Tesla Inc. (TSLA) Stock Comprehensive Review as of August 2024 🟠

Current Price: $197.42

Industry: Electric Vehicles, Renewable Energy

Stock Type: Growth, High Volatility

Rating: B

Key Financial Metrics (Latest Earnings)

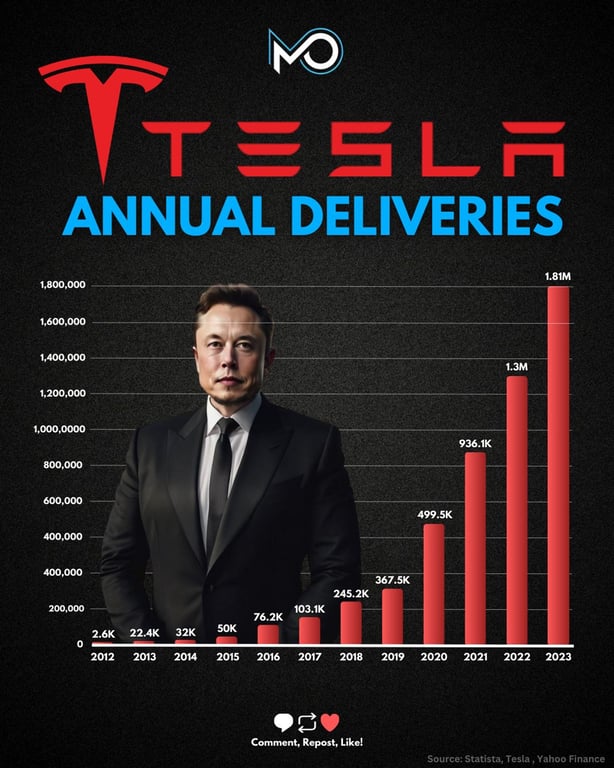

- Revenue Growth: Tesla reported $25.5 billion in revenue for Q2 2024, surpassing expectations by $1 billion. However, this growth represents only a 1.37% YoY increase, indicating a slowdown compared to previous years.

- Net Income: The company posted a net income of $12.39 billion over the past twelve months, with an EPS of $3.56. While profitability remains strong, the EPS growth of 1.06% YoY reflects pressure from rising costs and increased competition.

- Free Cash Flow: Tesla generated $1.7 billion in free cash flow, a significant decline from previous periods, reflecting increased capital expenditures and challenges in maintaining cash flow amidst rising operational costs.

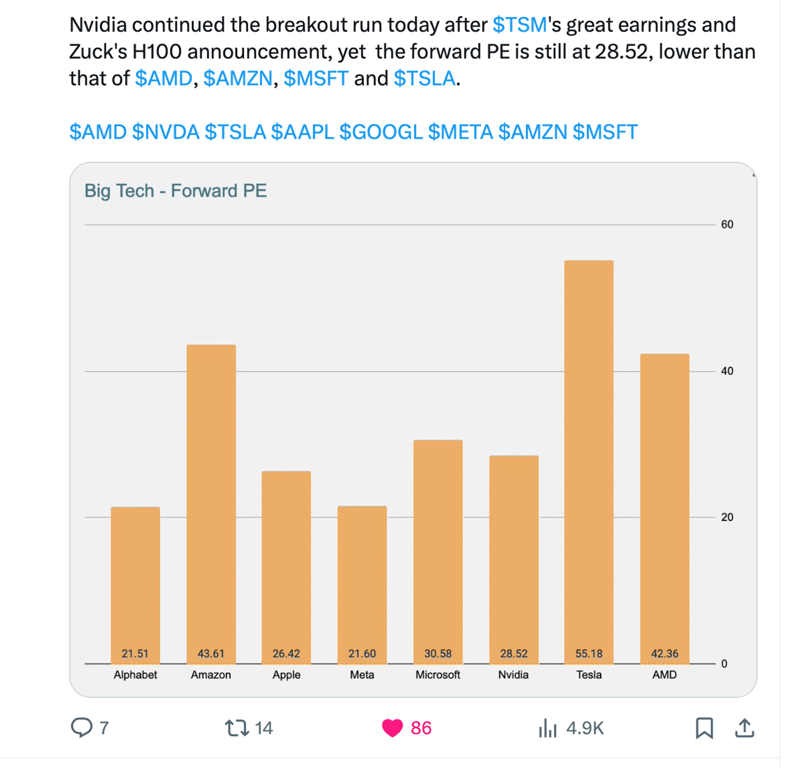

💰 Valuation Analysis

- P/E Ratio: Tesla’s trailing P/E ratio is 72.48x, indicating a high valuation relative to its earnings. The stock's premium valuation is based on high future growth expectations, but it also suggests vulnerability to market fluctuations.

