Nvidia (NVDA) Stock Comprehensive Review as of November 21, 2024 🟢

Current Price: $146.27

Industry: Semiconductors, Artificial Intelligence

Stock Type: Growth

Rating: A+

💡 Key Financial Metrics (Q3 FY2025)

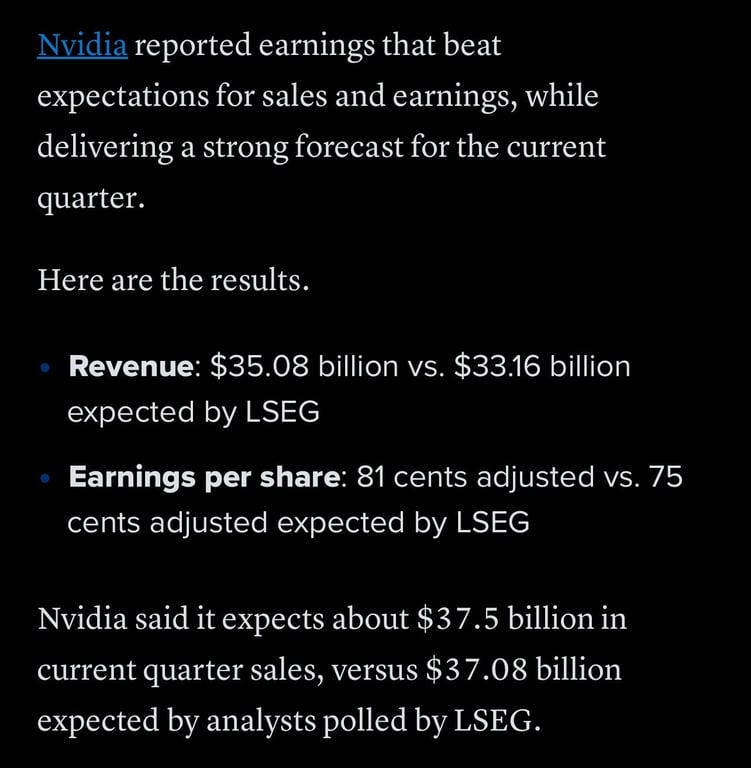

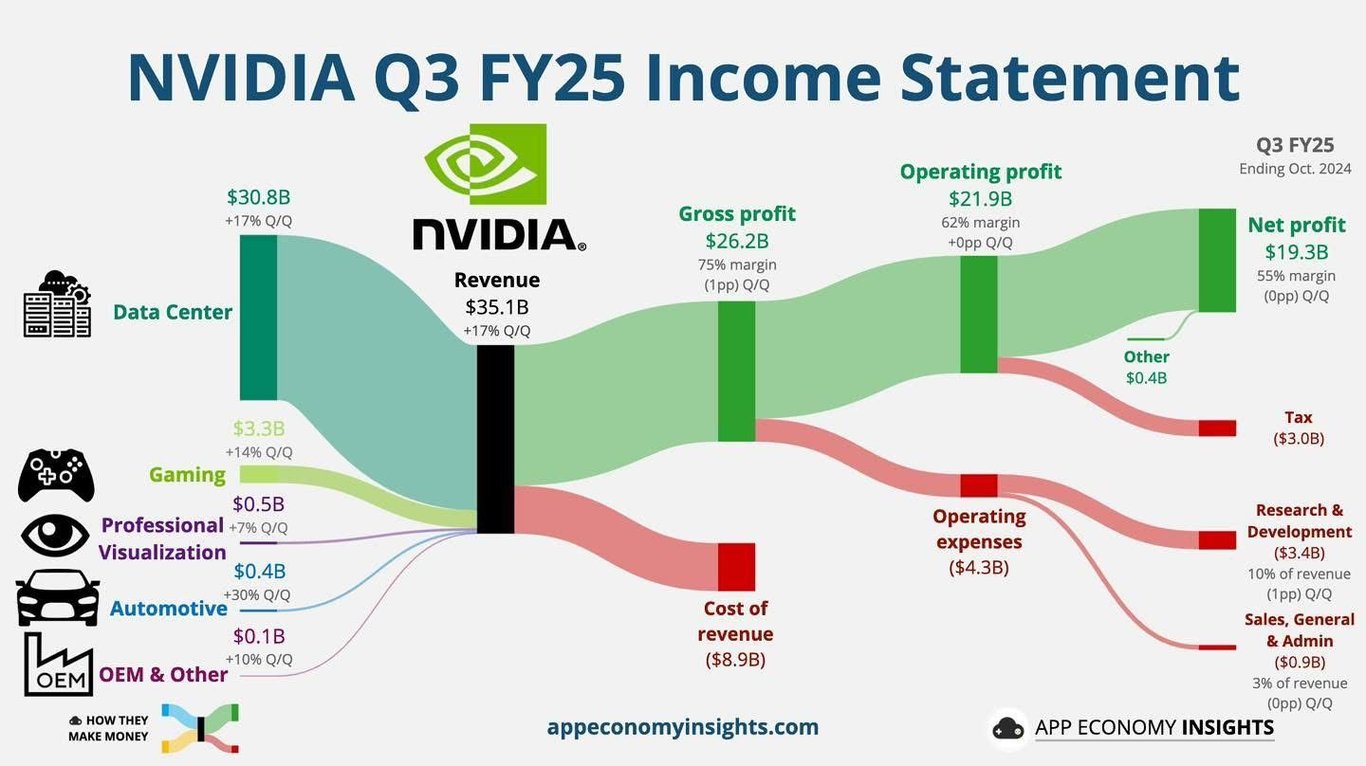

- Revenue: $35.1 billion, up 94% YoY.

- Net Income: $19.3 billion, increasing by 109% YoY.

- Gross Margin: 73.5%, indicating strong pricing power and operational efficiency.

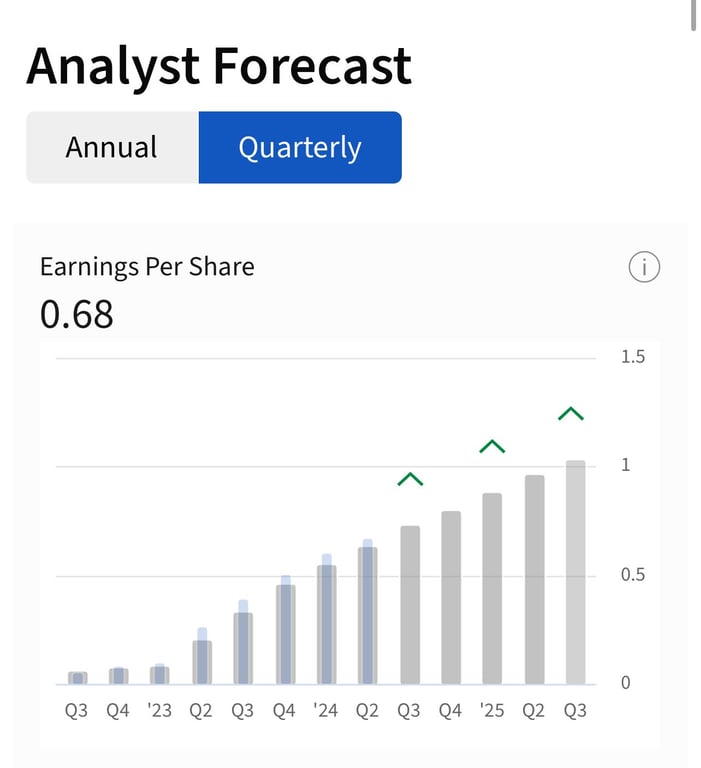

- EPS (Earnings Per Share): $0.81, surpassing analyst expectations of $0.75.

- Free Cash Flow: $10.5 billion, reflecting robust cash generation capabilities.

💰 Valuation Analysis

- P/E Ratio: 68.15x, higher than the industry average, reflecting a growth premium.

- P/S Ratio: 22.5x, indicating that the market values its revenue growth highly.

- Forward P/E: 30.2x, suggesting a continued growth trajectory.

- PEG Ratio: 1.1, highlighting a good balance between growth and valuation.

- Market Cap: $3.6 trillion, solidifying its status as a mega-cap stock.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Nvidia is projected to see continued strong growth, driven by AI, data centers, and gaming sectors.

- Price Target: Analysts have set a consensus price target of $200, reflecting confidence in Nvidia’s sustained performance.

🔍 Revenue Breakdown

- Data Center (53%): $18.6 billion (+110% YoY)

- Fueled by demand for AI workloads and cloud services.

- Gaming (30%): $10.5 billion (+25% YoY)

- Growth driven by strong adoption of GeForce RTX GPUs.

- Professional Visualization (8%): $2.8 billion (+10% YoY)

- Used for 3D rendering and creative industries.

- Automotive (6%): $2.1 billion (+50% YoY)

- Growth from autonomous vehicle chipsets and AI cockpit systems.

🔮 Forecast

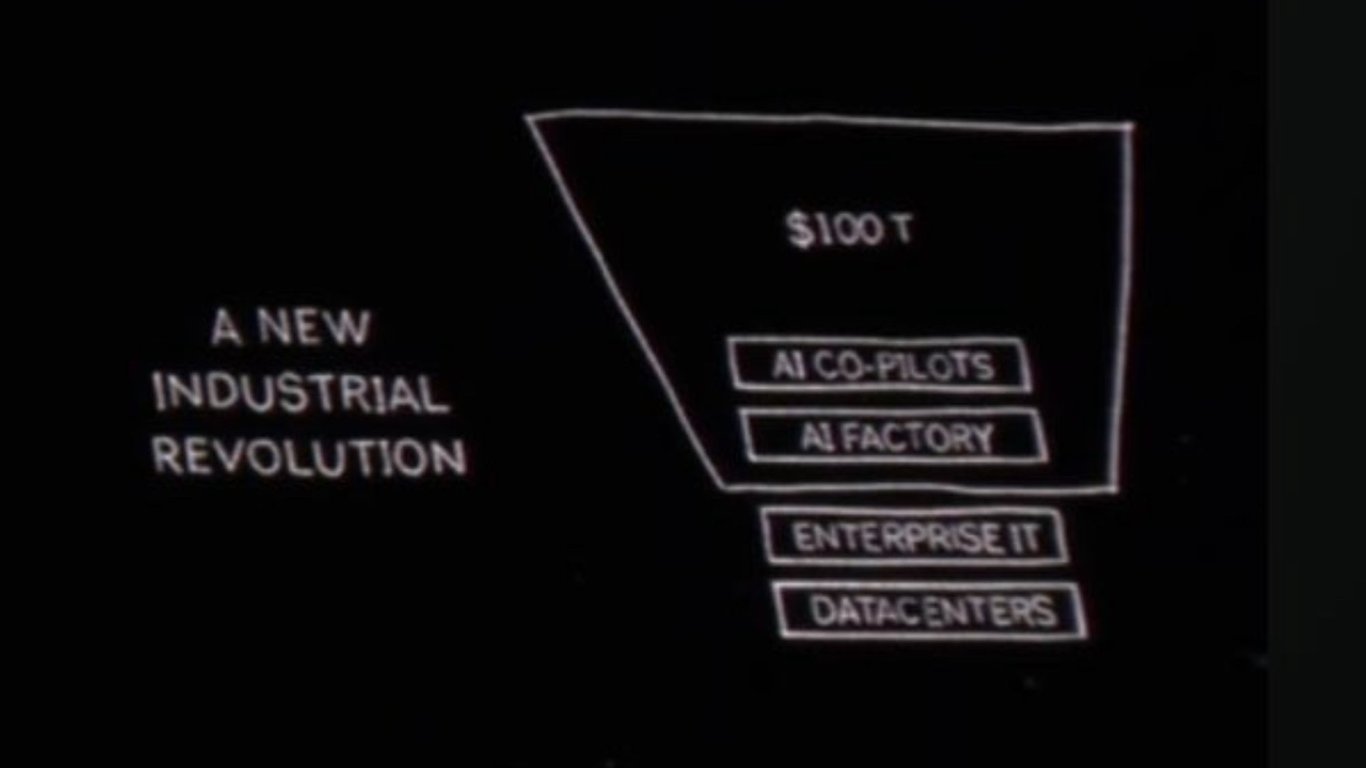

Nvidia is positioned at the cutting edge of AI, with strong financials and market leadership in GPUs. The company’s growth is underpinned by significant investments in AI and data center technologies, making it a cornerstone of future tech developments. While the stock trades at a premium, its robust earnings growth and market dominance justify the valuation.

Final Summary

- 🚀 Strong Buy: Nvidia’s leading position in the AI and semiconductor markets, combined with its exceptional financial performance, make it a top-tier stock.

- 📊 Strong Financials: With substantial revenue and net income growth, Nvidia’s financial health is outstanding.

- 💡 Valuation Justified: Despite high multiples, Nvidia’s growth potential in AI and other emerging technologies supports its valuation.

- ⚠️ Minor Risks: Watch for short-term market fluctuations due to high valuations, but the long-term outlook remains highly positive.

Nvidia remains one of the best-positioned tech stocks for growth in 2024 and beyond.

