Micron Technology Inc. (MU) Stock Comprehensive Review as of August 2024 🟠

Current Price: $107.99

Industry: Semiconductors

Stock Type: Growth, Cyclical

Rating: B+

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Micron reported $6.81 billion in revenue for Q2 2024, up 81.5% YoY, signaling strong recovery and demand, particularly in AI and memory markets.

- Net Income: The company posted an EPS of $0.62, exceeding analysts' expectations by $0.14, reflecting strong performance in the face of industry volatility.

- Free Cash Flow: Micron continues to maintain a healthy cash flow, supported by its operational efficiency and focus on cutting-edge memory and storage solutions.

💰 Valuation Analysis

- P/E Ratio: The P/E ratio is 75.32x due to previous periods of negative earnings, reflecting a company in recovery mode. Forward P/E metrics are improving as profitability returns.

- Price Target: Analysts have set a consensus price target of $157.92, with a potential 46.24% upside. The highest target is $225, indicating bullish expectations as the demand for DRAM and NAND flash memory grows.

- Market Cap: Approximately $118.59 billion, making Micron a significant player in the semiconductor sector.

📈 Growth Metrics

- 2024 EPS Growth Forecast: Analysts project that EPS will grow as the demand for AI and data center technologies increases, driving the need for advanced memory solutions.

- Price Target: With strong analyst support, the price target reflects confidence in Micron’s ability to capitalize on the AI and data center boom.

🔮 Forecast

Micron is poised to benefit from the growing demand in AI and cloud computing, which heavily rely on advanced memory technologies. However, the stock remains volatile due to the cyclical nature of the semiconductor industry. The recent dip in price could represent a buying opportunity, especially with the potential for significant upside.

Final Summary

- 🚀 Buy on Dips: Micron offers substantial upside potential, especially given its leadership in memory technologies crucial for AI and data centers.

- 📉 Volatile but Promising: Despite recent volatility, Micron's strong revenue growth and improving profitability make it a compelling investment.

- 🔎 Positive Analyst Sentiment: Analysts are largely bullish, with a strong buy consensus reflecting confidence in the company's strategic direction.

Micron remains a key player in the semiconductor industry, with a bright outlook driven by AI and cloud computing trends. Investors should be aware of its volatility but consider it for long-term growth potential.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [Aug 18, 2024 08:18 PMGMT+00:00]

- I am bullish about MU but i wasnt expecting a huge dip.

- Buytrigger revise to 121 which is the safety margin level meaning, anything below this level is business valuation itself without forecast optimism.

- The only problem with MU is the one trick pony effect. It will ride the Nvidia AI Boom, but what happens after is a only one way down.

Technical Analysis Update [Jul 9, 2024 08:11 AMGMT+00:00]

