Uber Technologies Inc. (UBER) Stock Comprehensive Review as of August 2024 🟢

Current Price: $72.05

Industry: Technology, Rideshare & Delivery

Stock Type: High Growth, Cyclical

Rating: A

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Uber reported $11.19 billion in Q3 2024, surpassing analyst expectations with a 20.4% YoY increase. This strong growth was driven by solid performance in both its Mobility and Delivery segments. The company’s gross bookings reached $41 billion, with growth primarily driven by pricing power and increased demand across global markets.

- Net Income: Uber achieved an EPS of $1.20, significantly up from $0.10 a year ago, reflecting Uber’s improved profitability and operational efficiency. This earnings beat demonstrates the company’s ability to scale profitably and manage costs effectively.

- Free Cash Flow: Uber’s free cash flow remains strong, providing substantial resources to reinvest in strategic areas such as autonomous vehicle partnerships and further expansion of its Uber One membership program.

💰 Valuation Analysis

- P/E Ratio: Uber's forward P/E ratio of approximately 60x shows the premium the market places on its growth prospects, especially as it edges closer to sustainable profitability. Although high, this valuation reflects investor confidence in Uber’s strategy and growth trajectory.

- Price Target: The average analyst price target is $89.94, implying a 22.79% upside from the current price. The high target is $120, signaling bullish expectations for Uber’s expansion into autonomous vehicles and geographic growth, along with increased revenue from its subscription-based Uber One membership.

- Market Cap: Uber’s market cap is approximately $140 billion, reflecting its solid positioning as a global leader in mobility and delivery solutions.

📈 Growth Metrics

- 2025 Growth Forecast: Uber’s revenue growth is expected to continue at a robust pace, with gross bookings projected to grow in the mid-to-high teens. Analysts are optimistic about its strategic investments in autonomous vehicle technology, which could significantly boost growth in the coming years, and its expansion into new customer segments through Uber One and new safety initiatives.

- Price Target: With promising long-term projects in place, analysts see strong potential for stock appreciation, especially as Uber moves deeper into AI and autonomous driving.

🔮 Forecast

Uber’s Q3 earnings beat underscores its ability to deliver growth at scale, with profitability now within reach. The company’s focus on innovation, expansion, and operational efficiency has positioned it as a formidable player in the mobility and delivery sectors. With strong performance across key metrics and potential upside in emerging technologies, Uber looks well-poised for continued growth.

Final Summary

- 🚀 High Growth and Profitability: Uber’s exceptional earnings, enhanced profitability, and strategic expansion efforts make it a standout growth stock in the tech sector.

- 📈 Strong Upside Potential: Given its strong performance and positive outlook, Uber deserves an A rating, with a promising future as it solidifies its position in mobility and delivery.

Uber remains a compelling growth stock with a promising outlook for 2024 and beyond.

