Veeva Systems Inc. (VEEV) Stock Comprehensive Review as of October 2024 🟢Current Price: $204.67Industry: Cloud Software, Life SciencesStock Type: Growth, StableRating: B

Key Financial Metrics (Latest Earnings)**

- Revenue Growth: Veeva Systems reported $676.2 million in revenue for Q2 FY2025, reflecting a 15% YoY increase. Subscription services, which make up the bulk of its revenue, grew by 19%, driven by its cloud-based solutions like Veeva Vault and CRM used in the life sciences sector. Veeva’s software helps pharmaceutical and biotech companies manage R&D, clinical trials, and regulatory compliance.

- Net Income: Veeva is highly profitable, with EPS growth expected to nearly double in 2024 to $6.36, up from $3.22 in 2023. The company's EPS is forecasted to further rise by 9.29% in 2025.

- Free Cash Flow: Veeva consistently generates solid cash flow, supporting its growth initiatives in the cloud and life sciences space.

💰 Valuation Analysis

- P/E Ratio: Veeva's forward P/E ratio of 32.16x reflects its premium valuation in the tech sector, typical of high-growth cloud software companies. Analysts expect further earnings growth, though some believe the stock's premium price reflects much of this optimism.

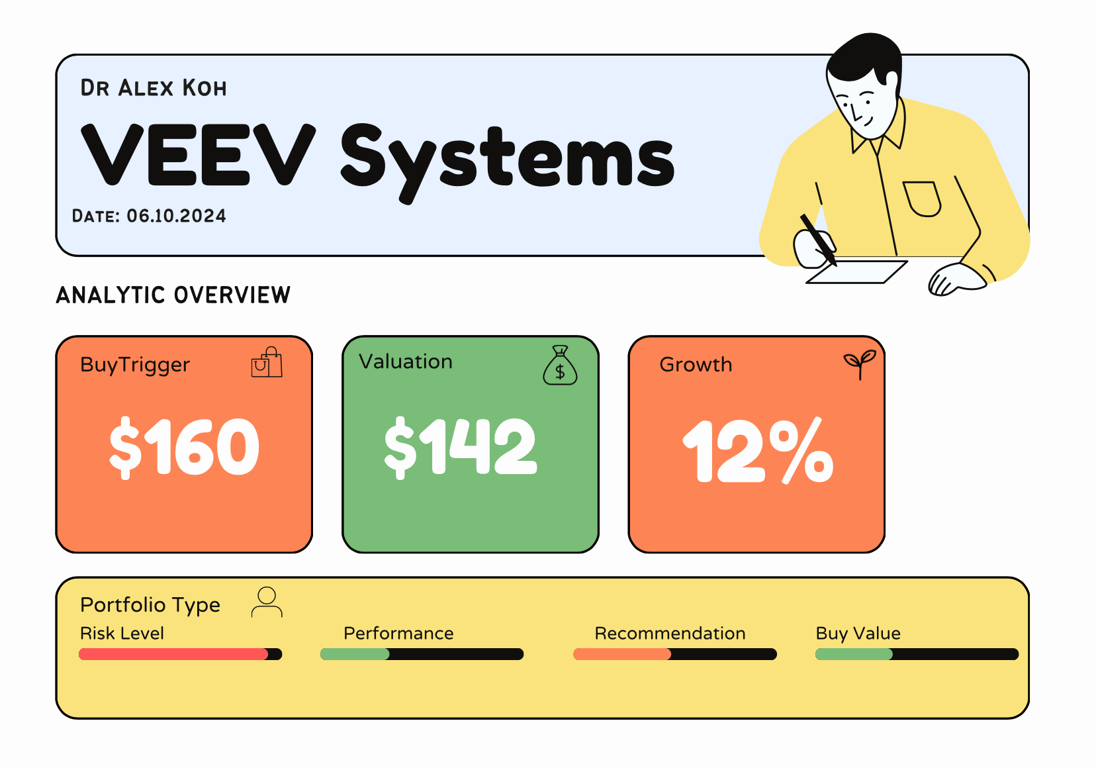

- Price Target: Analysts have an average price target of $231, implying a 12.86% upside. The most optimistic projections put the stock as high as $281, reflecting long-term confidence in the company's ability to capture market share in life sciences cloud software.

- Market Cap: With a market cap of around $33 billion, Veeva is a leader in its niche, particularly in providing cloud solutions for regulated industries like pharmaceuticals.

📈 Growth Metrics

- 2025 Growth Forecast: Veeva's revenue is expected to grow by another 11.98% in 2025, reaching $3.09 billion, driven by increasing adoption of its cloud-based platforms across the pharmaceutical and biotech industries. Expansion into newer areas like Veeva Vault QMS for quality management and Veeva Site Connect for clinical trial management are key growth drivers.

- Price Target: The company’s focus on expanding its suite of life sciences tools positions it well for continued growth, with analysts bullish about its potential to further penetrate the market.

🔮 Forecast

Veeva Systems is expected to maintain its leadership position in the life sciences cloud space, with steady revenue and earnings growth. The stock remains a strong long-term growth opportunity, although its high valuation reflects expectations of continued success. Investors should be aware of the premium pricing but can expect strong performance as Veeva continues to innovate and capture market share in regulated industries.

Final Summary

- 🚀 Stable Growth Leader: Veeva remains a dominant player in cloud solutions for the life sciences sector, with robust growth and profitability prospects.

- 📈 Strong Long-Term Potential: While the stock trades at a premium, its consistent growth trajectory and leadership in a specialized market justify a B rating.

Interesting Facts

🕶️ Chronological Update below 👇🏻

Technical Analysis Update [Oct 6, 2024 07:45 PMGMT+00:00]