Interesting Facts

Tesla Vs Nvidia Revenue [@now]

Updates and Notes

News Sentiment

Other Updates

Nvidia year end ratingsDec 31, 2023

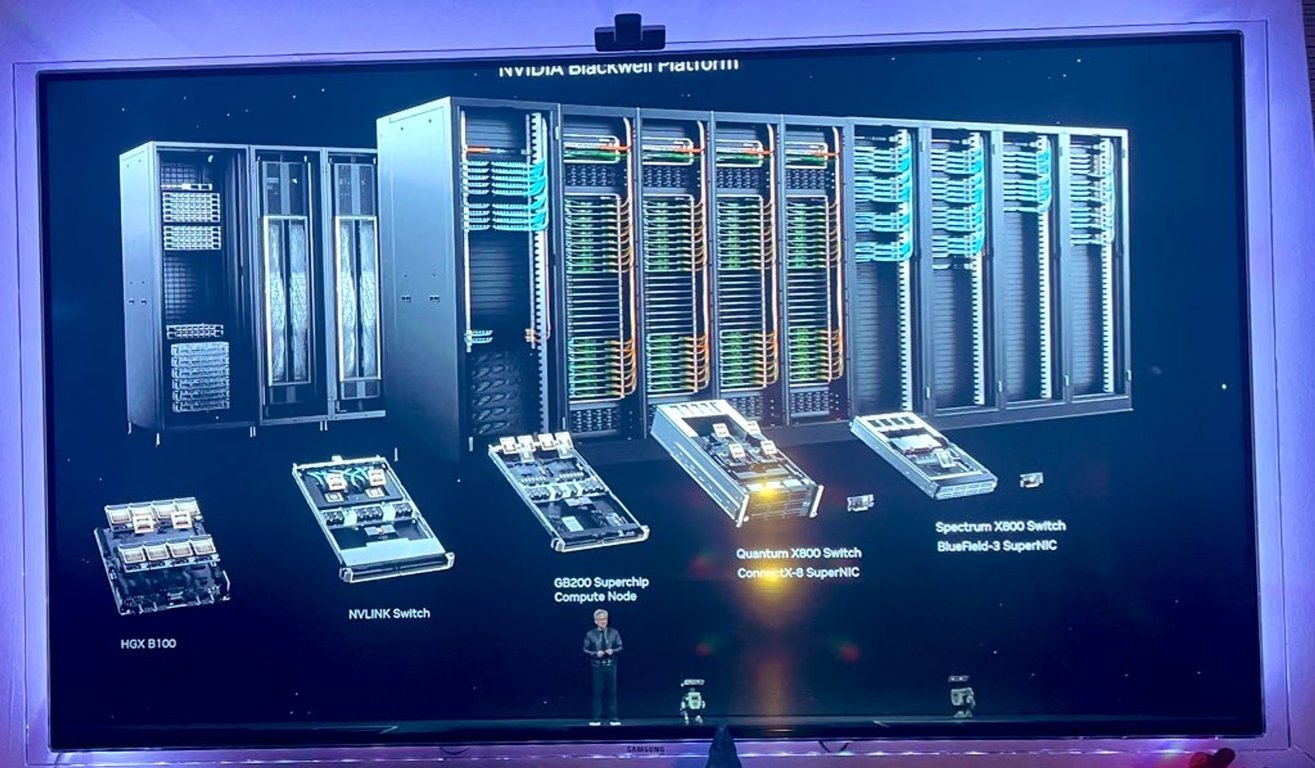

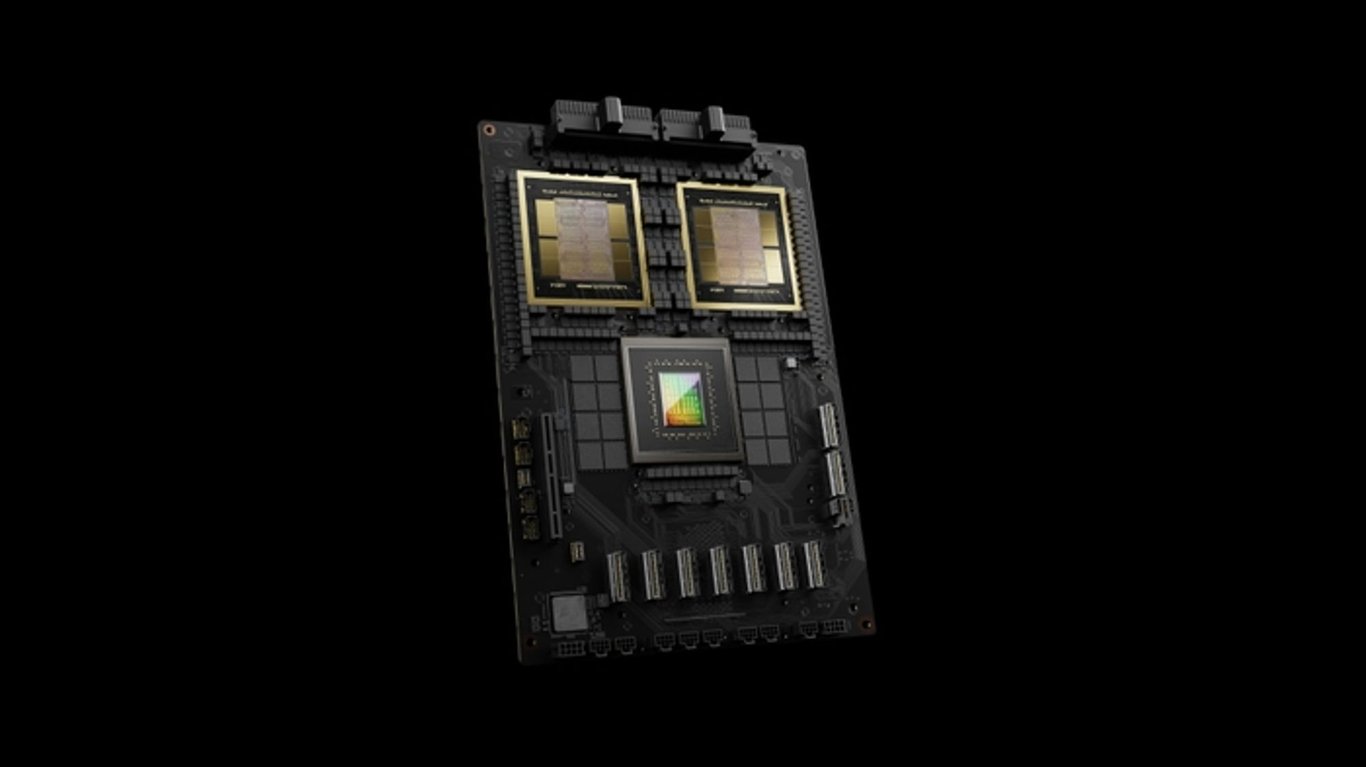

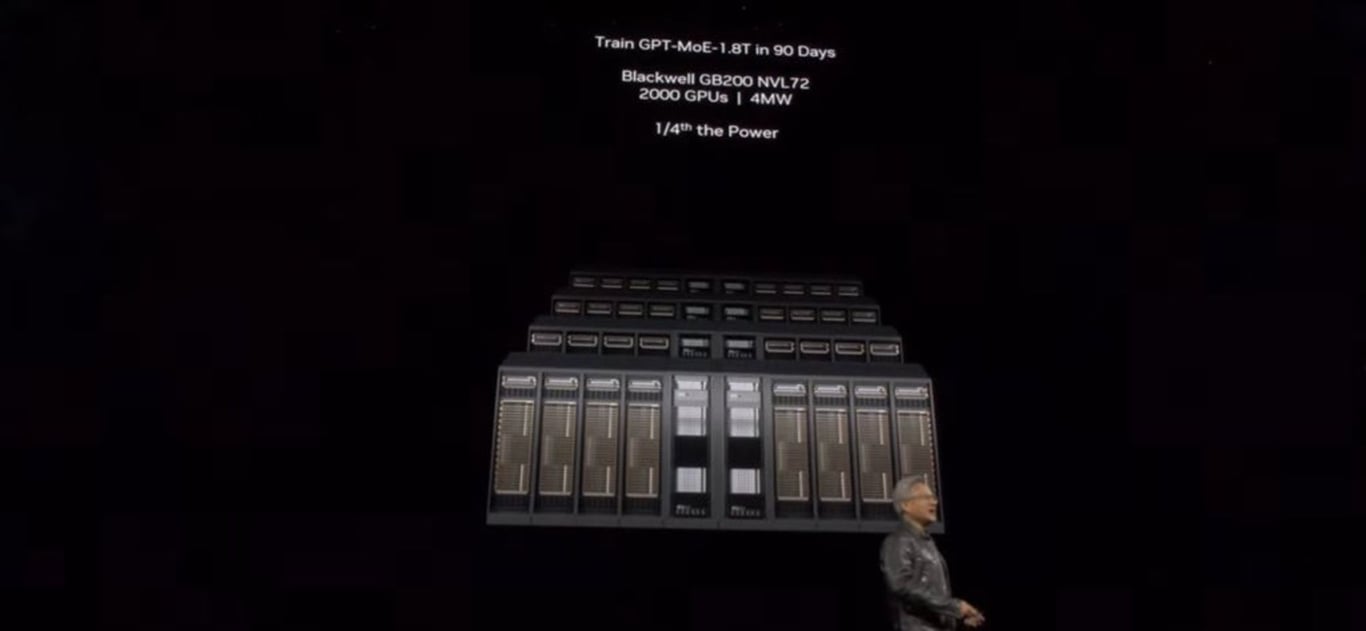

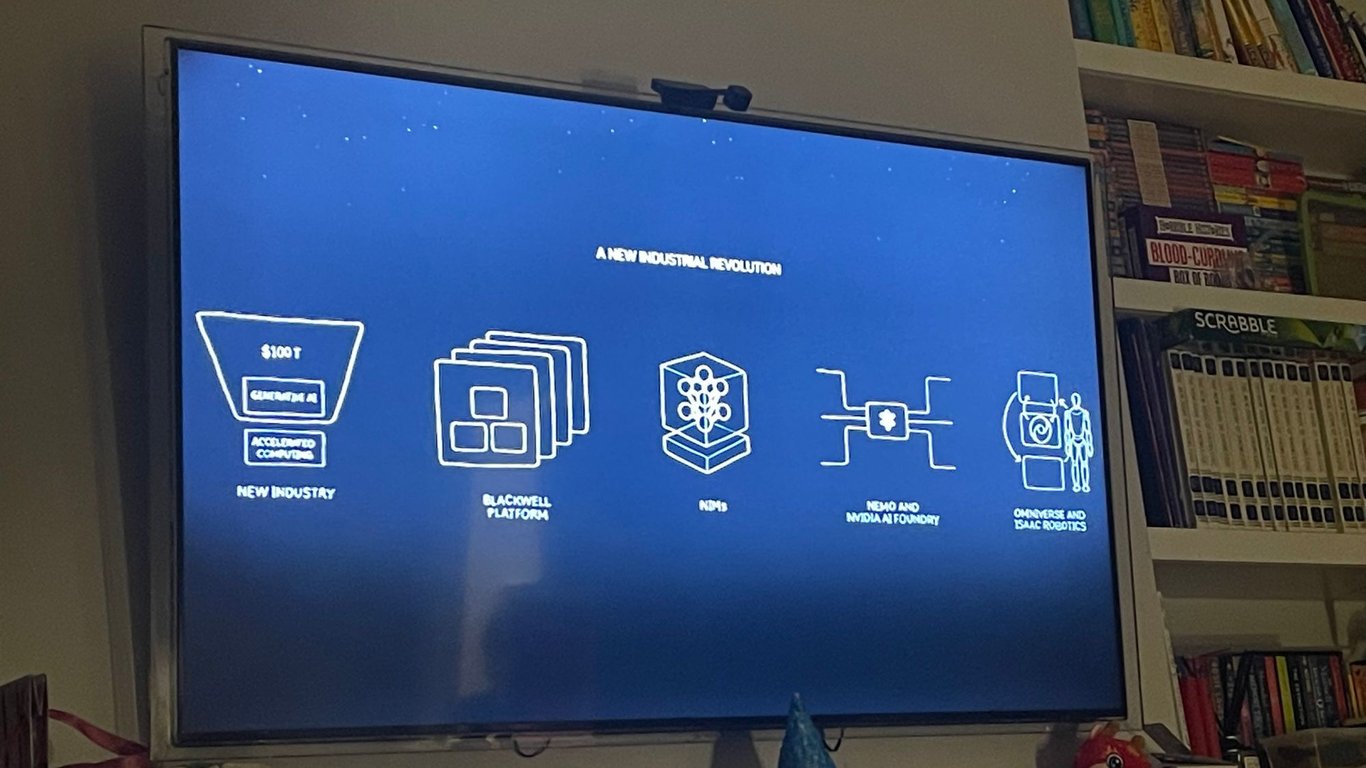

