Netflix Inc. (NFLX) Stock Comprehensive Review as of August 2024 🟢

Current Price: $674.07

Industry: Streaming Media, Entertainment

Stock Type: High Growth

Rating: A-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Netflix reported a 16.8% YoY increase in revenue for Q2 2024, reaching $9.56 billion, slightly above expectations.

- Net Income: The company achieved a strong net margin of 19.54%, with an EPS of $4.88, beating analyst estimates by $0.14.

- Free Cash Flow: Netflix continues to generate significant free cash flow, supporting its content creation and international expansion strategies.

💰 Valuation Analysis

- P/E Ratio: The stock trades at a P/E ratio of 44.5x, reflecting high expectations for future growth.

- Price/Book Ratio: The current price-to-book ratio is elevated, consistent with its tech and media sector peers, given its dominant market position.

- Market Cap: Approximately $279.30 billion, making Netflix a major player in global media and entertainment.

📈 Growth Metrics

- 2024 EPS Growth Forecast: Analysts project continued growth with an EPS estimate of $19.08 for the full year, supported by Netflix’s expansion into live sports and advertising.

- Price Target: The consensus price target is $681.21, with a potential 1.06% upside. The highest target is $800, while the lowest is $465, reflecting a mix of bullish and cautious sentiments.

🔮 Forecast

Netflix continues to lead the streaming market, and its recent moves into advertising and live sports broadcasting are expected to drive further growth. However, the stock’s high valuation suggests limited upside in the near term, and investors should be aware of the increasing competition in the streaming industry.

Final Summary

- 🚀 Strong Buy: Netflix's strong financials and strategic expansions make it an attractive investment for long-term growth, although current valuation limits immediate upside.

- 💹 Financial Strength: With robust revenue growth and profitability, Netflix is well-positioned to continue leading in the streaming space.

- 🔎 Positive Analyst Sentiment: While most analysts recommend a "Buy," the price target suggests that the stock is approaching its fair value, indicating more modest gains ahead.

Netflix remains a top choice in the streaming sector, with significant potential driven by its diverse content offerings and strategic initiatives.

