Toast, Inc. (TOST) Stock Comprehensive Review as of October 2024 🟡Current Price: $28.60Industry: Fintech, Restaurant SoftwareStock Type: High Growth, High RiskRating: B-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Toast reported $4.99 billion in revenue for 2024, representing a 29.18% YoY increase. The company continues to grow its customer base within the restaurant industry by expanding its product offerings, including point-of-sale systems and additional features like payroll, online ordering, and analytics.

- Net Income: Despite its strong revenue growth, Toast remains unprofitable, with EPS at -$0.09 for 2024. This marks an improvement from its 2023 EPS of -$0.47, though the company is not expected to break even until 2025.

- Free Cash Flow: Toast has negative free cash flow due to its high operating costs and focus on aggressive expansion. The company continues to invest heavily in product development and customer acquisition, impacting its bottom line.

💰 Valuation Analysis

- P/E Ratio: Since Toast is not yet profitable, traditional P/E metrics are not applicable. However, with a forward price-to-sales ratio of 5.69x, Toast is considered highly valued for its growth potential in the restaurant fintech space.

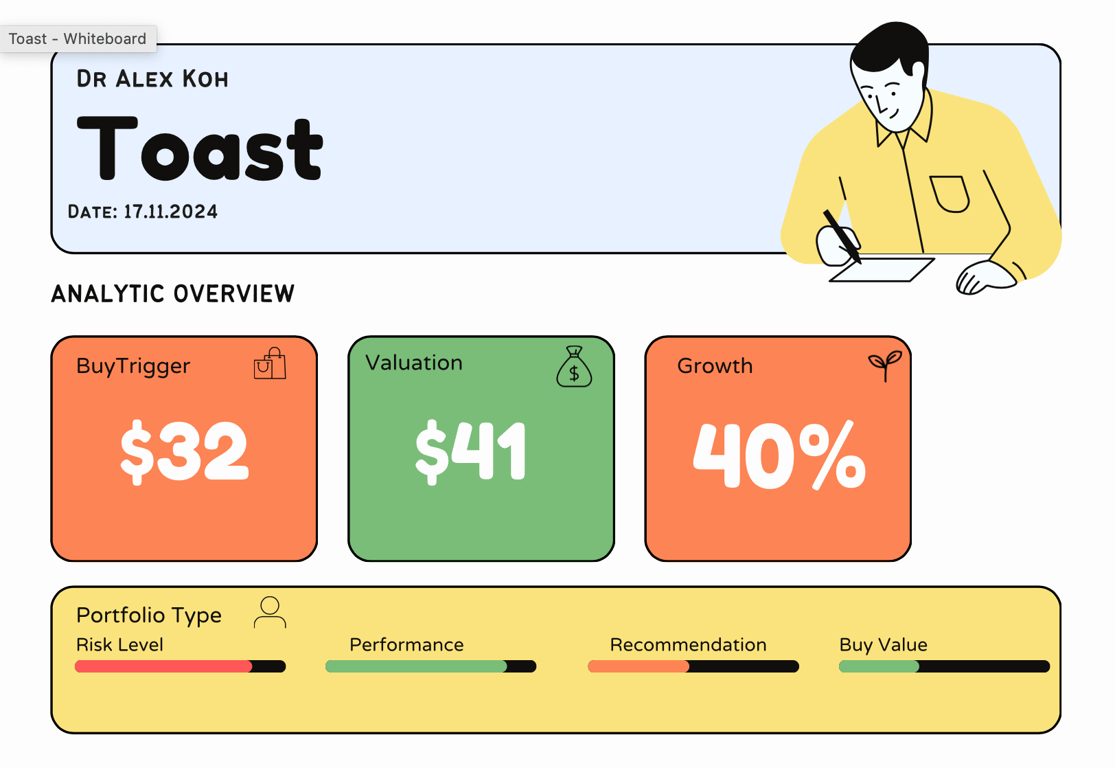

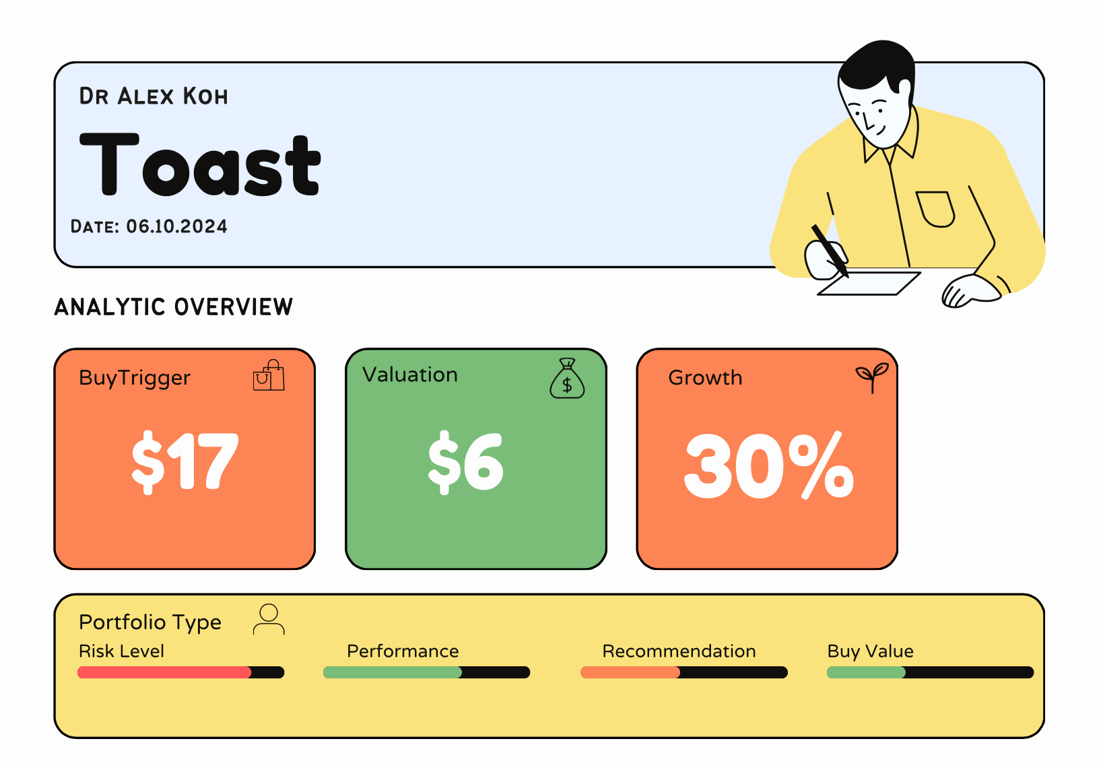

- Price Target: The consensus price target is $27.20, suggesting a 5.46% downside from current levels. However, bullish projections see potential upside up to $33 (a 14.7% increase) as revenue continues to grow.