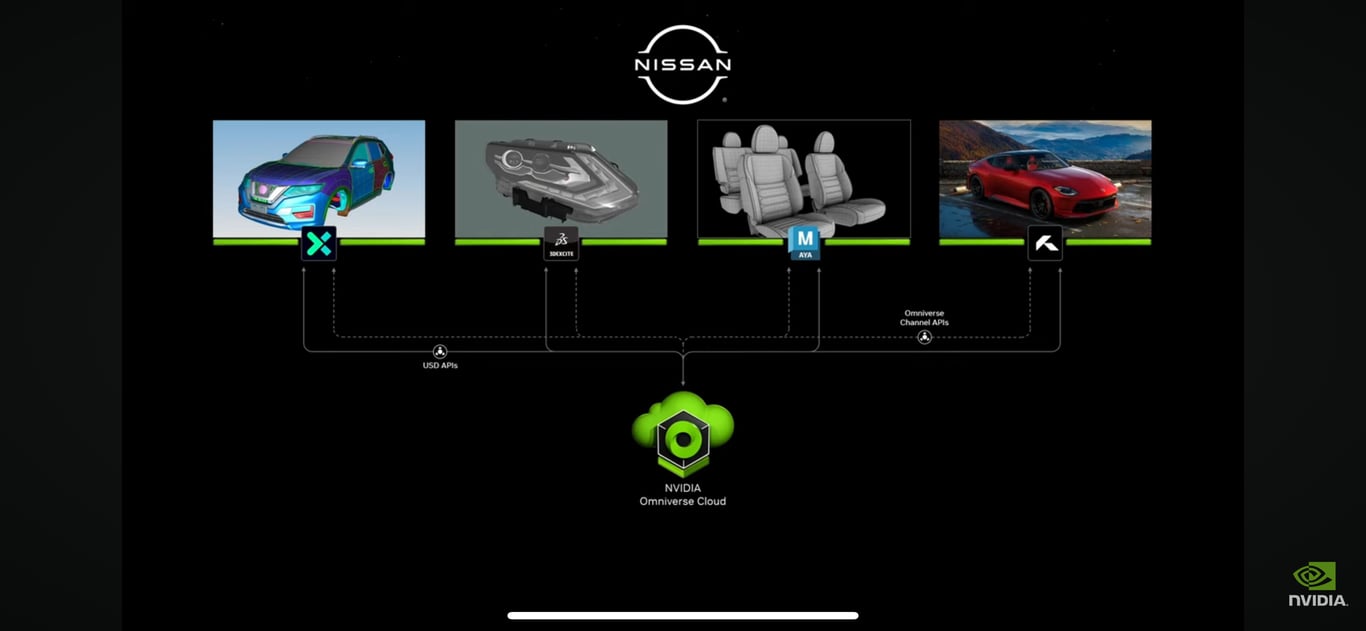

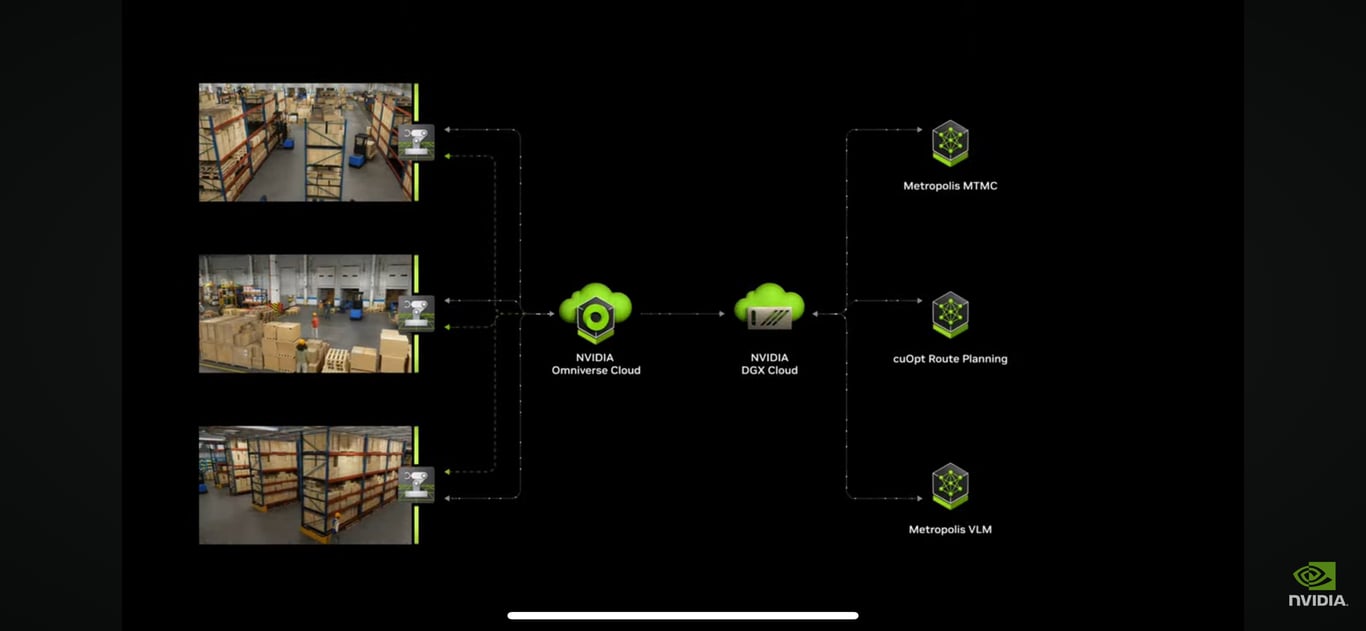

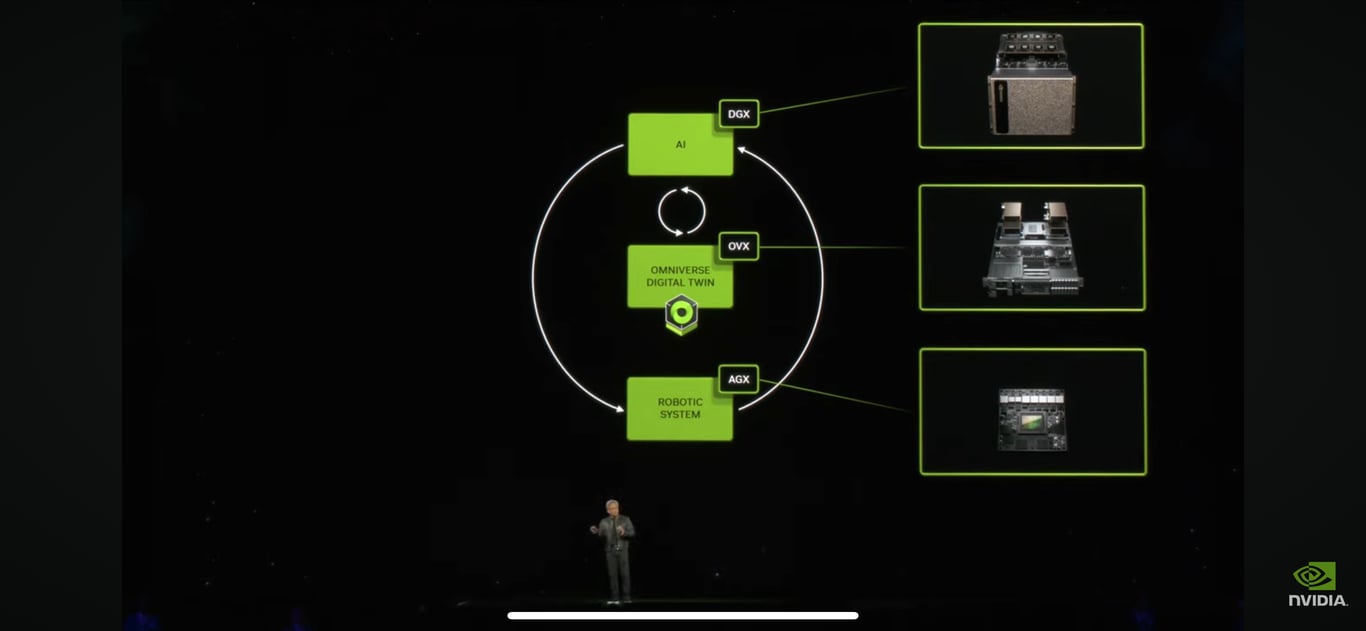

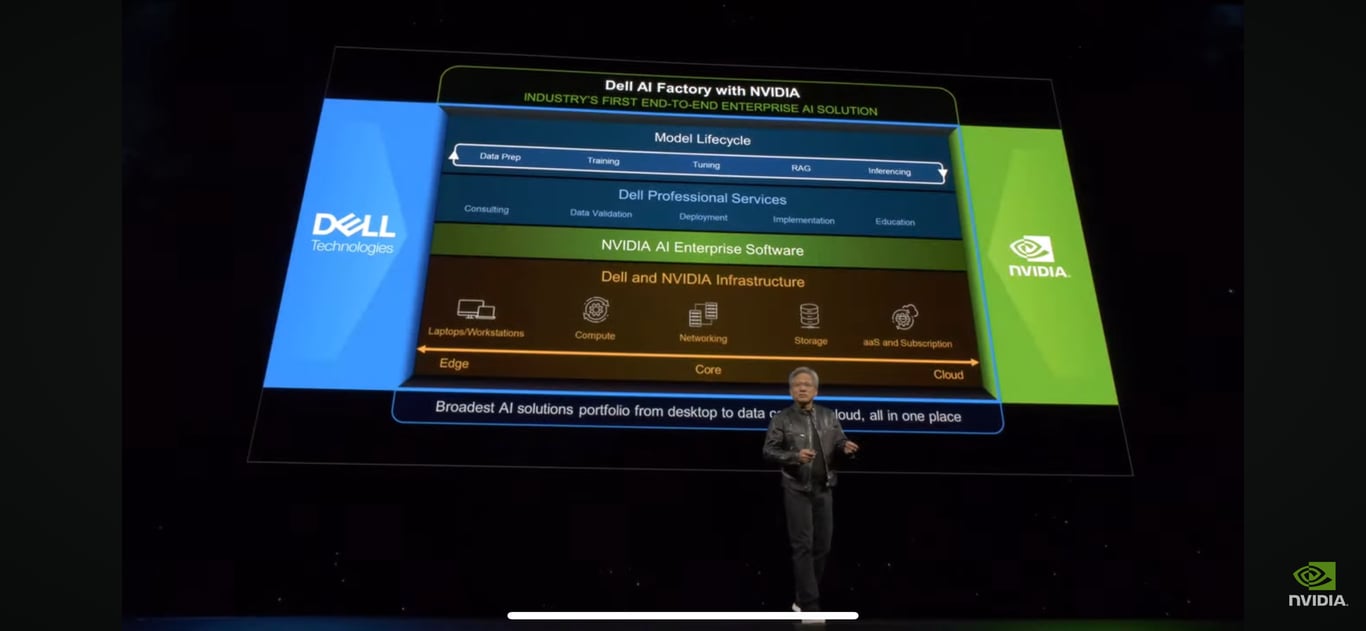

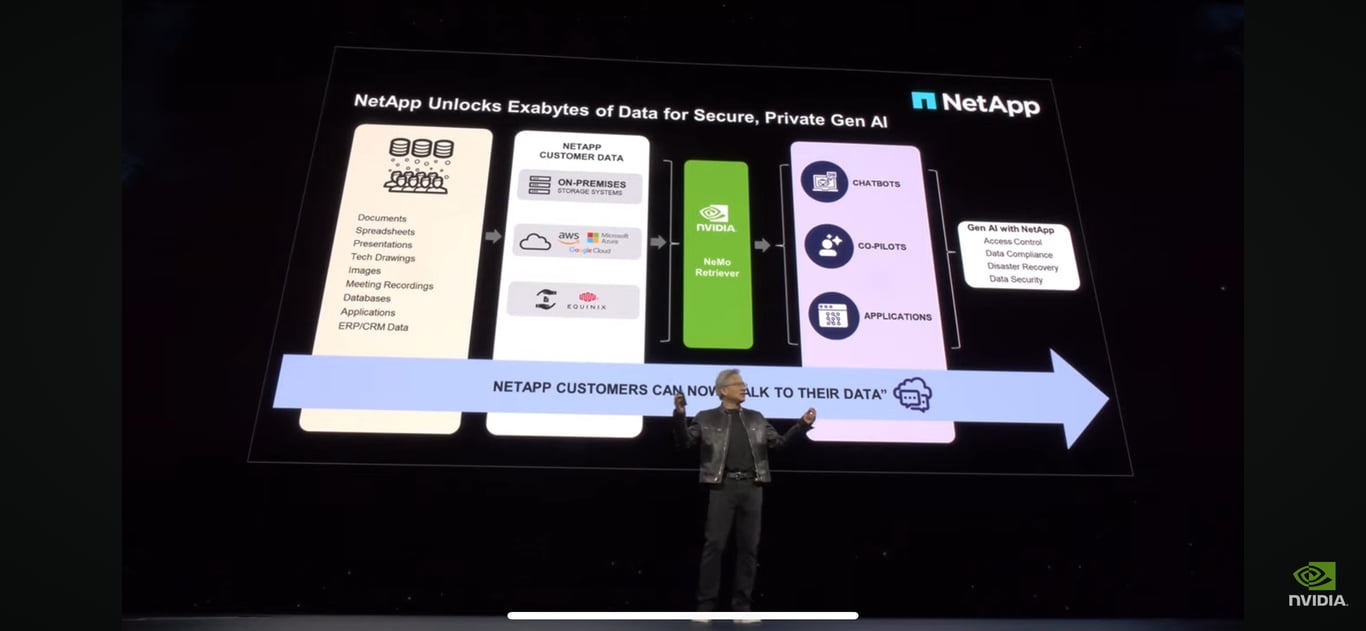

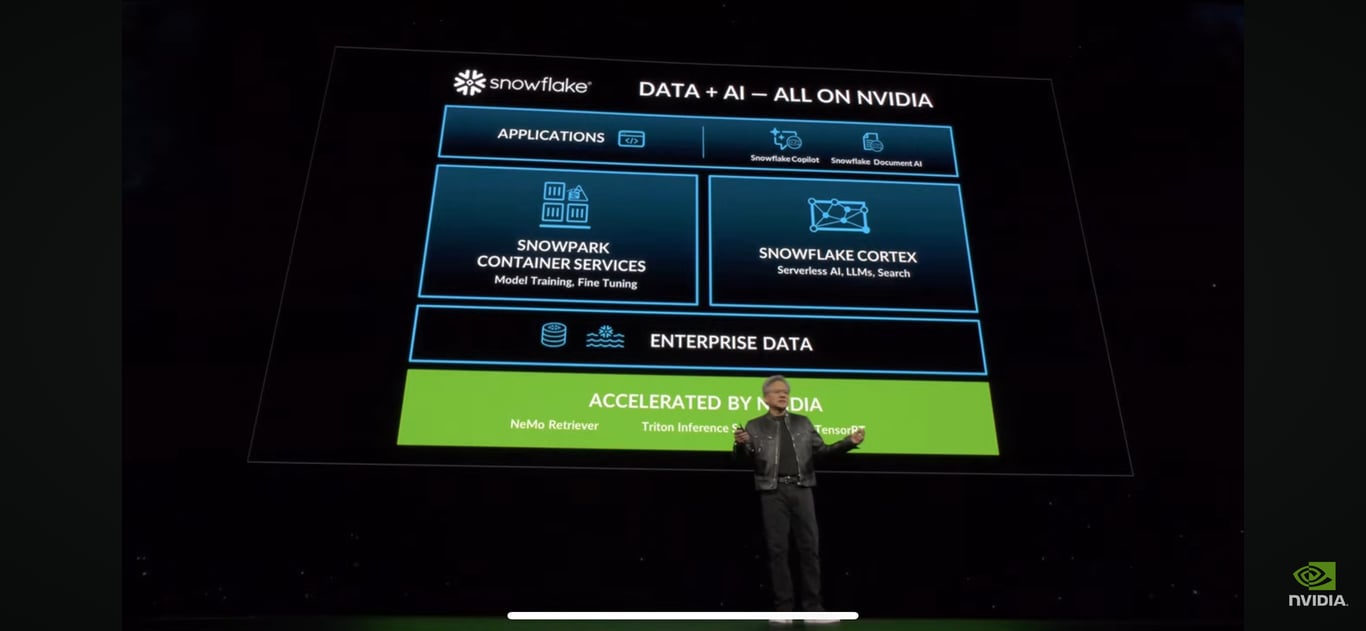

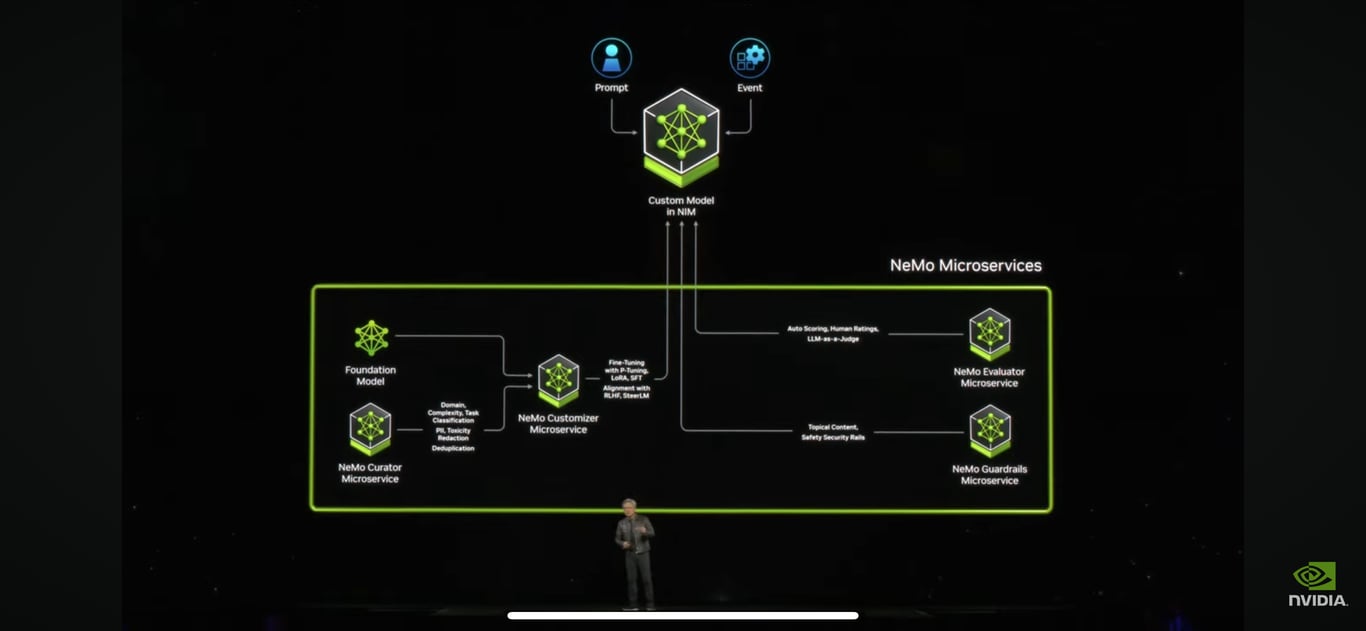

