Visa Inc. (V) Stock Comprehensive Review as of August 2024 🟢

Current Price: $268.87

Industry: Financial Services, Digital Payments

Stock Type: Blue Chip, Growth

Rating: A-

Key Financial Metrics (Latest Earnings)

- Revenue Growth: Visa reported $8.9 billion in revenue for Q3 2024, reflecting a 9.57% YoY increase. This growth was driven by a rise in payment volumes and a steady increase in digital transactions globally.

- Net Income: The company achieved an EPS of $2.42, marking a 20% YoY increase. Visa’s profitability remains robust, underpinned by its efficient business model and strong market position.

- Free Cash Flow: Visa continues to generate significant free cash flow, supporting its aggressive share buyback program and dividend payments.

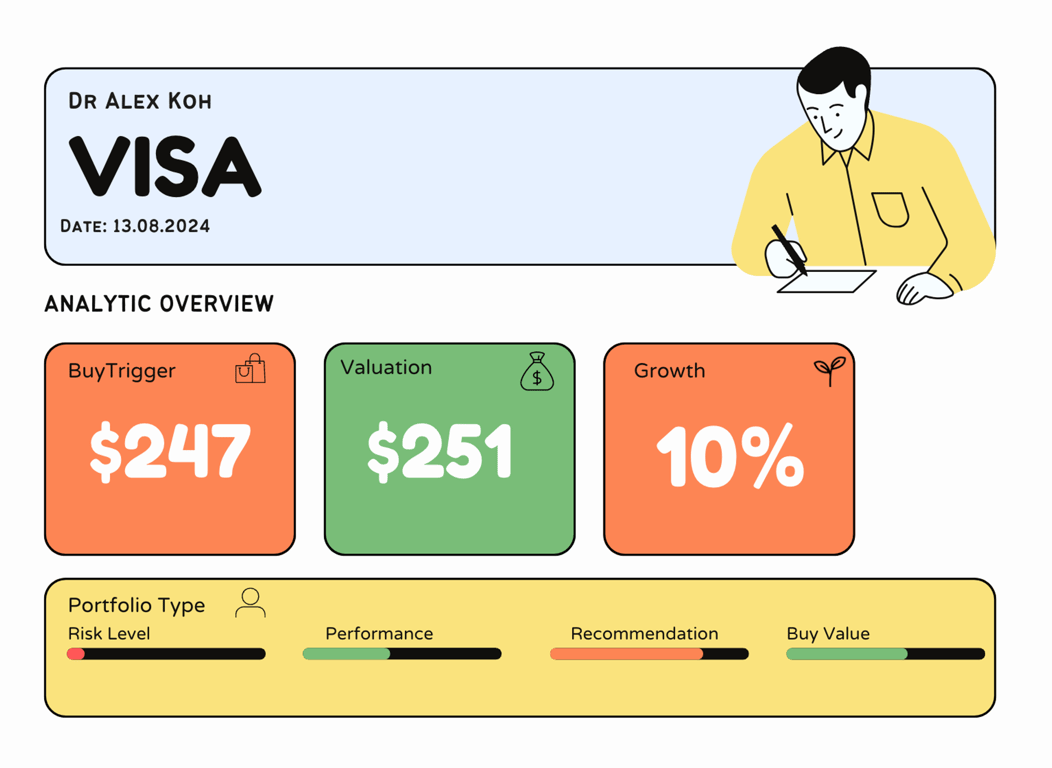

💰 Valuation Analysis

- P/E Ratio: Visa’s current P/E ratio is 30.12x, indicative of a premium valuation typical for a company with consistent growth and profitability.

- Price Target: Analysts have set a consensus price target of $306.24, suggesting a potential 13.92% upside from current levels. The highest target is $330, reflecting strong confidence in Visa's future performance.

- Market Cap: Approximately $503 billion, solidifying Visa’s position as one of the largest financial services companies in the world.

📈 Growth Metrics

- 2025 EPS Growth Forecast: Analysts expect EPS to grow by 15.4% in 2025, driven by continued expansion in digital payments and the increasing adoption of Visa’s services in emerging markets.

- Price Target: The price target reflects confidence in Visa’s ability to maintain its leadership position and capitalize on the ongoing digital payment trends.

