Nike Inc. (NKE) Stock Comprehensive Review as of August 2024 🟠

Current Price: $82.69

Industry: Apparel, Footwear

Stock Type: Growth, Consumer Staples

Rating: B-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Nike reported $51.4 billion in revenue for FY2024, showing a minimal increase of 1% YoY. In Q4 2024, revenues were $12.6 billion, a 2% decline YoY, reflecting challenges in key markets like North America.

- Net Income: Nike posted an EPS of $0.99 for Q4 2024, slightly above expectations, due to improved gross margins of 44.7%, thanks to strategic pricing and lower logistics costs.

- Free Cash Flow: Nike continues to generate significant cash flow, although the company is facing headwinds from inventory management issues and lower digital sales.

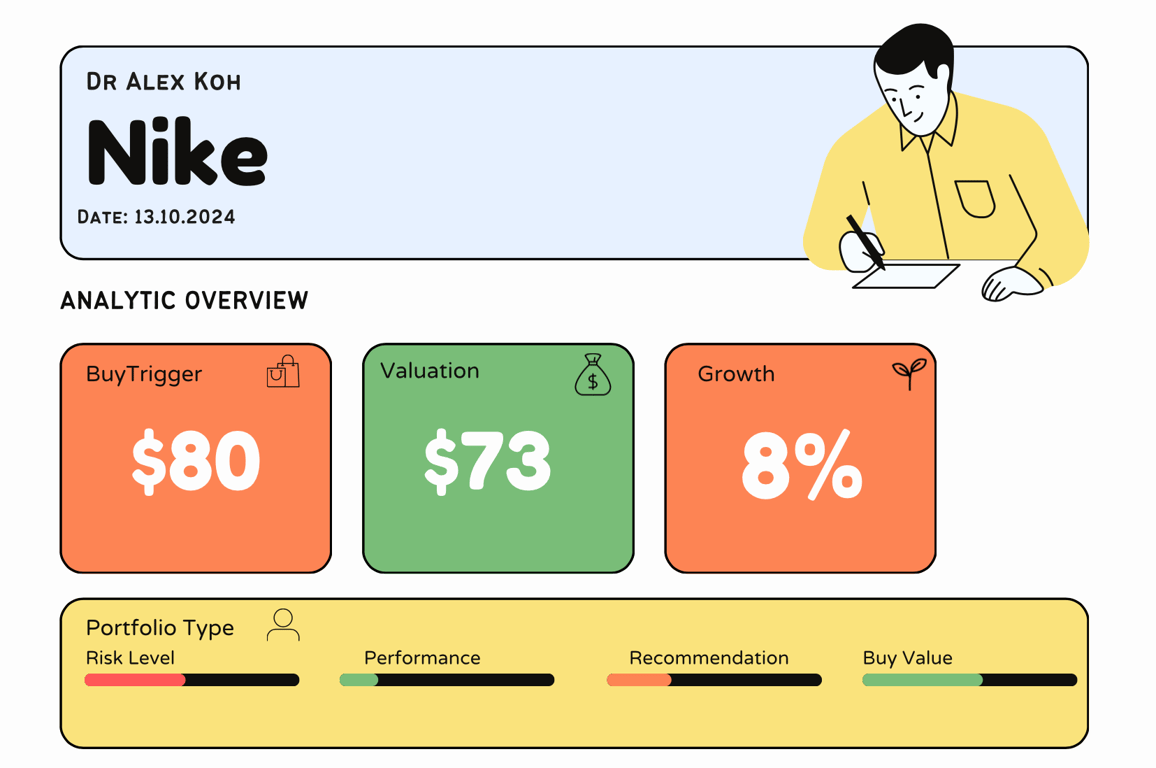

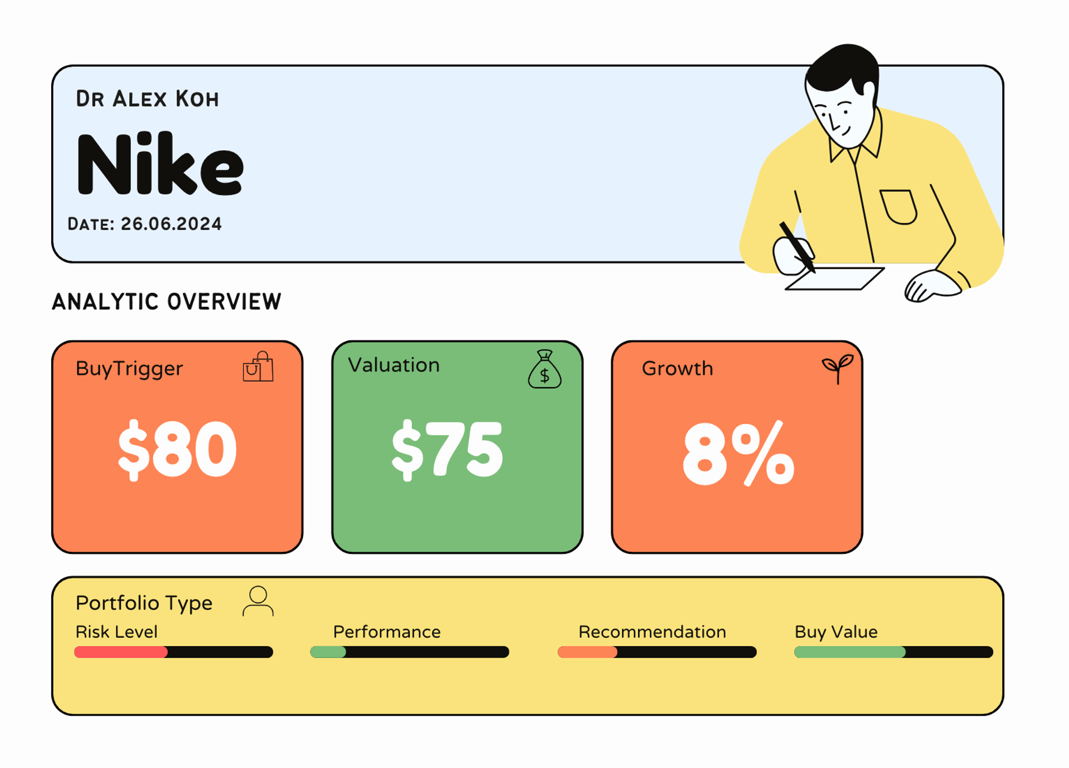

💰 Valuation Analysis

- P/E Ratio: Nike’s forward P/E ratio is 26.28x, reflecting a valuation premium typical of strong consumer brands, though it remains under pressure due to recent performance.

- Price Target: Analysts have set a consensus price target of $101.85, with a potential 23.13% upside. The range of targets spans from $71 to $136, showing uncertainty about Nike's ability to navigate current challenges.

- Market Cap: Approximately $130 billion, positioning Nike as a leader in the global sportswear market, despite recent struggles.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Analysts expect Nike’s EPS to grow by 15.07% in 2025, driven by potential recovery in key markets and continued innovation in product lines.

