Qualcomm Inc. (QCOM) Stock Comprehensive Review as of August 2024 🟠

Current Price: $171.47

Industry: Semiconductors

Stock Type: Mature Growth, High Volatility

Rating: B+

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Qualcomm reported $39.38 billion in revenue for FY 2024, reflecting a 9.93% YoY increase. This growth is largely driven by demand in 5G, automotive, and IoT sectors, despite challenges in the smartphone market.

- Net Income: The company achieved an EPS of $10.28, marking a significant improvement of 60.17% YoY, supported by a strong recovery in its core segments.

- Free Cash Flow: Qualcomm continues to generate strong free cash flow, allowing it to invest in R&D and return capital to shareholders through dividends and share buybacks.

💰 Valuation Analysis

- P/E Ratio: Qualcomm’s forward P/E ratio is 16.48x, which suggests the stock is reasonably valued relative to its expected earnings growth.

- Price Target: Analysts have set a consensus price target of $205.21, indicating a potential 21.07% upside. The highest target is $270, reflecting optimism about Qualcomm's expansion into AI and other emerging technologies.

- Market Cap: Approximately $191.44 billion, making Qualcomm a significant player in the global semiconductor industry.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Analysts expect continued growth, with EPS forecasted to reach $11.34 in FY 2025, driven by new product launches and expanded partnerships in AI and 5G technologies.

- Price Target: The broad range of price targets reflects mixed sentiment, but overall, analysts are optimistic about Qualcomm's ability to capitalize on industry trends.

🔮 Forecast

Qualcomm is well-positioned to benefit from the growing demand for advanced semiconductors, particularly in 5G, AI, and automotive applications. However, the stock's high volatility and exposure to global economic conditions could present risks.

Final Summary

- 🚀 Growth Potential: Qualcomm’s leadership in 5G and expansion into AI offer significant growth opportunities, although the stock's volatility should be considered.

- 📉 Valuation Considerations: The stock's current valuation appears reasonable, but it remains sensitive to market fluctuations and competitive pressures.

- 🔎 Mixed Analyst Sentiment: While most analysts recommend a "Buy," the wide range of price targets suggests varying degrees of confidence in Qualcomm’s near-term growth prospects.

Qualcomm remains a strong contender in the semiconductor industry, with promising growth potential balanced by some risk factors(

Interesting Facts

🕶️ Chronological Update below 👇🏻

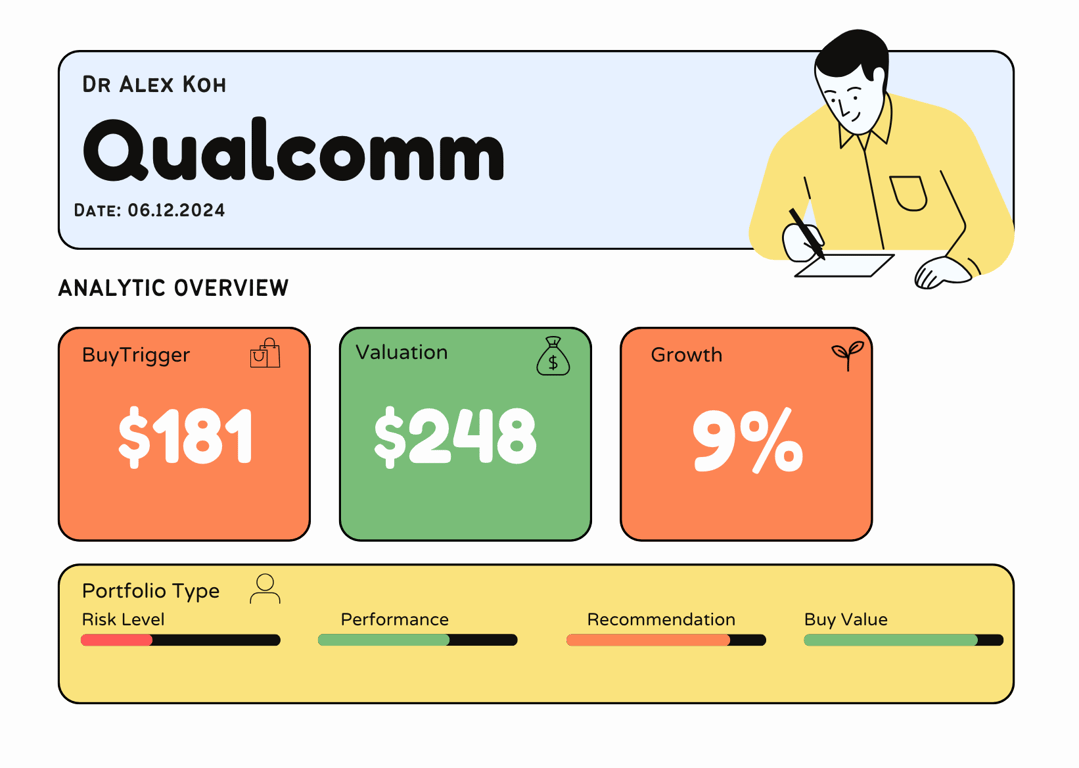

Technical Analysis Update [Dec 6, 2024 10:17 AMGMT+00:00]