🔮 Forecast

Visa is strategically positioned to benefit from the ongoing shift to digital payments and increased global e-commerce activity. The company's strong cash flow, robust revenue growth, and consistent profitability make it a stable investment choice. However, the high valuation suggests that investors should be mindful of potential market corrections or economic downturns that could impact consumer spending.

Final Summary

- 🚀 Strong Buy: Visa’s solid financial performance, market leadership, and growth prospects make it an attractive investment for growth-oriented investors.

- 📉 Valuation Considerations: While Visa’s premium valuation is justified by its consistent performance, investors should remain aware of potential risks, including regulatory challenges and market volatility.

- 🔎 Positive Analyst Sentiment: Analysts are generally bullish, with most recommending a "Buy," driven by confidence in Visa’s ability to continue delivering strong financial results.

Visa remains a cornerstone investment in the financial services sector, offering both stability and growth potential in a rapidly evolving digital economy.

Interesting Facts

🕶️ Chronological Update below 👇🏻

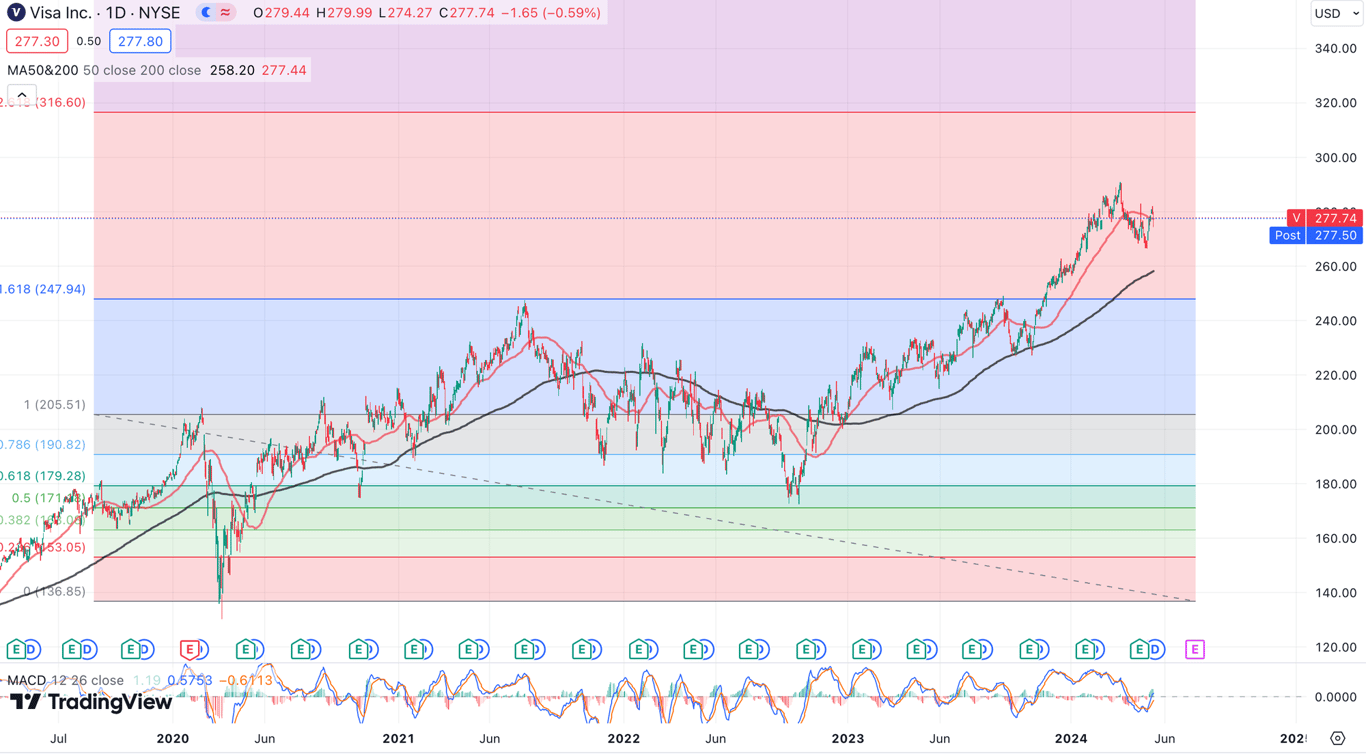

Technical Analysis Update [May 14, 2024 09:32 PMGMT+00:00]