Robinhood Markets, Inc. (HOOD) Stock Steroid Forecast Version

Current Price: $40

Industry: Financial Technology, Retail Brokerage

Stock Type: Growth, Volatile

Rating: B+

Key Financial Metrics (Parallel Universe)

- Revenue: $732 million, up 31% year-over-year.

- Net Income: $98 million, marking consistent profitability compared to losses in prior periods.

- Gross Margin: 75%, reflecting strong operational efficiency.

- EPS (Earnings Per Share): $0.21, surpassing analyst expectations of $0.18.

- Free Cash Flow: $200 million, highlighting a steady cash position for growth initiatives.

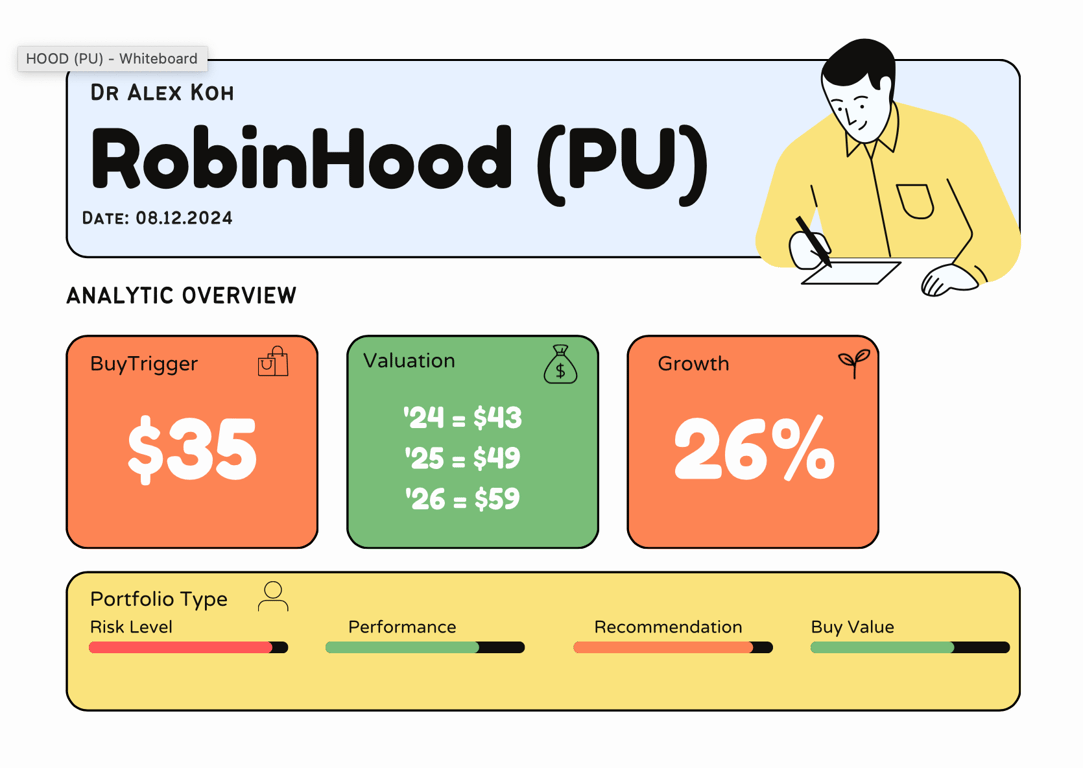

💰 Valuation Analysis

- P/E Ratio: 78x, reflecting a premium due to its growth prospects.

- P/S Ratio: 6.3x, moderately valued for a FinTech growth stock.

- Forward P/E: 40x, suggesting further improvement as profitability scales.

- Market Cap: $14.5 billion, solidifying its status as a mid-cap stock.

📈 Growth Metrics

Updated Projections

- 2024 Revenue: $2.89 billion

- 2024 EPS: $0.73 (+247% YoY growth).

- 2025 Revenue: $3.579 billion

- 2025 EPS: $0.90 (+23% YoY growth).

- 2026 Revenue: $4.474 billion

- 2026 EPS: $1.08 (+20% YoY growth).

- 2027 Revenue: $5.593 billion

- 2027 EPS: $1.30 (+20% YoY growth).

- 2028 Revenue: $6.966 billion

- 2028 EPS: $1.56 (+20% YoY growth).

