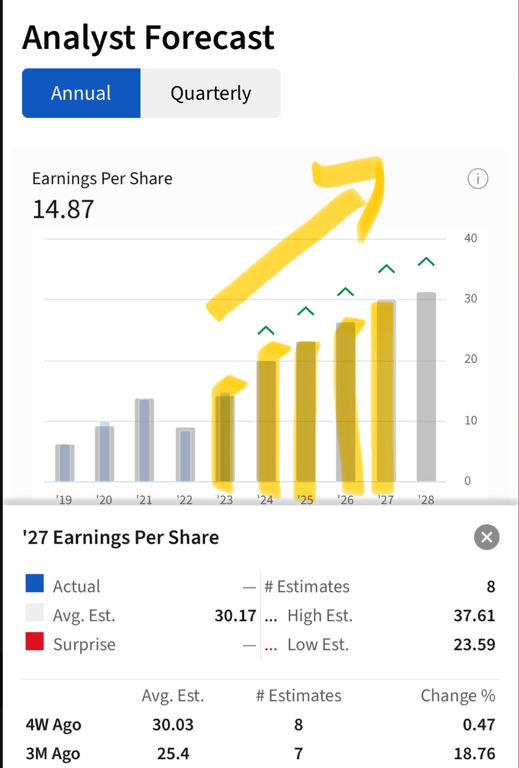

- Net Income: Meta achieved an EPS of $21.63 for 2024, up 45.48% YoY. This increase reflects improved operational efficiency and strong ad revenue performance, despite the heavy investments in Reality Labs. EPS for 2025 is projected to be $24.60, reflecting continued profitability in its core advertising business.

- Free Cash Flow: Meta's cash flow remains robust, with significant cash reserves of $65 billion, positioning it to sustain its investments in AI and Reality Labs, as well as weather any economic or regulatory challenges.

💰 Valuation Analysis

- P/E Ratio: Meta’s forward P/E ratio of 23.06x reflects a balanced valuation for a high-growth tech giant, signaling investor confidence in its potential while considering its hefty investments in AI and VR.

- Price Target: The average analyst price target is $632.69, indicating an 11.55% upside from current levels. The high-end target reaches $811, reflecting optimism surrounding Meta's long-term prospects in AI, VR, and digital advertising.

- Market Cap: Meta’s market cap is approximately $1.43 trillion, placing it among the largest global tech companies and underscoring its dominant position in digital advertising.

📈 Growth Metrics

- 2025 Growth Forecast: Revenue is projected to increase by 13.86% to reach $187.80 billion, driven by strong ad demand, advancements in AI for ad targeting, and increased user engagement across Meta’s platforms. Enhanced monetization from Reels and new ad spaces on Threads is expected to support growth.

- Price Target: Meta’s extensive investments in Reality Labs and AI show long-term potential, though they carry short-term profitability risks.

🔮 Forecast

Meta's focus on expanding its AI and AR/VR capabilities, including initiatives through Reality Labs and its Llama AI models, positions it for growth in new technology sectors. While regulatory risks remain, particularly regarding antitrust concerns in the U.S., Meta’s core advertising business provides a stable revenue stream, making it a strong growth stock with robust future potential.

Final Summary

- 🚀 High Growth Potential with Innovative Expansion: Meta's strong core advertising business, combined with pioneering efforts in AI and VR, keeps it at the forefront of the tech sector.

- 📈 Long-Term Upside: Given its consistent growth and new monetization opportunities, Meta earns an A rating, reflecting solid long-term investment potential.

