Microsoft Corporation (MSFT) Stock Comprehensive Review as of November 2024 🟢

Current Price: $410.37

Industry: Technology, Cloud Computing, Software

Stock Type: Growth, Blue Chip

Rating: A

Key Financial Metrics (Latest Earnings)

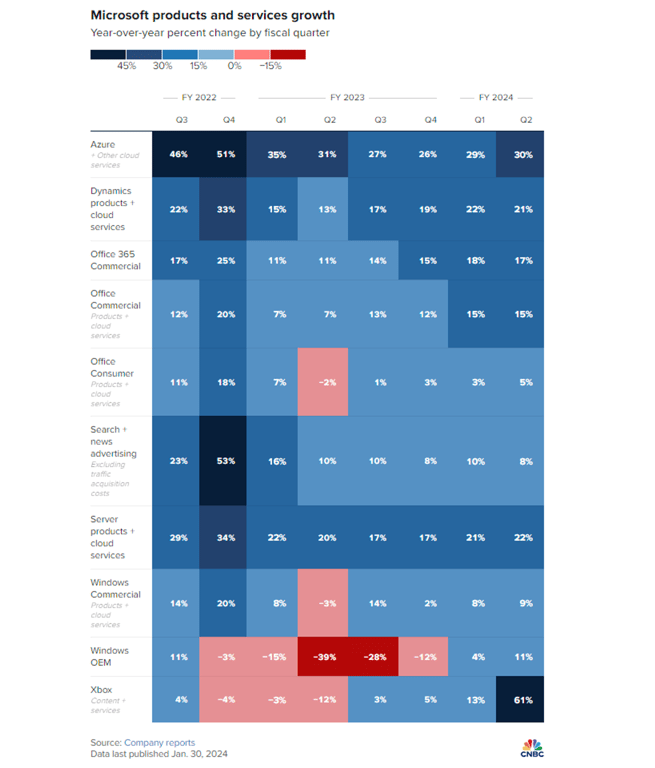

- Revenue Growth: Microsoft reported total revenue of $245.12 billion for 2024, marking a 15.67% increase from the prior year, driven by growth across its cloud computing, AI initiatives, and productivity tools. Azure, its cloud platform, continues to be a major growth engine, with steady double-digit growth supporting the company’s top line.

- Net Income: EPS for 2024 was $10.05, reflecting a 21.8% increase due to enhanced operational efficiencies and cloud service expansion. Earnings are projected to grow further in 2025 as Microsoft benefits from strong demand in AI and cloud-based services.

- Free Cash Flow: Microsoft’s cash flow remains strong, with substantial free cash flow generated to support both growth investments and shareholder returns through dividends and share buybacks.

💰 Valuation Analysis

- P/E Ratio: With a forward P/E ratio of 35.88x, Microsoft is trading at a premium that aligns with its high-growth profile and strong competitive positioning, particularly in cloud and AI sectors.

- Price Target: The average analyst price target is $503.43, suggesting a potential upside of 22.68%. The high target is $600, driven by expectations that Microsoft’s cloud and AI divisions will continue delivering robust results.

- Market Cap: Microsoft’s market capitalization stands at approximately $3.07 trillion, underscoring its leadership role in the technology sector and resilience in the market.

📈 Growth Metrics

- 2025 Growth Forecast: Microsoft is expected to continue growing steadily, with analysts projecting a 10.7% increase in revenue in 2025. This growth is largely driven by Azure’s expansion and AI integration, as well as continuous innovation in products like Microsoft 365 and Teams.

- Price Target: The forecast for Microsoft remains highly optimistic, given the company’s focus on high-demand areas and its expanding ecosystem in AI, productivity software, and cloud services.

🔮 Forecast

Microsoft’s financial performance remains strong, backed by diverse revenue streams and strategic investments in AI and cloud computing. While Microsoft’s valuation is high, its growth potential in leading technology segments makes it a valuable long-term investment. Demand for its cloud and AI offerings is expected to remain high, supporting consistent growth.

Final Summary

- 🚀 Strong Growth and Resilience: Microsoft’s market leadership and innovation in cloud and AI solidify its status as a top-tier growth stock.

- 📈 Attractive Upside: Given its robust growth trajectory and financial strength, Microsoft earns an A rating, reflecting its solid long-term potential.

Microsoft continues to be a cornerstone investment in the technology sector, offering significant growth potential driven by its leadership in cloud computing and AI.

