Ulta Beauty, Inc. (ULTA) Stock Comprehensive Review as of October 2024 🟡Current Price: $381.80Industry: Specialty Retail, BeautyStock Type: Mature, Value-OrientedRating: B

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Ulta Beauty reported $11.39 billion in revenue for 2024, reflecting a modest 1.6% year-over-year increase. This is indicative of slower-than-expected growth as the beauty industry faces stiffer competition and cost pressures.

- Net Income: Ulta Beauty’s EPS has declined by 8.3% to $23.87 in 2024, driven by increasing costs and inventory management challenges.

- Free Cash Flow: Despite declining earnings, the company continues to generate solid free cash flow, which supports its ongoing stock buyback program and store expansions.

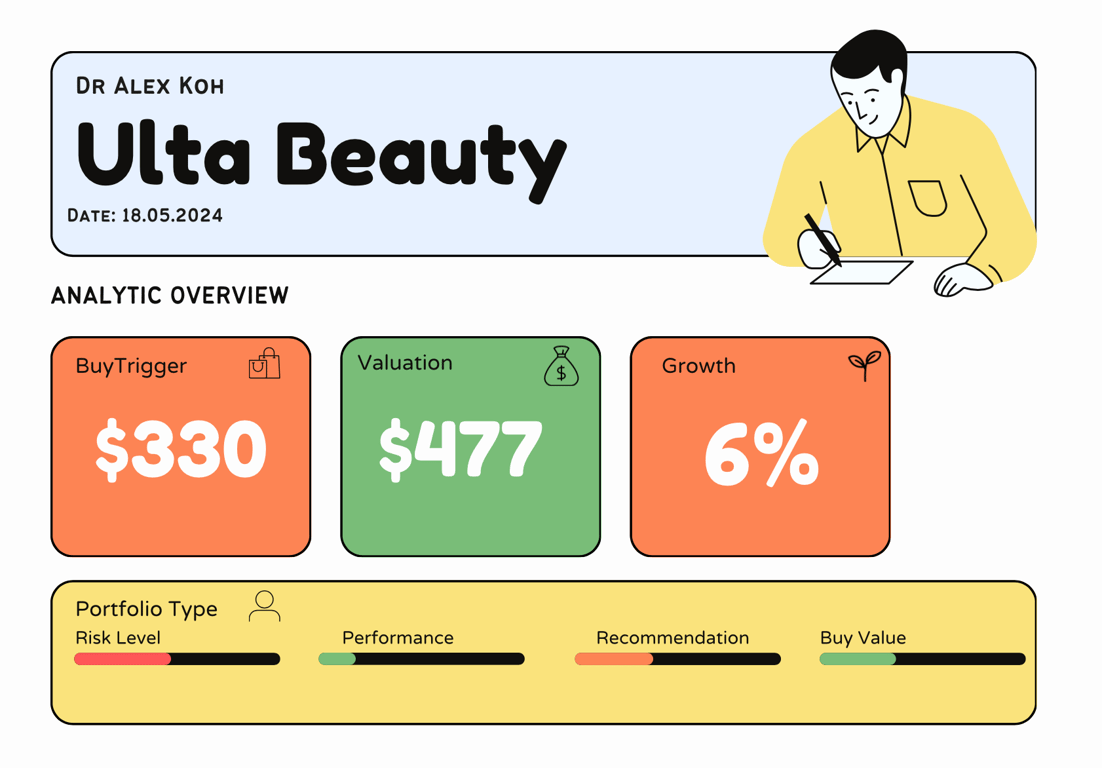

💰 Valuation Analysis

- P/E Ratio: The forward P/E ratio of 15.61x signals that Ulta is currently trading at a more value-driven level compared to its growth-oriented past. This makes the stock appealing for long-term investors focused on stable returns.

- Price Target: Analysts project an average 12-month price target of $429.76, implying a potential upside of 12.56%. Some forecasts suggest a high as $610, though short-term volatility may dampen immediate gains.

- Market Cap: Ulta Beauty’s market cap stands at $18.33 billion, reflecting its significant position in the beauty retail market but also the challenges it faces in growing further.

📈 Growth Metrics

- 2025 Growth Forecast: Analysts expect a slight rebound in EPS growth of 7.67% for 2025, driven by cost control measures and increased focus on digital channels and exclusive product offerings.

- Price Target: While Ulta’s long-term growth prospects remain solid, analysts are cautious about short-term volatility, especially with rising competition from online platforms and other brick-and-mortar retailers.

🔮 Forecast

Ulta Beauty is likely to remain a strong player in the beauty industry, but its growth will be tempered by rising operational costs and competition. The company’s focus on digital strategies and exclusive partnerships may help offset some of these challenges in the coming years, but near-term performance is expected to be more conservative.

Final Summary

- 🚀 Resilient but Pressured: Ulta remains a market leader in the beauty retail space, but faces significant headwinds in maintaining its previous growth momentum.

- 📉 Moderate Upside: While long-term potential exists, short-term challenges such as rising costs and competitive pressures justify a B rating.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [Oct 6, 2024 06:46 PMGMT+00:00]