Meta Platforms continues to be a cornerstone investment in the tech sector, with substantial upside driven by its leadership in AI and digital advertising

🕶️ Chronological Update below 👇🏻

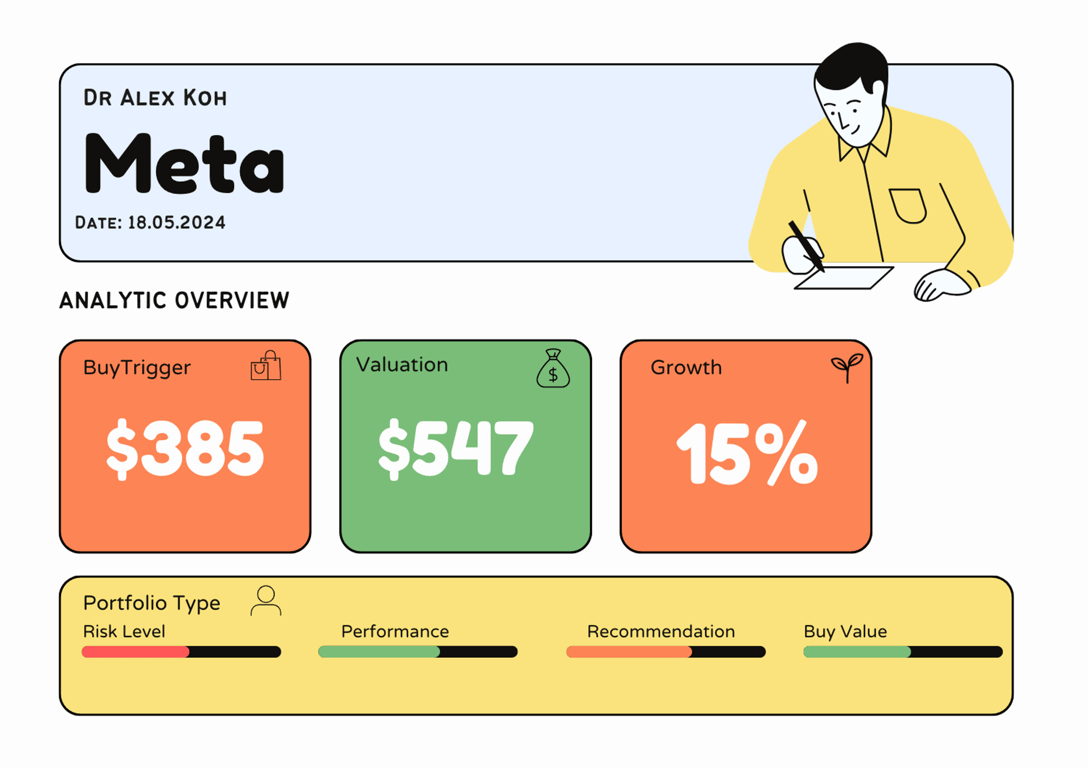

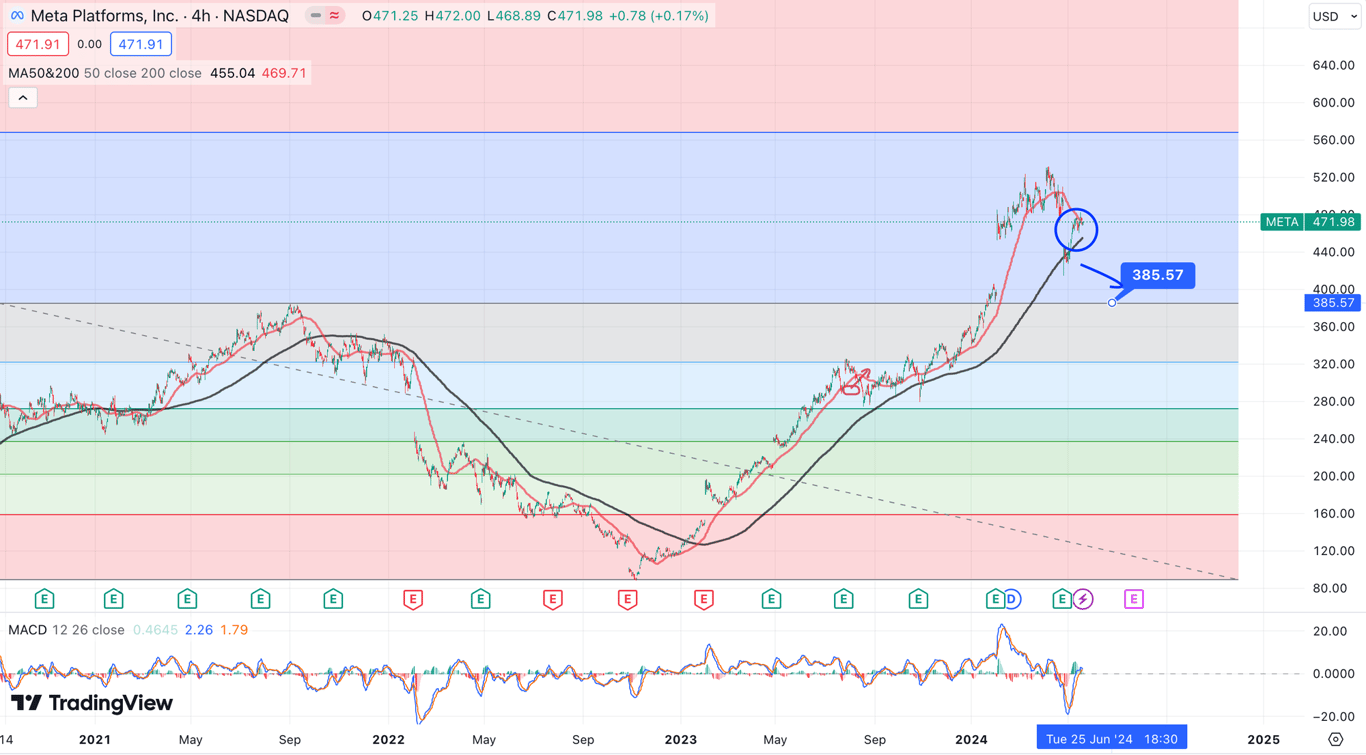