- Price Target: Analysts have set a consensus price target of $202.12, with a potential upside of 2.38%. The range of targets varies widely, from a low of $140 to a high of $310, reflecting mixed sentiment on Tesla's near-term potential.

- Market Cap: Approximately $631 billion, positioning Tesla as a dominant player in the EV market, though it faces increasing competition from both established automakers and new entrants.

📈 Growth Metrics

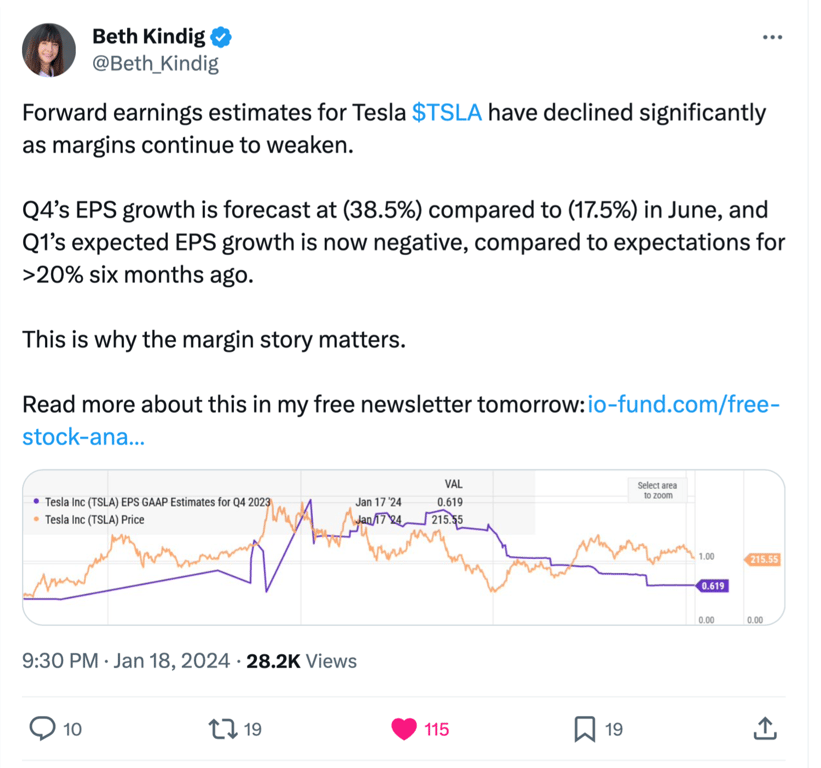

- 2025 EPS Growth Forecast: Analysts are cautious about Tesla's future earnings, forecasting moderate growth due to rising competition in the EV space and potential pressures on margins.

- Price Target: The consensus price target suggests limited upside, with some analysts predicting further downside if Tesla cannot meet high market expectations or if economic conditions worsen.

🔮 Forecast

Tesla continues to lead the electric vehicle market, but its growth is slowing as competition intensifies. The company's ability to maintain its high valuation will depend on its execution in new markets, technological advancements, and maintaining profitability in a challenging environment. The stock remains highly volatile, reflecting both its potential and the risks involved.

Final Summary

- ⚠️ High Risk, Moderate Growth: Tesla offers significant potential but comes with high risk due to its valuation and the competitive landscape.

- 📉 Profitability Concerns: The slowdown in revenue growth and declining free cash flow highlight the challenges Tesla faces in sustaining its growth.

- 🔎 Mixed Analyst Sentiment: Analysts are divided, with some seeing potential upside but others warning of risks, particularly in the face of rising competition and economic headwinds.

Tesla remains a key player in the EV industry, but investors should be aware of the risks associated with its high valuation and the competitive pressures it faces.

Interesting Facts

Tesla Vs Nvidia Revenue [@now]

