Take-Two Interactive Software, Inc. (TTWO) Stock Comprehensive Review as of October 2024 🟡Current Price: $151.69Industry: Video Games, Interactive EntertainmentStock Type: Growth, VolatileRating: B-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Take-Two's revenue for the last fiscal year (2024) was $5.35 billion, showing a slight 0.01% year-over-year increase. This stagnation comes after a significant boost in prior years, but it indicates that the company’s growth has cooled off, mainly due to delays in major game releases.

- Net Income: The company recorded a net loss of $3.7 billion over the past year, attributed to impairment charges and high operating costs. The loss led to a sharp decline in EPS to -$22.25, as Take-Two continues to manage its post-acquisition integration costs, particularly from its purchase of Zynga.

- Free Cash Flow: Free cash flow remains negative at $357.4 million, pointing to struggles in converting revenues into positive cash generation.

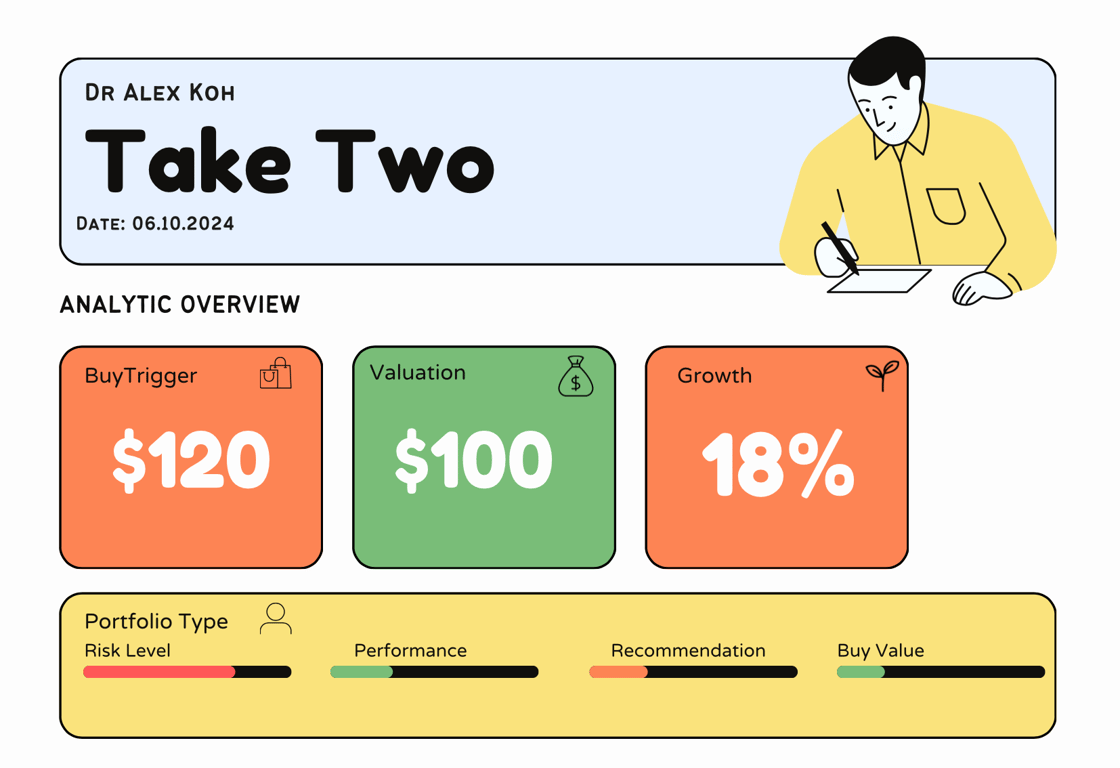

💰 Valuation Analysis

- P/E Ratio: Given the negative earnings, traditional valuation metrics like the P/E ratio aren’t as relevant. However, its gross margin of 55.58% shows that the core business remains strong, but profitability is weighed down by restructuring costs and delays in new game launches.

- Price Target: Analysts have set a 12-month price target of $185.10, implying a potential 22% upside from the current price. This reflects optimism around the release of anticipated games like the next entry in the Grand Theft Auto franchise.

- Market Cap: Take-Two’s market cap is approximately $18 billion, placing it among the top players in the gaming industry, although its valuation has been under pressure due to recent challenges.

📈 Growth Metrics

- 2025 Growth Forecast: Analysts are optimistic that 2025 will bring a turnaround, with anticipated game releases expected to drive revenue growth. The release of key franchises is expected to reaccelerate growth and bring the company back to profitability.

- Price Target: The stock remains a long-term play, with analysts betting on its future content pipeline, despite near-term earnings volatility and the impact of Zynga's integration.

🔮 Forecast

Take-Two is at a critical juncture, with significant upside potential linked to its blockbuster gaming franchises. While the company has struggled with losses, analysts are hopeful that major releases in the coming years will help drive growth. However, current financials reflect a company in transition, making it a somewhat risky play until stronger profitability returns.

Final Summary

- 🚀 Potential for Long-Term Growth: Once key game titles launch, Take-Two could see a strong rebound, but this may take time.

- 📉 Short-Term Caution: With current losses and cash flow challenges, Take-Two faces short-term risks, justifying the B- rating.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [Oct 6, 2024 07:06 PMGMT+00:00]