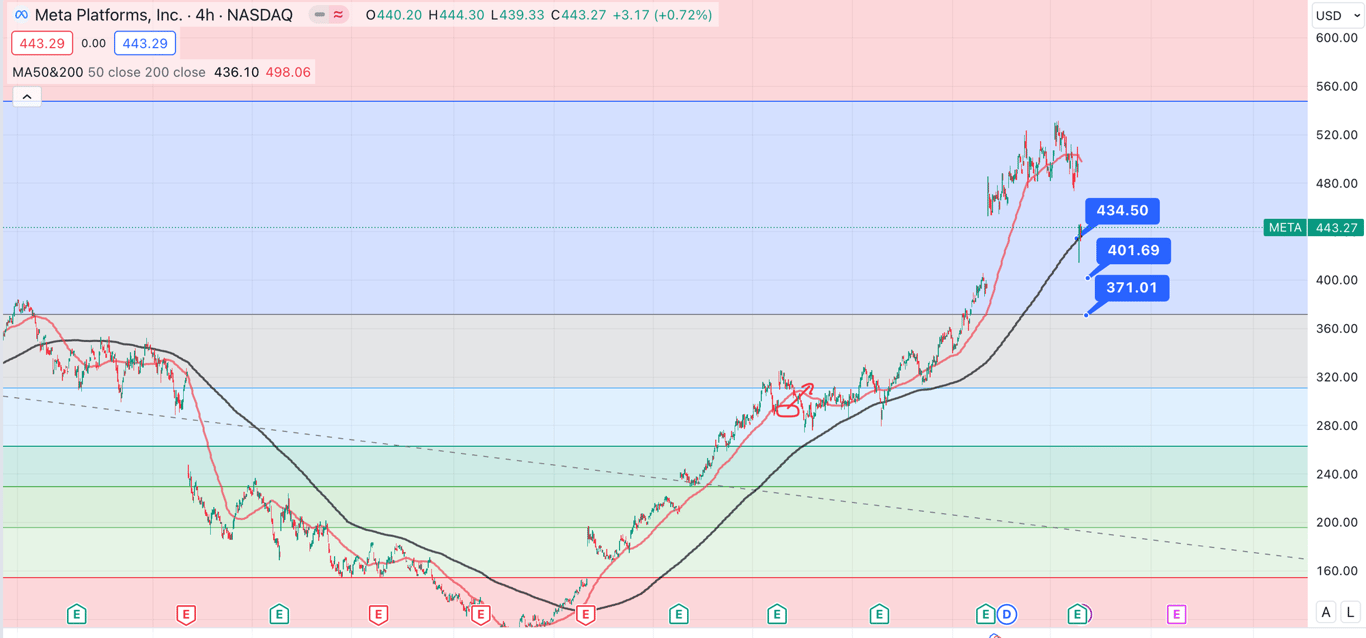

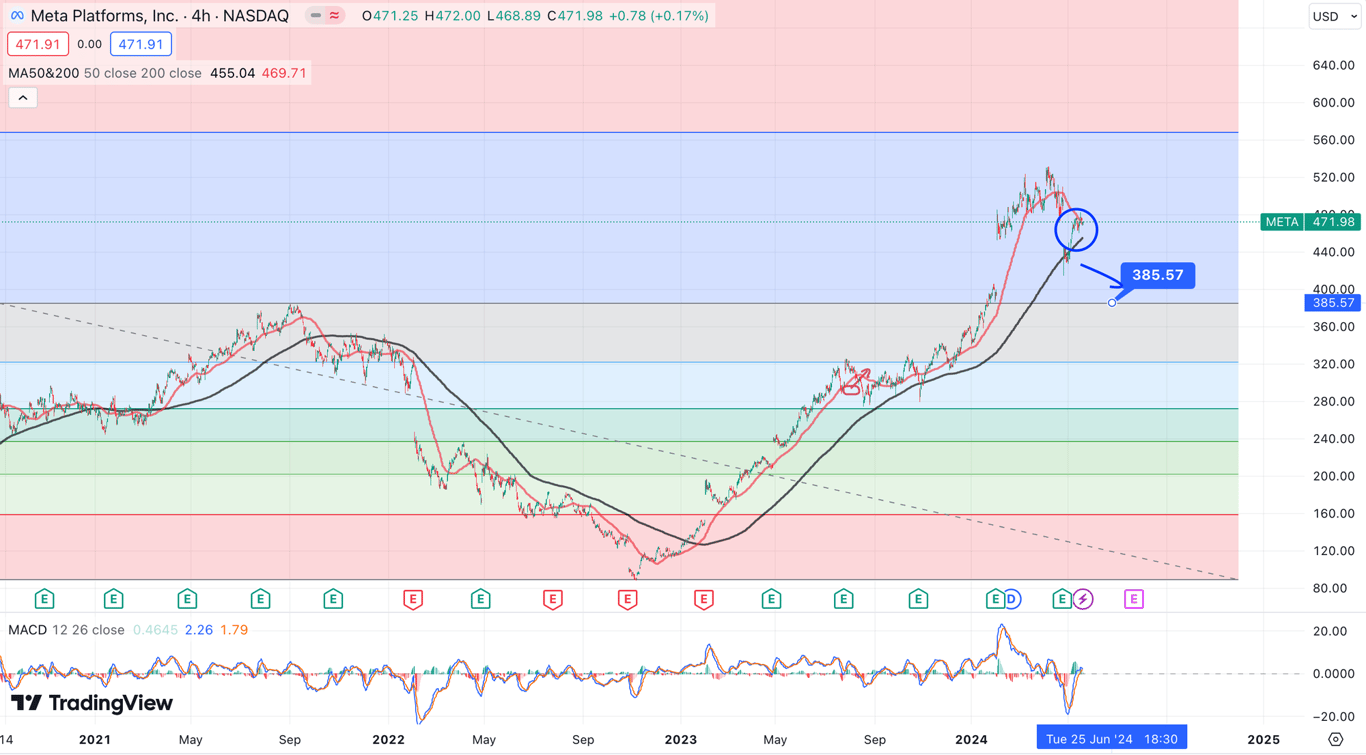

Technical Analysis Update [May 19, 2024 08:19 PMGMT+00:00]

