Robinhood Markets, Inc. (HOOD) Stock Comprehensive Review as of November 2024 🟡

Current Price: $23.97

Industry: Financial Technology, Retail Brokerage

Stock Type: Growth, Volatile

Rating: B

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Robinhood posted revenue of $2.69 billion for 2024, representing an impressive 44.08% year-over-year increase. This growth has been supported by strategic fee adjustments and new product offerings, including an options trading fee pass-through, which is projected to boost EBITDA by over 5%.

- Net Income: For 2024, Robinhood is on track to achieve positive EPS of $0.73, a major improvement from a loss of -$0.61 last year. This turnaround reflects successful cost management and improved monetization strategies as Robinhood begins to deliver on its path to profitability.

- Free Cash Flow: Robinhood's cash position remains strong, with a focus on maintaining high cash reserves. The company has leveraged its operating leverage to increase profitability, despite volatility in the retail investing space.

💰 Valuation Analysis

- P/E Ratio: With a forward P/E ratio of 32.89x, Robinhood is priced at a premium, reflecting the market's anticipation of continued growth and profitability. However, its valuation is still sensitive to execution risks, given its competition and regulatory landscape.

- Price Target: Analysts have an average price target of $25.06, indicating a modest 4.55% upside from the current price. The high-end target reaches $33, reflecting optimism around Robinhood's recent financial improvements and strategic growth initiatives.

- Market Cap: Robinhood’s market capitalization is around $22 billion, indicating solid positioning in the fintech sector, though still facing competitive pressures from larger brokerages.

📈 Growth Metrics

- 2025 Growth Forecast: Robinhood’s revenue is projected to grow by 7.67% in 2025, reaching approximately $2.89 billion. This growth is expected to come from further enhancements to its premium offerings and geographic expansion, particularly with the recent launch of products in the UK.

- Price Target: Analysts remain cautiously optimistic, expecting Robinhood to continue its growth trajectory, though market conditions and regulatory impacts could affect short-term performance.

🔮 Forecast

Robinhood’s strategic fee adjustments and product diversification efforts have led to stronger-than-expected earnings, with the company now on a profitable trajectory. While its outlook is positive, Robinhood faces challenges from competition and regulatory scrutiny. Nevertheless, with a path to sustainable profitability and growth potential in international markets, Robinhood is positioned as a promising growth stock.

Final Summary

- 🚀 Profitable Growth in Progress: Robinhood’s recent earnings beat and profitability improvements underscore its potential as a key fintech player.

- 📈 Moderate Upside: The stock has growth potential, though competition and regulatory factors temper its outlook, supporting a B rating.

Robinhood's stock remains a speculative investment, appealing to those who believe in its growth story but carrying inherent risks due to its current financial instability.