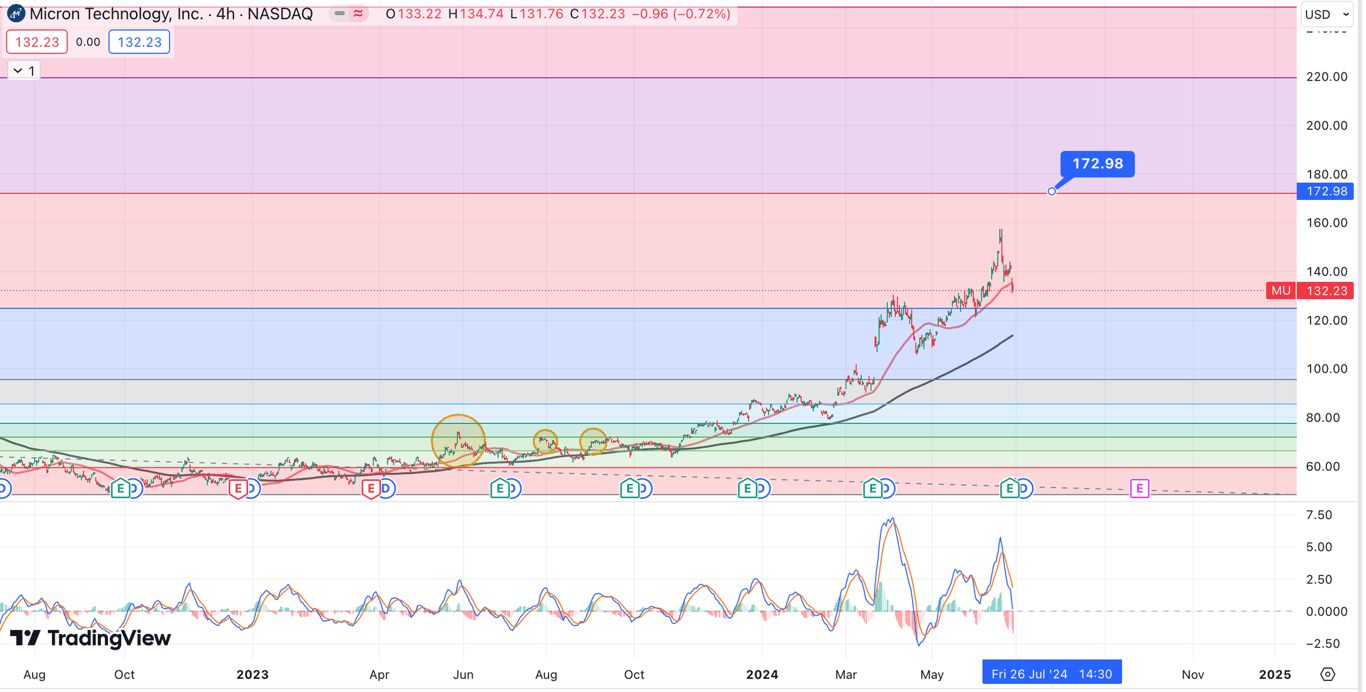

- Support and Resistance: The marked area around $130 looks to be a crucial support level, aligning with past price action. If this support holds, it could serve as a strong base for a potential upward move. A failure to hold this level might lead to a decline towards the next support around $120, possibly testing the 200-period moving average.

- Moving Averages: The 50-period moving average (red line) is currently acting as a dynamic support. The 200-period moving average (black line) below is another significant support, indicating a long-term bullish trend unless breached.

- MACD (Moving Average Convergence Divergence): The MACD has shown a bullish crossover recently, suggesting potential upward momentum. The blue circled area indicates the recent crossover where the MACD line crosses above the signal line, often interpreted as a buy signal.

- Price Action: Given the recent pullback, the next few sessions are crucial. If the price can reclaim and hold above the 50-period MA, we might see a bullish continuation towards the previous high around $145. Conversely, failure to hold above $130 could trigger further downside.

- Potential Scenarios:

• Bullish Scenario: A bounce off the current support zone with increasing volume could drive the price back towards the $140-$145 range.

• Bearish Scenario: If the price breaks below the $130 support, expect a retest of the $120-$125 range, where the 200-period MA lies.

In conclusion, the market seems at a pivotal point. Pay close attention to volume and price action around these key levels. Should the bullish momentum, indicated by the MACD, materialize, we could see significant upward movement. However, prudent risk management is advised if the support fails.

Price Valuation Update[Jun 28, 2024 06:54 AMGMT+00:00]

Reason for Update

- Now lsited as a High Growth company

- Updated blog to explain why i updated the growth from 10% to 26% and this boosted the valuation from $100 to $236. Link here

BT#1

BT#2

Valuation

Technical Analysis Update [May 18, 2024 11:51 PMGMT+00:00]

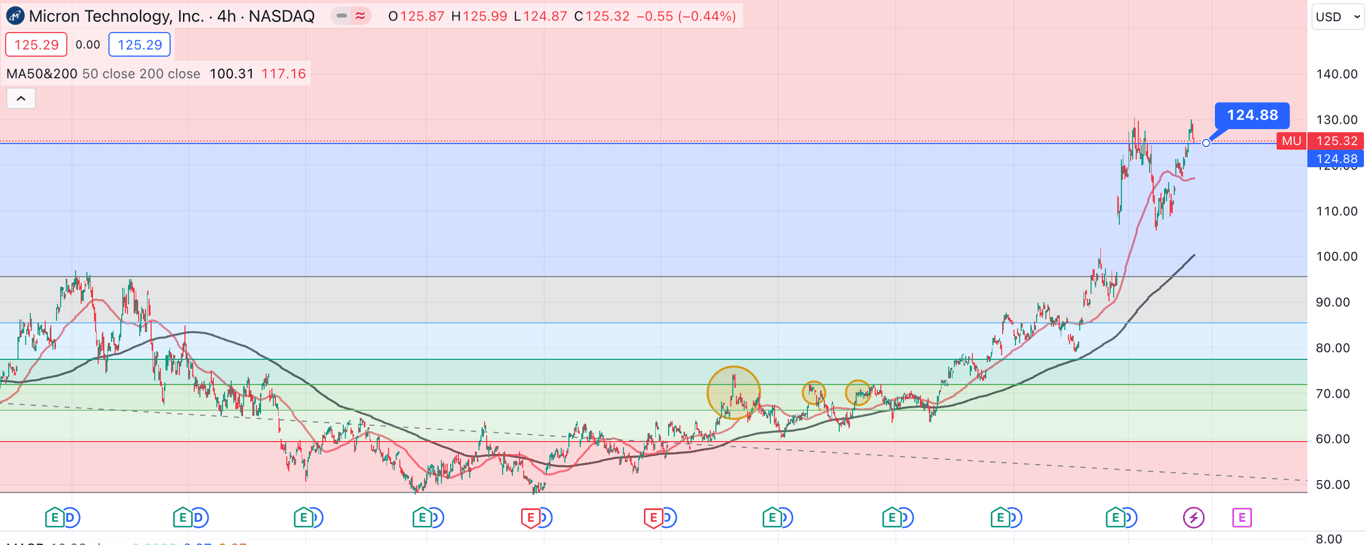

- the $124 base is establishing until we see an upside or downside