- Market Cap: Toast’s market capitalization stands at $14.6 billion, indicating the market’s confidence in the company’s long-term potential despite short-term profitability issues.

📈 Growth Metrics

- 2025 Growth Forecast: Toast is projected to see further revenue growth of 22.35% in 2025, potentially reaching $6.11 billion. This growth is expected to come from deeper adoption of its product modules and increasing average revenue per user (ARPU). Expanding its addressable market through new product categories like enhanced POS systems and mobile apps will be key drivers.

- Price Target: Analysts remain cautiously optimistic, citing high growth potential, but concerns about profitability and cash flow in the near term temper enthusiasm.

🔮 Forecast

Toast’s long-term outlook remains positive, supported by its expanding role as a comprehensive technology provider for restaurants. However, profitability remains a key concern, and its high valuation indicates investors are betting on strong future performance. The company's ability to execute on its growth plans will determine its future stock trajectory.

Final Summary

- 🚀 High Growth, Profitability Challenges: Toast is a leader in the restaurant tech space and continues to deliver strong revenue growth, but its lack of profitability is a significant risk factor.

- 📉 Bumpy Near-Term: With ongoing cash flow and earnings challenges, Toast faces potential volatility, justifying a B- rating for now.

Interesting Facts

🕶️ Chronological Update below 👇🏻

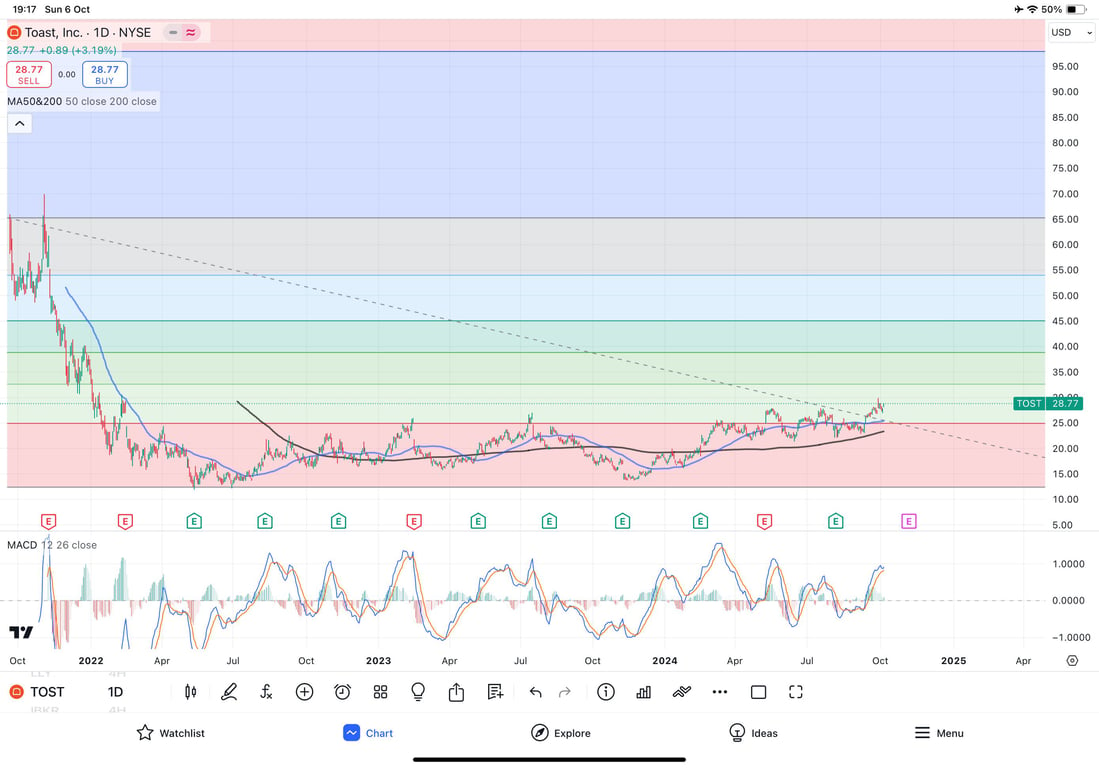

Technical Analysis Update [Oct 6, 2024 07:18 PMGMT+00:00]