Interesting Facts

🕶️ Chronological Update below 👇🏻

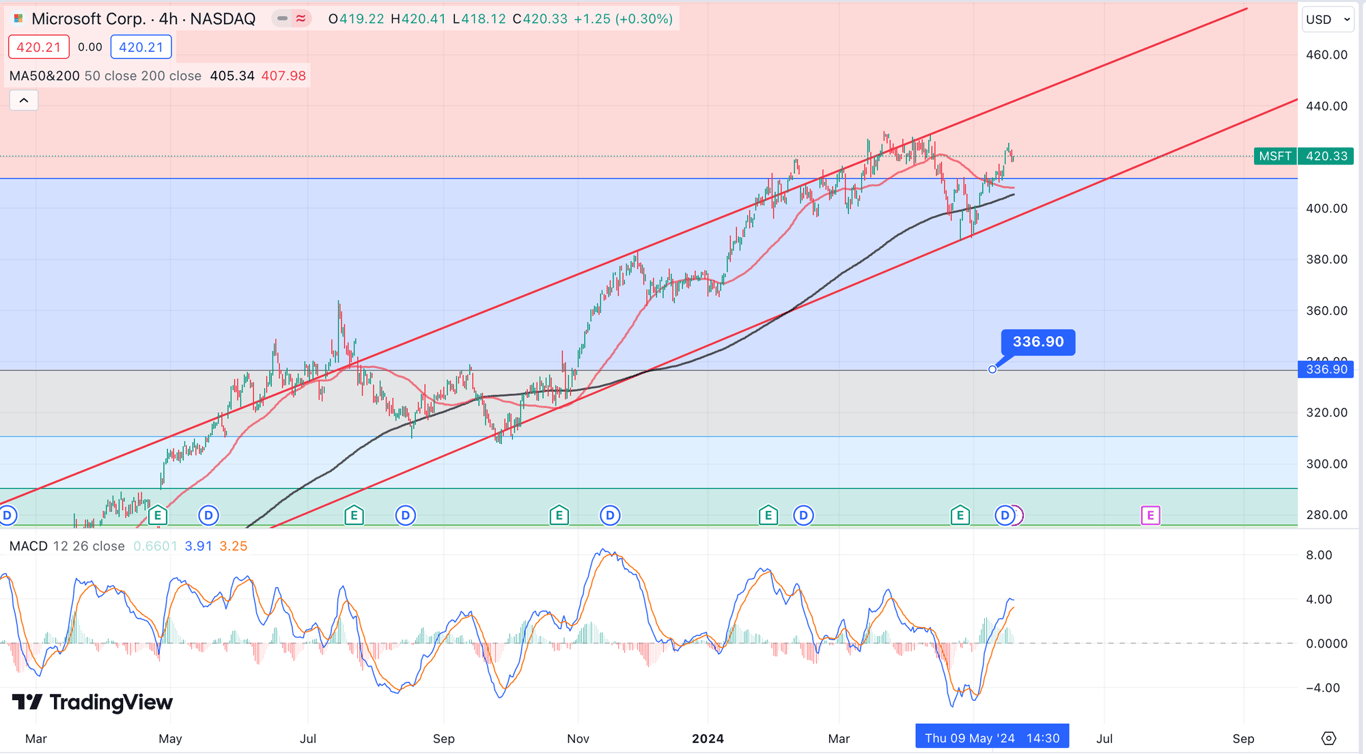

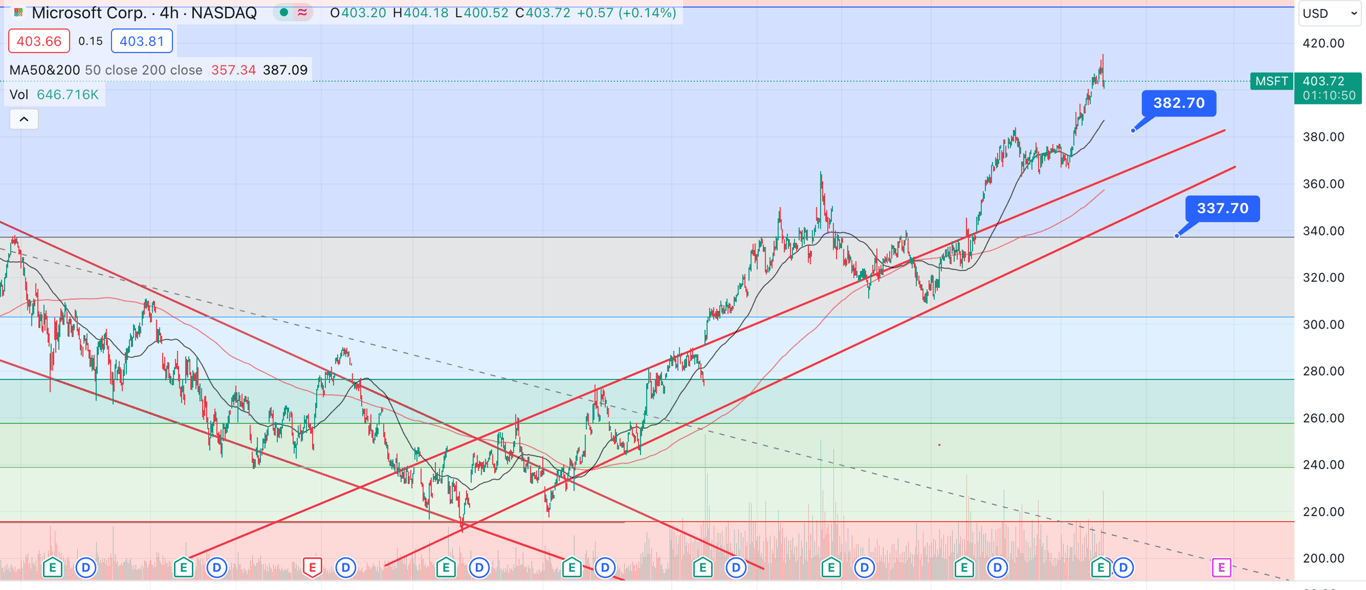

Technical Analysis Update [May 18, 2024 10:31 PMGMT+00:00]

- I see potential deathcross forming. I am pulling my buy trigger for $336 good value entry.

Earnings Update 30/01/2024

- EPS Expected Vs EPS Recveived

- Revenue Exp vs Revenue Received

Updates and Notes

News Sentiment

Other Updates