PayPal Holdings, Inc. (PYPL) Stock Comprehensive Review as of November 29, 2024 🟢Current Price: $86.77Industry: Fintech, Digital PaymentsStock Type: GrowthRating: C+

Key Financial Metrics (Q3 2024)

- Revenue: $7.85 billion, up 6% year-over-year.

- Net Income: $1.34 billion, increasing by 22% YoY.

- Gross Margin: 45%, indicating moderate operational efficiency.

- EPS (Earnings Per Share): $1.20, surpassing analyst expectations of $1.07.

- Free Cash Flow: $1.5 billion, reflecting strong cash generation.

💰 Valuation Analysis

- P/E Ratio: 18.92x, aligning with industry averages.

- P/S Ratio: 2.89x, suggesting the market values its revenue moderately.

- Market Cap: $86.79 billion, classifying it as a large-cap stock.

📈 Growth Metrics

- 2025 EPS Growth Forecast: PayPal is projected to experience modest growth, focusing on higher-margin businesses and strategic partnerships.

- Price Target: Analysts have set a consensus price target of $84.04, indicating a potential downside from the current price.

🔍 Revenue Breakdown

- Transaction Revenues (85%): $6.67 billion (+5% YoY)

- Growth driven by increased total payment volume and transaction margins.

- Other Value-Added Services (15%): $1.18 billion (+10% YoY)

- Boosted by new product offerings and partnerships.

🔮 Forecast

PayPal continues to navigate a competitive fintech landscape, with a strategic shift towards higher-margin segments and innovative partnerships. The company's growth is supported by investments in technology and a focus on profitable operations. However, challenges such as intense competition and market saturation may impact its growth trajectory.

Final Summary

- 🚀 Hold: PayPal's stable financial performance and strategic initiatives make it a viable option for investors seeking moderate growth.

- 📊 Solid Financials: Consistent revenue and net income growth highlight PayPal's operational stability.

- 💡 Valuation Considerations: Current valuation reflects market expectations; potential for upside exists with successful execution of strategic plans.

- ⚠️ Risks: Heightened competition and evolving regulatory environments pose challenges to sustained growth.

PayPal remains a significant player in the digital payments industry, with a C+ rating reflecting its balanced prospects amid competitive pressures.

