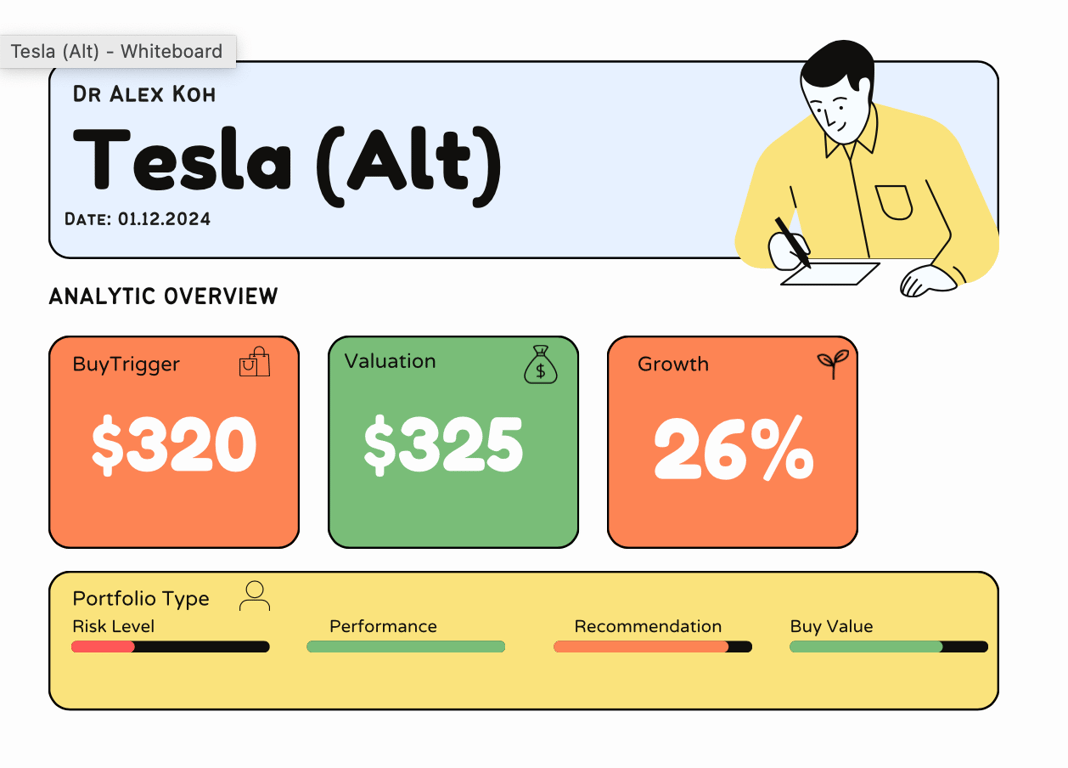

What if Tesla was on Steriod Mode on a Parallel Universe

Tesla Inc. (TSLA) Stock Comprehensive Review as of August 2024

Current Price: $361

Industry: Electric Vehicles, Renewable Energy, Robotics and Self Driving Cars

Stock Type: Hyper Growth, High Volatility

Rating: A+ (Steroid Mode)

Key Financial Metrics (Latest Earnings)

To build a forecast for Tesla's EPS from 2024 to 2028, starting from an EPS of $2.50 in 2024 to reach $11-$12 by 2028, we need to consider several factors including revenue growth, margin expansion, share count, and potential operational efficiencies. Here's a simplified model to illustrate how this might be achieved:

Assumptions:

- Revenue Growth: Assume Tesla achieves a Compound Annual Growth Rate (CAGR) in revenue of 20% from 2024 to 2028, driven by new models, market expansion, and new business ventures.

- Margin Improvement: Suppose operating margins improve from about 15% in 2024 to 20% by 2028 due to economies of scale, better cost management, and perhaps higher average selling prices or lower production costs.

- Share Count: Assume the number of shares remains relatively constant or grows very slowly, with no significant dilution. Let's use a constant share count of 3.2 billion shares.

Calculations:

2024:

- EPS: $2.50 (given)

- Revenue: Let's say it's $100 billion for simplicity (actual might be different, but this serves our model).