Interesting Facts

🕶️ Chronological Update below 👇🏻

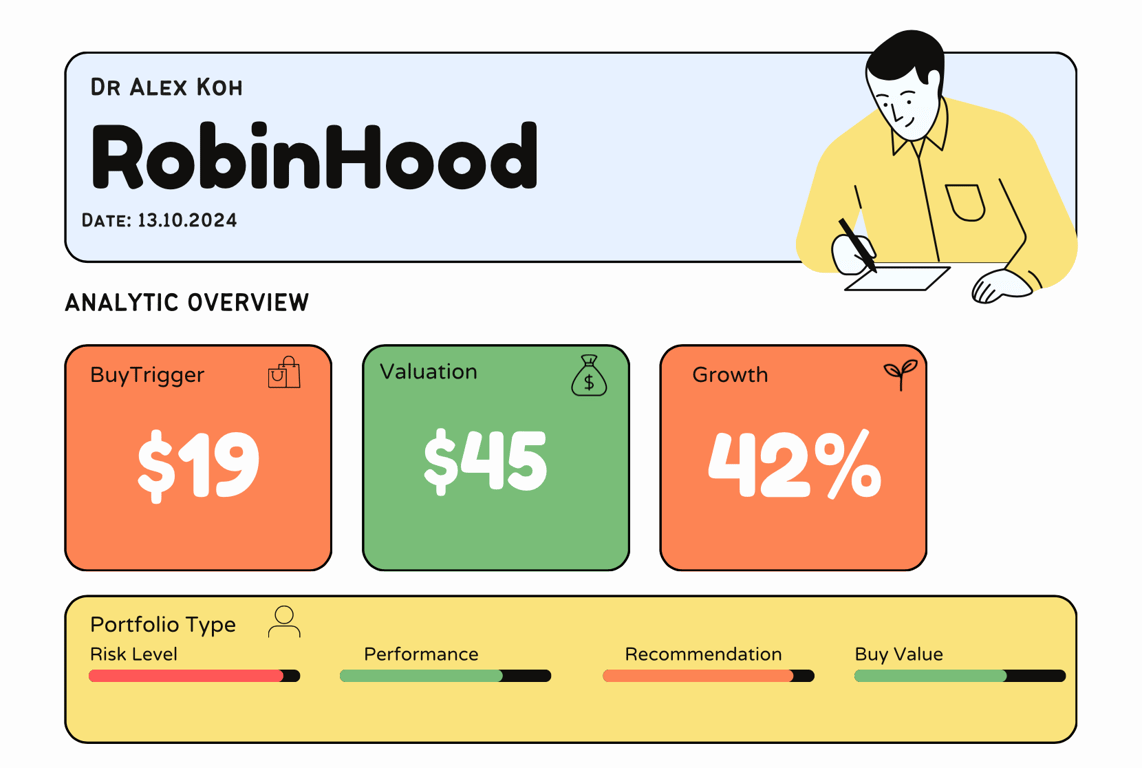

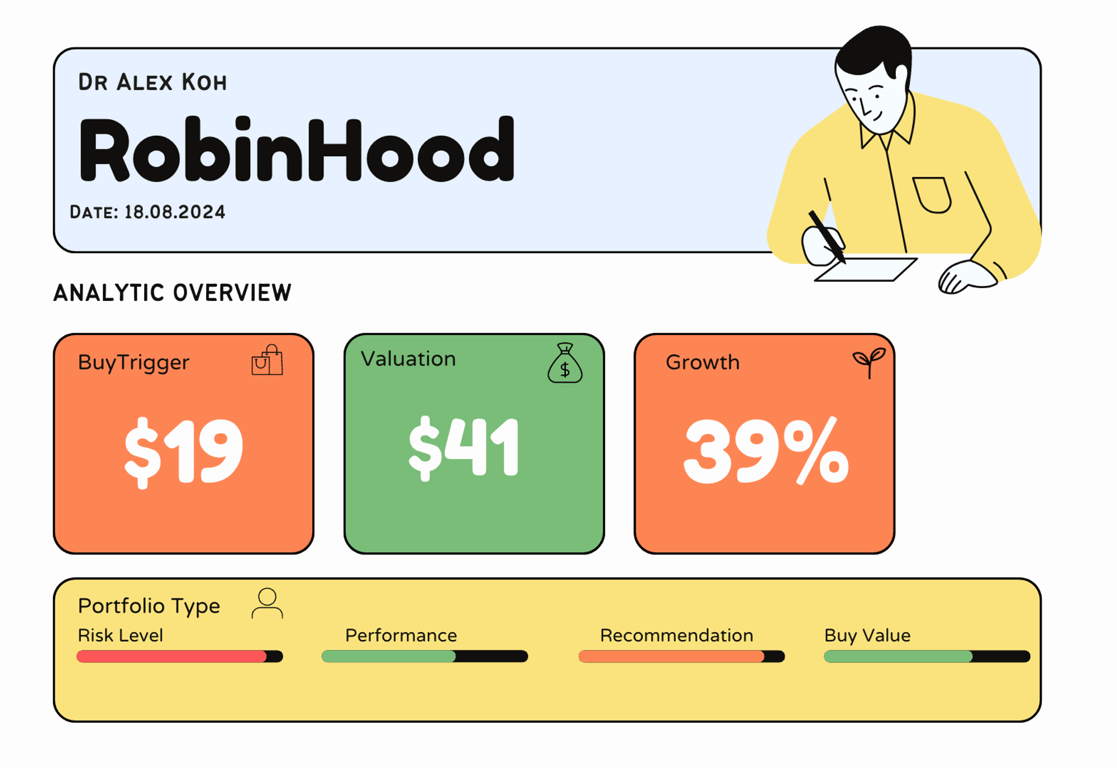

Technical Analysis Update [Aug 18, 2024 02:08 PMGMT+00:00]

- Crossroad for Hood. If they dont push higher, the 50/200 will turn it to bearish mode.

- The stock needs more fundamental growth over crypto momentum to survive any form of long term growth.

