Palantir Technologies Inc. (PLTR) Stock Comprehensive Review as of August 2024 🟢

Current Price: $31.49

Industry: Software, AI & Data Analytics

Stock Type: Growth

Rating: B+

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Palantir reported $678.13 million in revenue for Q2 2024, marking a strong 27% YoY increase. This was driven by robust demand for its AI platform, particularly in the U.S. commercial sector, which saw a 55% increase in sales.

- Net Income: The company posted a net income of $134 million, translating to an EPS of $0.03, slightly below analyst expectations of $0.04 per share.

- Free Cash Flow: Palantir continues to generate solid cash flow, with free cash flow margins improving as the company scales its operations.

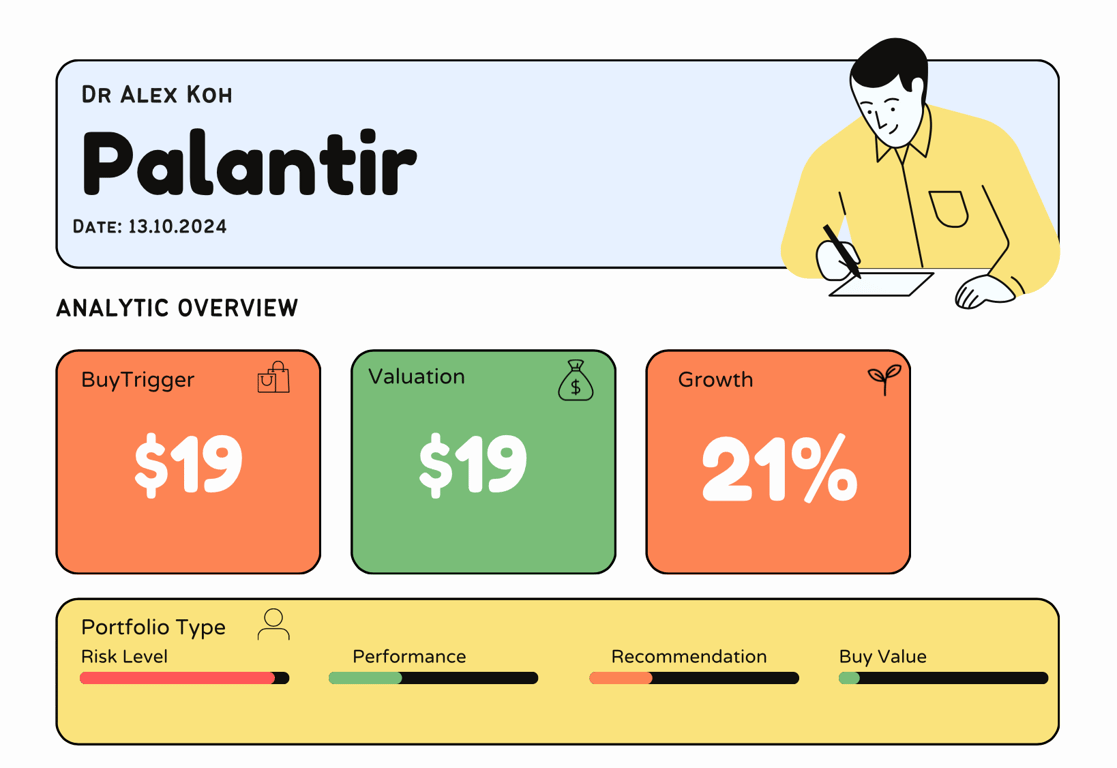

💰 Valuation Analysis

- P/E Ratio: Palantir’s current P/E ratio is 258.4x, reflecting the high valuation investors place on its future growth potential.

- Price Target: Analysts have set a consensus price target of $24.07, indicating a potential 22.35% downside from current levels. However, targets range widely from $9.00 to $35.00, reflecting varying views on the company’s growth prospects.

- Market Cap: Approximately $65 billion, underscoring its significant position in the AI and data analytics sectors.

📈 Growth Metrics

- 2024 EPS Growth Forecast: Analysts expect Palantir’s EPS to grow by 36.84% in the next year, with a forecasted EPS of $0.44 in 2025, as the company continues to expand its AI-driven solutions.

- Price Target: The mixed price target reflects both optimism for Palantir’s long-term AI strategy and caution over its high valuation and potential market volatility.

🔮 Forecast

Palantir is well-positioned to capitalize on the growing demand for AI and data analytics, particularly in the commercial and government sectors. However, its high valuation suggests that any slowdown in growth or profitability could lead to significant stock price volatility.

Final Summary

- 🚀 Growth Potential: Palantir’s leadership in AI and data analytics offers substantial growth opportunities, especially in the government and commercial sectors.

- ⚠️ High Valuation Risk: The stock’s high valuation presents risks, and analysts are divided on its near-term potential, with some forecasting a decline from current levels.

- 🔎 Mixed Analyst Sentiment: While Palantir has strong growth prospects, its current valuation and competitive landscape lead to cautious recommendations from analysts.

Palantir remains a speculative but potentially rewarding investment for those willing to tolerate high risk in the rapidly evolving AI and data analytics markets.