Vistra Corp. (VST) Stock Comprehensive Review as of August 2024 🟠

Current Price: $79.35

Industry: Energy, Utilities

Stock Type: High Risk

Rating: B

Key Financial Metrics (Latest Earnings)

- Revenue: Vistra reported a revenue of $3.85 billion for Q2 2024, which was slightly below expectations.

- Net Income: The company recorded $1.49 billion in net income with a net margin of 4.61%, reflecting stable profitability despite fluctuations in the energy market.

- EPS (Earnings Per Share): The latest EPS was $0.90, missing the consensus estimate by $0.69, indicating some challenges in the recent quarter.

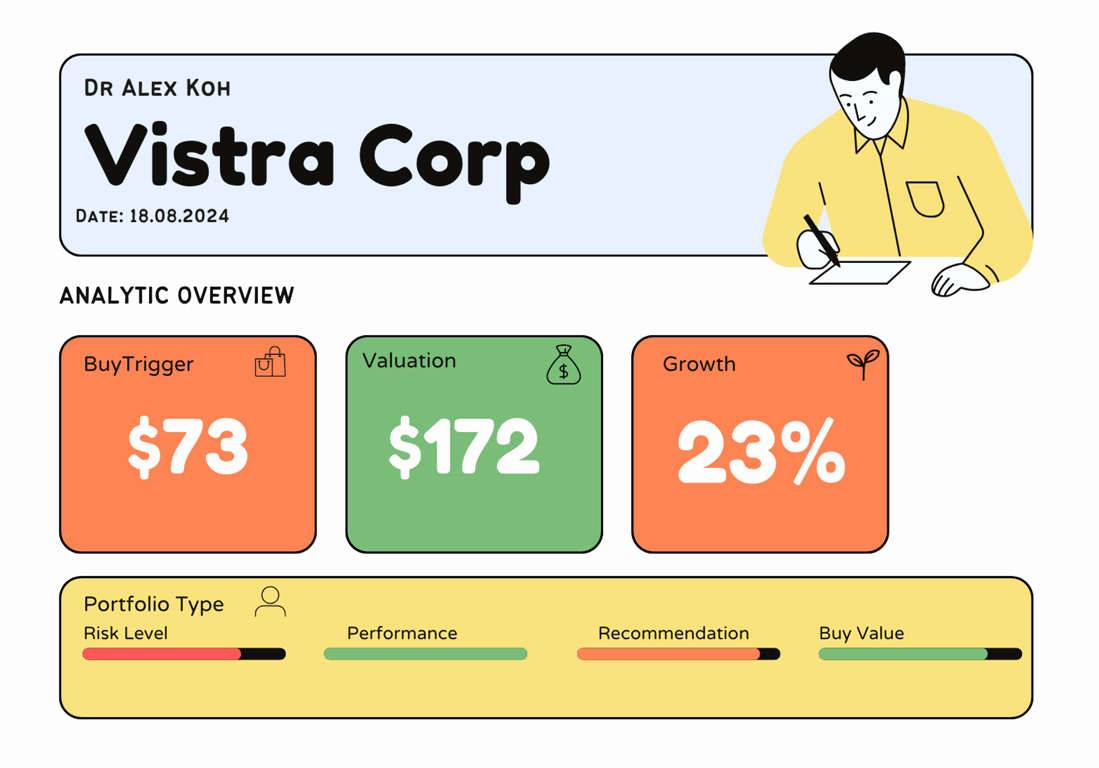

💰 Valuation Analysis

- P/E Ratio: The forward P/E ratio stands at 16.33x, which is reasonable given the utility sector’s stability and the company's growth prospects.

- Price/Sales Ratio: 1.84x, indicating the market's moderate confidence in Vistra’s revenue generation capacity.

- Market Cap: Approximately $27.26 billion, positioning Vistra as a major player in the utility sector.

📈 Growth Metrics

- 2024 EPS Growth Forecast: Analysts remain cautiously optimistic, with moderate growth expectations due to stable demand for energy and Vistra’s strategic expansions.

- Price Target: The consensus price target is $87.83, with a potential 10.69% upside. The highest target is $110, reflecting some bullish sentiment, while the lowest is $37, indicating risk factors.

🔮 Forecast

Vistra has a strong presence in the energy sector with solid fundamentals, though recent earnings misses highlight potential volatility. The company's growth is supported by long-term contracts and a diversified energy portfolio, but investors should be mindful of the ongoing risks in energy prices and operational costs.