- deathcross formation and expecting a pull back to fib hence the new Buy Trigger

Technical Analysis Update Apr 28, 2024

Technical Analysis Update [May 19, 2024 08:19 PMGMT+00:00]

- deathcross formation and expecting a pull back to fib hence the new Buy Trigger

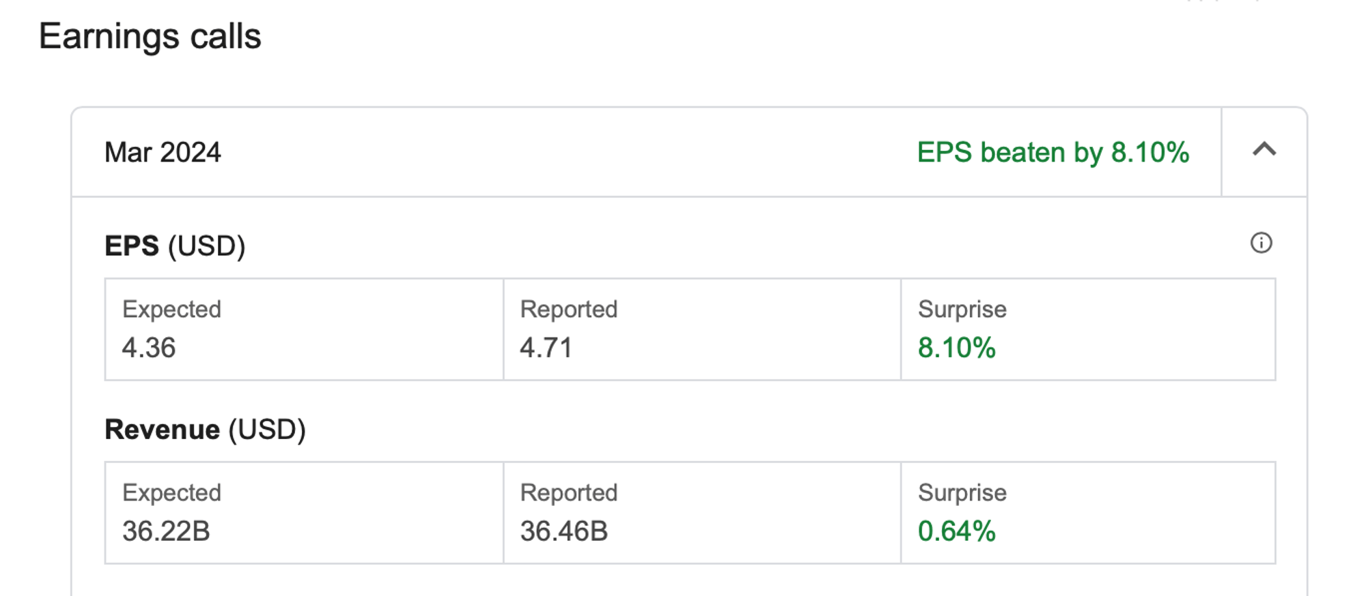

Q1 2024 Earnings Update

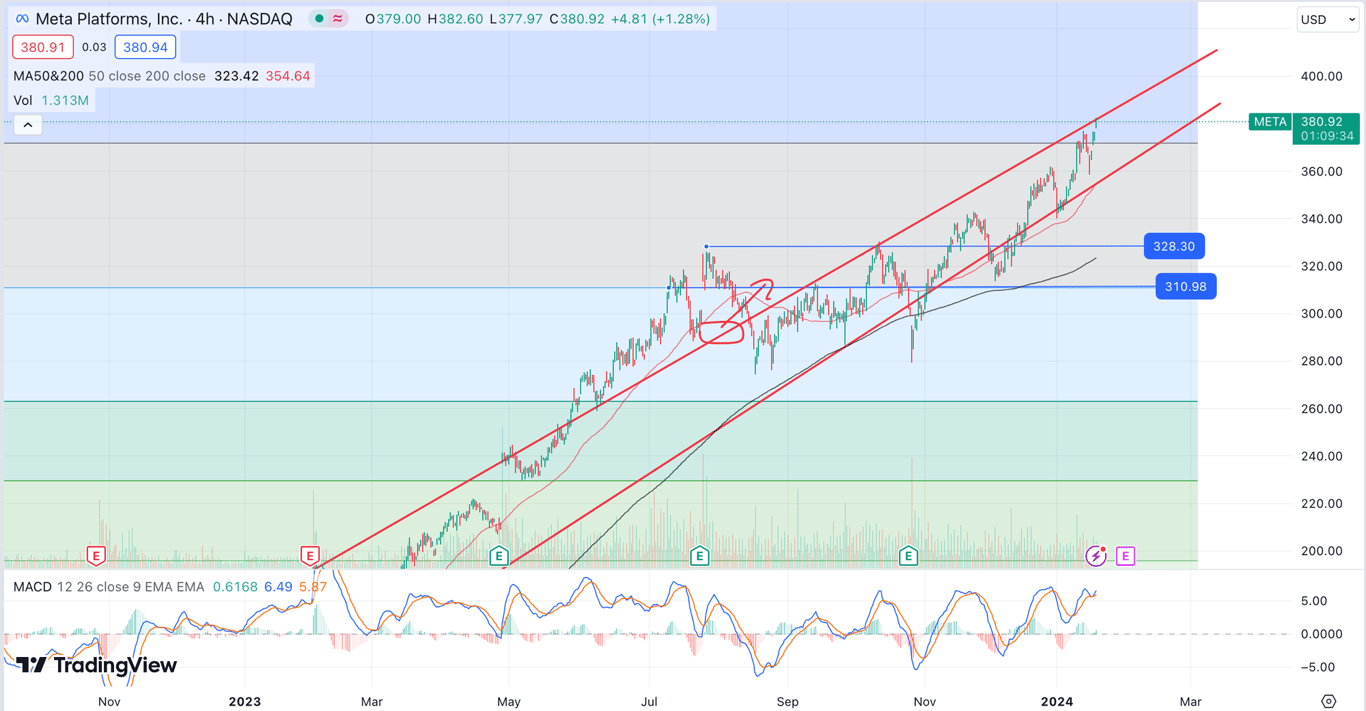

Technical Analysis Update 19th Jan 2023

- Buy Trigger at conservative $328 and $310.

- Waiting for the earnings before we determine forward case.