- Price Target: The broad range of price targets suggests mixed sentiment, reflecting both Nike's strong brand equity and the challenges it faces in maintaining growth.

🔮 Forecast

Nike is currently navigating a challenging environment, with pressures from declining digital sales and competitive dynamics in North America. The company’s strong brand and pricing power remain significant assets, but near-term growth is uncertain. Analysts remain cautiously optimistic, but investors should be aware of potential volatility.

Final Summary

- ⚠️ Hold with Caution: Nike’s strong brand and market position provide long-term potential, but short-term challenges suggest caution.

- 📉 Competitive and Market Pressures: Recent financial results highlight difficulties in North America and digital sales, which could impact performance.

- 🔎 Mixed Analyst Sentiment: While analysts see upside, the wide range of price targets indicates uncertainty about Nike's ability to overcome current challenges.

Nike remains a dominant player in the apparel and footwear industry, but recent financial performance and market conditions suggest a cautious approach for investors.

Interesting Facts

🕶️ Chronological Update below 👇🏻

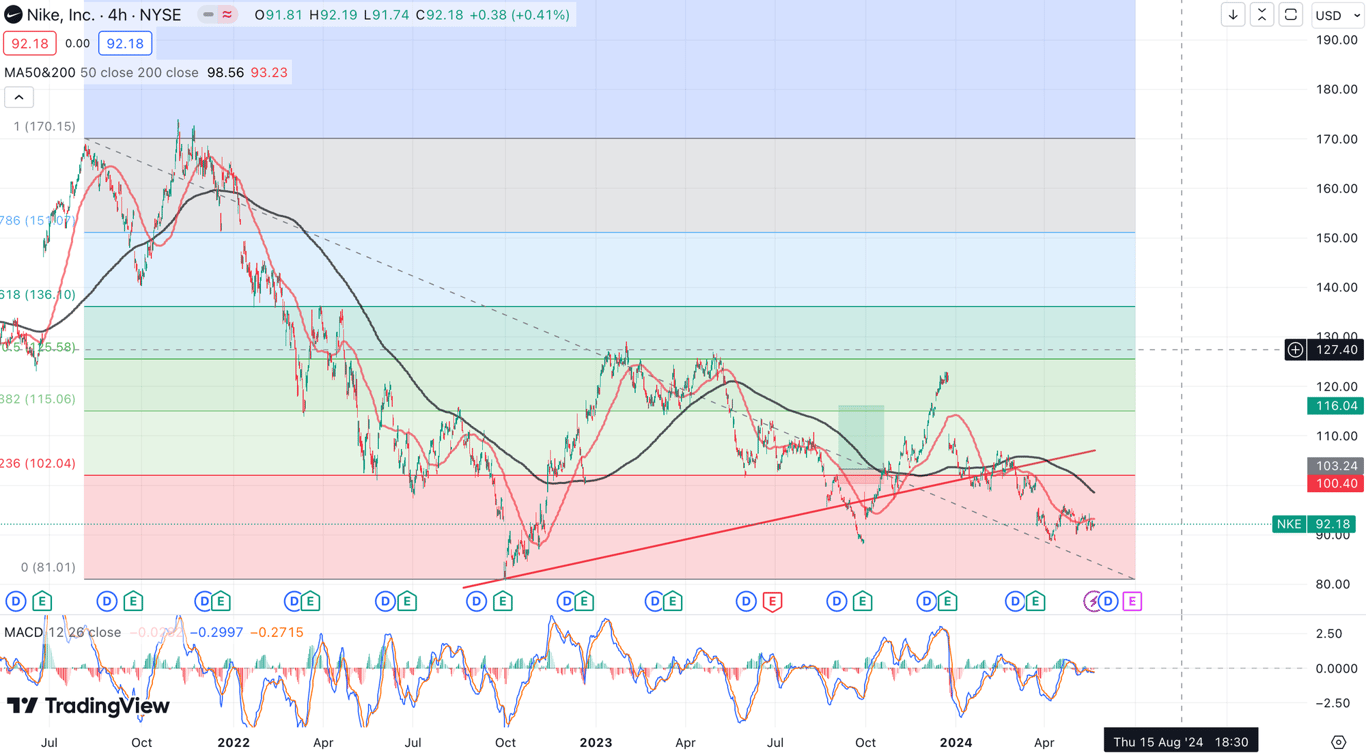

Technical Analysis Update [May 19, 2024 10:53 PMGMT+00:00]