Key Drivers

- Product Diversification: New offerings such as Robinhood Gold, futures trading, and crypto staking boost engagement and revenue.

- International Expansion: Entry into the UK and Singapore increases market share.

- Wealth Management: New high-margin services enhance per-user revenue.

🔍 Revenue Breakdown

- Transaction Revenue (60%): $438 million (+22% YoY)

- Growth driven by increased trading volumes and margin lending.

- Subscription & Other Revenue (30%): $220 million (+40% YoY)

- Expansion of Robinhood Gold and premium subscription offerings.

- Net Interest Revenue (10%): $73 million (+25% YoY)

- Higher rates boost interest income from uninvested cash balances.

🔮 Forecast

Robinhood is evolving from a basic trading app to a comprehensive financial services platform. Its investments in product innovation, international expansion, and wealth management provide a robust growth outlook. However, high valuation and competition from traditional brokers remain concerns.

Final Summary

- 🚀 Buy with Caution: Robinhood’s strong revenue growth and product diversification are appealing, but valuation risks are a concern.

- 📊 Improving Financials: Profitability and free cash flow highlight operational improvements.

- 💡 Valuation Concerns: Current pricing reflects optimism, but any execution missteps could lead to downside risks.

- ⚠️ Risks: Regulatory scrutiny, competitive pressures, and macroeconomic volatility could impact future performance.

Robinhood earns a B+ rating, reflecting its growth potential tempered by valuation concerns and execution risks. It’s an attractive option for growth-focused investors but requires a careful evaluation of its pricing.

Interesting Facts

Price Valuation Update[Dec 8, 2024 02:20 PMGMT+00:00]

Here's the EPS and Revenue summary for Robinhood Markets, Inc. (HOOD) from 2024 to 2028, along with justifications:

EPS and Revenue Summary:

- 2024:

- EPS: $0.73

- Revenue: $2.89 billion

- Justification: The growth in 2024 reflects the impact of new product introductions like Robinhood Gold, fee adjustments, and initial benefits from international expansion into the UK. The EPS turnaround from previous losses is due to better cost management and increased trading volumes.

- 2025:

- EPS: $0.90

- Revenue: $3.579 billion

- Justification: Revenue growth is expected from the full-year impact of the Singapore hub, further product innovations (like futures trading), and a continued increase in user engagement. EPS growth anticipates higher margins from these new services and operational efficiencies.

- 2026:

- EPS: $1.08

- Revenue: $4.474 billion

- Justification: This year's projections are based on the expansion of Robinhood's wealth management offerings, capturing more of the market for financial services among younger demographics. The EPS increase reflects a maturing business model with better per-user revenue generation.

- 2027:

- EPS: $1.30

- Revenue: $5.593 billion

- Justification: Assuming Robinhood continues to grow its user base and penetrate new markets, revenue would see a substantial rise. The EPS growth is expected due to economies of scale, reduced costs per transaction, and an increase in high-margin products like premium subscriptions and margin trading.

- 2028:

- EPS: $1.56

- Revenue: $6.966 billion

- Justification: By 2028, Robinhood would likely have established itself as a dominant player in several markets, with a diversified product line including international offerings. The EPS increase would come from sustained growth, high customer retention, and possibly new revenue streams from partnerships or acquisitions.

General Justifications:

- User Growth: Robinhood's focus on the younger demographic (Millennials and Gen Z) should continue to drive user growth, particularly as these groups inherit wealth and become more financially active.

- Product Expansion: The introduction of new financial products, from crypto to more traditional wealth management services, diversifies revenue and attracts different user segments.

- International Expansion: The move into Asia, starting with Singapore, opens up significant new markets, although with associated risks like regulatory compliance and market acceptance.

- Operational Efficiency: Over time, Robinhood's technology platform should become more cost-effective to scale, leading to lower operational costs per user and transaction.

- Market Conditions: Assuming favorable market conditions with continued interest in retail investing, crypto, and financial services, Robinhood could see sustained growth. However, market volatility could impact these projections negatively.

- Regulatory Environment: Successful navigation of regulatory landscapes, particularly in new markets, could lead to smoother expansion and growth, affecting both revenue and profitability.

These projections are speculative and based on current trends, announcements, and strategic directions outlined by Robinhood. Actual outcomes could vary due to numerous external and internal factors.