Interesting Facts

🕶️ Chronological Update below 👇🏻

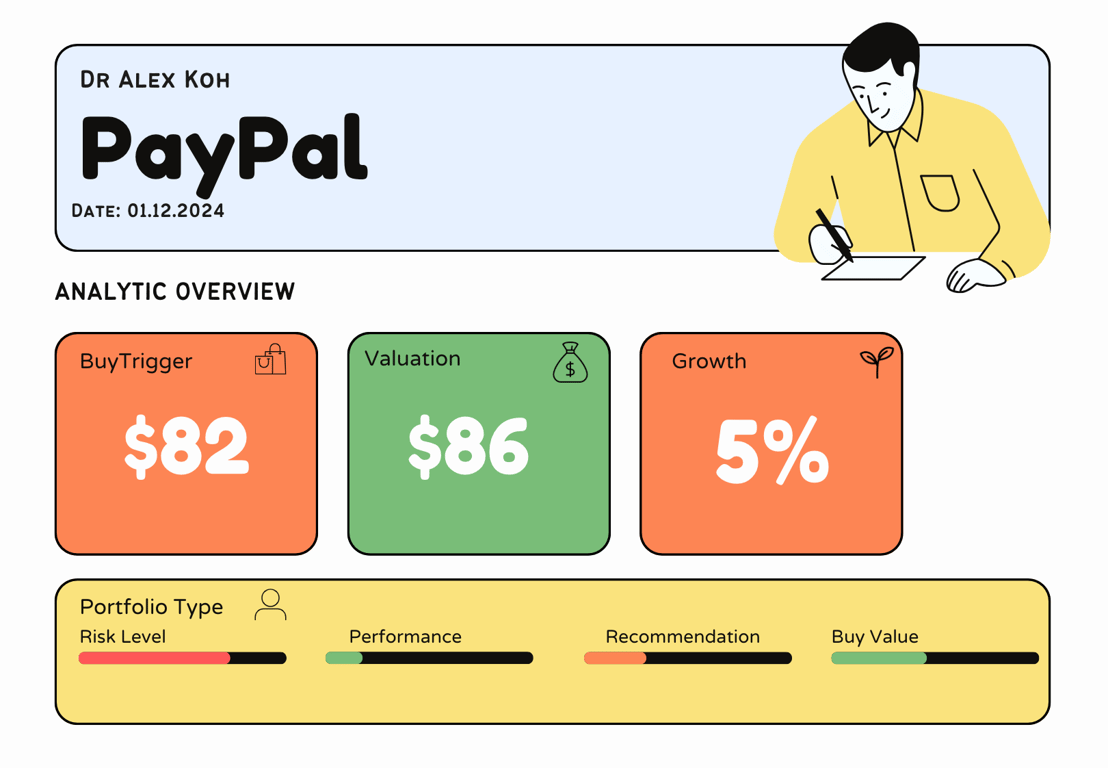

Price Valuation Update[Dec 1, 2024 06:30 PMGMT+00:00]

Reason for Update

Adjusted Final Rating:

After careful consideration, Broadcom (AVGO) deserves to stay at A-, given the following:

- 🚀 Strengths: Diversification into high-margin software (VMware), strong AI and networking growth, and robust cash generation.

- ⚠️ Risks: Elevated P/E ratio and significant reliance on data center clients like Google and Microsoft, which might slow down spending.

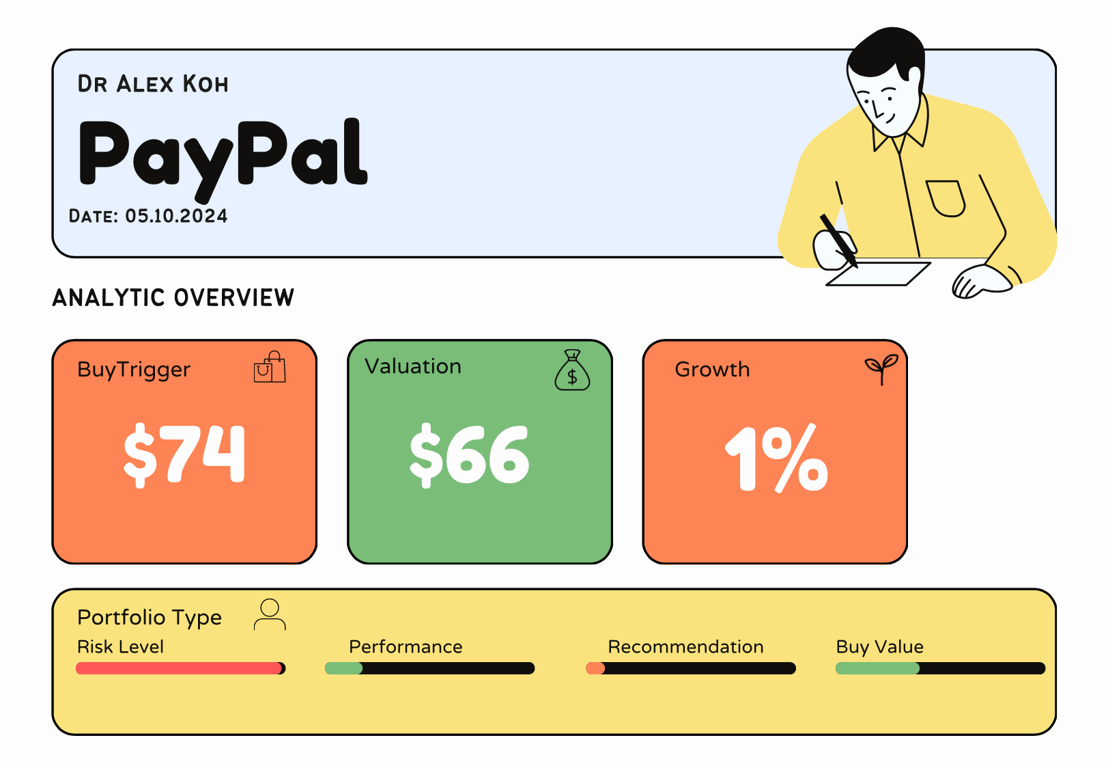

BT#1 - 74 to 82

Valuation - 66 to 86

Technical Analysis Update [Oct 6, 2024 06:55 PMGMT+00:00]