NextEra Energy Inc. (NEE) Stock Comprehensive Review as of August 2024 🟠

Current Price: $79.81

Industry: Utilities, Renewable Energy

Stock Type: Defensive, Growth

Rating: B-

Key Financial Metrics (Latest Earnings)

- Revenue (Q2 2024): $7.45 billion, up 12% YoY.

- Net Income: $1.38 billion, growing 5% YoY.

- Gross Margin: 65.1%, reflecting solid operational efficiency.

- EPS (Earnings Per Share): $0.70, slightly below estimates.

- Free Cash Flow: $2.1 billion, indicating strong liquidity.

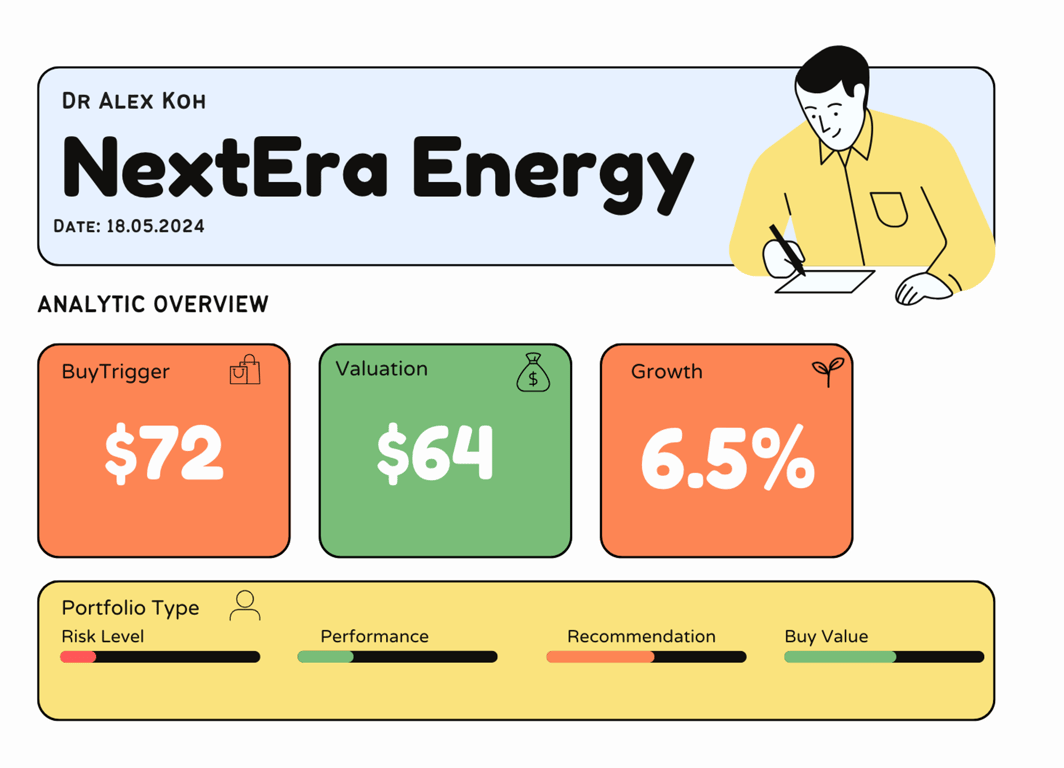

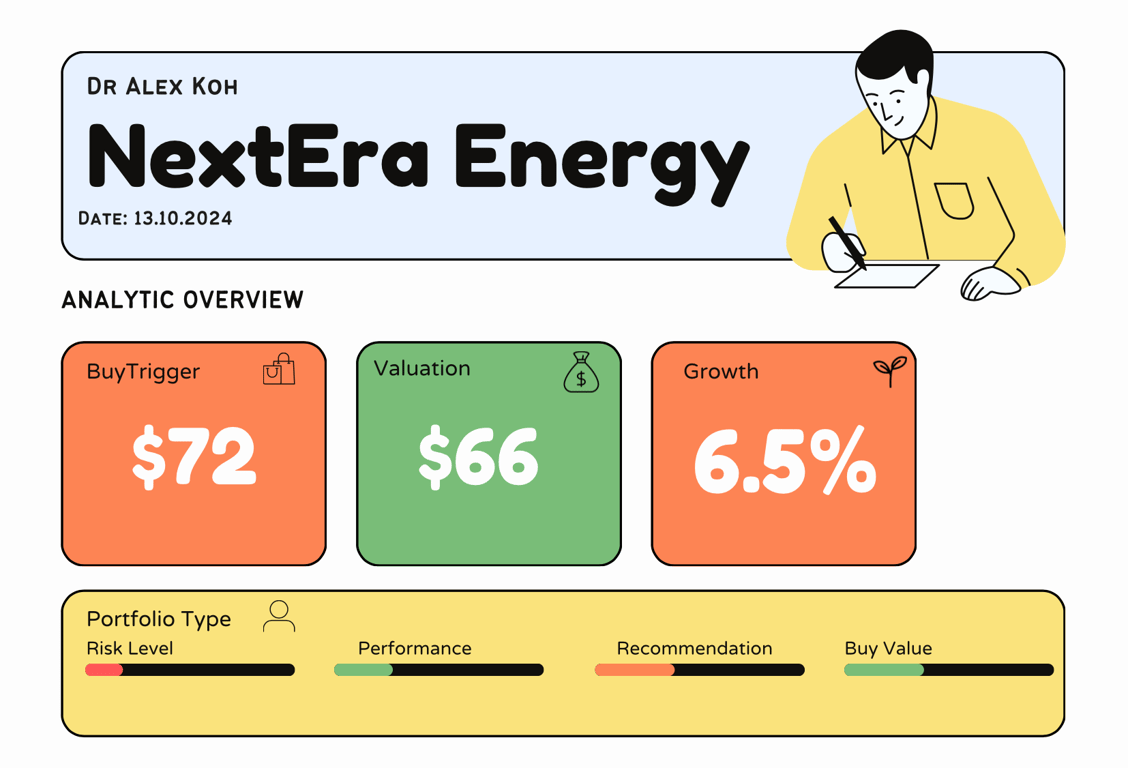

💰 Valuation Analysis

- P/E Ratio: 21.5x, slightly above industry average.

- P/S Ratio: 4.2x, showing moderate market optimism.

- Forward P/E: 19.7x, suggesting stable future performance.

- PEG Ratio: 2.1, showing that growth is priced in.

- Market Cap: $158 billion, making NEE a significant player in renewable energy.

📈 Growth Metrics

- 2024 EPS Growth Forecast: Moderate growth expected, driven by investments in renewable energy.

- Price Target: Analysts set a consensus price target of $85, with a high target of $95.

📊 Technical Indicators

- RSI (Relative Strength Index): Currently around 45, indicating the stock is neither overbought nor oversold.

- MACD (Moving Average Convergence Divergence): Bearish crossover observed, suggesting potential short-term weakness.

- Moving Averages: The 50-day moving average is slightly below the 200-day moving average, indicating a potential bearish trend.

- Support/Resistance Levels: Strong support around $75, with resistance near $85.

🔮 Forecast

NextEra Energy is expanding its renewable portfolio, but faces challenges like rising costs and regulatory hurdles, which could impact margins. Despite these risks, NEE remains well-positioned in the renewable energy sector.

Final Summary

- 🚀 Buy with Caution: NEE offers stable growth with potential upside, though regulatory risks should be monitored.

- 📊 Solid Financials: Strong revenue and cash flow, but with slight earnings pressure.

- 💡 Fair Valuation: Valuation reflects stable growth, with potential for moderate gains.

- ⚠️ Risks: Regulatory changes and rising costs are key concerns, but the long-term outlook remains positive.

NextEra Energy is a reliable investment in the renewable energy sector with steady growth prospects.

Interesting Facts