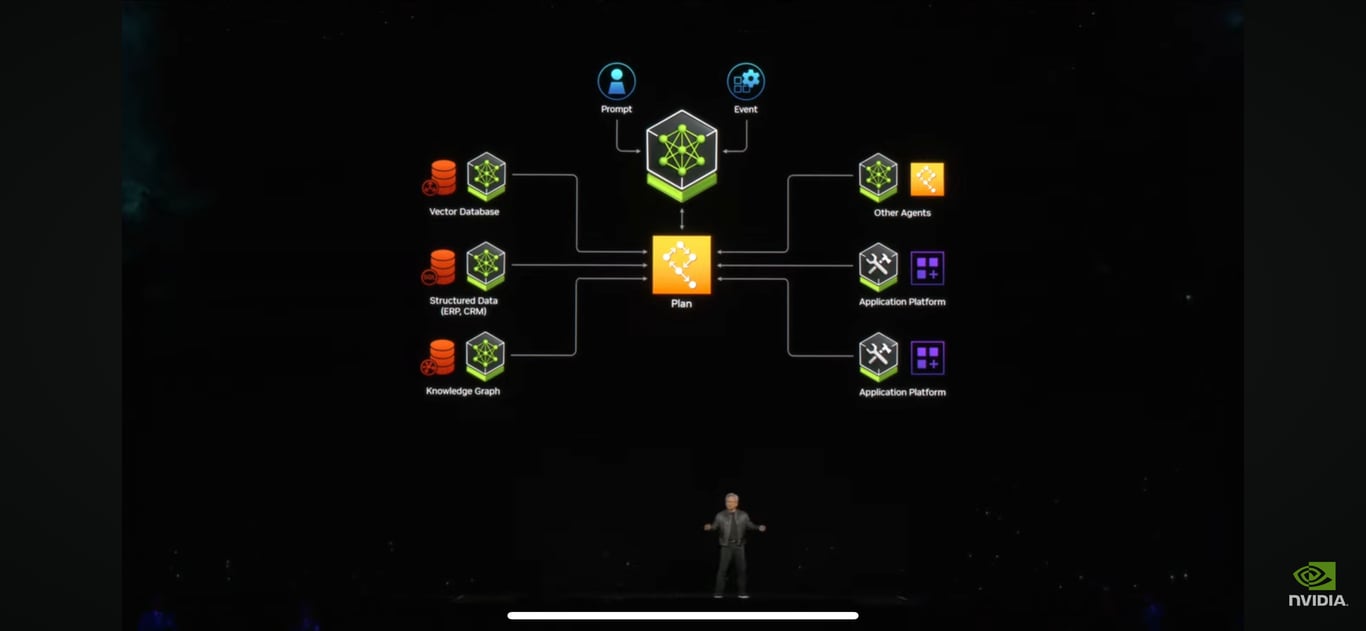

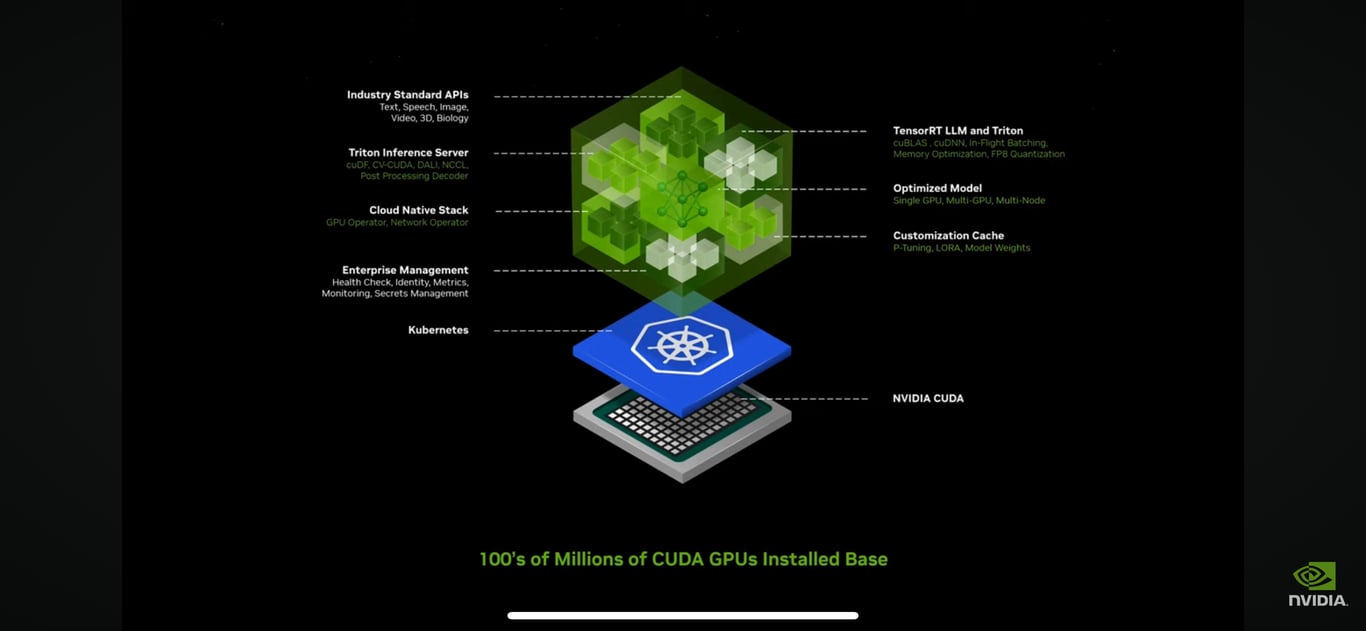

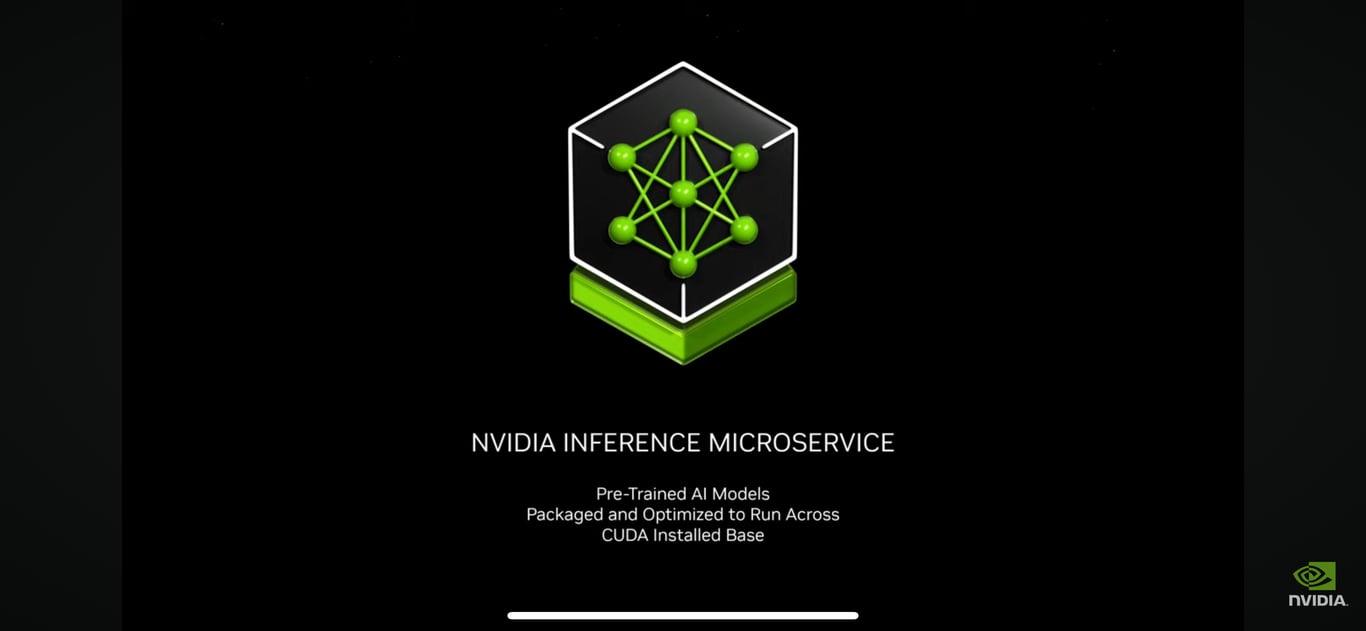

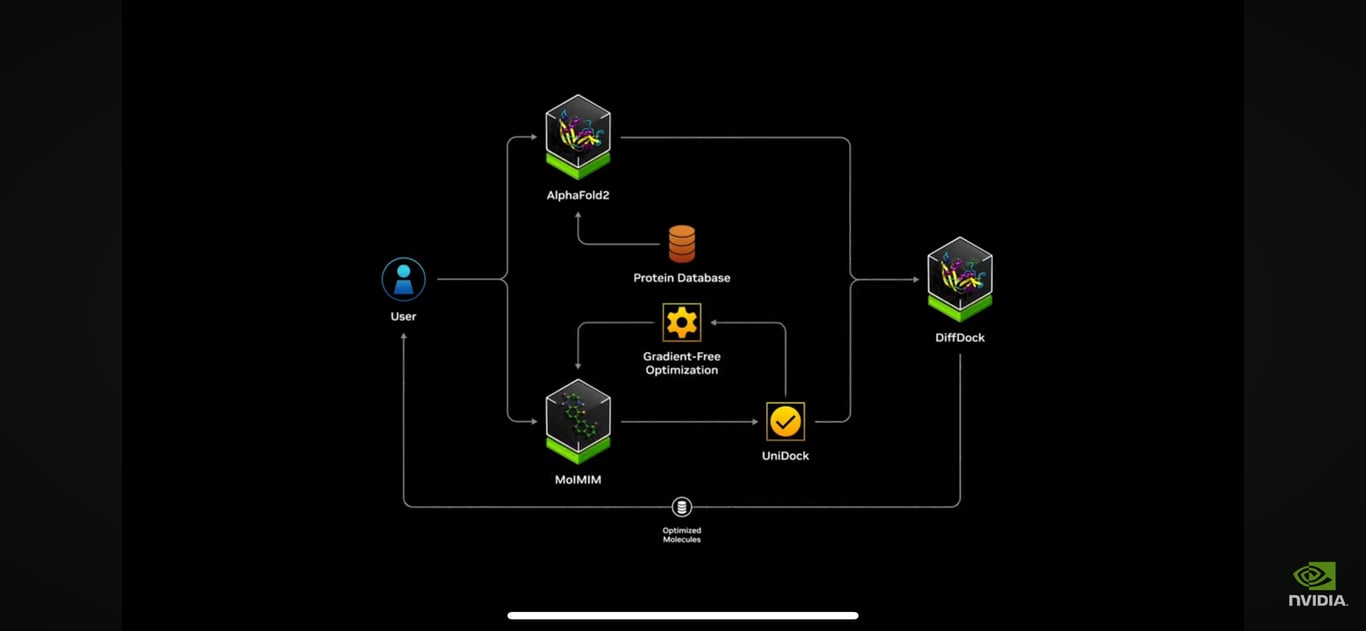

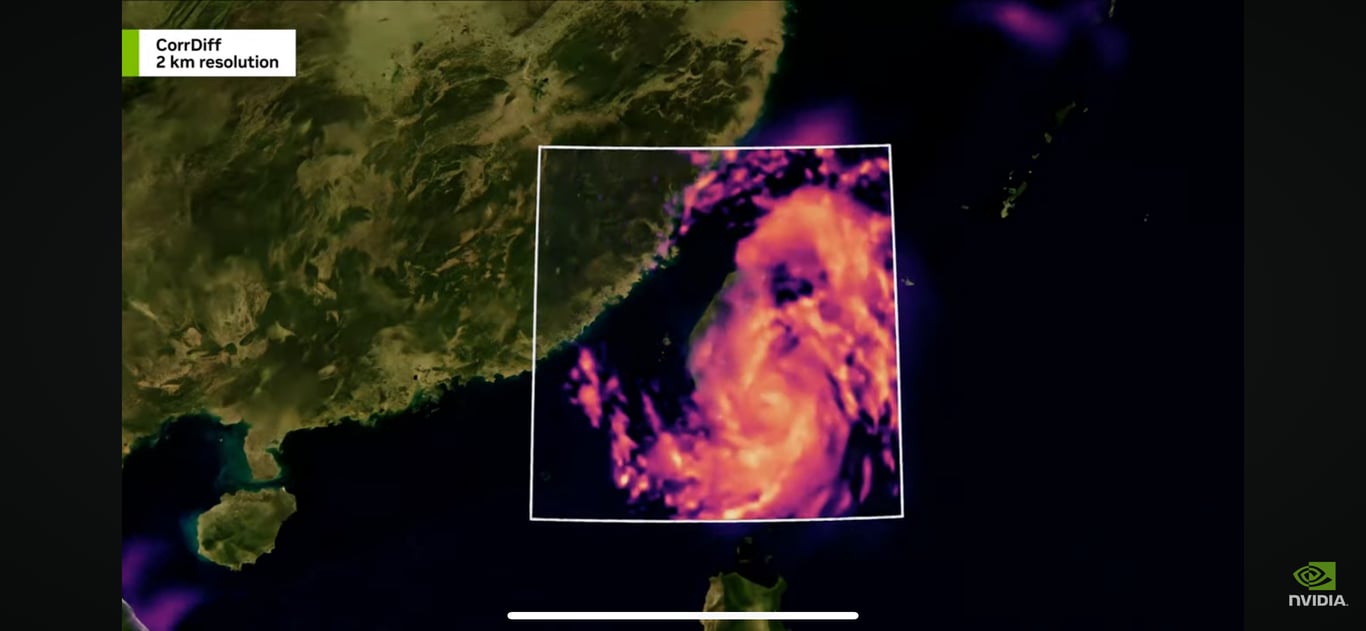

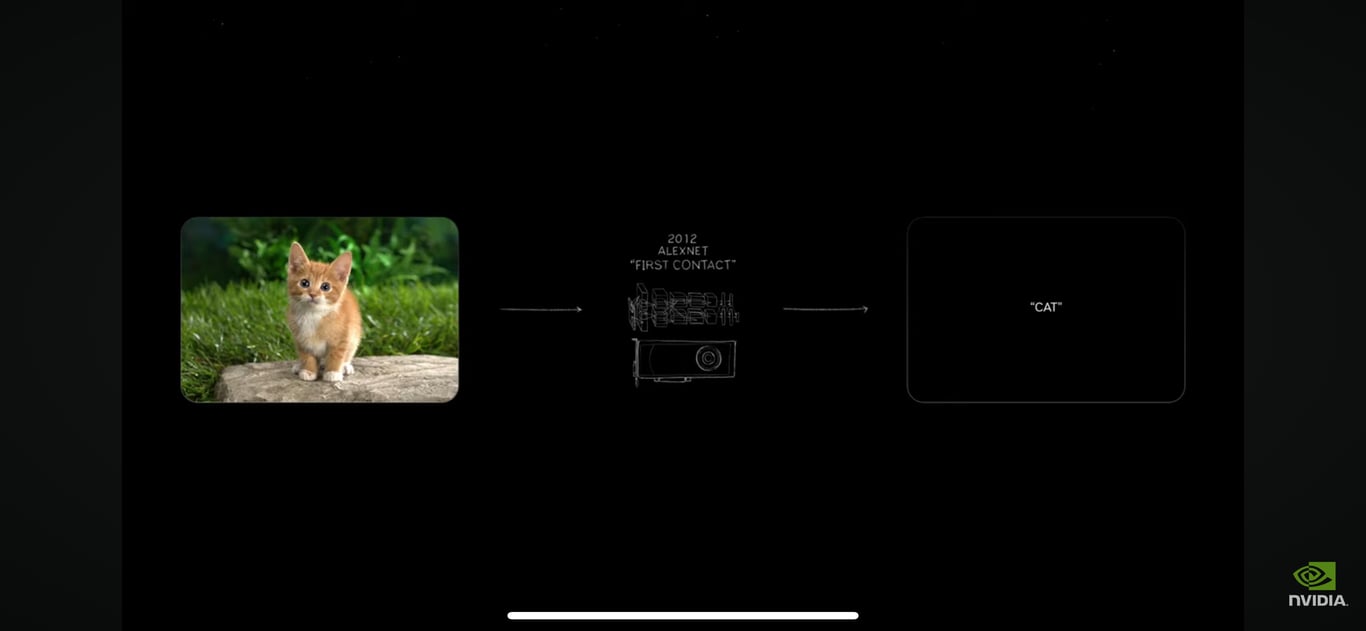