Interesting Facts

🕶️ Chronological Update below 👇🏻

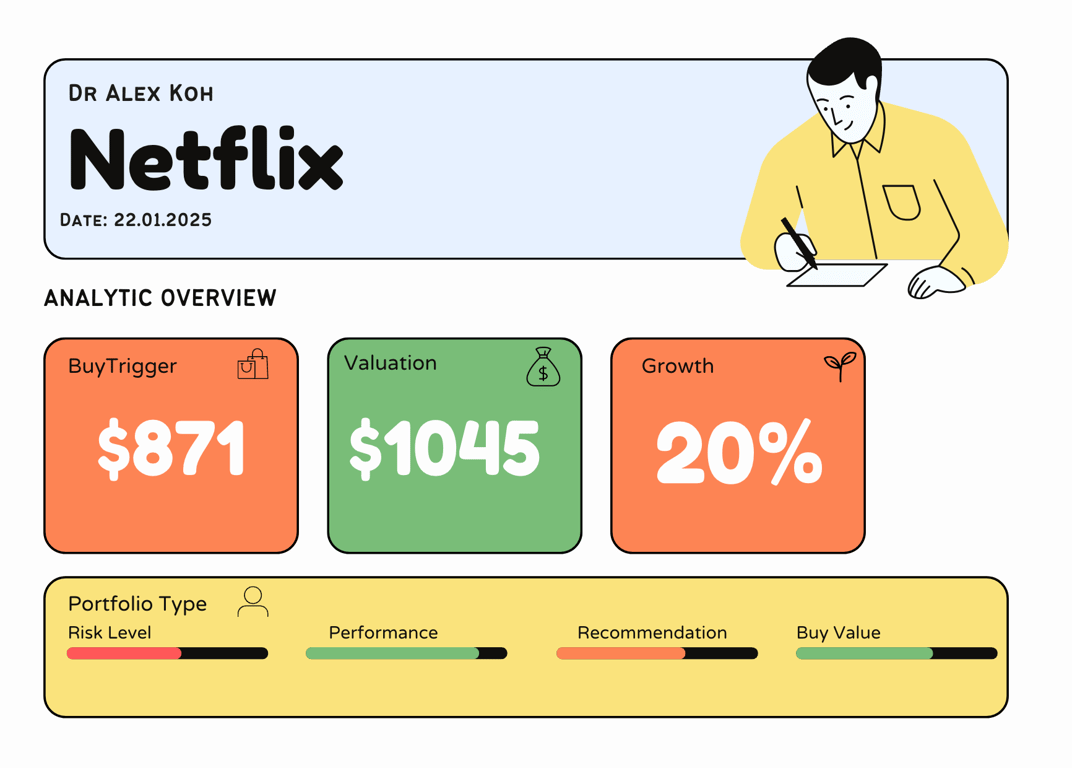

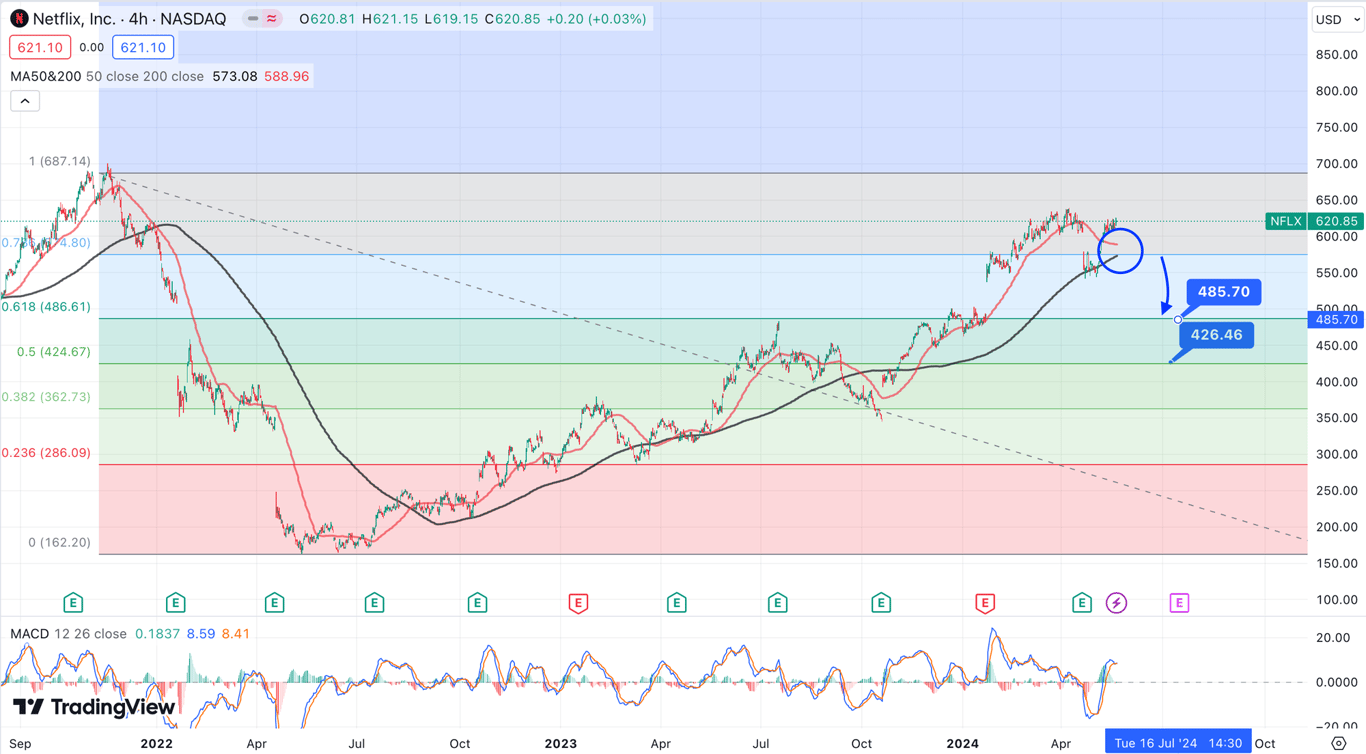

Technical Analysis Update [Aug 18, 2024 07:54 PMGMT+00:00]

- Looking to retest ATH again.

- This time with higher future forecast valuation.

- Personally i think they would fail as there is nothing new in their product range to push higher. AI isnt really going to boost their revenue.

- I raised the BT to next FIB levels as a fishing oppurtunity.

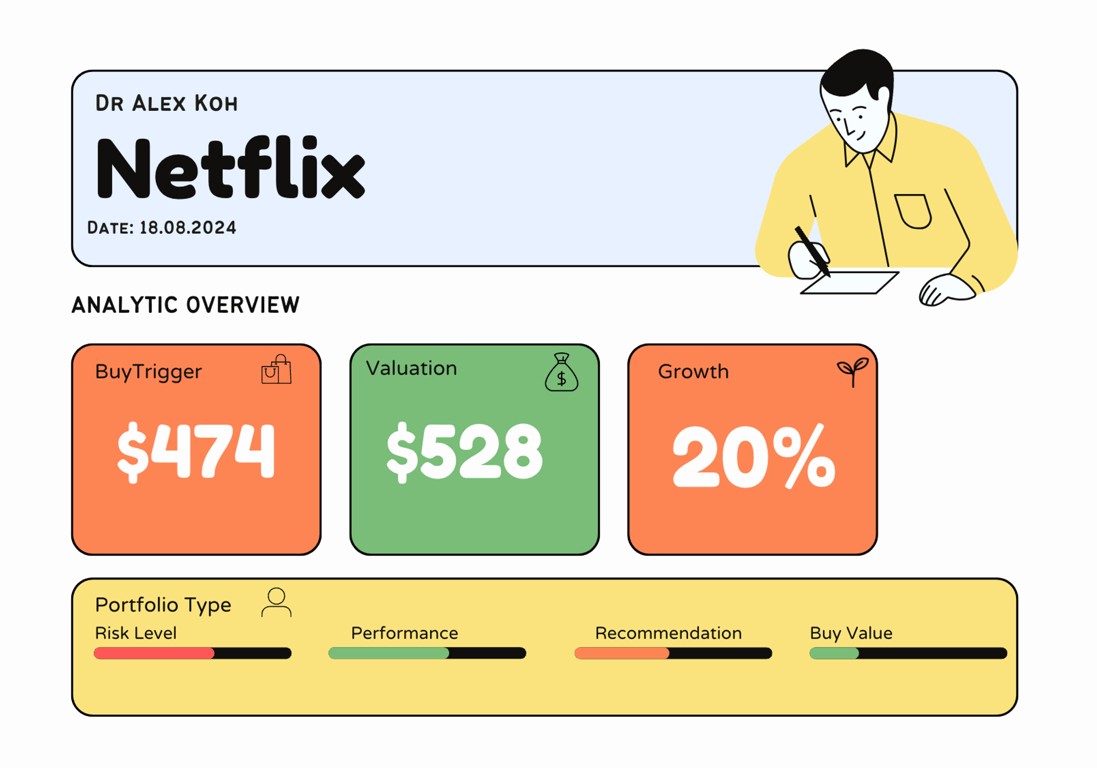

Technical Analysis Update [May 19, 2024 05:15 PMGMT+00:00]

- deathcross anticipated and expected decline to the next 2 fib levels..