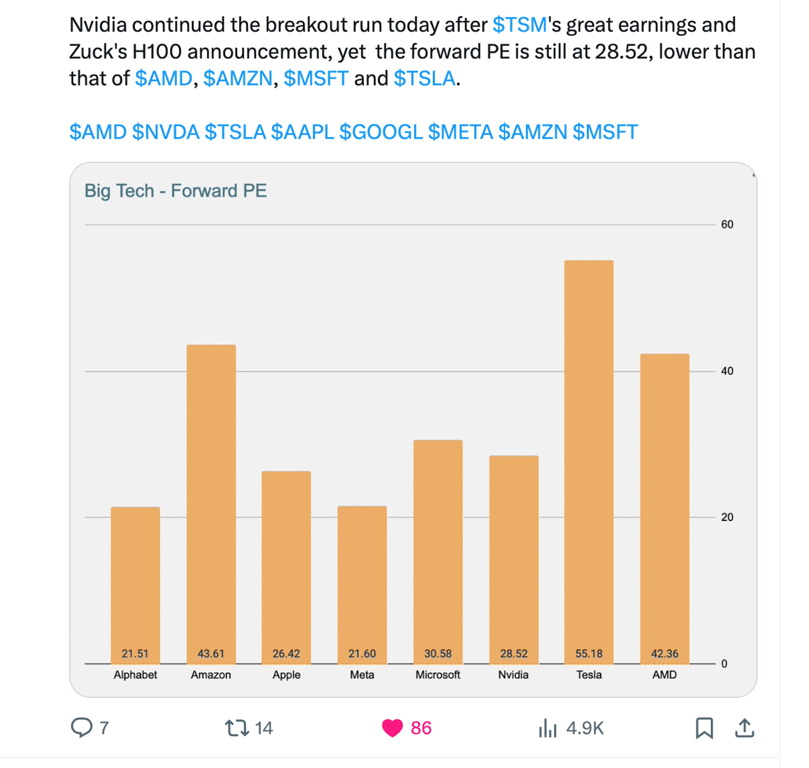

- META is the most undervalued among magnificient 7

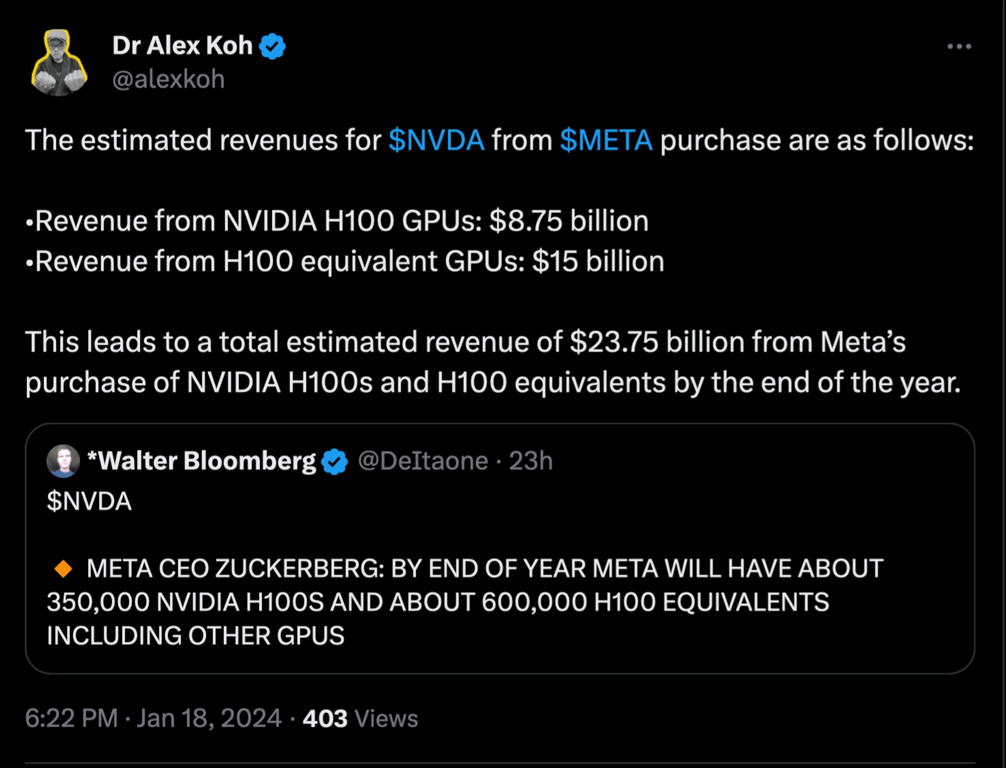

Breaking News 18th Jan 2023