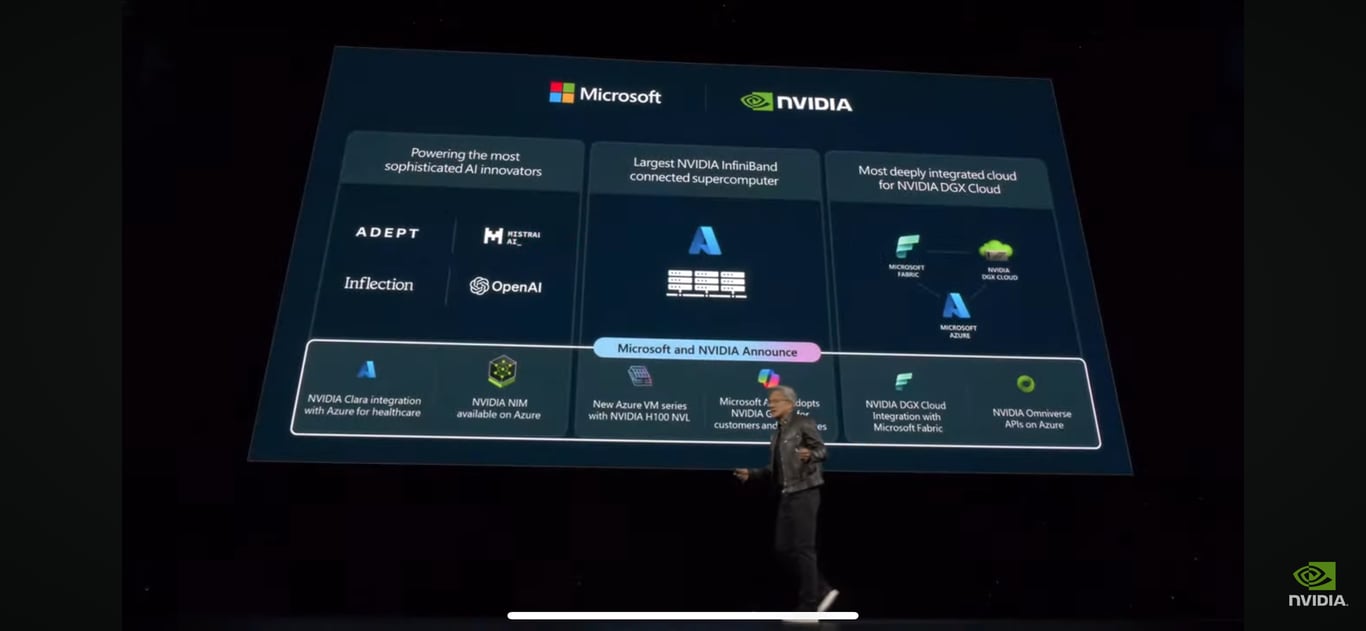

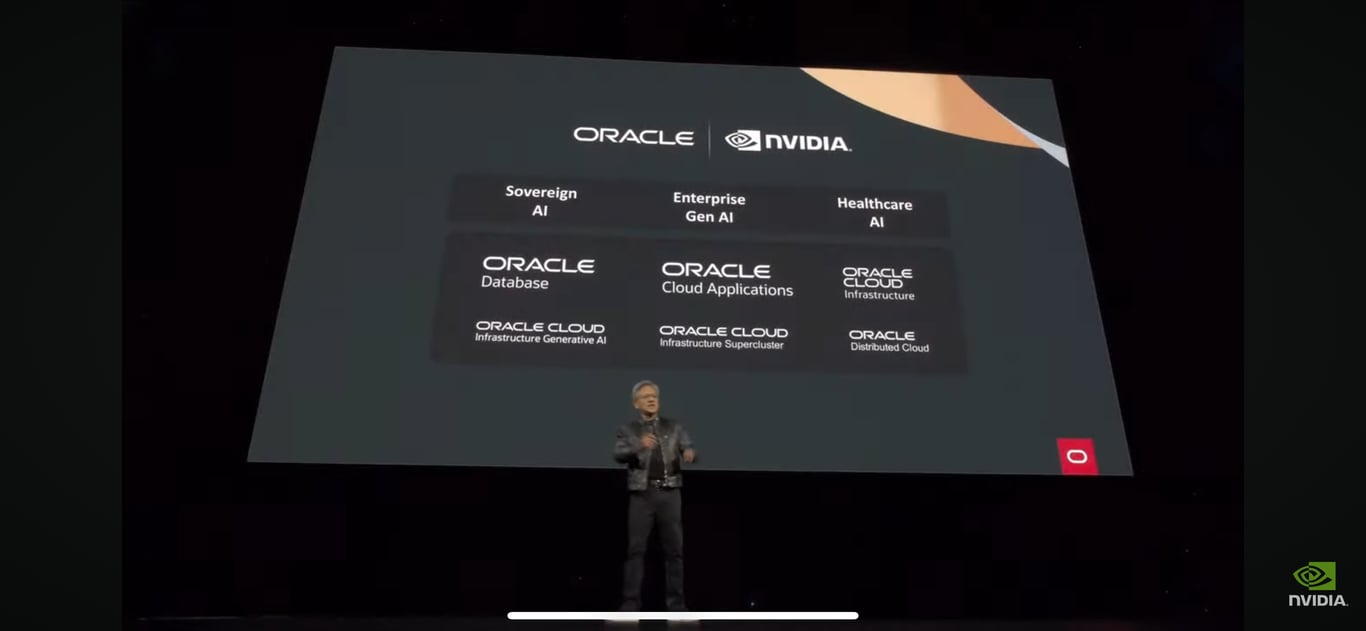

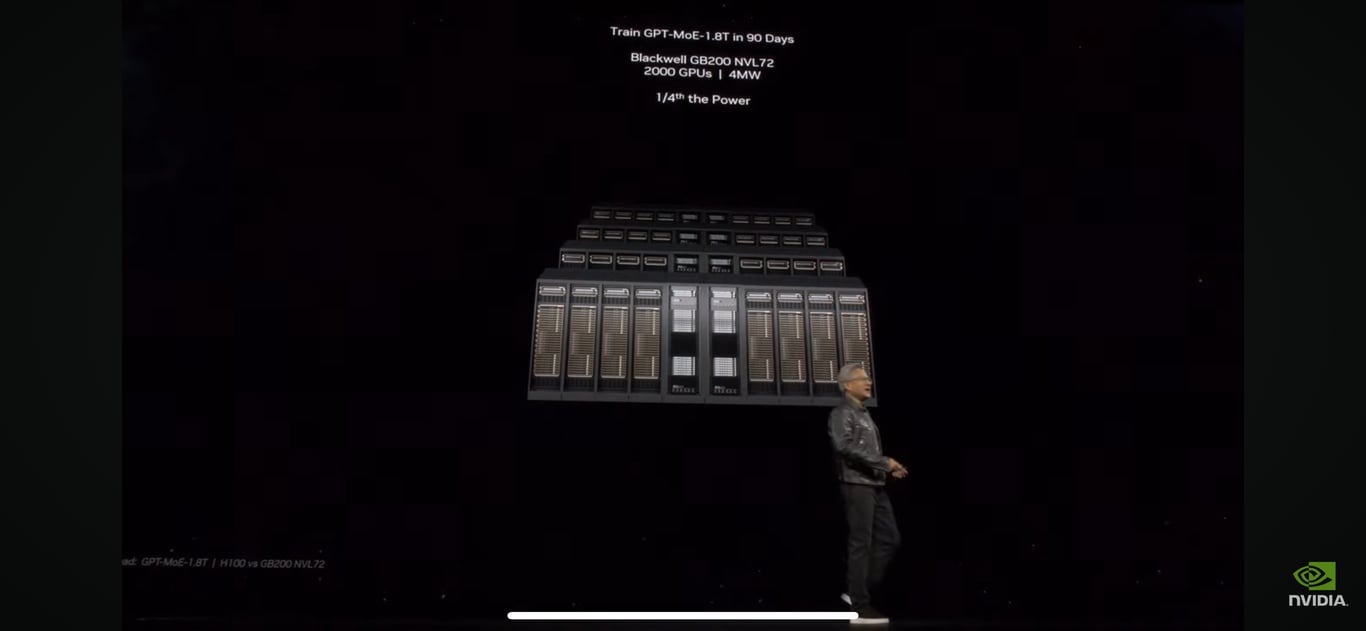

Mar 26, 2024 GTC 2025

🕶️ Chronological Update below 👇🏻

Earnings Update [Q3/2024]

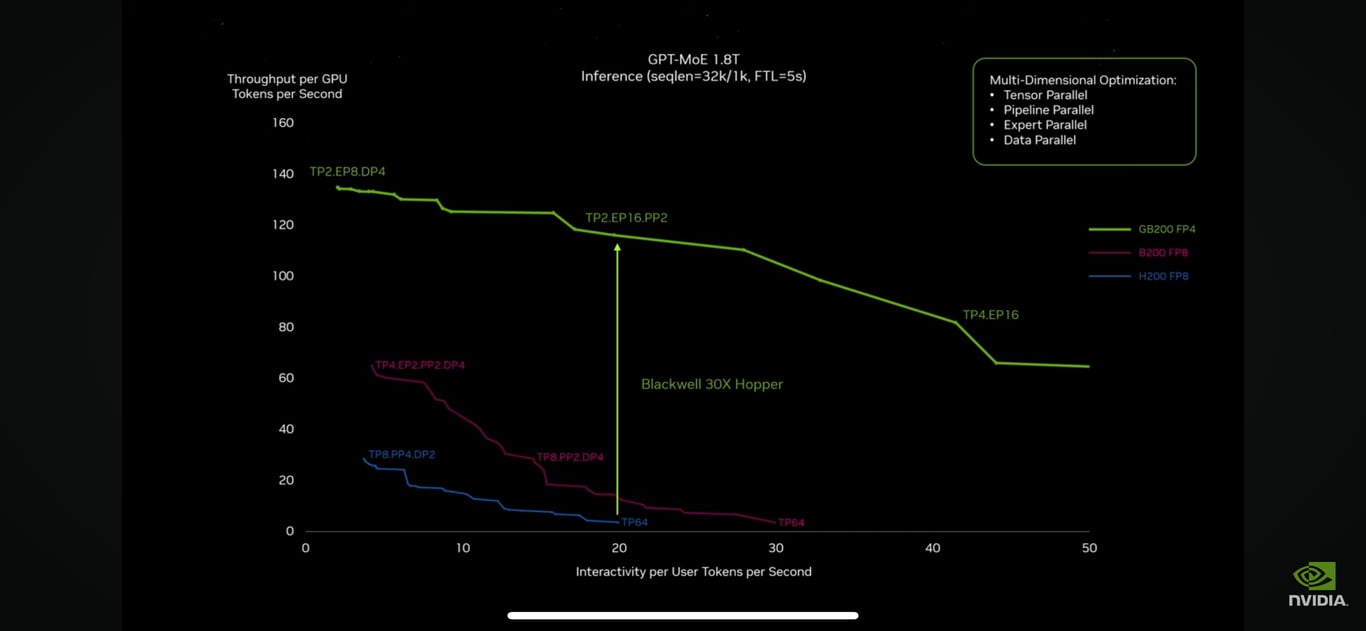

- Double beat again! Blackwell is running wild for 2025.