Updates and Notes

News Sentiment

Other Updates

Tesla year end sell rating Dec 31, 2023

🕶️ Chronological Update below 👇🏻

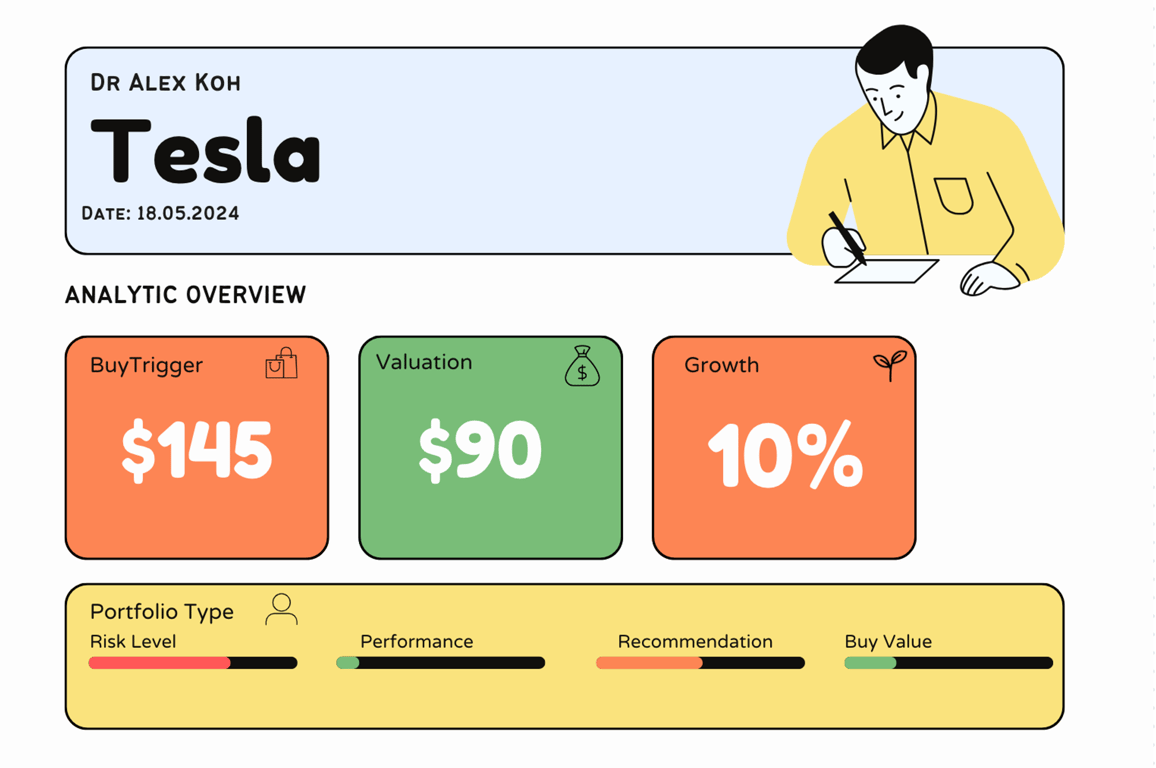

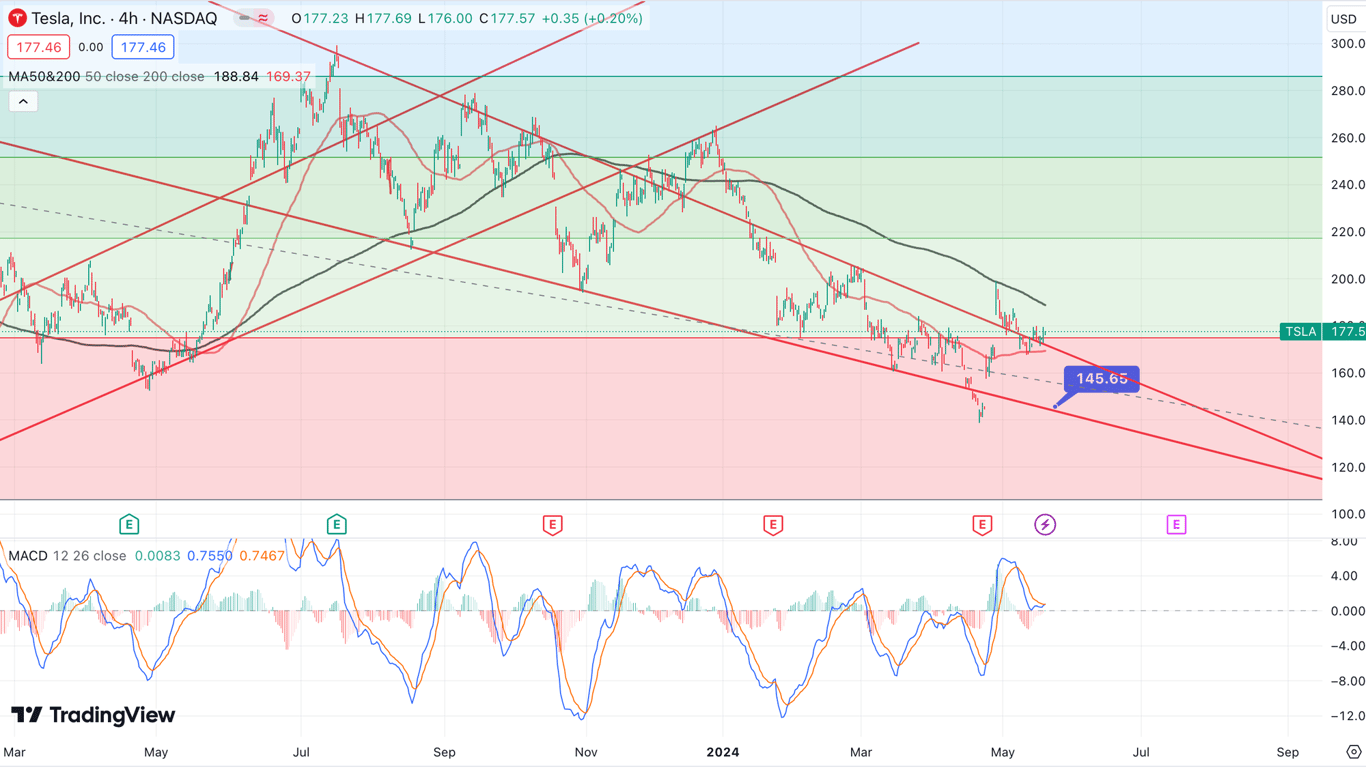

Technical Analysis Update [May 18, 2024 10:19 PMGMT+00:00]

- i dont think tesla is out of the woods yet as they are not breaking my two red channel band yet. there is still a possibility of $145 drop. There is no evidence new business revenue is in yet and could be few years to comeby. Too high risk to be buying overvalue.