- If they prevail life after $30 might be around the corner. The growth forecast can change drastically if they upkeep the growth momentum.

- Very speculative with high risk and higher reward.

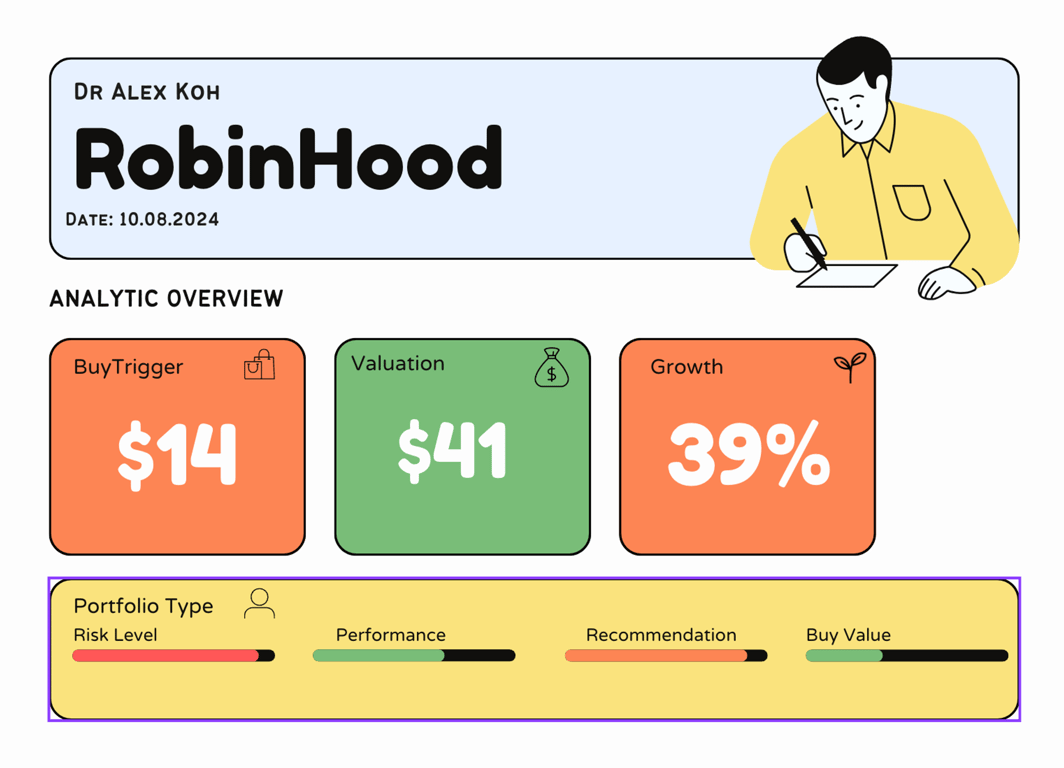

Price Valuation Update[Aug 11, 2024 12:06 AMGMT+00:00]

Reason for Update

- Valuatiuon for 2024 taken in advance over 2023. Growth doing well and expected a potential EPS of 0.8 with increased 39% growth increase after two earnings sprout