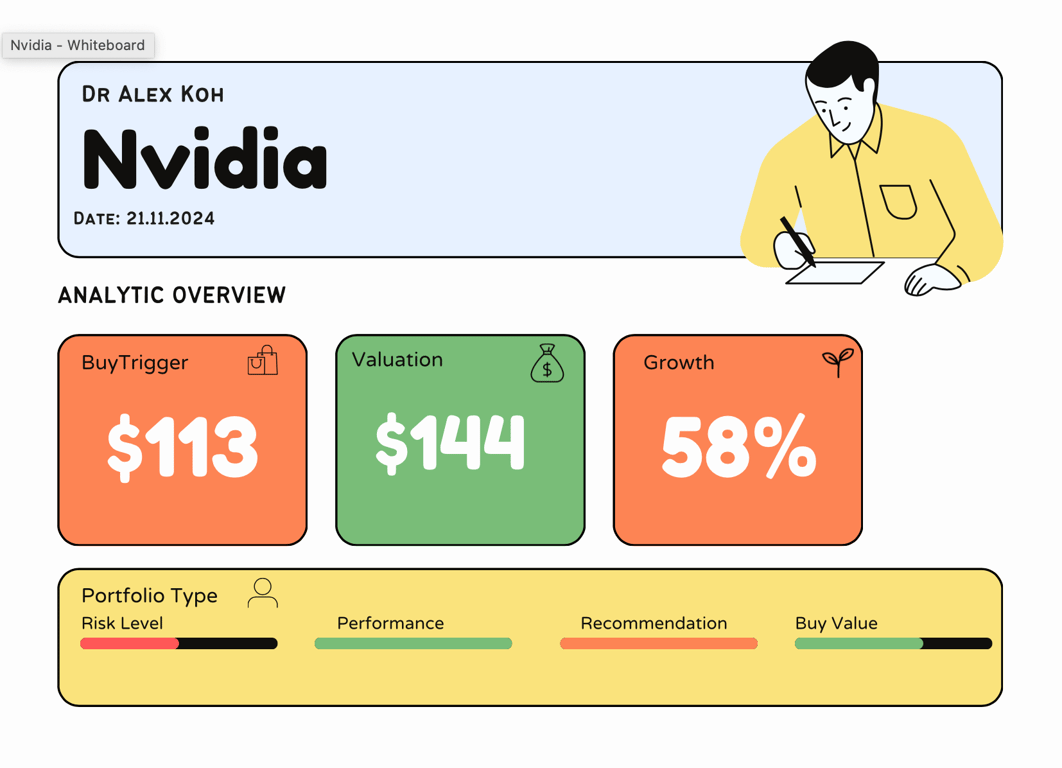

- BuyTrigger won't be adjusted to $134 until Q4 earnings.

- I've lowered both the BuyValue and Risk. With Blackwell shipping, the Risk will be cut in half.

- Recommendation and Performance maxed at 100% to maintain the A+ Rating.

Updates and Notes

News Sentiment

Other Updates

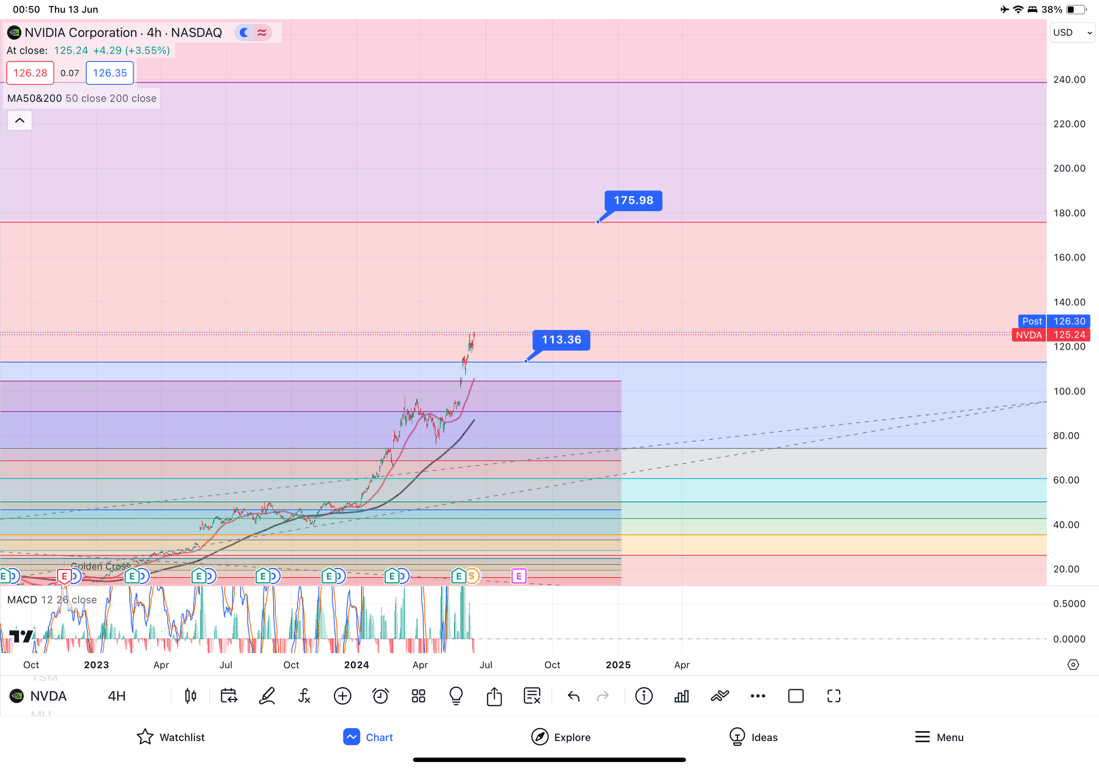

Technical Analysis Update [Aug 18, 2024 01:56 PMGMT+00:00]

- Earnings coming up. Bullish trend (not engulfing pushing upwards)

- Watch for immediate resistance at $140. 3 attempts in less that 4 months is too high frequency. However the expectations may exceed too.

- Stick to strict buytrigger!

- Still undervalued - but this is only valid if they stick to the growth% criteria for next 5 years.

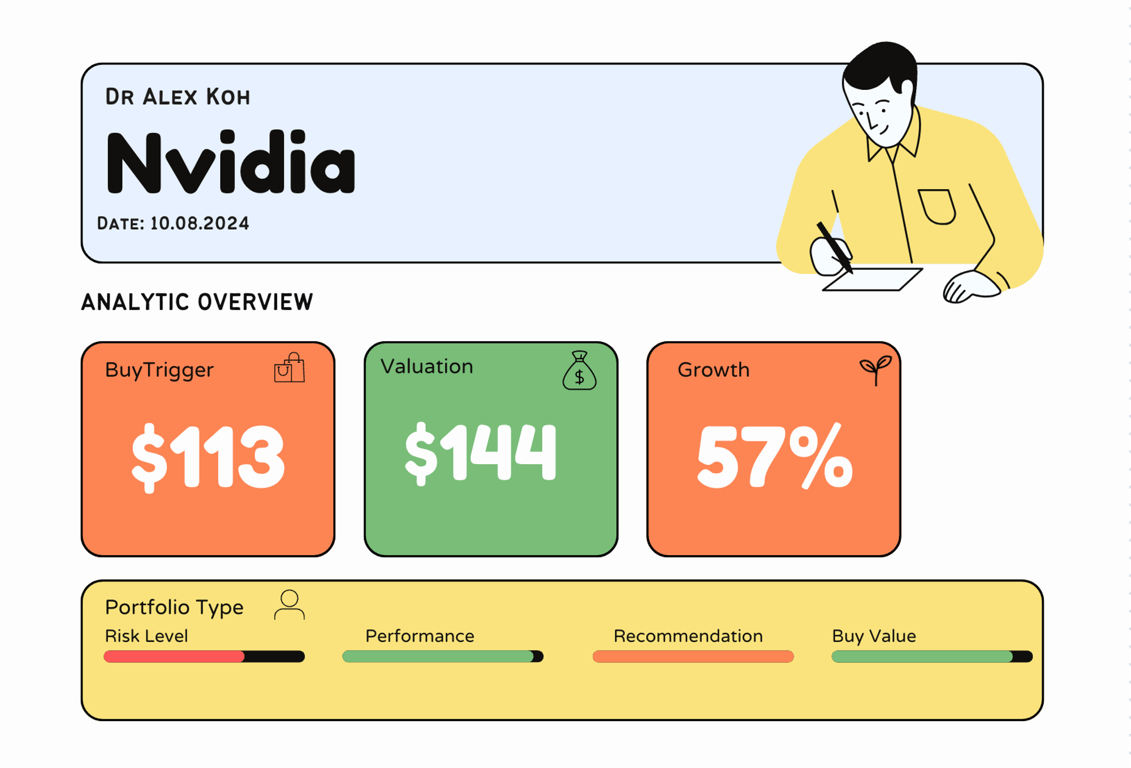

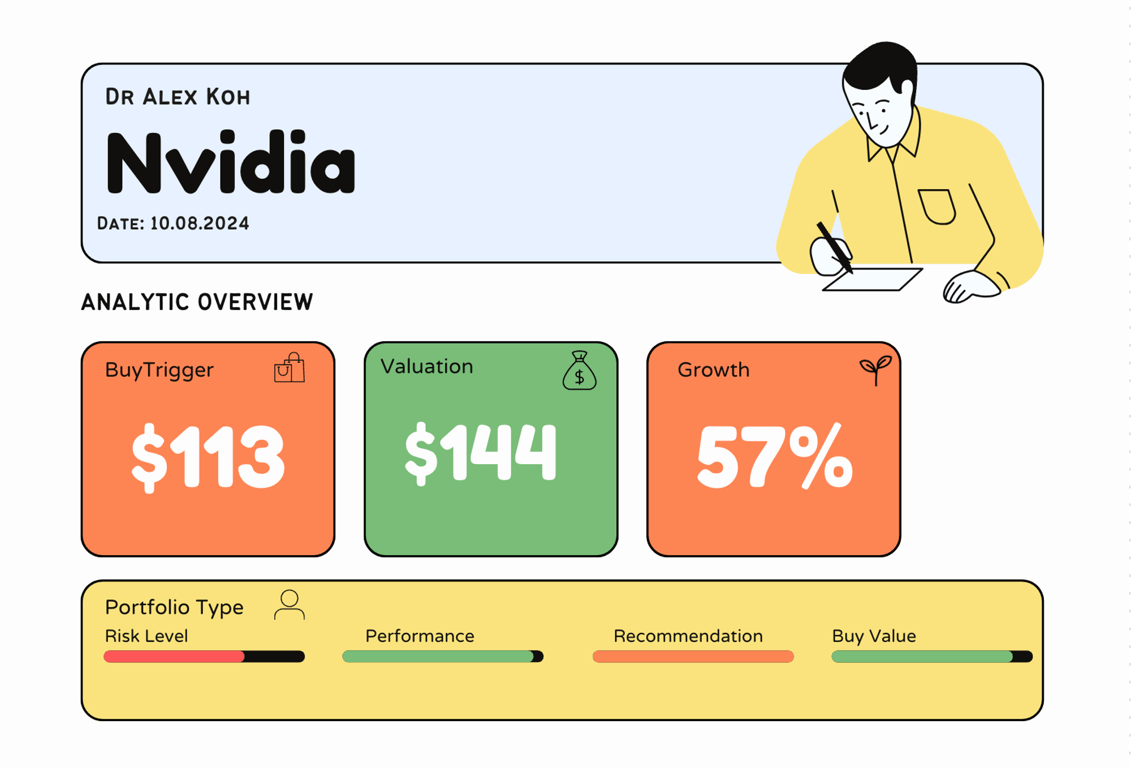

Price Valuation Update[Aug 10, 2024 11:58 PMGMT+00:00]

Reason for Update

- Updated the formula to anticipate the rate drop in september

- This dropped the valuation from 174 to 144 and decrease in growth from 65 to 57%

- This took into account 2028 forecast now.