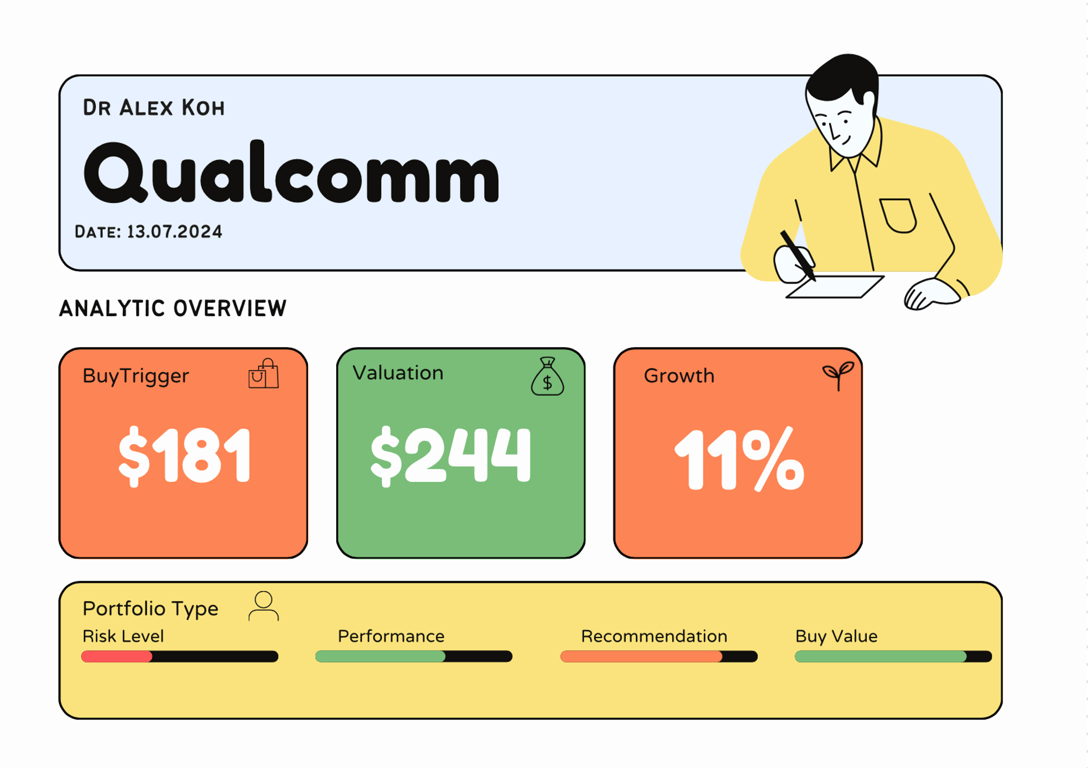

Technical Analysis Update [Jul 13, 2024 11:57 AMGMT+00:00]

Qualcomm Incorporated (QCOM) Analysis

Timestamp: July 12, 2024

Industry: Semiconductors

Stock Type: Mature Growth

Key Metrics:

- Current Price: $202.43 (+1.29%)

- 50-Day Moving Average (MA50): ~$200.00

- 200-Day Moving Average (MA200): ~$181.35

- MACD: Showing a bullish crossover

Technical Analysis:

- Fibonacci Levels:

- Resistance Levels:

- ~$230.00 (Upper resistance)

- ~$210.00 (Recent high)

- Support Levels:

- ~$181.35 (200-Day Moving Average & Fibonacci support)

- Moving Averages:

- The stock is currently trading above both its 50-day and 200-day moving averages, indicating a bullish trend.

- MACD:

- The MACD line is above the signal line, suggesting bullish momentum.

- The histogram is positive, reinforcing the bullish sentiment.

- Buy Trigger:

- The buy trigger is set at $181.35, which coincides with the 200-day moving average and a key Fibonacci support level. This is a strong support zone and could be a good entry point if the stock price retraces to this level.

Growth and Forecast:

- Growth Percentage (Past Year):

- Significant upward movement observed from ~$130 to ~$230, indicating strong growth.

- 2023 EPS Growth Forecast:

- Expected to continue growing, driven by demand in the semiconductor industry.

Conclusion:

- Rating: B+

- The stock has shown significant growth and is currently in a bullish trend. The buy trigger at $181.35 provides a solid entry point if the price retraces, aligning with both technical and Fibonacci support levels. The bullish indicators and upward momentum make it a promising stock, though investors should watch for potential pullbacks.

Summary:

- 📈 Current Price: $202.43

- 🏢 Industry: Semiconductors

- 📊 Stock Type: Mature Growth

- 💹 Growth: Strong past year growth with bullish outlook

- 🕵️♂️ Technical Indicators: Trading above MA50 and MA200, bullish MACD

- 🔮 Forecast: Continued growth expected in 2024

- 🚨 Buy Trigger: $181.35

- ⭐ Rating: B+

This analysis suggests Qualcomm Incorporated (QCOM) is a strong contender for investment, particularly if the price approaches the buy trigger at $181.35.