Final Summary

- ⚖️ Moderate Buy: Vistra offers stability with potential for moderate growth, making it suitable for income-focused and risk-averse investors.

- 💡 Operational Strength: With consistent net income and a stable market position, Vistra’s fundamentals remain strong.

- 🔎 Analyst Sentiment: While most analysts recommend a "Buy," the range of price targets indicates some uncertainty, particularly in the face of recent earnings shortfalls.

Vistra remains a stable investment in the utility sector, though recent performance suggests keeping an eye on operational and market challenges.

Interesting Facts

🕶️ Chronological Update below 👇🏻

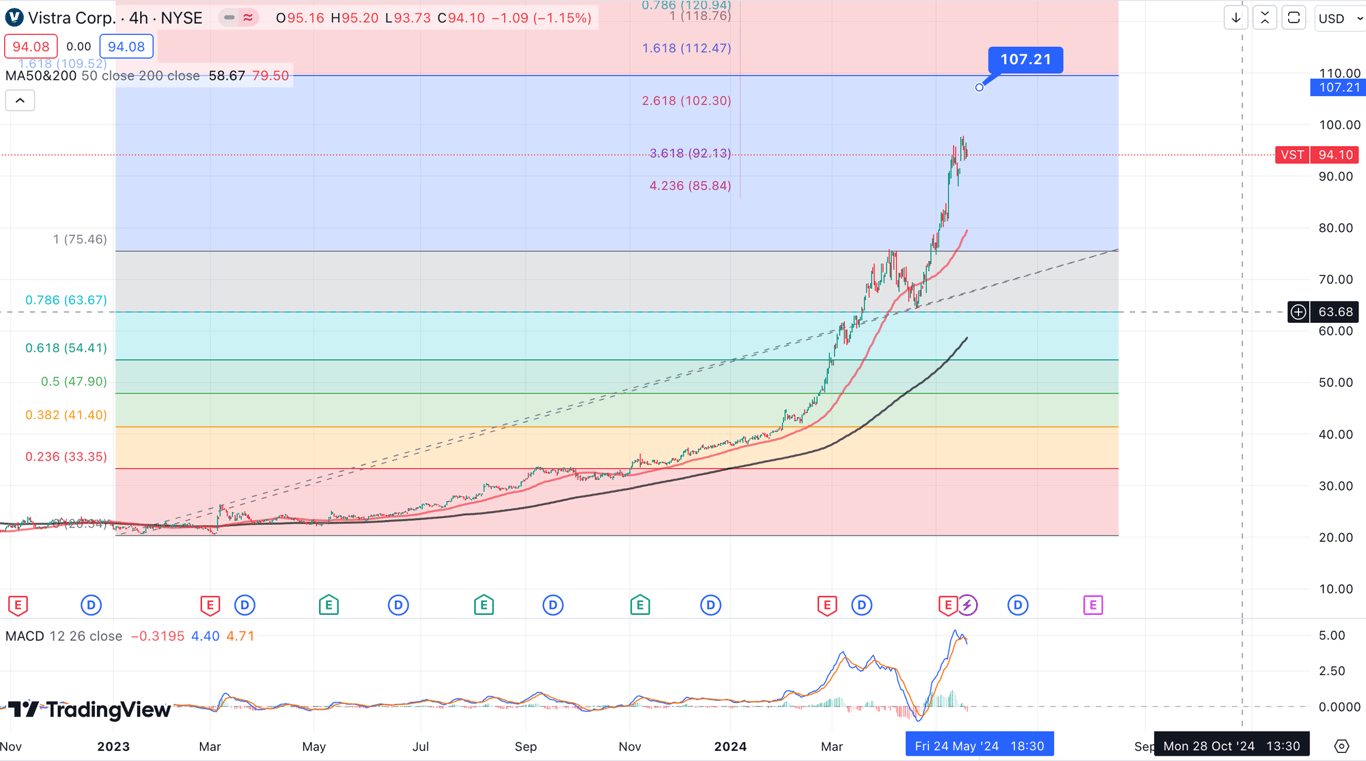

Technical Analysis Update [Aug 18, 2024 03:20 PMGMT+00:00]

- I moved my BT from 90 to 73, but i am still keeping the high valuation. It will take time but i think this stock will be a winner long term. Now the bearish X over is in and we could see come lower pull back to 60. I left it as high risk for a reason.

- It could drop 30% and it could potentially 2X still.

Technical Analysis Update [May 19, 2024 04:57 PMGMT+00:00]