BT#1 - remains the same

Technical Analysis Update [Jun 13, 2024 12:50 AMGMT+00:00]

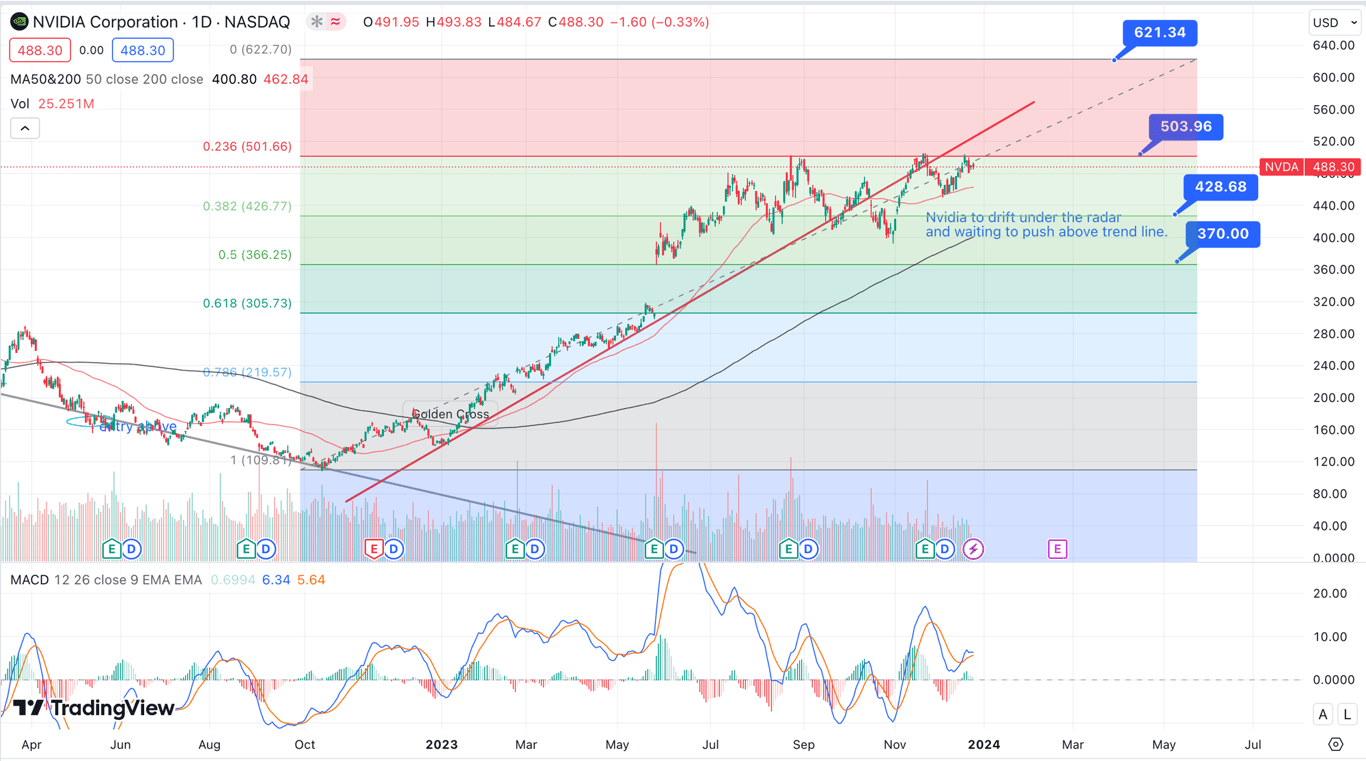

- Added a new Fib layer and the new fib level ties in with the new valuation - preety scary!

- BuyTrigger adjusted to $113

Technical Analysis Update [May 20, 2024 08:35 AMGMT+00:00]

Technical Analysis Update [Mar 26, 2024 08:34 PMGMT+00:00]

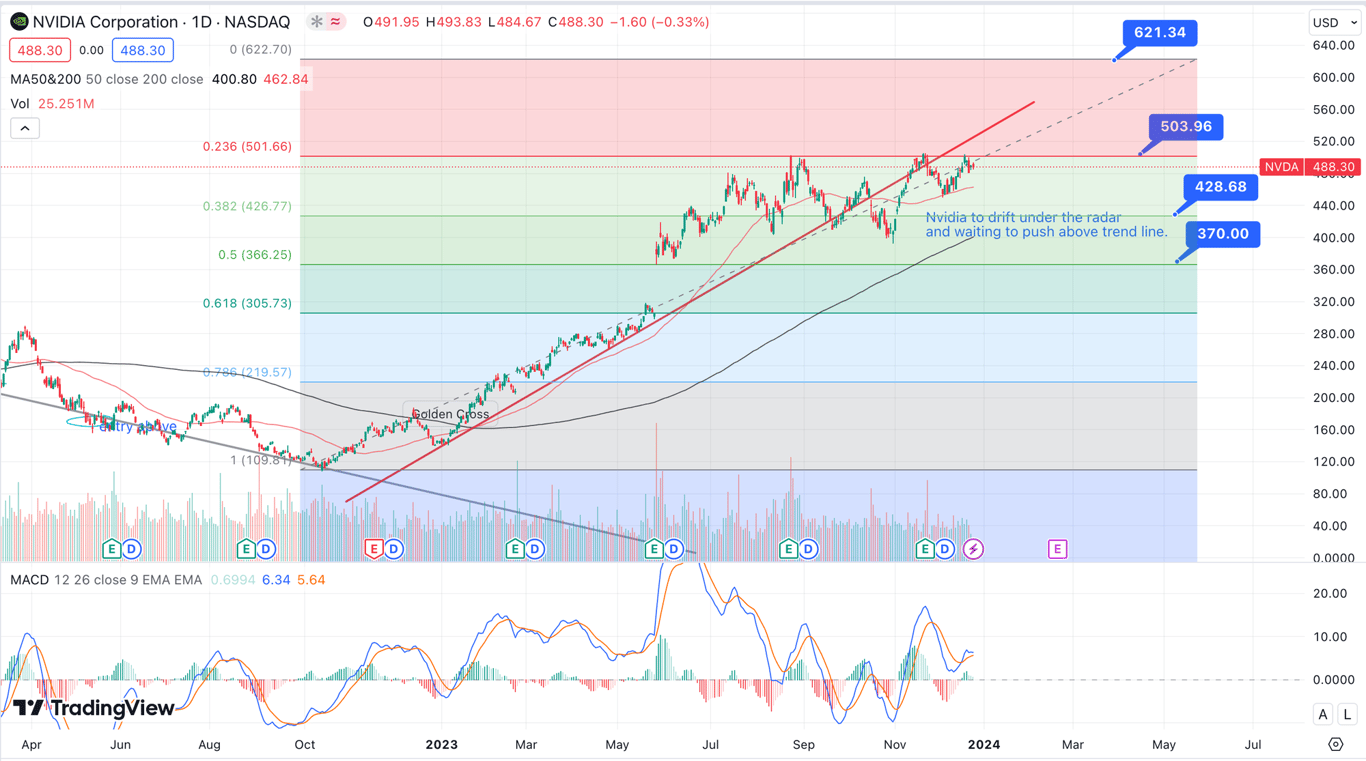

Major Update Analysis Nvidia is a Recommended Buy (25th December 1700hrs)

My new Blog Post can be found here ( https://family.investments/nvidia_2024_outlook/ )

Updates and Notes

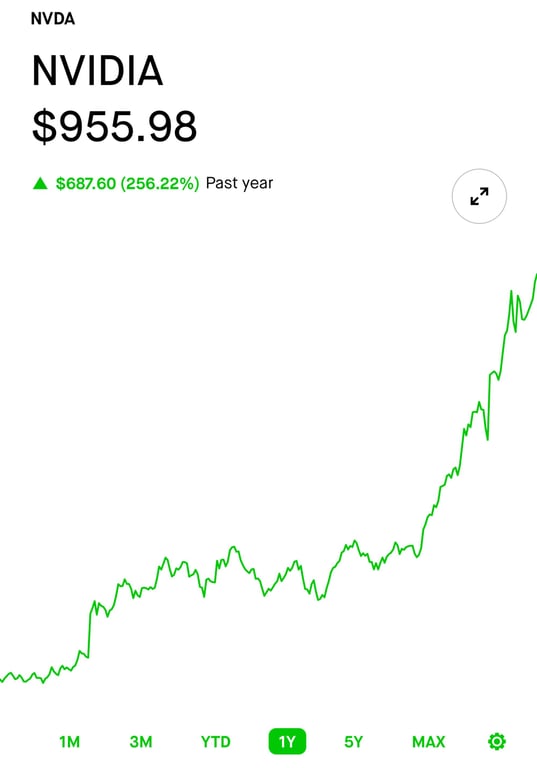

Nvidia might be a huge buy before the Q4 2023 earnings release as this will break it above $500 and beyond $621.34. This will be. along term hold because the 2026 forecast is scarily high for those not buying now. I will start accumulating for my kids and also my retirement account as these are long term.

The biggest risk drop for Nvidia is to $370 levels. The only reason for drops are due to global economic concerns and prehaps global trade tension. In terms of leadership in sustainable Gen AI, LLM and Machine learning, Nvidia will be the one true leader ahead of everyone else.

The AI narrative is too fresh and new for many to catch up. The current valuation proves sustainable and the technical charts shows disbelief in the market to sustain an upward trend.

The Risk level would be -30% downside and +20% upside.

My strategy would be, 10% entry and then buying the dip levels. Major buys on the $426 and below.