Interesting Facts

🕶️ Chronological Update below 👇🏻

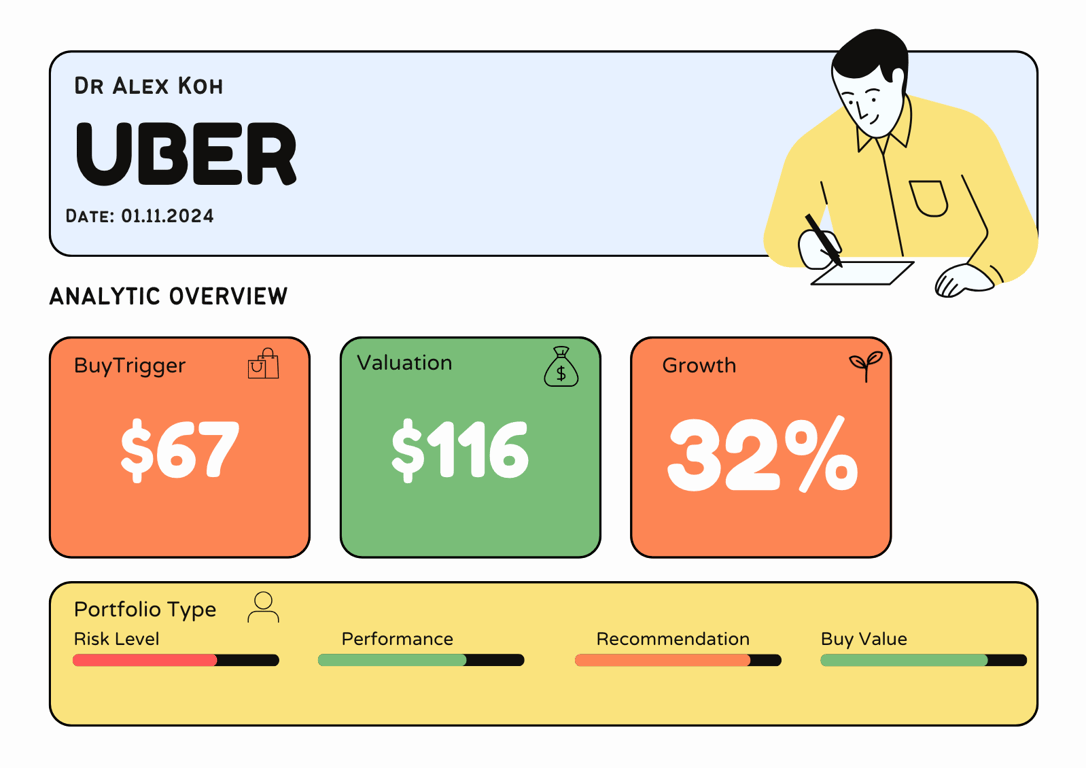

Price Valuation Update[Nov 2, 2024 09:35 PMGMT+00:00]

Reason for Update - fantastic Earnings

BT#1 - changed to 67

BT#2

Valuation -upgraded to 116

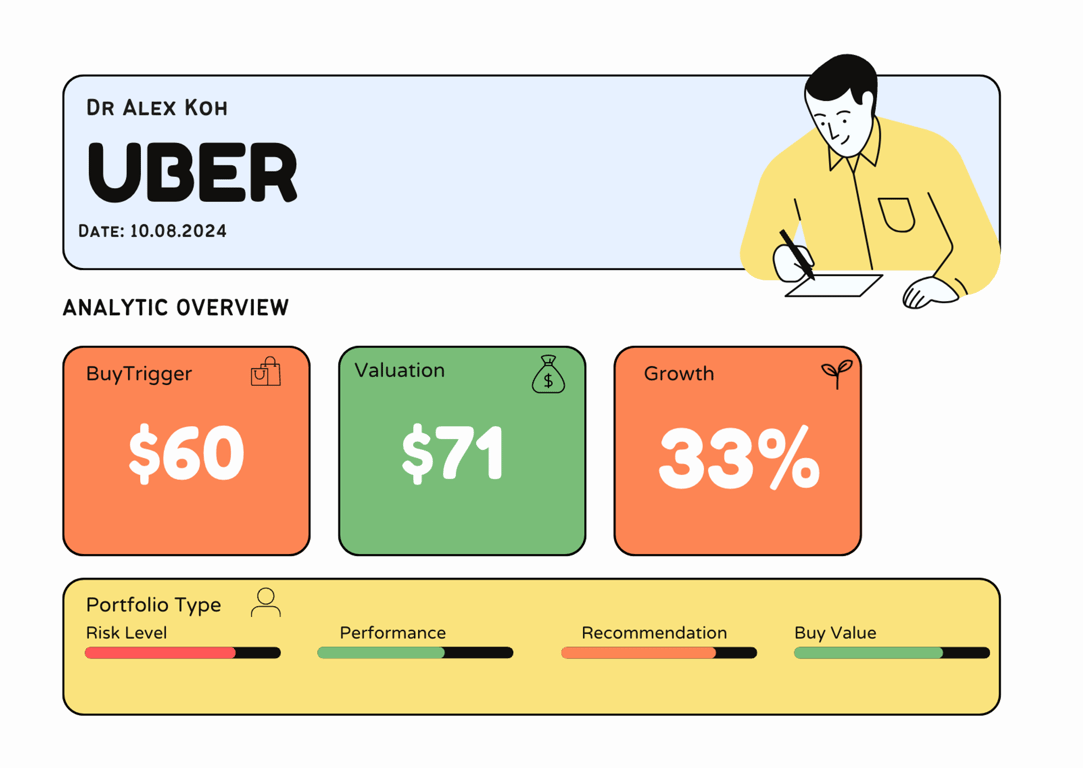

Technical Analysis Update [Aug 18, 2024 02:14 PMGMT+00:00]

- I just took profit on the $UBER swing.