2025:

- Revenue: $100B * 1.20 = $120B

- Operating Margin: Increase to 16%

- Net Income: $120B * 16% = $19.2B

- EPS: $19.2B / 3.2B shares = ~$6.00

2026:

- Revenue: $120B * 1.20 = $144B

- Operating Margin: Increase to 17%

- Net Income: $144B * 17% = $24.48B

- EPS: $24.48B / 3.2B shares = ~$7.65

2027:

- Revenue: $144B * 1.20 = $172.8B

- Operating Margin: Increase to 18.5%

- Net Income: $172.8B * 18.5% = $31.968B

- EPS: $31.968B / 3.2B shares = ~$9.99

2028:

- Revenue: $172.8B * 1.20 = $207.36B

- Operating Margin: Increase to 20%

- Net Income: $207.36B * 20% = $41.472B

- EPS: $41.472B / 3.2B shares = ~$12.96

Justification:

- Revenue Growth: The 20% CAGR might be ambitious but reflects potential from new vehicle models like the Cybertruck, Semi, and new lower-cost vehicles, alongside increased global market penetration and expansion into new revenue streams like energy solutions and autonomous driving services.

- Margin Expansion: The increase in margins could come from higher volumes reducing per-unit costs, vertical integration (like battery production), and better pricing power due to brand strength or technology edge.

- Operational Efficiencies: Tesla's focus on manufacturing efficiency, cost reduction, and potentially selling higher-margin products or services could drive this margin expansion.

- Non-Automotive Revenue: Growth in areas like energy storage, solar, and software services could contribute significantly to both revenue and margin.

This model is simplistic and assumes a linear progression which real-world businesses rarely follow due to external factors like economic conditions, competition, regulatory changes, and unforeseen events. However, it provides a framework to see how Tesla could potentially achieve an EPS of around $11-$12 by 2028, considering aggressive but not entirely implausible growth and efficiency gains.

Remember, these are speculative projections and should be taken with caution. Actual results could vary widely based on numerous variables. For a more accurate forecast, detailed industry analysis, company guidance, and broader economic forecasts would be necessary.

Here's a table projecting Tesla's revenue from 2024 to 2028, incorporating both existing car sales and new revenue streams like robo-taxi (assuming it becomes operational and profitable within this timeframe) and other ventures:

Revenue Projections for Tesla (2024-2028)

Assumptions:

- Car Sales Growth:

- Assume a 12-15% yearly growth in car sales, considering both volume growth and potential price increases or mix changes towards higher margin vehicles.

- Robo-Taxi Revenue:

- 2024: No revenue as the service is assumed to be in testing or early stages.

- 2025-2028: Rapid scaling with initial conservative estimates growing to significant contributions. This assumes:

- Successful regulatory approval and operational scale-up.

- Pricing at about $1/mile for service with an average daily use per vehicle and increasing fleet size.

- Other Revenue (Energy, FSD, etc.):

- Includes income from:

- Energy generation and storage (solar, batteries).

- Full Self-Driving (FSD) software subscriptions or licensing.

- Potential other ventures like insurance, connectivity services, or robotics.

- Growth Rates:

- Car sales: 12% annually from 2024 to 2028.

- Robo-taxi: From $0 in 2024 to a significant contribution by 2028, leveraging an aggressive growth model but with conservative early estimates due to development and regulatory hurdles.

- Other Revenue: Assumes a 40% growth rate from 2024 to 2028, reflecting rapid expansion in these areas.

Notes:

- This model assumes no major economic downturns, continued technological success, and regulatory environments that favor Tesla's expansion into robo-taxis and other services.

- The figures for robo-taxi and other revenue streams are highly speculative due to the innovative and somewhat unpredictable nature of these businesses.

- The increase in total revenue aligns with our earlier EPS projections, considering that these revenue streams would need to contribute significantly to both top-line growth and margin improvement to reach the EPS targets.

This table should be viewed as a conceptual model rather than a prediction, given the many variables that could impact Tesla's actual performance.