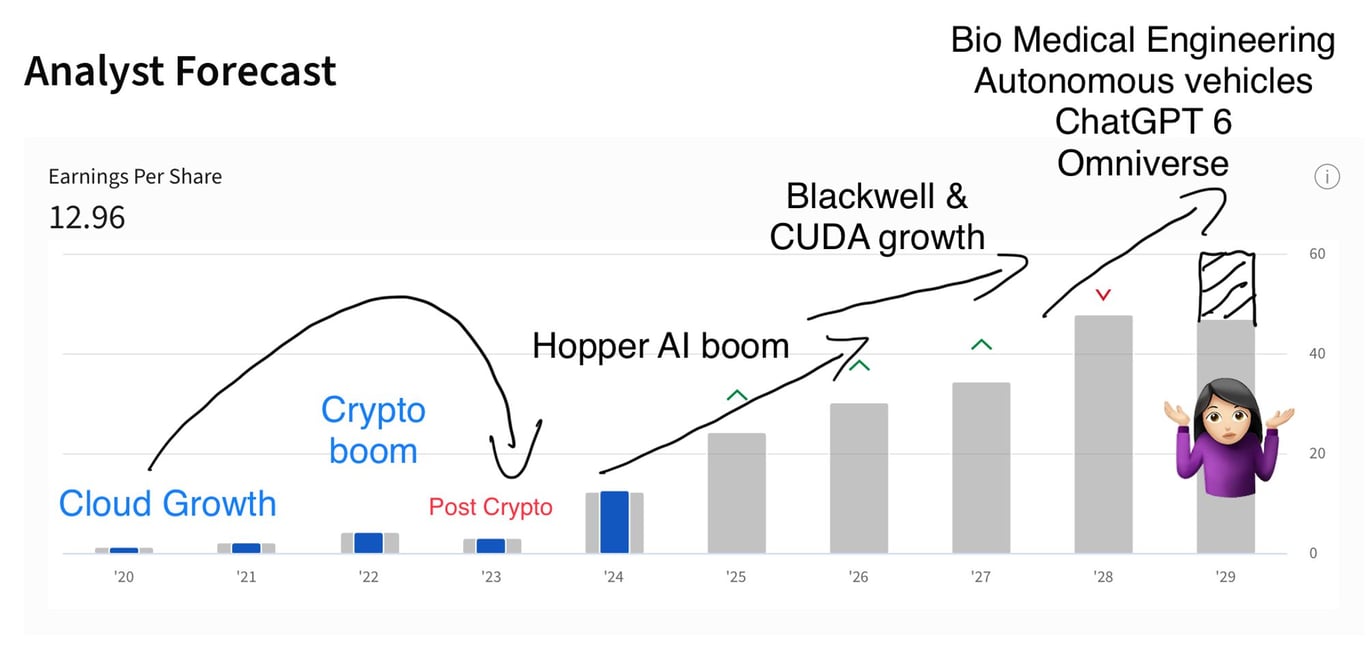

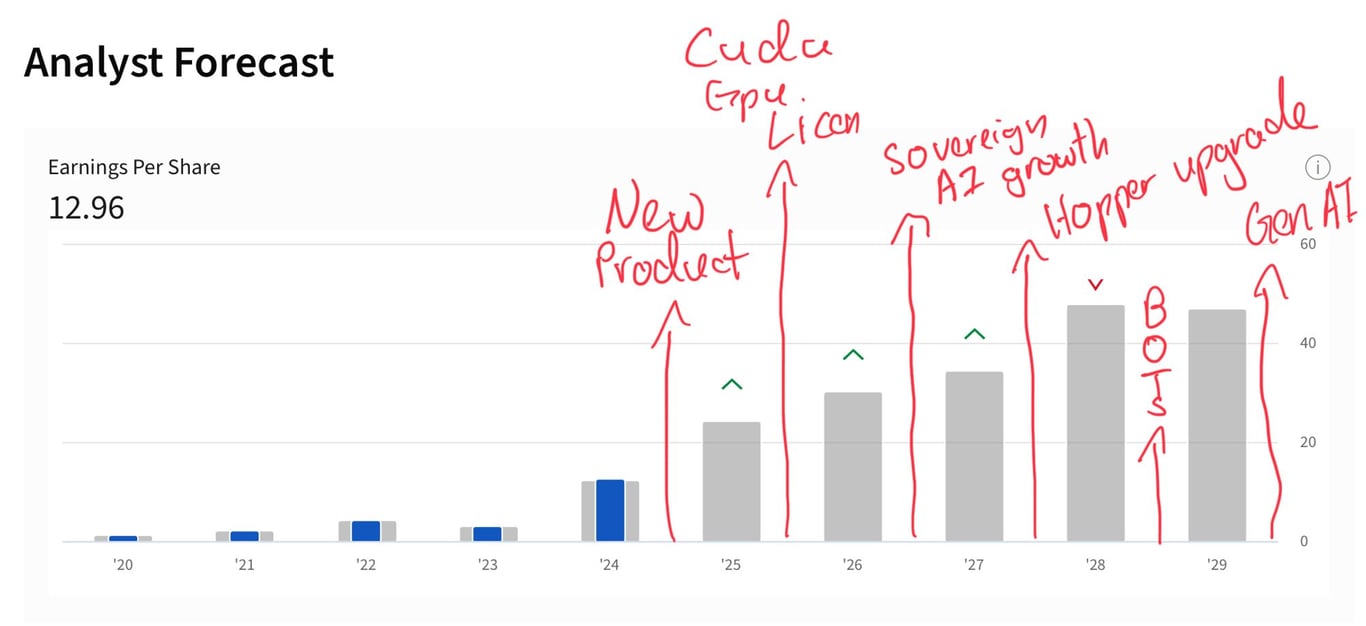

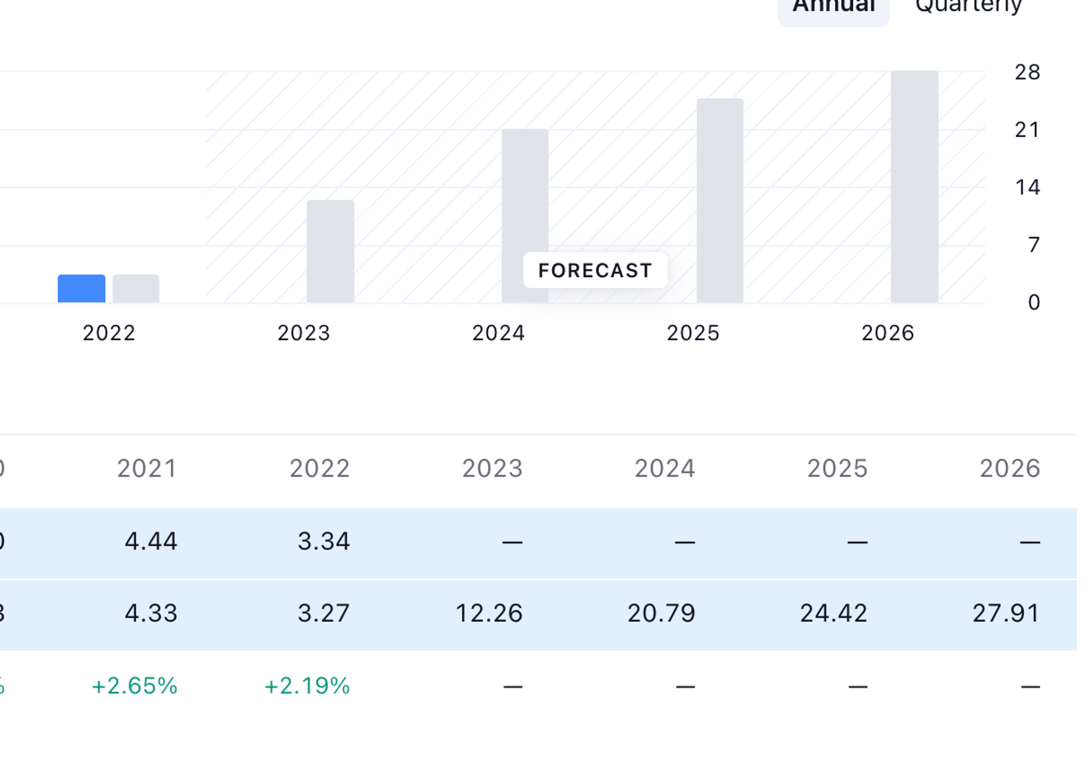

Price Valuation Update[Dec 25, 2023 04:45 PMGMT+00:00] (25th December 1645hrs)

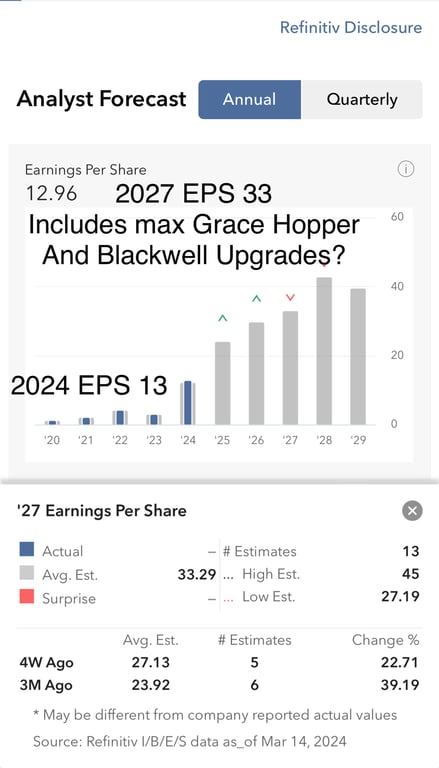

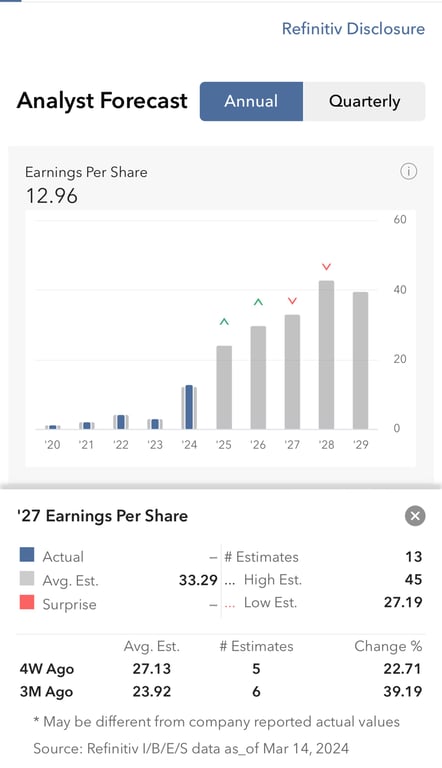

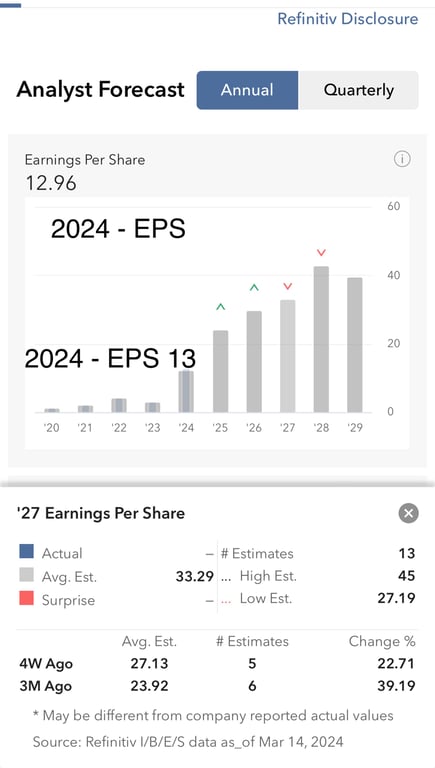

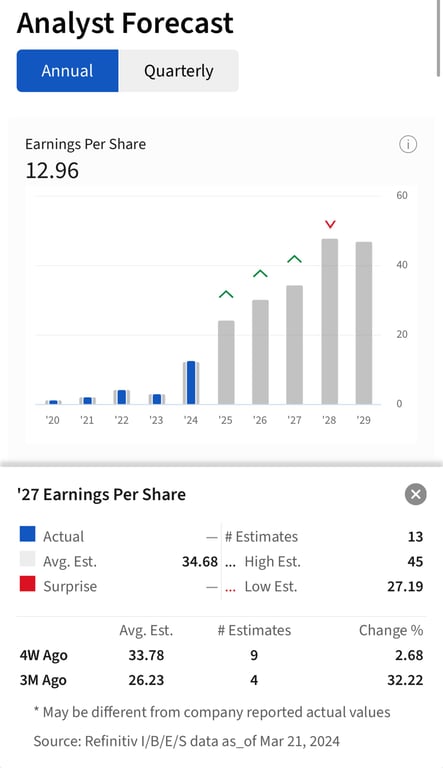

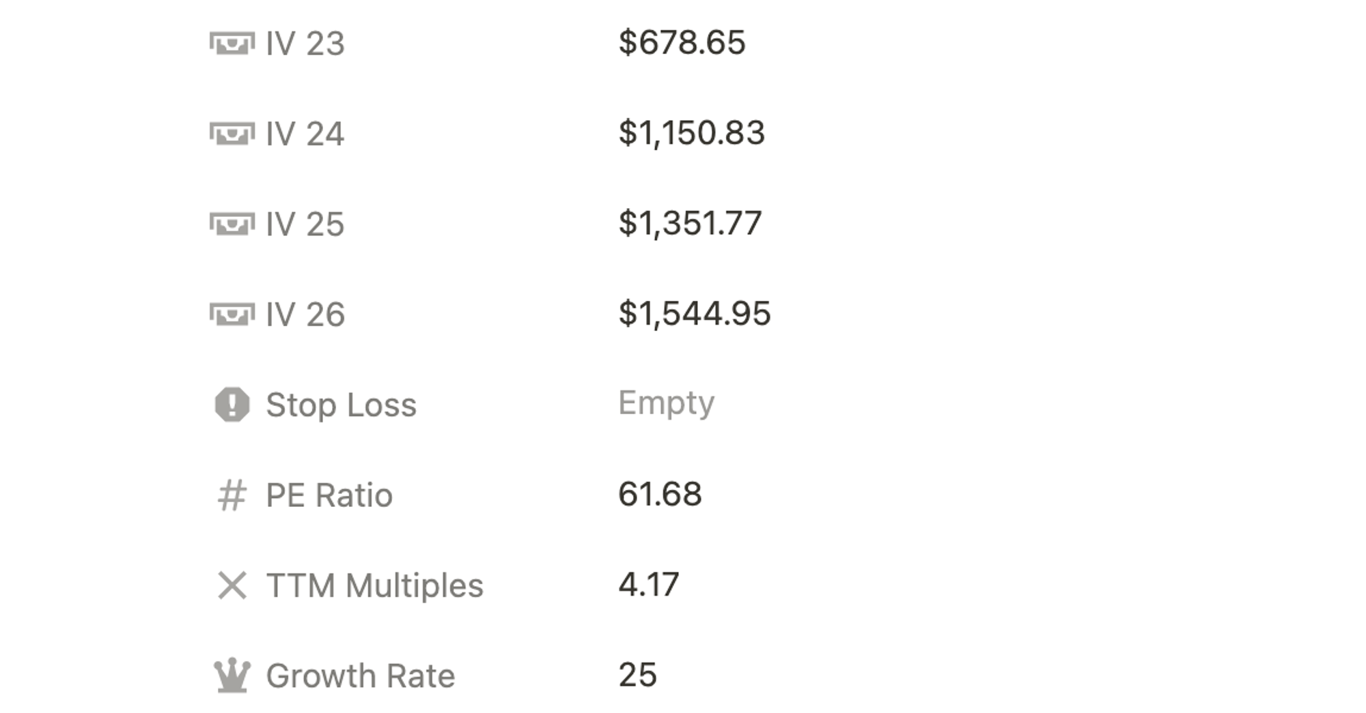

- Above EPS forecast is from Trading View

- Latest PE Ratio: Nvidia's PE ratio as of December 21, 2023, is 61.68.

- Growth Forecast: Nvidia is forecasted to grow earnings and revenue by 28.9% and 27.4% per annum, respectively. The EPS is expected to grow by 29.3% per annum.

- Current TTM EPS for 2023: The TTM EPS for Nvidia in 2023 is $4.17.

This information forms a comprehensive picture of Nvidia's financial outlook, including its growth potential and EPS projections for the coming years.

Reason for Update

- Hoping for an Entry point for Nvidia

Valuation

Some crazy numbers based on the super high EPS forecast. Can Nvidia sustain the phenomenal boom? Looks like even the current 2023 makes it look undervalued! Despite the PE at 64, once the Q4 earnings are out this shall leave the company PE 40.

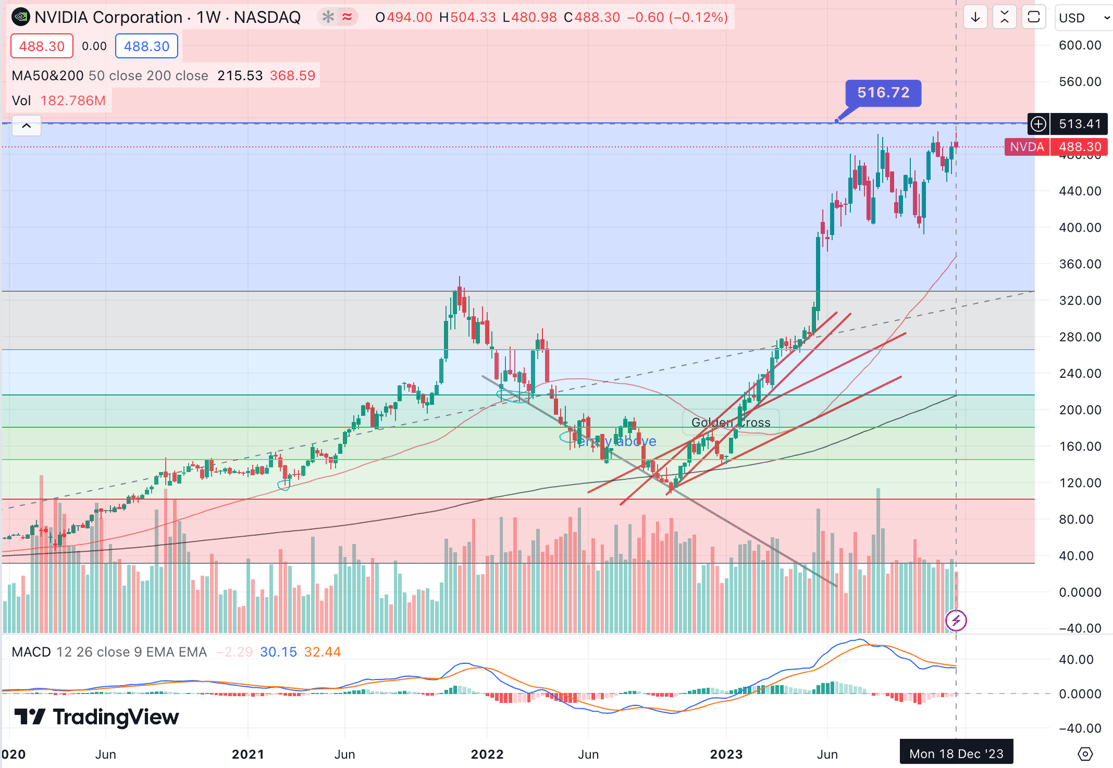

Technical Analysis Update [Dec 25, 2023 04:06 PMGMT+00:00] (25th December 1606hrs)

- Xmas Day Nvidia outlook. Huge jump from $320 support and sustaining near $500 support for last seven months. The Q2 and Q3 2023 earnings have define the justice of growth of Nvidia from its full 2023 forecasted sales of their H100 servers chips.

- The last time I applied the Fib Retracement was back in 2022 and now I have updated the trend as the 12 months bullish market have broke all trends. So the graphs above shows the changes and update and this imapacts all new support and But/Sell Trigger levels.

- BT#1 $428

- BT#2 $370

- ST#1 $621

- If Nvidia were to drop lower it would be the oversold trend line if they cannot sustained $500 support over next 2Q.

- This is purely TA view and I have yet to see how this will correlate with the Fundamental and Trend analysis. Lets watch the valuation to determine if the forecast earnings are in line with the TA support level.