- Fundamentals strong and in tact. However, this has become a traders playground stock with the large volatility swing.

- Still ambitious about life after $100 but it will not be a nice line but huge swings both directions.

- Technicals are on an expected downturn this round forward.

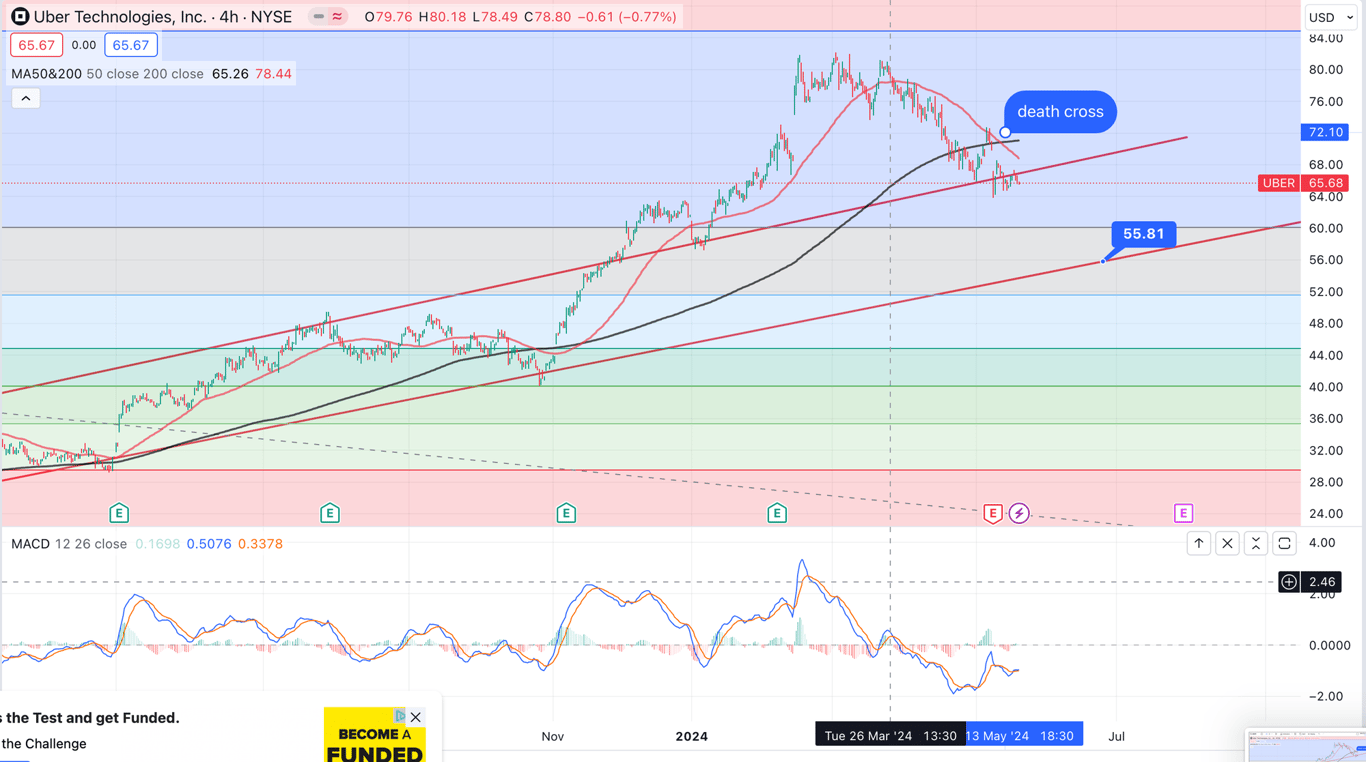

Technical Analysis Update [May 18, 2024 04:36 PMGMT+00:00]

- I see a deathcross on the 4 hours means it fails to go higher and now breaking down. Since with a death cross i have to update my buy trigger to $55 and keep the $60 valuation.