BT#1

$14 is my strict fib level but i am buying anything under $20

Technical Analysis Update [May 12, 2024 09:14 PMGMT+00:00]

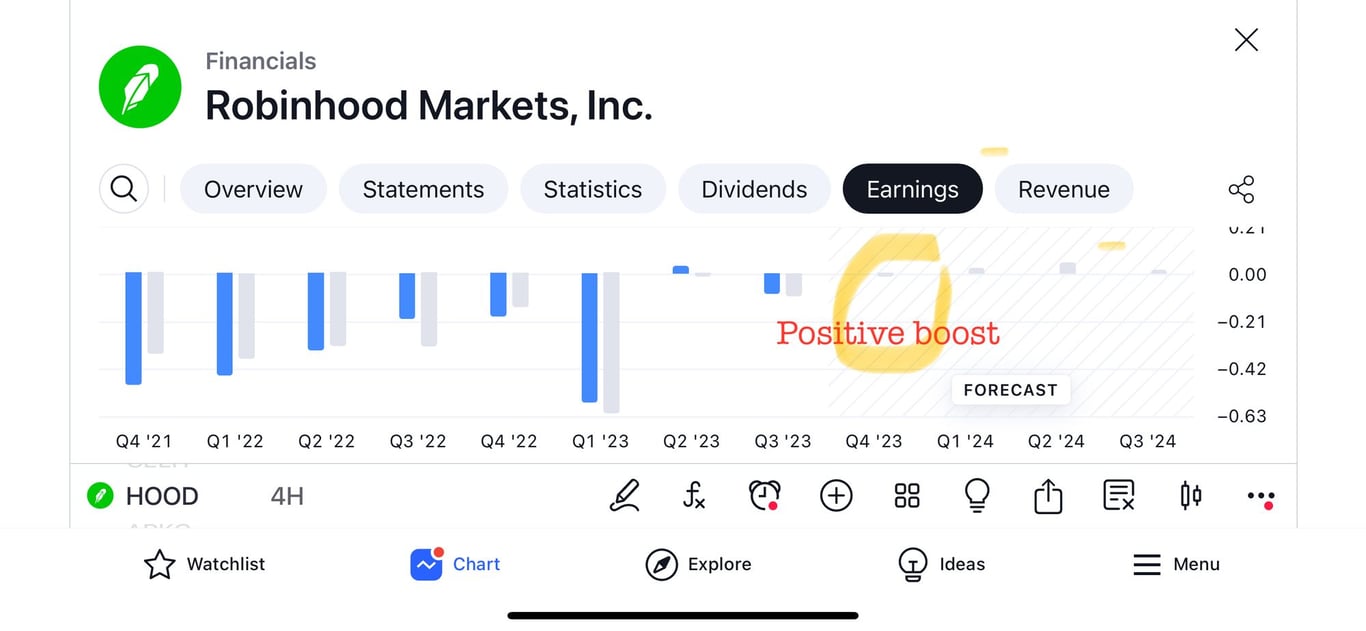

Technical Analysis Update 14th Jan 2024

- Updated Blog here

Robinhood have fallen nearly close to 15% in the first two weeks of financial trading year 2024 and I may be topping up after my technical observations below 👇.

Earnings are. Inning up and I am expecting a potential positive boost EPS due to the high crypto and stock option trading activity from the last three months.

I am expecting $HOOD to be on a profitable year after the expenses clean up.

On the technical aspects, I notice an early golden cross observed on the 4hr interval charts. The recent drop just establish the $11 rebases support as seen for the last six months. I am expecting a third retry and break away above $14.