Breaking News 19th Jan 2023

Updates and Notes

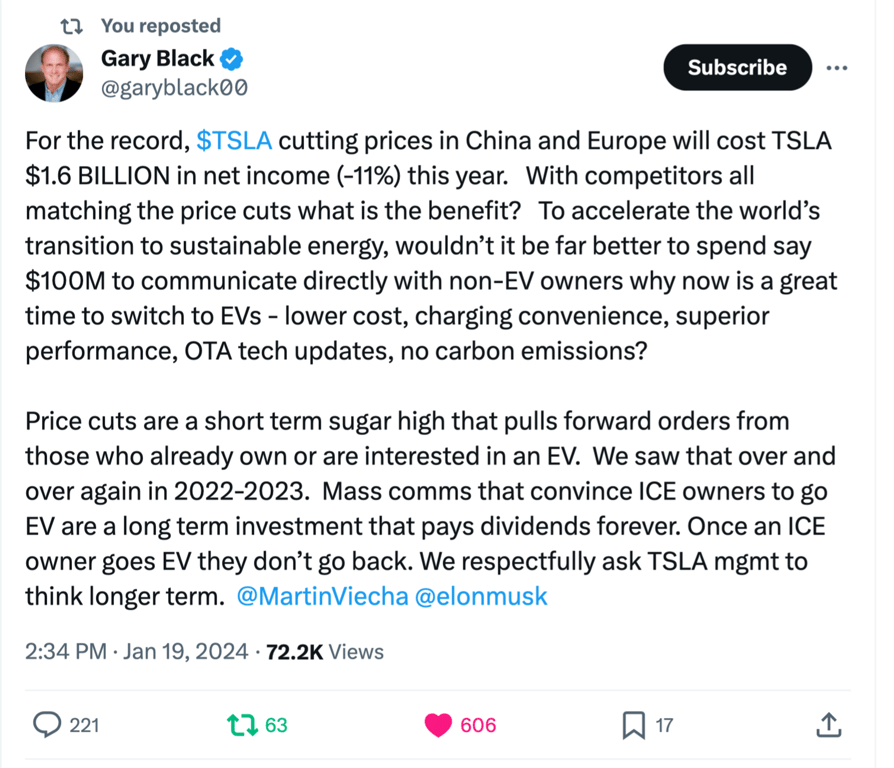

- Tesla is the most expensive forward PE due to decline in growth from their lower pricing of their cars.

News Sentiment

Other Updates

Price Valuation Update 19th Jan 2023

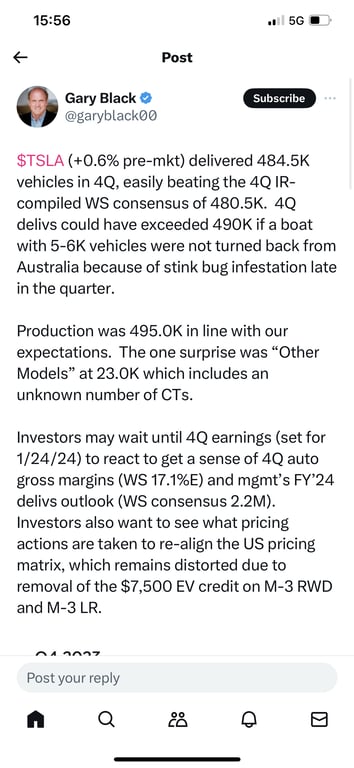

Breaking News 2nd Jan 2024

Updates and Notes

News Sentiment

Other Updates

Breaking News [@now]