Price Valuation Update[Dec 31, 2023 09:57 PMGMT+00:00] (31st Dec 2023)

Reason for Update

- I expect above 0.4 eps minimum by 2026 for hood which is above 18 valuation

- Whatever you buy now is for 2026. Above 18 is overpaying

- Expected for uk and eu expansion soon

- Crypto will boost sales

BT#1

BT#2

Valuation

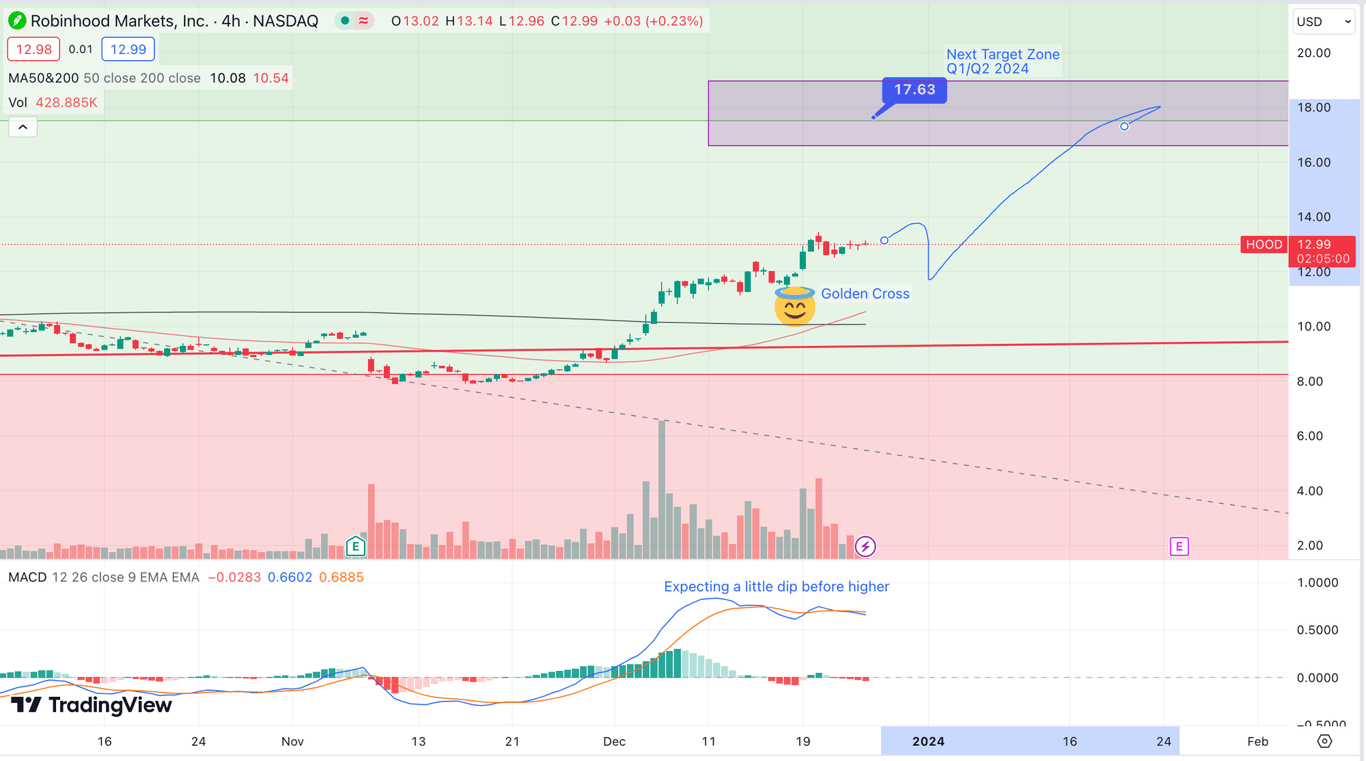

Technical Analysis Update [Dec 26, 2023 04:21 PMGMT+00:00] (26th December 16:21)

- Pure technical analysis. Golden cross on 4 hour means 75% bullish opportunity play.

- Next Level to be at $17.63

- There should be a short pull back to $11-12 at some point before the Q1/Q2 earnings bullish play on future earnings and announcements for rebound.

- Crypto kicking off which could impact improved earnings

- HOOD bought marketting company to improve branding.

- My short term play is to swing from 11-12 order to $18 within 6 months to take profit. Expected to buy at $9 if it drops lower to hold.